Blockchain In Financial Services - Future-Proofing Finance

Unlocking financial innovation: Explore impact of blockchain in financial services. Transparency, security, efficiency redefine the future.

Author:Stefano MclaughlinReviewer:Camilo WoodFeb 02, 202411.2K Shares187.1K Views

Blockchain technology has emerged as a revolutionary force in the financial services sector, reshaping traditional systems and fostering innovation. The transformative technology of blockchain in financial serviceshas introduced transparency, security, and efficiency, addressing longstanding challenges and opening new avenues for financial transactions.

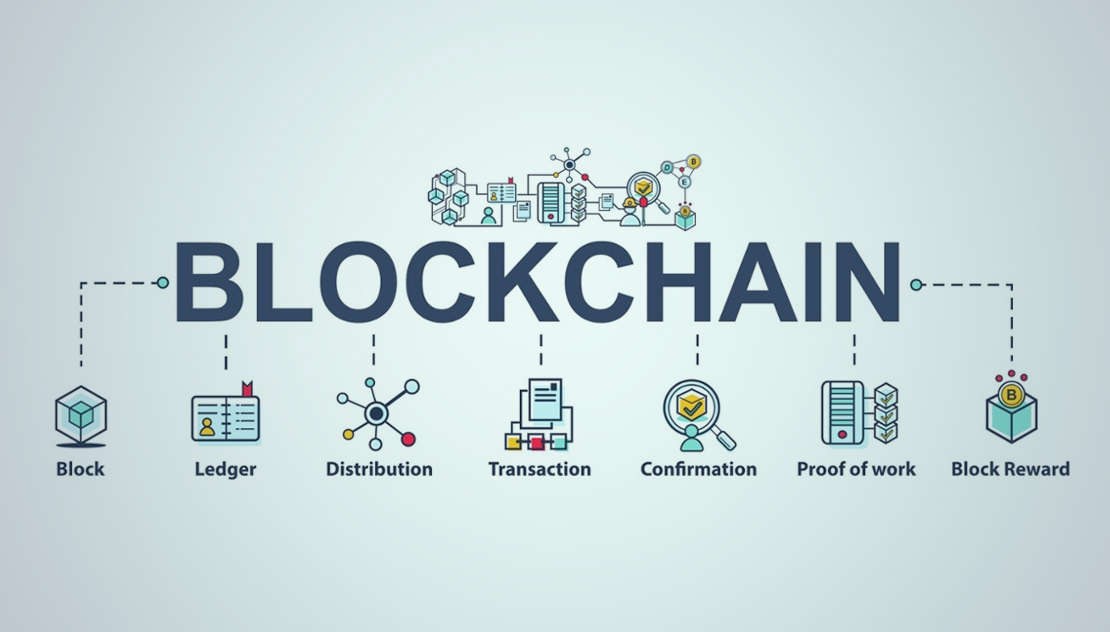

Frequently praised as the foundation of virtual money, blockchain technology has gradually developed into a disruptive force within the financial services sector. Blockchain is a decentralized, transparent, and secure ledger system that has the potential to completely transform the financial industry and bring about cost savings, increased security, and increased efficiency.

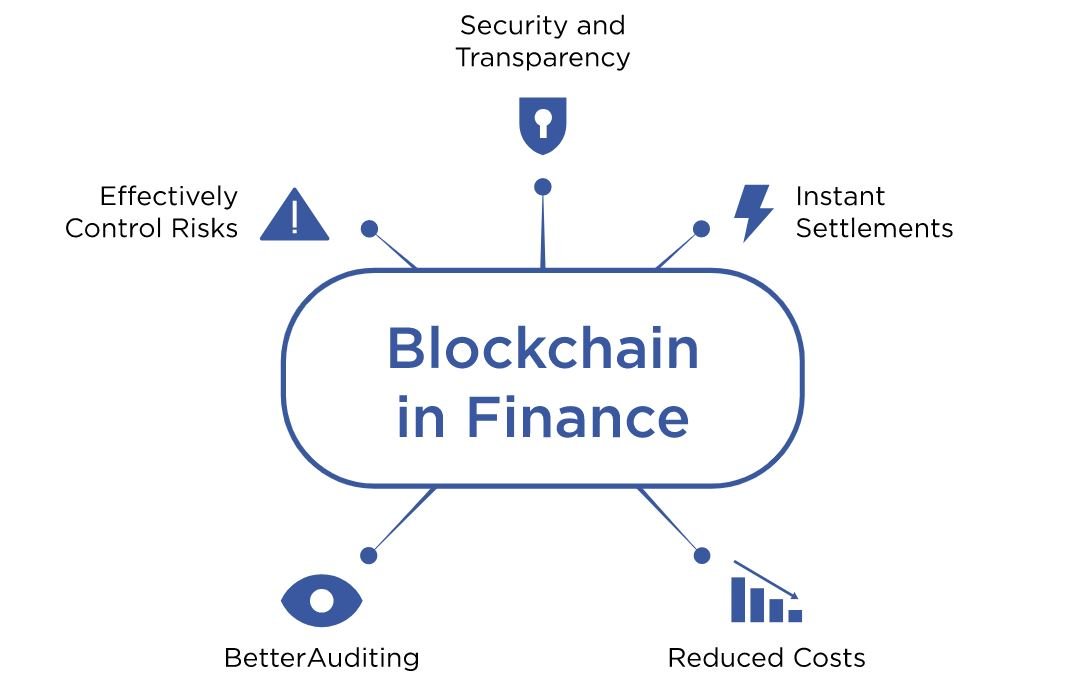

What Financial Benefits Does Blockchain Offer?

More transparent, inclusive, and safe corporate networks, shared operating models, streamlined procedures, lower expenses, and innovative banking and financial goods and services are all made possible by the blockchain.

It makes it possible to issue digital securities more quickly, more cheaply per unit, and with more customization options.

As a result, digital financial instruments may be customized to meet investor needs, opening up new investment opportunities, lowering issuer costs, and lowering counterparty risk.

The technology has developed over the last five years to the point where it is suitable for enterprise use, offering the following advantages:

- Security -By eliminating single points of failure and reducing the need for data intermediaries like transfer agents, messaging system operators, and ineffective monopolistic utilities, its distributed consensus-based architecture improves security. Additionally, blockchain makes it feasible to develop secure application code that is virtually impossible to hack or alter and is intended to be tamper-proof against fraud and malevolent third parties.

- Transparency -It acts as a single shared source of truth for network users by using mutualized standards, protocols, and shared processes.

- Trust -Its unchangeable, transparent ledger facilitates data management, collaboration, and agreement-making amongst various stakeholders in a business network.

- Programmability - It facilitates the development and use of smart contracts, which are deterministic, tamper-proof programs that automate corporate processes and boost efficiency and trust.

- Privacy - It enables selective data sharing in corporate networks by offering industry-leading capabilities for granular data privacy across all software stack layers. This preserves confidentiality and privacy while significantly enhancing openness, trust, and efficiency.

- High-Performance -Its hybrid and private networks are designed to withstand sporadic spikes in network activity as well as hundreds of transactions per second.

- Scalability -It facilitates private and public chain interoperability, giving every enterprise solution access to the mainnet's enormous resilience, high integrity, and worldwide reach.

By the end of 2030, blockchain deployments could allow banks to achieve savings on cross-border settlement transactions of up to $27 billion, lowering costs by more than 11%, according to a report by Jupiter Research.

Specifically, blockchain has already proven disruptive economics by outperforming established solutions in terms of cost by more than ten times. Financial institutions agree that over the next ten years, distributed ledger technology will save banks and other large financial institutions billions of dollars.

Now, we delve into the multifaceted impact of blockchain in financial services, examining key applications, challenges, and future prospects.

Decentralized Financial Systems

One of the cornerstones of blockchain's influence in financial services is its role in establishing decentralized systems. By leveraging blockchain, financial transactions can occur directly between parties without the need for intermediaries like banks. Smart contracts, self-executing pieces of code on the blockchain, enable the automation of financial processes, reducing costs and increasing operational efficiency.

Cross-Border Payments

Blockchain technology has significantly streamlined cross-border payments, offering a viable alternative to the traditional banking system. Cryptocurrencies, which operate on blockchain networks, facilitate faster and more cost-effective international money transfers. The decentralized nature of blockchain ensures direct peer-to-peer transactions, eliminating the delays associated with intermediary banks.

Digital Identity Verification

In the realm of financial services, digital identity verification is a critical aspect, and blockchain has stepped in to enhance security and reliability. Blockchain provides a secure and immutable record of personal information, reducing the risk of identity theft and fraud. Individuals have greater control over their data, and the transparency of the blockchain ensures that only authorized parties can access and verify the information.

Streamlining Payment Systems

Simplifying payment systems is one of blockchain technology's most important uses. Blockchain-based payment systems can make cross-border transactions quicker, safer, and more economical by doing away with the need for middlemen.

For example, financial institutions may process payments in real time with minimal fees thanks to Ripple, a global payment network powered by blockchain technology. This is an economical and effective substitute for conventional payment systems.

Blockchain adoption will probably cause a significant change in the global payments environment by enabling more smooth cross-border transactions for both individuals and enterprises.

Smart Contracts In Lending

Blockchain's impact extends to lending processes, where smart contracts play a transformative role. These self-executing contracts automatically enforce and execute the terms and conditions of a loan agreement. By removing intermediaries, such as banks, smart contracts streamline lending processes, reduce transaction costs, and minimize the risk of defaults.

Trade Finance And Supply Chain Management

Blockchain's application in trade finance and supply chain management has garnered considerable attention. It provides a tamper-proof and transparent record of transactions throughout the supply chain. This not only reduces the risk of fraud but also ensures the authenticity of products, contributing to improved efficiency and trust in the entire supply chain.

Tokenization Of Assets

The concept of tokenization, enabled by blockchain, has brought about a paradigm shift in how traditional assets are represented and traded. Real estate, stocks, and commodities can be tokenized, allowing for fractional ownership. This democratizes investment opportunities, making traditionally illiquid assets more accessible to a broader range of investors.

Regulatory Compliance

Blockchain's transparency and immutability make it an invaluable tool for regulatory compliance in the financial industry. Regulators can access a real-time and auditable record of transactions, facilitating monitoring and enforcement. This not only reduces the likelihood of financial crimes but also fosters a more accountable and compliant financial ecosystem.

Decentralized Finance (DeFi)

Decentralized Finance, commonly known as DeFi, has emerged as a prominent application of blockchain in financial services. DeFi platforms leverage smart contracts to recreate traditional financial services, including lending, borrowing, and trading, without the need for traditional banking institutions. This opens up new avenues for financial inclusion and participation.

Central Bank Digital Currencies (CBDCs)

Several central banks are exploring the development of Central Bank Digital Currencies (CBDCs) using blockchain technology. These digital representations of national currencies aim to enhance payment systems, reduce counterfeiting, and provide central banks with more tools for implementing monetary policy.

Continued Growth Of DeFi

Decentralized Finance (DeFi) is expected to continue its growth trajectory, offering decentralized alternatives to traditional financial services. This includes decentralized exchanges, lending platforms, and other financial instruments accessible to a global audience.

Increased Collaboration

Collaboration between traditional financial institutions and blockchain-based startups is likely to increase. This synergy can lead to the development of hybrid systems that combine the strengths of both traditional finance and blockchain technology, fostering innovation and broadening the scope of financial services.

Blockchain In Financial Services - FAQs

How Can Blockchain Be Used In Financial Services?

Blockchain technology can digitize the trade finance lifecycle in a way that is more efficient and secure. More open governance, faster processing, less capital needed, and a lower chance of fraud, human mistake, and overall counterparty risk are all made possible by it.

What Is The Future Of Blockchain In Financial Services?

Blockchain's ability to create a decentralized database of transactions may make it possible to execute banking operations without the assistance of a third party. This would increase the efficiency and security of banking. Furthermore, the price of banking services may decrease as a result of blockchain technology.

How Does Blockchain Enhance Transparency In Financial Services?

Blockchain enhances transparency by providing a decentralized and immutable ledger, allowing all parties to access and verify transactions in real-time.

Conclusion

The impact of blockchain in financial services is nothing short of transformative. From decentralizing financial systems to revolutionizing cross-border payments, the technology is reshaping the industry's landscape. Challenges notwithstanding, the potential for increased transparency, security, and efficiency makes blockchain a key player in the future of financial services.

As the industry navigates hurdles and embraces ongoing innovations, the promise of a decentralized, efficient, and inclusive financial ecosystem powered by blockchain technology becomes increasingly tangible.

Jump to

What Financial Benefits Does Blockchain Offer?

Decentralized Financial Systems

Cross-Border Payments

Digital Identity Verification

Streamlining Payment Systems

Smart Contracts In Lending

Trade Finance And Supply Chain Management

Tokenization Of Assets

Regulatory Compliance

Decentralized Finance (DeFi)

Central Bank Digital Currencies (CBDCs)

Continued Growth Of DeFi

Increased Collaboration

Blockchain In Financial Services - FAQs

Conclusion

Stefano Mclaughlin

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles