Bitcoin Volatility Management - Decoding Bitcoin's Moves

Navigate Bitcoin volatility management expert strategies. Master market swings for successful cryptocurrency management.

Author:James PierceReviewer:Camilo WoodFeb 13, 20241.1K Shares66.7K Views

Bitcoin, the pioneer of cryptocurrencies, has captivated the financial world with its potential for high returns. However, this journey comes with the challenge of navigating its notorious volatility. Understanding Bitcoin volatility managementis crucial for investors and traders seeking to harness its benefits while minimizing risks.

In this comprehensive guide, we will delve into the dynamics of Bitcoin volatility and explore effective strategies for Bitcoin volatility management.

Understanding Bitcoin Volatility

Bitcoin's volatility is deeply rooted in its inherent characteristics. Unlike traditional assets, Bitcoin is not tied to any physical entity, and its value is subject to speculative trading, market sentiment, and macroeconomic factors.

Market sentiment plays a pivotal role in Bitcoin's price movements. Positive news, regulatory developments, or endorsements can trigger bullish trends, while negative news may lead to rapid declines. Speculation intensifies these movements, contributing to heightened volatility.

Bitcoin's relatively smaller market size compared to traditional assets contributes to increased volatility. Lower liquidity and market depth make it susceptible to price swings, as large trades can have a more pronounced impact.

Here are some Bitcoin volatility management strategies you must consider:

Understanding the many causes of volatility is the first step towards managing it successfully. Market speculation, which is typically propelled by excitement and the interwoven aspects of fear, uncertainty, and doubt (FUD), regularly affects the pricing of cryptocurrency assets.

Limited liquidity might intensify this volatility by causing sharp price swings during notable trading alterations. The market's unstable environment can also be shaped by the interaction of legislative changes, possible cybersecurity breaches that target cryptocurrency exchanges, and the constant effect of news reports, official statements, and popular social media attitude.

It is still impossible to say with precision whether volatility will rise or fall, even though its causes are known.

Diversification

Diversifying a crypto portfolio can help mitigate the impact of Bitcoin's volatility. Including a mix of cryptocurrencies, stablecoins, and traditional assets spreads risk and reduces vulnerability to the fluctuations of a single asset.

Risk Management And Position Sizing

Implementing risk management strategies is paramount. This involves determining the percentage of the portfolio allocated to Bitcoin and setting stop-loss orders to limit potential losses. Position sizing ensures that no single trade significantly impacts the overall portfolio.

Hedging With Derivatives

Derivatives such as options and futures provide tools for hedging against Bitcoin volatility. Investors can use options contracts to protect against downside risk or engage in futures contracts to speculate on price movements while managing risk exposure.

Stablecoins As A Safe Haven

During periods of heightened volatility, converting Bitcoin holdings into stablecoins offers a temporary safe haven. Stablecoins, pegged to traditional currencies, provide stability and liquidity, allowing investors to re-enter the market strategically.

Active Monitoring And Analysis

Staying informed about market trends, news, and macroeconomic factors is crucial for making informed decisions. Technical and fundamental analysis tools can aid in identifying potential price movements and adjusting strategies accordingly.

Long-Term Holding Strategy

Adopting a long-term holding strategy, often referred to as "HODLing," involves weathering short-term volatility for potential long-term gains. This approach requires a strong belief in Bitcoin's future value and resilience to short-term market fluctuations.

Algorithmic Trading Bots

Algorithmic trading bots can execute predefined strategies based on market indicators, ensuring swift responses to price movements. These bots can automate buy/sell decisions, allowing for disciplined trading and risk management.

Stay Informed About Regulatory Developments

Regulatory changes can significantly impact Bitcoin's volatility. Staying abreast of legal and regulatory developments worldwide can provide valuable insights into potential market shifts.

Dollar-Cost Averaging (DCA)

Bitcoin's Dollar-Cost Averaging (DCA) Regardless of the price of Bitcoin, the Dollar-Cost Averaging (DCA) investing method entails buying a set quantity of the cryptocurrency on a regular basis. By minimizing the effects of transient price swings and market volatility, this strategy enables investors to progressively increase their Bitcoin holdings over time.

How Does Bitcoin DCA Operate?

Rather of making a single, large investment, participants in the Bitcoin DCA agree to invest a predetermined sum of money (for example, $100) at regular intervals (for example, weekly, monthly).

The quantity of Bitcoin acquired for every investment is contingent upon the prevailing market value. In the event of a high price of Bitcoin, a fixed dollar amount will purchase fewer units, and in the event of a low price, more units.

DCA helps investors avoid making emotionally charged investing decisions based on transient price changes by distributing purchases over time. Rather, it smoothes out the price of Bitcoin purchases, which can lower the danger of investing during a peak in the market.

DCA is a long-term investment technique that enables investors to build up a substantial Bitcoin holding over time. This strategy is appropriate for people who want to reduce short-term risks but still believe in the long-term potential of Bitcoin.

Bitcoin Volatility Management - FAQs

How Do You Solve Crypto Volatility?

Diversifying your portfolio across several assets, sectors, and methods is one of the best ways to lessen your exposure to the volatility and unpredictability of the cryptocurrency market.

What Drives Bitcoin Volatility?

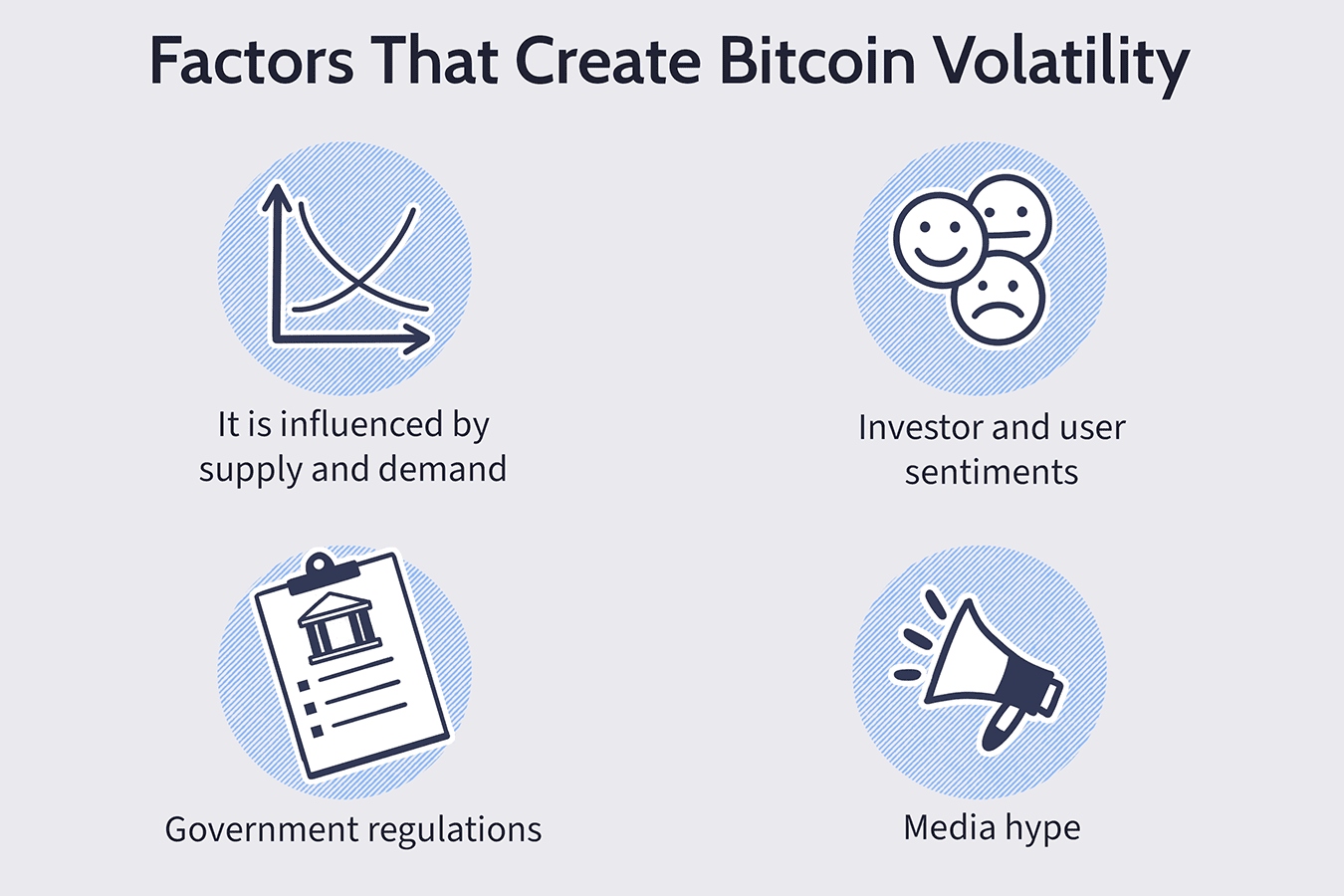

Similar to other assets, the price of bitcoin fluctuates due to supply and demand as well as investor reactions to news, excitement, and governmental measures. The degree to which the price of bitcoin fluctuates sets it apart from other investment pricing.

How Can Investors Manage Bitcoin Volatility Effectively?

Investors can manage Bitcoin volatility through strategies like diversification, risk management, and hedging with derivatives to mitigate potential losses.

How Will Bitcoin Become Less Volatile?

The conventional wisdom maintains that as Bitcoin's user base grows and its use in transactions increases, it will become more stable. But historical patterns do not indicate that its volatility is trending lower (Baur and Dimpfl, 2021).

What Role Does Diversification Play In Bitcoin Volatility Management?

Diversification involves spreading risk across various assets, including cryptocurrencies, stablecoins, and traditional assets, reducing vulnerability to Bitcoin's price fluctuations.

What Is The Significance Of Active Monitoring And Analysis In Bitcoin Volatility Management?

Staying informed about market trends, news, and macroeconomic factors is crucial for making informed decisions and adjusting strategies according to Bitcoin's dynamic price movements.

How Can Investors Participate In Staking Or Yield Farming For Bitcoin Volatility Management?

Some crypto platforms offer staking or yield farming opportunities, allowing users to earn rewards by locking their Bitcoin. While introducing some illiquidity, it provides an avenue for generating additional returns.

What Psychological Considerations Are Important For Navigating Bitcoin Volatility?

Managing Bitcoin volatility requires psychological resilience. Investors must be prepared for the emotional challenges that come with price fluctuations and avoid making impulsive decisions based on short-term market movements.

Conclusion

Bitcoin volatility is an inherent aspect of its dynamic nature, offering both opportunities and challenges. Effective Bitcoin volatility management requires a combination of strategic approaches, risk mitigation, and a deep understanding of market dynamics.

Investors and traders should continuously adapt their strategies, stay informed about market developments, and embrace a diversified and disciplined approach to navigate the evolving landscape of Bitcoin and cryptocurrency markets.

Jump to

Understanding Bitcoin Volatility

Diversification

Risk Management And Position Sizing

Hedging With Derivatives

Stablecoins As A Safe Haven

Active Monitoring And Analysis

Long-Term Holding Strategy

Algorithmic Trading Bots

Stay Informed About Regulatory Developments

Dollar-Cost Averaging (DCA)

Bitcoin Volatility Management - FAQs

Conclusion

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles