Blockchain In Banking - Securing Tomorrow's Transactions

Explore the transformative impact of blockchain in banking with our comprehensive guide. Learn how this revolutionary technology is reshaping the financial landscape, enhancing security, transparency, and efficiency in transactions.

Author:James PierceReviewer:Camilo WoodJan 18, 2024249 Shares31K Views

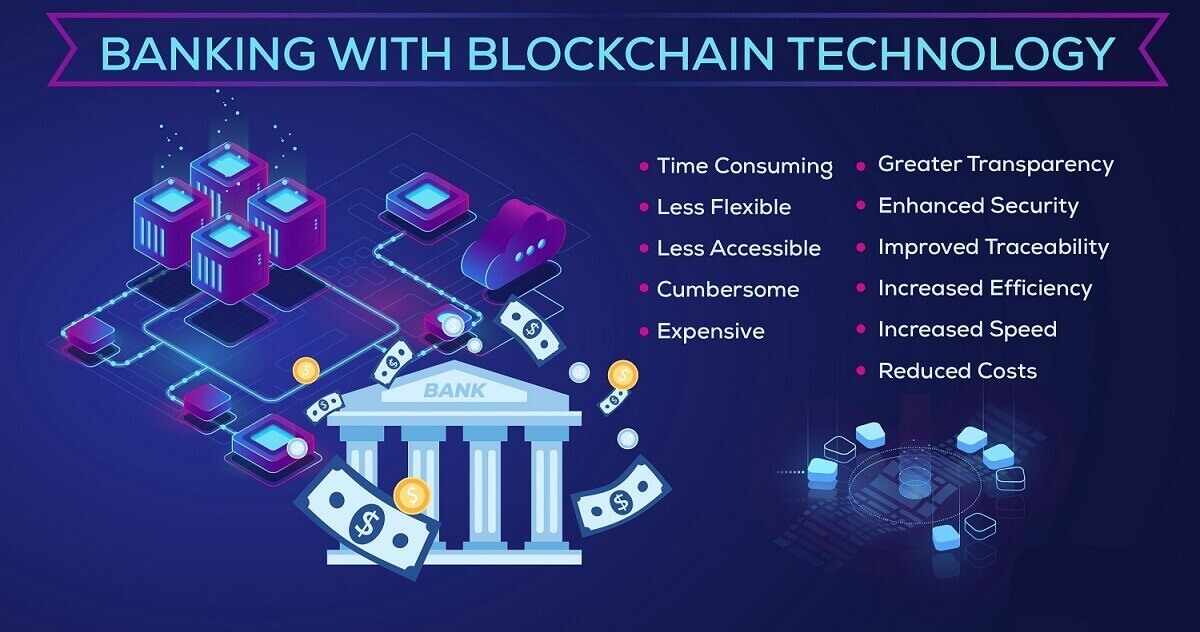

Blockchain in bankinghas emerged as a game-changer in the realm of finance, promising to revolutionize traditional financial systems. As we navigate the ever-evolving landscape of finance, the integration of blockchain in banking is not merely a trend but a strategic shift towards enhanced security, transparency, and efficiency.

This transformative technology is breaking down silos, fostering trust, and reshaping the way financial transactions are conducted. In this exploration, we delve into the intricacies of the future of blockchain in banking, unraveling its potential to redefine the very fabric of banking operations.

How Is Blockchain Changing The Financial Industry?

Blockchain has brought about significant developments in financial and other industries in recent years. Blockchain enables untrusted parties to agree on the status of a database without relying on an intermediary for a transaction. There is a ledger that nobody manages. The technology will enable financial services like as payments without the use of a third party, such as a bank.

Thus, blockchain generates decentralization, allowing institutions to focus on things other than tracking payment transactions. The usage of blockchain has transformed banking in a variety of ways. It has impacted payments, settlement systems, fundraising, securities management, loans, credit, and trade finance.

Blockchain, with its decentralized payment ledger, can deliver speedier payments and lower rates than banks. Blockchain influences clearance and settlement systems, as distributed ledgers can cut operational costs and enable more real-time transactions between financial institutions.

The introduction of Initial Coin Offerings has altered the fundraising landscape. A new financing paradigm can separate access to cash from capital-raising services and enterprises. Securities including stocks, bonds, and alternative assets, are stored on public blockchains. This leads to more efficient capital markets.

Blockchain has transformed the banking business by eliminating the need for gatekeepers in the loan and credit industries as well. It has made borrowing money more secure while also offering reduced interest rates. Blockchain has transformed trade finance by replacing paper-based processes. It has increased openness, security, and confidence between trading parties around the world.

Common Issues In The Banking System

It's no wonder that the world's largest banks are pooling their resources to investigate the potential of this technology. Collaborative research and innovative efforts are laying the groundwork for a banking ecosystem in which blockchain is not an afterthought, but an essential component of operations. But what are the present banking industry's major challenges? Here are some instances.

Ensure Consistently Secure And Transparent Transactions

Blockchain applications in financial technology provide several significant advantages in the banking industry. For starters, it ensures safe and transparent transaction recording, a significant improvement over traditional banking, which logs transactions in a centralized database.

The blockchain is based on a semi-decentralized structure in which only trusted entities can host validating nodes. This design reduces the likelihood of the entire system being penetrated by a single weak point, lowering the risk of fraud and cyber-attacks.

Inefficiency Caused By The Use Of Intermediaries

Furthermore, blockchain technology in banking can dramatically increase efficiency and reduce costs. Traditional banking systems include intermediaries such as clearinghouses and custodians, which adds time and expense to transactions. With blockchain, the need for intermediaries is greatly minimized, allowing for faster and more cost-effective transactions. Such efficiency can lead to significant cost savings for both banks and their customers.

The Slow Process Of Settlement

Banks frequently deal with lengthy settlement procedures involving several intermediaries. This is where blockchain technology in banking can excel. Using blockchain instead of centralized processing methods allows you to avoid the onerous processes inherent in traditional banking.

As a result, transactions are not only traceable in hours rather than days, but they also streamline processes for banks and clients, resulting in faster response times and simpler procedures.

How Can Blockchain Be Used In Banking?

Accounting And Audit

The capacity of blockchain to preserve immutable records has the potential to revolutionize accounting, bookkeeping, and auditing in the financial sector. Technology can aid in this area by minimizing paperwork, streamlining traditional bookkeeping procedures, and ensuring that records are easily accessible for auditing. Regulatory compliance in the sector is anticipated to increase dramatically as a result.

So far, four major auditors, PwC, KPMG, Ernst & Young, and Deloitte, have expressed interest in blockchain.

Borrowing And Lending

One of the most popular blockchain and banking movements in recent years is DeFi (decentralized finance), which aspires to alter many elements of traditional finance, including borrowing and lending.

DeFi's purpose is not to enhance the banking industry, but to directly challenge it by making financial services more accessible to retail users. To discover more about how DeFi is enabling the development of innovative services such as peer-to-peer lending and borrowing apps, check out our article on decentralized finance.

However, blockchain in bankingcan be utilized to improve lending and borrowing activities provided by banks. The technology's comprehensive verification capabilities may lower the risk of bad loans.

Furthermore, blockchain can ensure that borrowers are not criminals or bad actors, which will help banks improve their know-your-customer (KYC) and anti-money laundering (AML) procedures.

Syndicated loans are another area where blockchain technology might help. Large loans to corporate clients are usually made by a group of banks. This is a difficult process that requires lender collaboration and can last up to 19 days. Compliance with KYC and AML regulatory regulations is a significant challenge in this context.

The traditional strategy requires all banks involved in a syndicated loan to ensure KYC and AML compliance independently. However, blockchain technology enables a bank that has already completed the compliance procedures to securely exchange that information with the other loan participants, streamlining the process significantly.

In 2016, Credit Suisse, Ipreo, Symbiont, and R3 formed a collaboration to focus on facilitating syndicated loans on blockchain networks. Using Synaps Loans technologies, the consortium successfully produced a proof of concept in 2017.

Trade Finance

Blockchain is perfectly suited to improving an area where modernization is long overdue. Even today, trade finance relies heavily on documentation, which is delivered globally via fax or mail. Blockchain technology has the potential to ultimately put a stop to this and usher in a new era of rapid digitalization across space.

Trading

DeFi has already proved that there is a strong need for decentralized marketplaces and exchanges. While this is currently happening outside of the banking business, lenders may be enticed to embrace the concept. As previously noted, blockchain technology in banking has the potential to totally alter clearing and settlement activities, which are critical components of any trading organization.

Fundraising

Historically, banks have handled the majority of fundraising activities, including initial public offerings. The introduction of initial coin offerings (ICOs) a few years ago aimed to challenge existing models by allowing start-ups to issue and sell cryptocurrency tokens to investors.

While very contentious, the ICO craze spurred a new way of thinking about fundraising, ultimately leading to the creation of security token offerings (STOs), a far more mature version of the original concept.

If the trend continues, it is logical to expect banks to explore for methods to enter the market.

Benefits Of Blockchain In Banking

The banking business has existed for centuries, acting as a facilitator for a wide range of financial and economic operations such as trade, lending and borrowing, transaction processing and settlement, underwriting, and so on. However, this durability has resulted in stagnation, as the industry has become increasingly slow to adapt to the quickly changing realities of the digital age.

Implementing new technologies can assist modernize the industry. Here's how blockchain affects banking:

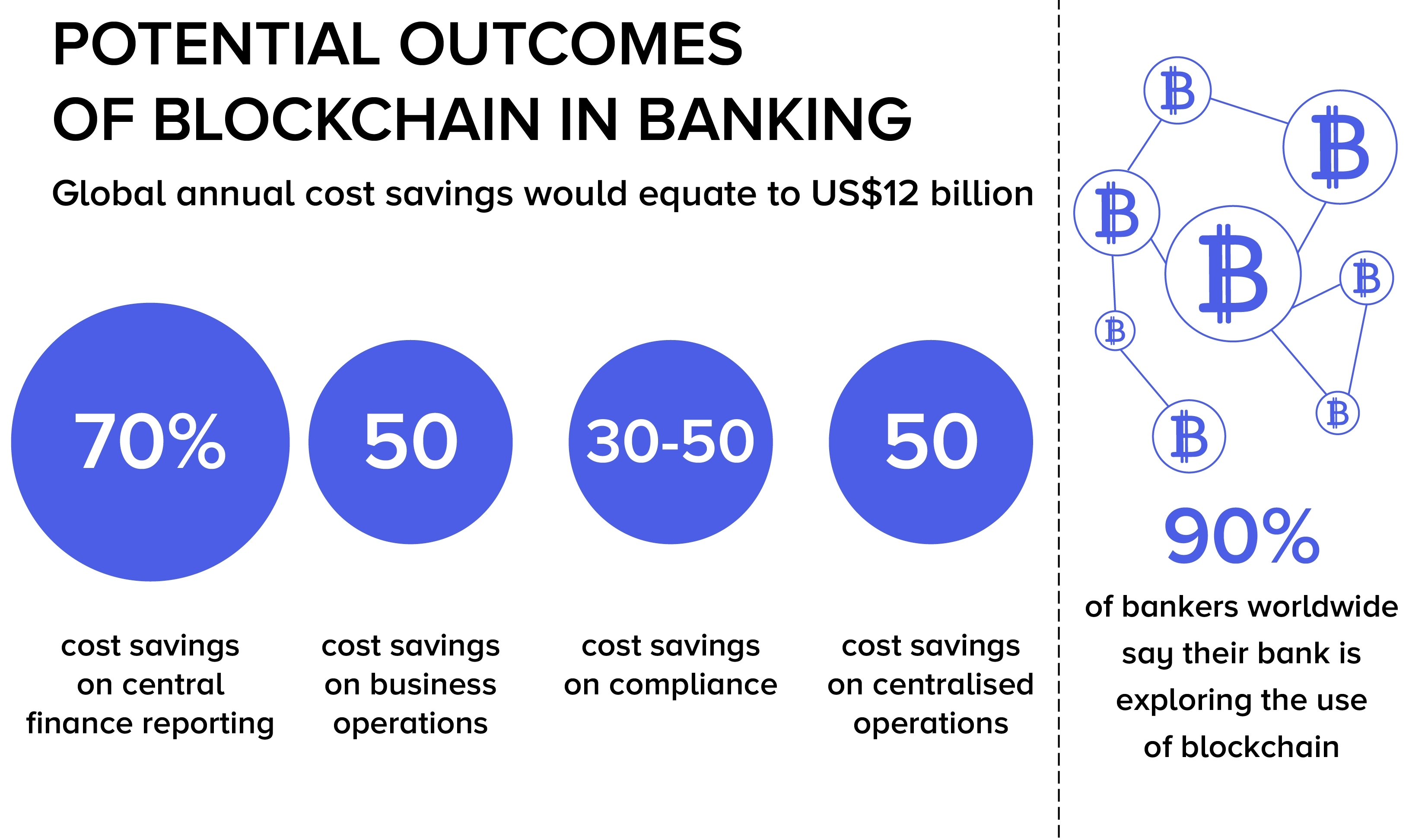

Cost Reduction

Banks continue to rely on obsolete and inefficient technology to support communication and coordination across extensive networks of counterparties. Various financial processes, such as clearing and settlement, require solutions that increase speed and efficiency.

Blockchain technology in banking can help to create such a solution. Blockchain technology, as a secure and efficient peer-to-peer mode of data dissemination, has the potential to eliminate inefficiencies within an organization, minimize dependency on middlemen, and bring considerable cost savings to the industry as a whole.

According to Accenture research from 2017, large investment banks may save $10 billion by implementing blockchain to increase the efficiency of their clearing and settlement operations.

Robust Security

Following a series of high-profile data breaches, banks have scrambled to tighten their security systems and safety processes. Cyber attacks, technical malfunctions, and human mistakes have wreaked havoc on the sector, exposing thousands of customers' financial information. Faced with these issues, some lenders have recently attempted to harness blockchain's promise to strengthen their security systems.

Blockchain can improve bank security in a variety of ways. For starters, the technology may be used to create powerful know-your-customer (KYC) solutions, as the cryptographic protection it provides ensures that the identities of all blockchain network users are validated. In addition, the information can be simply shared across all network participants, removing the requirement for middlemen to handle data distribution.

Blockchain's decentralized structure eliminates single points of failure, significantly reducing the danger of data breaches. Some blockchain protocols include an additional layer of security in the form of smart contracts, which allow for automated transactions when specific conditions are satisfied.

Instant Payments And Money Transfers

Blockchain protocols are already posing challenges to the banking industry in terms of payments and other money transfers, so it's no surprise that many lenders are looking closely at what the technology has to offer. Adopting blockchain, particularly for cross-border payments, might be a huge benefit to the industry.

To conduct cross-border payments, banks now predominantly rely on the Society for Worldwide Interbank Financial Telecommunications (SWIFT), a huge messaging network that facilitates information transfer between member banks.

However, with blockchain, lenders are directly connected to each other, eliminating the necessity for such intermediaries. It should also be mentioned that SWIFT has had its fair number of cyberattacks in recent years, which strengthens the case for embracing blockchain.

Mathew McDermott, Goldman Sachs' head of digital assets, told that "you could see a financial system where all assets and liabilities are native to a blockchain, with all transactions natively happening on chain" over the next five to ten years.

Digital Currency

One exciting application of blockchain in banking is its capacity to digitize tangible assets. This means that blockchains, among other things, can support a wide range of digital currencies.

We're already familiar with traditional cryptocurrencies like Bitcoin and stablecoins, which are linked to a fiat currency/asset or a basket of currencies/assets. These types of enterprises are often found outside of the traditional banking and financial sector. In recent years, however, a number of commercial and central banks have developed their own digital currency programs.

Perhaps the most visible initiative is that of the People's Bank of China (PBoC), which is developing its own Central Bank Digital Currency (CBDC). The CBDC, or DC/EP (Digital Currency/Electronic Payments), is now being piloted in several major Chinese cities.

In the commercial banking arena, US banking behemoth J.P. Morgan Chase last week introduced its own digital currency, JPM Coin. The coin operates on J.P Morgan's own blockchain Quorum, and the firm intends to expand it to other platforms in the future. One exciting application of blockchain in banking is its capacity to digitize tangible assets. This means that blockchains, among other things, can support a wide range of digital currencies.

We're already familiar with traditional cryptocurrencies like Bitcoin and stablecoins, which are linked to a fiat currency/asset or a basket of currencies/assets. These types of enterprises are often found outside of the traditional banking and financial sector. In recent years, however, a number of commercial and central banks have developed their own digital currency programs.

Perhaps the most visible initiative is that of the People's Bank of China (PBoC), which is developing its own Central Bank Digital Currency (CBDC). The CBDC, or DC/EP (Digital Currency/Electronic Payments), is now being piloted in several major Chinese cities. In the commercial banking arena, US banking behemoth J.P. Morgan Chase last week introduced its own digital currency, JPM Coin. The coin operates on J.P Morgan's own blockchain Quorum, and the firm intends to expand it to other platforms in the future.

Reduced Error

As previously stated, smart contracts can be used to automatically manage money transfers between counterparties. The benefits of this strategy include reducing the amount of trust required to reach an agreement as well as the possibility of errors.

As previously stated, smart contracts can be used to automatically manage money transfers between counterparties. The benefits of this strategy include reducing the amount of trust required to reach an agreement as well as the possibility of errors.

Blockchain In Banking - FAQs

How Does Blockchain Technology Enhance Security In Banking Transactions?

Blockchain ensures security in banking by employing cryptographic techniques, making data manipulation nearly impossible and safeguarding transactions against fraud.

What Are The Key Benefits Of Implementing Blockchain In The Banking Sector?

Implementing blockchain in banking offers benefits such as increased transparency, reduced operational costs, faster transactions, and improved traceability.

Can Blockchain Technology Improve Cross-border Transactions In Banking?

Yes, blockchain streamlines cross-border transactions in banking by reducing processing times, minimizing fees, and enhancing transparency through a decentralized ledger.

How Does Blockchain Foster Financial Inclusion In The Banking Industry?

Blockchain facilitates financial inclusion by providing a secure and accessible platform for individuals without traditional banking access, enabling them to participate in the financial system.

What Challenges Does The Banking Industry Face In Adopting Blockchain Technology?

Challenges include regulatory uncertainties, interoperability issues, and the need for industry-wide standards, which are gradually being addressed to facilitate widespread adoption.

Conclusion On Blockchain In Banking

The integration of blockchain in banking marks a pivotal moment in the evolution of financial services. As we witness the unfolding impact on security, efficiency, and trust, it is evident that blockchain is not just a buzzword but a catalyst for positive change.

The decentralized nature of this technology holds the promise of reshaping banking practices, fostering innovation, and creating a more inclusive financial landscape. As we embrace the era of blockchain in banking, the path ahead is one of continuous exploration, adaptation, and the realization of a more robust, secure, and transparent financial ecosystem.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles