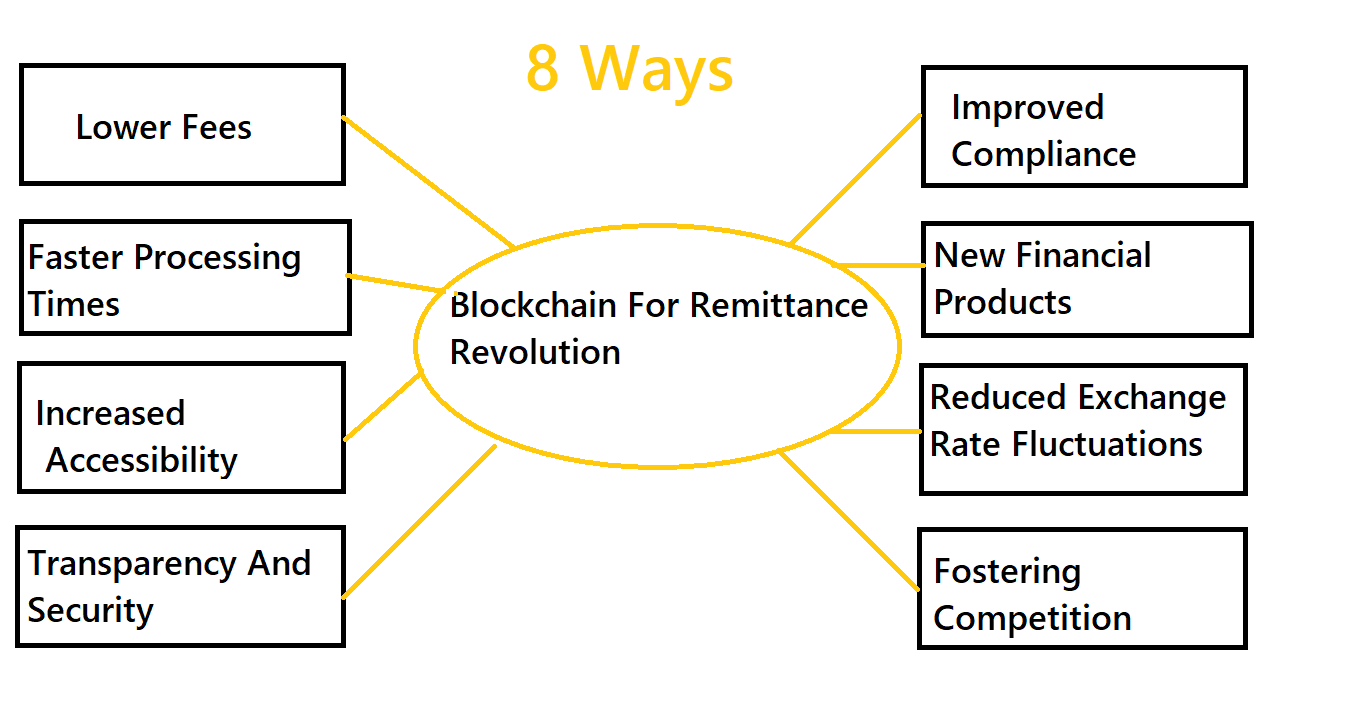

Blockchain For Remittances Revolution - 8 Ways It's Changing The Game

Discover how blockchain for remittances revolutionizes! Explore secure, fast, and cost-effective solutions for sending money globally. Uncover the power of decentralized technology in remittance services today.

Author:James PierceReviewer:Camilo WoodFeb 15, 202464 Shares32K Views

In an era of digital innovation, blockchain for remittancetechnology emerges as a game-changer in the realm of remittances. Picture a world where sending money across borders is not only seamless but also remarkably secure and cost-effective.

This vision is now a reality thanks to blockchain, a decentralized ledger system that eliminates the need for intermediaries, such as banks or traditional remittance services. Beyond speed, blockchain ensures unparalleled security, as each transaction is cryptographically secured and immutable, safeguarding against fraud and tampering.

8 Interesting Ways

Traditional remittance methods can be slow, expensive, and inconvenient, but blockchain technology offers a promising alternative. Here are 8 ways blockchain is changing the game for sending money across borders:

1. Lower Fees

By eliminating intermediaries, blockchain enables peer-to-peer transactions, significantly reducing fees compared to traditional money transfer services that can charge up to 10% or more.

2. Faster Processing Times

Imagine sending money instantly instead of waiting days! Blockchain transactions are completed within minutes or even seconds, regardless of location or currency exchange.

3. Increased Accessibility

No bank account? No problem! With blockchain, anyone with a mobile phone and internet access can send and receive money, promoting financial inclusion for the unbanked and underbanked populations.

4. Transparency And Security

Every transaction is recorded on a secure, public ledger, providing transparency and immutability. This reduces fraud risk and allows users to track their money in real-time.

5. Improved Compliance

Regulatory compliance is often a headache for traditional remittance services. Blockchain's transparent nature simplifies compliance and eases regulatory burdens.

6. New Financial Products

The possibilities extend beyond basic money transfers. Blockchain enables innovative financial products like microloans, escrow services, and even donations to directly reach intended beneficiaries.

7. Reduced Exchange Rate Fluctuations

Cryptocurrency fluctuations can be a concern, but stablecoins pegged to traditional currencies are emerging to mitigate this issue.

8. Fostering Competition

By disrupting the traditional remittance market, blockchain encourages competition and drives down costs for everyone involved.

Key Factors Contribute To The Importance Of Global Remittances

Global remittances, the transfer of money by migrants back to their home countries, hold immense importance for individuals, communities, and national economies. Several key factors contribute to their significance:

1. Poverty Alleviation And Improved Living Standards

- Direct source of income -Remittances act as a crucial source of income for millions in developing nations, often exceeding foreign aid or investment inflows. This income goes towards basic needs like food, shelter, healthcare, and education, directly impacting poverty rates and overall living standards.

- Investment in human capital -Remittances fund children's education, enabling them to acquire skills and access better employment opportunities in the future, breaking the cycle of poverty across generations.

- Support for small businesses -Recipients utilize remittances to invest in small businesses, creating jobs and stimulating local economies.

2. Economic Development And Stability

- Significant contribution to GDP -Remittances contribute significantly to the GDPof many developing countries, often surpassing exports or tourism revenue. This inflow stabilizes national economies and fuels growth.

- Foreign exchange reserves -Remittances build foreign exchange reserves, allowing governments to import essential goods and manage exchange rates, fostering overall economic stability.

- Counter-cyclical nature -During economic downturns or natural disasters, remittances tend to increase, offering much-needed financial support and aiding recovery efforts.

3. Social Impact And Empowerment

- Improved health and education -Remittances enable access to better healthcare and education, impacting the overall well-being and future prospects of families and communities.

- Gender empowerment -Women often receive and manage remittances, increasing their decision-making power within households and communities.

- Reduced pressure on migration -With improved living conditions and economic opportunities created by remittances, the pressure on individuals to migrate might decrease.

How Do Blockchain-based Remittances Work?

Blockchain-based remittances offer an alternative to traditional money transfer methods with potential benefits like faster speeds, lower fees, and increased transparency. Here's a breakdown of how they work:

1. Initiation

- You initiate the transfer on a platform using a smartphone app or website.

- You specify the amount to send, recipient details, and preferred cryptocurrency or token.

2. Conversion

You might convert your local currency to the chosen cryptocurrency (e.g., Bitcoin, stablecoins) on the platform or through an exchange.

3. Transaction On The Blockchain

- The platform broadcasts the transaction details (amount, sender, receiver) onto the blockchain network.

- Miners or validators on the network verify the transaction through a consensus mechanism.

4. Settlement

- Once verified, the cryptocurrency or token is deducted from your account and transferred to the recipient's wallet address on the blockchain.

- The recipient can convert the cryptocurrency back to their local currency if needed.

Key Differences From Traditional Methods

- Decentralization -No central authority like a bank controls the transaction, potentially removing intermediaries and associated fees.

- Transparency -Every transaction is recorded on the blockchain, accessible to anyone, offering transparency and immutability.

- Speed -Transactions can settle in minutes compared to days with traditional methods, depending on the platform and network congestion.

- Fees -Platforms might charge lower fees compared to traditional money transfer operators due to bypassing intermediaries.

Are Blockchain-based Remittances Widely Adopted?

Blockchain-based remittances are showing promise and gaining traction but still represent a small portion of the overall remittance market. While the potential benefits like faster speeds, lower fees, and increased transparency are attractive, widespread adoption faces several challenges:

1. Limited Adoption By Mainstream Institutions

Integrating blockchain technology into existing financial systems and gaining trust from established banks and money transfer operators remains a hurdle. Regulatory uncertainties and compliance requirements add further complexity.

2. Volatility Of Cryptocurrencies

The fluctuations in value associated with cryptocurrencies can introduce uncertainty and risk for remittance recipients, especially those relying on stable income.

3. Technical Hurdles

Scalability and interoperability between different blockchain platforms are technical challenges that need to be addressed to handle larger volumes and facilitate seamless transactions across networks.

4. Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies and blockchain-based services is still evolving, creating confusion and hesitancy for both users and platforms.

5. Accessibility And Digital Divide

Not everyone has access to smartphones, internet connectivity, or digital wallets, which are crucial for using blockchain-based remittances. This limits accessibility, particularly in underdeveloped regions with high remittance needs.

Growing Adoption And Future Potential

1. Pilot Programs And Initiatives

Governments and institutions are exploring pilot programs to test the technology and assess its viability for remittances in specific regions.

2. Increasing Platform Choice

A growing number of reputable platforms offer user-friendly interfaces and integrate with mainstream financial systems, improving accessibility and trust.

3. Stablecoin Adoption

The use of stablecoins, cryptocurrencies pegged to fiat currencies, reduces volatility concerns and makes transactions more predictable for recipients.

4. Collaboration And Innovation

Collaboration between different stakeholders, including financial institutions, technology companies, and regulators, is fostering innovation and addressing technical and regulatory challenges.

5. Potential For Regulatory Clarity

Ongoing discussions and pilot programs can pave the way for clearer regulations, providing a more stable environment for wider adoption.

The Road Ahead For Remittances

The road ahead for remittances is an exciting one, paved with both challenges and opportunities. While traditional money transfer services have dominated the landscape for decades, innovative technologies like blockchain and the evolving global economic landscape are shaping a future where sending money across borders could be faster, cheaper, and more accessible than ever before.

Here are some key factors to consider for the future of remittances:

Technological Advancements

- Blockchain -As discussed previously, blockchain's potential to reduce fees, increase transparency, and enable faster transactions could revolutionize the industry. However, scalability and regulatory adaptation still pose hurdles.

- Digital currencies -The rise of digital currencies like stablecoins could mitigate exchange rate fluctuations and offer alternative remittance options.

- Mobile wallets and financial inclusion -Expanding access to mobile wallets and other digital financial tools can further drive financial inclusion, especially in developing countries.

Regulatory Landscape

- Adapting regulations -Regulatory frameworks need to adapt to accommodate the innovative nature of blockchain and digital currencies while ensuring financial stability and consumer protection.

- Combating illegal activity -Collaboration between regulators, financial institutions, and technology companies is crucial to prevent money laundering and other illegal activities through remittance channels.

Economic And Social Trends

- Migration patterns -Shifts in migration patterns and demographics will influence remittance flows and recipient needs.

- Economic development -As developing countries advance economically, the focus of remittances might shift from basic needs to investments and entrepreneurship.

- Climate change and natural disasters -Remittances often play a crucial role in disaster relief and reconstruction efforts, and their importance might increase with climate change-induced events.

FAQ's About Blockchain For Remittances

Can Blockchain Be Used For Money Transfer?

With blockchain, one can: Transfer funds from one country to another very quickly. Blockchain payment systems can reduce payment processing time from days to a few hours. Reduce the intermediaries in the payment process, as blockchain ensures the authenticity of payments with a high degree of transparency.

Do People Use Crypto For Remittances?

The global remittance landscape is experiencing a profound shift with the advent of cryptocurrencies. In response to the challenges posed by traditional cross-border remittance methods, cryptocurrencies, such as Bitcoin, Ripple, and stablecoins, have emerged as disruptive forces offering a range of benefits.

How Is Blockchain Used In Payments?

Using a decentralized network removes the need for multiple intermediaries to authenticate and process transactions. A payment is authenticated in real time against data contained in a blockchain. This new transaction is added to a block that is then added to the chain for traceability.

Conclusion

Blockchain technology stands as a beacon of hope in the landscape of remittances, offering unprecedented efficiency, security, and accessibility. Its decentralized nature removes barriers and intermediaries, streamlining the transfer process and reducing costs for senders and recipients alike. As blockchain adoption continues to grow, particularly in the realm of remittances, it holds the potential to reshape the global financial landscape, making cross-border transactions more inclusive and affordable for everyone.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles