Bitcoin Volatility - Factors, Implications, And Management Strategies

Explore causes, implications, and strategies for managing Bitcoin volatility. Learn to navigate market fluctuations effectively.

Author:Camilo WoodReviewer:Stefano MclaughlinFeb 13, 20243.3K Shares80.6K Views

Bitcoin volatilityrefers to the rapid and unpredictable price fluctuations experienced by the world's first and most popular cryptocurrency. Since its inception in 2009, Bitcoin has been characterized by extreme price swings, attracting both fervent supporters and cautious skeptics.

In this comprehensive exploration, we delve into the factors driving Bitcoin volatility, its implications for investors and the broader financial ecosystem, and strategies for managing and mitigating its effects.

Factors Driving Bitcoin Volatility

After becoming live in 2009, the price of a single Bitcoin token increased from pennies on the dollar to $0.09 in 2010, which marked the beginning of the cryptocurrency's surge in popularity. Its price has risen by tens of thousands of dollars since then, and it has occasionally dropped or surged by thousands in a single day.

The price history of Bitcoin has been extremely unstable for a number of reasons. You can choose to trade it, invest in it, or keep an eye on its advancements by knowing the elements that affect its market price.

Supply And Demand For Bitcoin

More than any other aspect, supply and demand affect the pricing of most commodities. The amount of money that individuals are willing to pay and the quantity of coins in circulation have an impact on the value of bitcoin. The cryptocurrency has a 21 million coin maximum by design; as the amount in circulation approaches this limit, prices are expected to rise.

When the limit is reached, mining Bitcoin will no longer be profitable, but it is difficult to forecast what will happen to the pricing at that point. With a limited quantity, major financial actors will likely battle for ownership, and as a result, the price of Bitcoin will probably move in response to their moves.

Investor Actions For Bitcoin

Since Bitcoin is the most widely used cryptocurrency, demand is rising as supply gets more scarce. Wealthier, longer-term investors hold their Bitcoins, limiting exposure for individuals with fewer assets. By the end of 2020, the top 10,000 investors possessed one-third of all Bitcoins, according to the National Bureau of Economic Research.

Institutional and big investor holdings will probably continue to rise as long as there is widespread confidence in the sustainability and profitability of cryptocurrencies.

These investors also contribute to the volatility of bitcoin to some extent. How Bitcoin whales, investors with substantial holdings of BTC that potentially effect market value, would convert their substantial holdings into fiat money without having an impact on the price of Bitcoin is a mystery. Prices would crash if the whales started selling their Bitcoin holdings all of a sudden, as other investors would panic as well.

The maximum amount that can be liquidated in a single day on most exchanges is $50,000. It may not be possible for investors holding thousands of bitcoins to quickly sell their holdings and avoid suffering huge losses.

If the price of Bitcoin stays at $50,000, a larger investor would only be able to sell one coin every day. Before anyone owning more than $50,000 in coins could sell them all, other investors would start to sell, sending values plummeting, resulting in large and swift losses.

News Articles About Bitcoin

Because media and news organizations are businesses that depend on content for its viewers and readers, they frequently publish information and forecasts from "experts" that aren't always supported by facts or opinions.

It's not unusual to hear someone with significant Bitcoin investments predict that the coin will soon be valued in the hundreds of thousands. Others try to undercut Bitcoin by marketing recently created coins. To the advantage of those who possess vast quantities of coins, the majority of this media coverage and publicity, however, influences the price of Bitcoin.

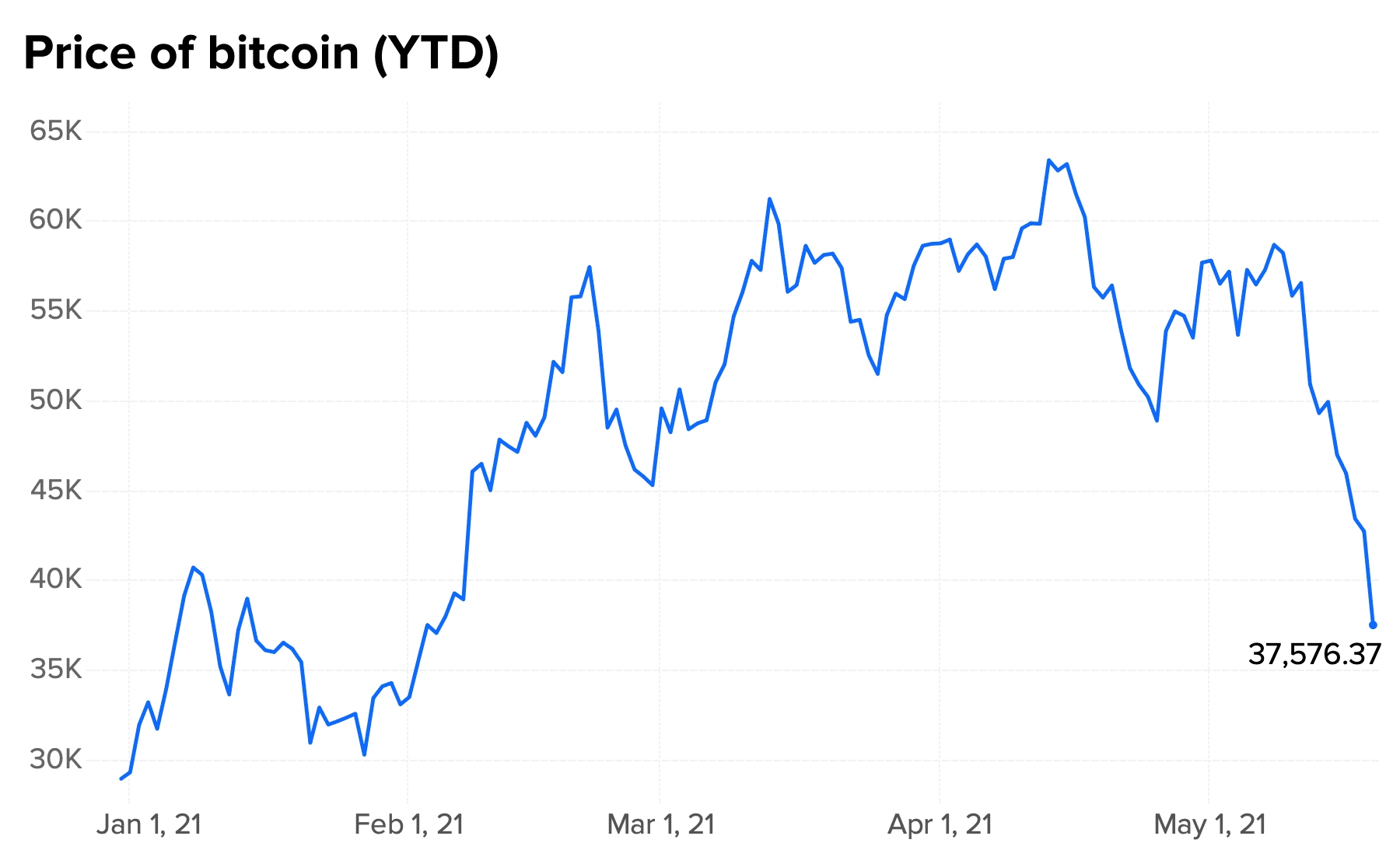

Over the following several weeks, the price of Bitcoin surged as media outlets revealed Proshare's launch of its Bitcoin Strategy ETF (exchange-traded fund) in late October 2021. The opportunity to purchase a cryptocurrency on a recognized exchange was eagerly awaited by investors, who sent the price skyrocketing to nearly $69,000.

Prices fell back to about $50,000 as the initial excitement subsided and investors realized the ETF was connected to Bitcoin through futures contracts that were sold on the commodities market.

Bitcoin Regulation

Short-term price fluctuations in Bitcoin are sometimes caused by rumors regarding laws, however the importance of these fluctuations is still being examined and discussed.

The price of Bitcoin may also be impacted by government agency opinions on cryptocurrencies. For instance, because Bitcoin may be converted into cash, the Internal Revenue Service (IRS)views it as a convertible virtual money. In addition, if Bitcoin is utilized as an investing tool, the IRS views it as a capital asset. In addition, you have to declare any revenue you receive from mining Bitcoins based on their market value on the day they are received.

Implications Of Bitcoin Volatility

- Investment Risk- Bitcoin's volatility poses significant risks for investors, including price instability, capital erosion, and potential loss of investment. Rapid price fluctuations can lead to emotional decision-making, panic selling, and herd behavior, amplifying market volatility further.

- Market Efficiency and Price Discovery- While volatility may deter some investors, it also presents opportunities for profit-seeking traders and arbitrageurs. Volatility contributes to market liquidity and price discovery, as buyers and sellers adjust their strategies in response to changing market conditions.

- Regulatory and Institutional Concerns- Heightened volatility in the cryptocurrency markets has drawn regulatory scrutiny and raised concerns among institutional investors about market manipulation, fraud, and investor protection. Regulatory uncertainty and lack of oversight exacerbate market volatility and hinder mainstream adoption.

Strategies For Managing Bitcoin Volatility

- Diversification- Diversifying investment portfolios across different asset classes, including stocks, bonds, commodities, and cryptocurrencies, can help mitigate the impact of Bitcoin volatility on overall portfolio performance. By spreading risk across multiple assets with varying risk-return profiles, investors can reduce their exposure to individual market fluctuations.

- Risk Management Techniques -Implementing risk management strategies such as stop-loss orders, position sizing, and hedging strategies can help limit losses and protect capital in volatile markets. Setting predetermined exit points, establishing risk tolerance levels, and using options, futures, or derivative products can enhance risk-adjusted returns.

- Long-Term Perspective- Adopting a long-term investment horizon and focusing on fundamental factors, such as Bitcoin's adoption, network effects, and scarcity, can help investors withstand short-term volatility and capitalize on long-term growth potential. Dollar-cost averaging, or regularly investing fixed amounts over time, smoothens the impact of price fluctuations and reduces market timing risks.

- Staying Informed and Educated -Keeping abreast of market developments, industry trends, and regulatory updates is essential for making informed investment decisions in the volatile cryptocurrency market. Engaging with reputable sources, attending conferences, and joining cryptocurrency communities can provide valuable insights and perspective.

Bitcoin Volatility - FAQs

What Does Volatile Mean In Bitcoin?

The amount that an asset's price has fluctuated up or down over time is measured by its volatility.

What Is The Volatility Score Of Bitcoin?

It gauges how much the price of Bitcoin changes in relation to its price on a given day.

What Causes Bitcoin Volatility?

Bitcoin volatility is driven by factors such as market demand, liquidity, technological developments, regulatory news, and media coverage.

How Does Bitcoin Volatility Affect Investors?

Bitcoin volatility poses risks for investors, including price instability, potential loss of investment, and emotional decision-making. However, it also presents opportunities for profit-seeking traders.

Can Bitcoin Volatility Be Predicted?

Predicting Bitcoin volatility is challenging due to its complex and dynamic nature. While technical analysis and market indicators can offer insights, volatility remains inherently unpredictable.

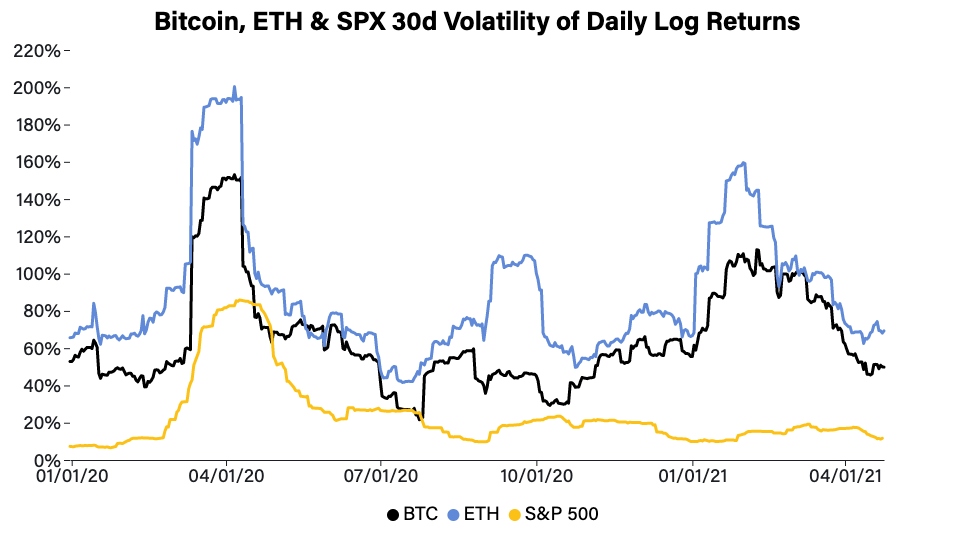

How Volatile Is Bitcoin Compared To The S&P 500?

The ratio of realized Bitcoin volatility to VIX is currently 3.4x, compared to an average of 2.4x in 2023. This indicates that Bitcoin volatility is 30% higher than VIX volatility. Given that the correlation coefficient has been at 58% for the past 30 days, traders may use SP500 put options to hedge their exposure to Bitcoin.

How Can Investors Manage Bitcoin Volatility?

Investors can manage Bitcoin volatility through diversification, risk management techniques, adopting a long-term perspective, and staying informed about market developments.

Is Bitcoin Volatility Increasing Or Decreasing Over Time?

Bitcoin volatility fluctuates over time, influenced by various factors such as market maturity, regulatory developments, adoption trends, and macroeconomic conditions.

Conclusion

Bitcoin volatility is an inherent characteristic of the cryptocurrency market, driven by a myriad of factors including market demand, liquidity, technological advancements, and media coverage.

While volatility presents both risks and opportunities for investors, adopting prudent risk management strategies, maintaining a long-term perspective, and staying informed are essential for navigating the dynamic and often turbulent landscape of Bitcoin investing.

As the cryptocurrency ecosystem continues to evolve and mature, addressing volatility remains a key challenge and opportunity for market participants, regulators, and stakeholders alike.

Camilo Wood

Author

Stefano Mclaughlin

Reviewer

Latest Articles

Popular Articles