Blockchain In Real Estate Transactions - Decentralizing Property Listings

Learn about blockchain in real estate transactions in detail. Explore blockchain's impact on transparent, secure, and efficient transactions.

Author:James PierceReviewer:Camilo WoodFeb 02, 2024159 Shares39.7K Views

Blockchain technology is making significant inroads into the real estate sector, revolutionizing traditional processes, and bringing about transparency, security, and efficiency. In this comprehensive exploration, we will delve into the impact of blockchain in real estate transactions, examining key applications, challenges, and the transformative potential it holds.

Title Transfer And Smart Contracts

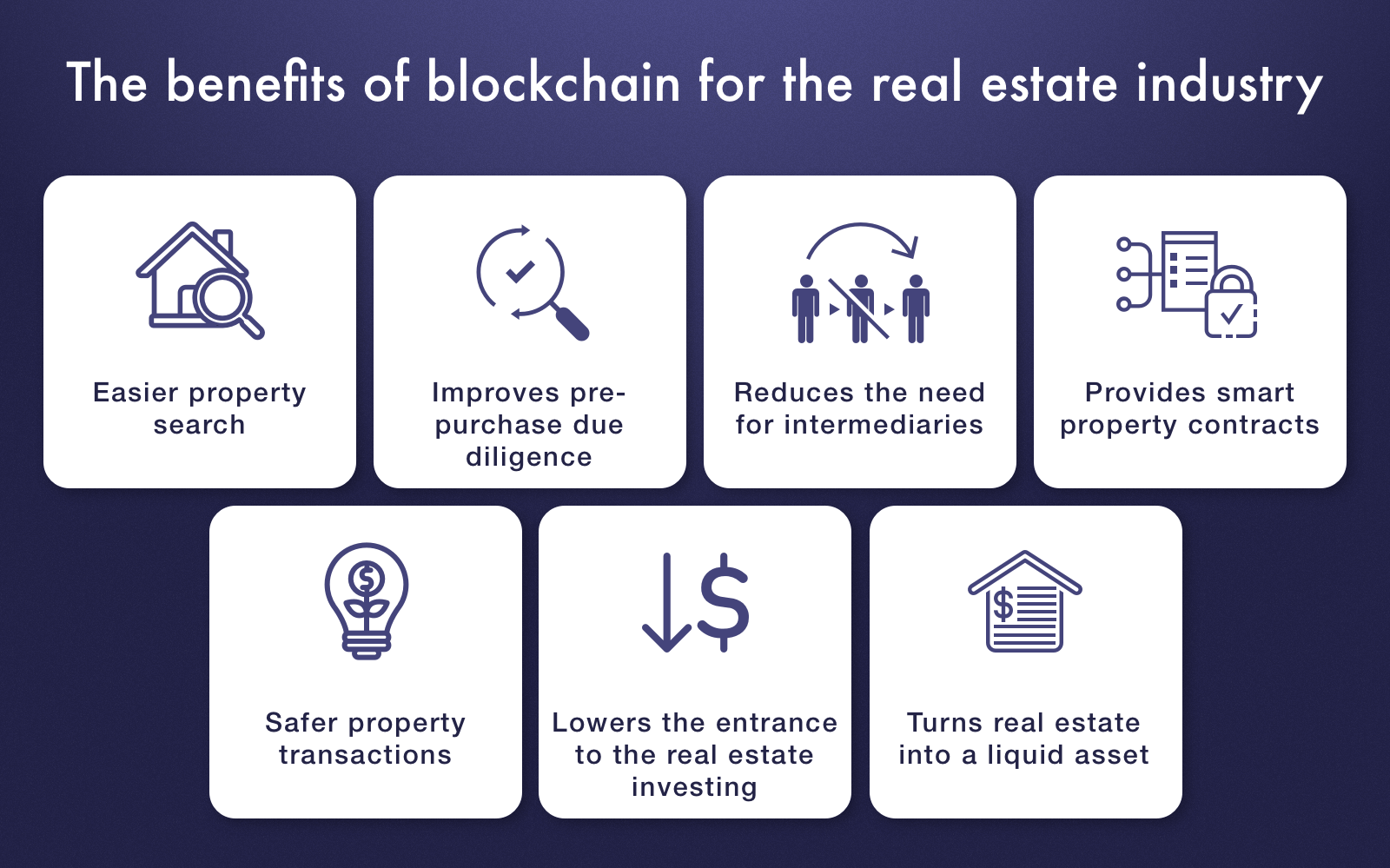

Blockchain facilitates seamless title transfers in real estate transactions. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate the transfer process. Once predefined conditions are met, the ownership is automatically updated on the blockchain, reducing the need for intermediaries and minimizing the risk of errors.

Management Of Funds And Assets

Keeping track of everything can be difficult, particularly if a real estate investor has a sizable portfolio or there are numerous parties involved in the ownership of an asset. In addition to keeping an impeccable balance sheet, it's critical to accurately record every money coming into and going out of the system.

For such specific purposes, a ledger might be created on the blockchain. It is real-time auditable and visible. Additionally, it is unchangeable, meaning that no one entity may alter its specifics at will.

A native digital coin that is used as a means of exchange for asset leases and purchases can also be included in the same ledger at the same time. Additionally, the digital currency can be used to pay utility bills, a task that smart contracts can automate.

It's true that rent payments and lease agreements can be automated using blockchain-based smart contracts. Furthermore, real-time data from the blockchain can be used to inform important asset management decisions.

Property Tokenization

One of the groundbreaking applications of blockchain in real estate transactions is the concept of property tokenization. This involves representing real estate assets as digital tokens on a blockchain. Fractional ownership becomes possible, allowing investors to buy and sell tokens representing a share of the property. This democratizes access to real estate investment, making it more liquid and inclusive.

Tokenization in real estate describes the digitalization of financial instruments, alternative assets, and securities. Digital assets can be created to incorporate ownership rights, transaction histories, and regulations to guarantee that asset issuance, distribution, and transfers comply with legal requirements using Ethereum blockchain technology. Controls that guarantee that tokens can only be transferred to specific counterparties, or not at all, during a lock-up period, are basic examples. Digital assets can be tailored to satisfy a wide range of issuer specifications.

Tokenization also lowers costs and speeds up the process of developing new features, issuing and exchanging assets, paying dividends, and handling other business operations. Issuers can directly tailor digital assets to investor expectations through extensive customisation and quick issuance, which greatly lowers counterparty risk.

Lower expenses enable issuers to lower the minimum investment amounts and increase investor access to a larger group of people. Enhanced connectivity across digital assets and related networks broadens the scope of opportunities in the secondary market and enhances liquidity. These advantages for issuers and investors show that blockchain has true promise for radically new markets and instruments in the future.

Enhanced Transparency

Blockchain's decentralized and transparent nature brings a new level of trust to real estate transactions. Every transaction, from property listings to ownership transfers, is recorded on an immutable ledger. This transparency reduces the risk of fraud, ensures the authenticity of property records, and provides potential buyers with verified information about a property's history.

Streamlined Due Diligence

Blockchain simplifies the due diligence process in real estate transactions. All relevant information, such as property titles, inspection reports, and transaction history, can be securely stored on the blockchain. This accessibility streamlines the due diligence process for buyers, sellers, and other stakeholders, reducing the time and resources required for thorough assessments.

Property And Land Registries

Property ownership is fundamental to democratic society. That specifically corresponds to having the capacity to prove and secure it with ease and certainty. The property registry, also referred to as titling systems, is used to do this.

But the security of real estate ownership ends at the property registry. others in positions of authority have the ability to evict others without them if the system is nonexistent or readily compromised. Furthermore, property ownership can be altered unilaterally and weak land registries can be compromised.

Because of this, investing in real estate can be both very hazardous and very appealing. The benefits of cryptography, immutability, and decentralization make it difficult to accomplish arbitrary changes in a land registry on the blockchain. On the blockchain, titles may exist as non-fungible tokens (NFTs).

Decentralized Property Listings

Blockchain facilitates decentralized property listings, eliminating the need for centralized platforms. This peer-to-peer approach allows property owners to list their assets directly on the blockchain, providing a more direct connection between buyers and sellers. This disintermediation reduces costs associated with traditional listing platforms.

Real-time Accounting For Payments And Leasing

In real estate deals, paying includes many processors, which drives up the price of the property. It occasionally may also take many days or weeks for the payment to be processed. This blockchain application enables instantaneous payments that are controlled by smart contracts thanks to its own currencies.

For instance, in a sale, the title and the money can be transferred at the same time. In the interim, smart contract lease agreements allow for the specification and automatic execution of payment schedules. The transactions are kept on an unchangeable ledger that is always open for inquiries.

Fractional Ownership And Crowdfunding

Blockchain enables fractional ownership models, allowing multiple investors to collectively own a portion of a property. This fractional ownership can be facilitated through tokenization, making real estate investment more accessible to a broader range of investors. Additionally, blockchain-powered crowdfunding platforms allow individuals to pool funds for real estate projects, opening up new avenues for investment.

Reduced Fraud And Cybersecurity Risks

The immutable and tamper-resistant nature of blockchain ensures that once information is recorded, it cannot be altered retroactively. This feature reduces the risk of fraudulent activities, such as property title fraud. Additionally, blockchain's robust cryptographic techniques enhance cybersecurity, protecting sensitive real estate data from unauthorized access.

Blockchain In Real Estate Transactions - FAQs

What Is The Future Of Blockchain In Real Estate?

Property transactions can be sped up, reduced in cost, and made more transparent with blockchain. through turning physical assets into blockchain-based tokens that may be exchanged like cryptocurrencies. Tokenization is a procedure that has the potential to increase accessibility to real estate investing.

How Does Blockchain Enhance Transparency In Real Estate Transactions?

Blockchain brings transparency by maintaining an immutable ledger of property transactions, reducing the risk of fraud and providing verified property records.

What Role Does Smart Contracts Play In Real Estate Transactions On The Blockchain?

Smart contracts automate processes like title transfers, ensuring seamless real estate transactions without the need for intermediaries.

How Does Blockchain Streamline Due Diligence In Real Estate Transactions?

Blockchain simplifies due diligence by securely storing property-related information, allowing stakeholders to access and verify data efficiently.

What Is Property Tokenization In The Context Of Blockchain And Real Estate?

Property tokenization involves representing real estate assets as digital tokens on the blockchain, enabling fractional ownership and democratizing real estate investment.

Conclusion

Blockchain technology is poised to reshape the landscape of real estate transactions, introducing unprecedented levels of transparency, security, and efficiency. From streamlined title transfers to the tokenization of real estate assets, the potential applications are vast.

While challenges of blockchain in real estate transactions exist, ongoing developments in regulations, standards, and technology integration are paving the way for a future where blockchain plays a central role in the evolution of the real estate industry. As stakeholders continue to explore and embrace these transformative possibilities, the synergy between blockchain and real estate is set to redefine how properties are bought, sold, and managed.

Jump to

Title Transfer And Smart Contracts

Management Of Funds And Assets

Property Tokenization

Enhanced Transparency

Streamlined Due Diligence

Property And Land Registries

Decentralized Property Listings

Real-time Accounting For Payments And Leasing

Fractional Ownership And Crowdfunding

Reduced Fraud And Cybersecurity Risks

Blockchain In Real Estate Transactions - FAQs

Conclusion

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles