Bitcoin Halving Effects - Discussing Its Far-reaching Consequences

Explore the profound Bitcoin halving effects: from supply dynamics to market sentiment, unraveling the impact on the crypto landscape.

Author:Camilo WoodReviewer:James PierceFeb 05, 2024715 Shares19.8K Views

Bitcoin halving is a significant event embedded in the cryptocurrency's protocol that occurs approximately every four years or after every 210,000 blocks have been mined. The process involves reducing the reward that miners receive for validating transactions by half. Bitcoin halving effectscan be seen on various aspects of the cryptocurrency ecosystem, influencing its supply dynamics, miner incentives, market sentiment, and ultimately, its price.

In this detailed exploration, we will delve into the intricacies of Bitcoin halving effects.

Understanding Bitcoin Halving

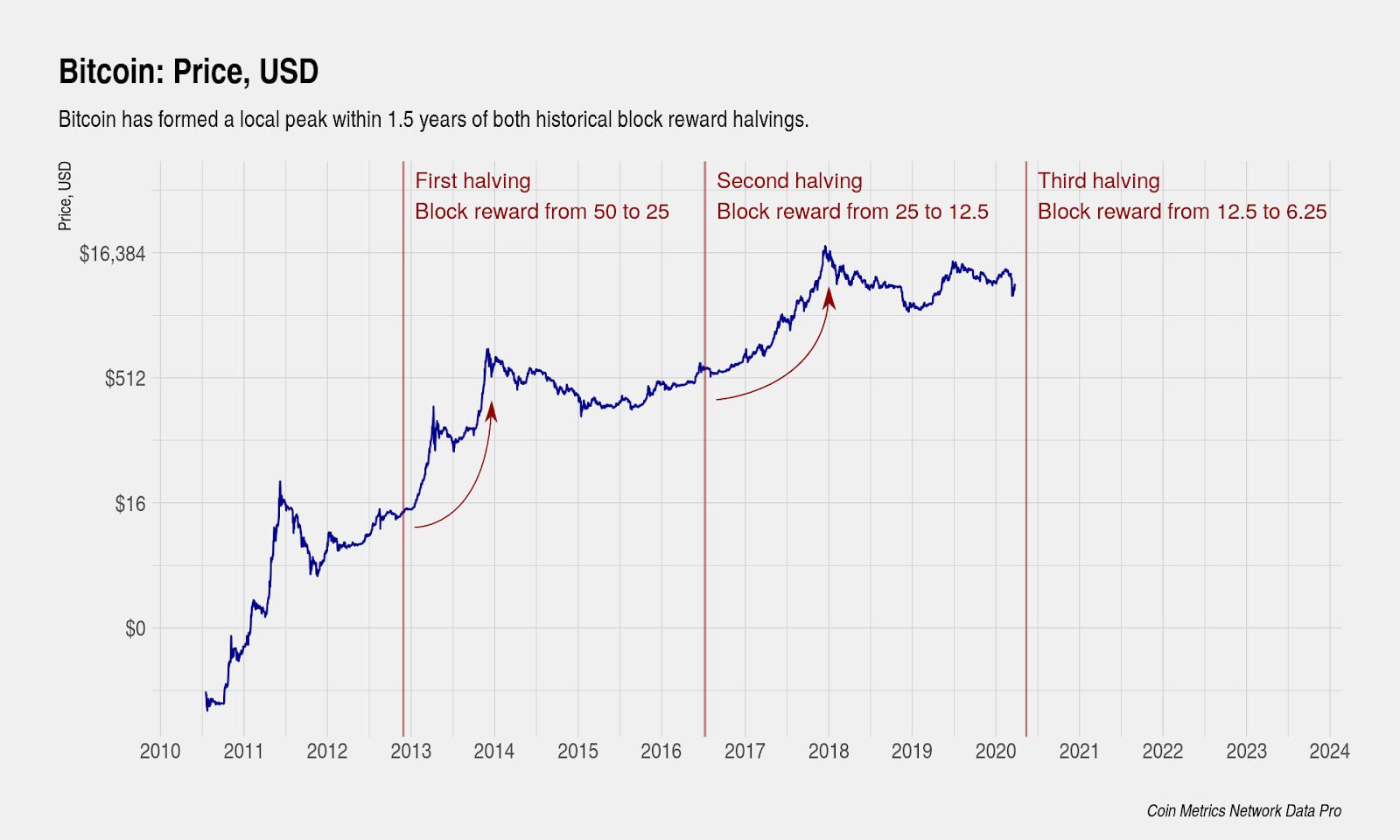

Bitcoin halving is programmed into its source code to control the issuance rate and limit the total supply to 21 million coins. The first two halvings occurred in 2012 and 2016, with subsequent events anticipated approximately every four years until the year 2140 when the last Bitcoin is projected to be mined.

What Happens When Bitcoin Halves?

A Bitcoin halving primarily and most prominently results in a decrease in the mining reward. The payouts to Bitcoin miners that successfully mine a new block are divided in half. The quantity of newly generated bitcoins that are put into use is halved.

The rate at which new bitcoins are created falls as the block reward is lowered by 50%. The coin experiences less inflation as a result of its slower supply expansion.

The network steadily gets closer to this maximum supply as halvings continue. Miners will no longer earn block rewards in the form of freshly created Bitcoins once the maximum quantity is achieved; instead, transaction fees will serve as the main source of miner incentives.

Price halvings of Bitcoin have in the past led to price increases in the months that followed. As a result of the ensuing price increase, miners have been compensated for their labor even though they are receiving fewer bitcoins. The payouts are still declining, so halving might not produce a big price hike that would drive some miners off the network.

Bitcoin Halving Effect On Price

Events involving the halves of Bitcoin have historically been linked to price gains. This is due to the possibility of scarcity resulting from the decreased rate of new Bitcoin generation, which might raise demand and, consequently, the price. But it's crucial to keep in mind that a number of factors affect market dynamics, and price fluctuations can be intricate.

Examining the last three halving incidents reveals that a noteworthy price increase often starts six to twelve months later. Additionally, the price of Bitcoin tends to increase prior to a halving event because speculators anticipate a price rally following the halves.

It is uncertain, nevertheless, if prices will increase during the subsequent halving because the conditions surrounding these occurrences differ.

Supply And Demand Dynamics

One of the immediate effects of Bitcoin halving is a reduction in the rate at which new bitcoins are created. This reduced issuance impacts the inflation rate, making Bitcoin scarcer over time. The law of supply and demand suggests that, with a fixed supply and consistent or increasing demand, the price tends to rise. Investors often anticipate this scarcity, leading to increased market interest around the halving period.

Miner Incentives

Bitcoin miners play a crucial role in validating transactions and securing the network. With each halving, the reward for successfully mining a block is halved, requiring miners to adapt to the reduced incentives. Some less efficient mining operations may become unprofitable, leading to a potential decrease in the overall hash rate. However, this adjustment is a natural part of Bitcoin's self-regulating mechanism, ensuring the system's sustainability.

Market Sentiment

Bitcoin halving events are often surrounded by anticipation and speculation. Traders and investors closely monitor the lead-up to a halving, and market sentiment can significantly influence price movements. Historically, Bitcoin has experienced increased volatility around halving events, with prices surging in the months preceding and following the occurrence.

Macro-Economic Factors

Bitcoin's narrative as "digital gold" and a hedge against traditional financial uncertainties comes into play during times of economic turbulence. Some investors view Bitcoin as a store of value, especially in the face of inflationary pressures or currency devaluation. Bitcoin halving, with its impact on supply and scarcity, reinforces this narrative, attracting individuals seeking alternative investment options.

Network Security

Bitcoin halving events have implications for the security of the network. As miner rewards decrease, concerns arise about potential declines in hash rate and the overall security of the blockchain. However, the self-adjusting nature of Bitcoin's difficulty level ensures that the network remains robust, maintaining transaction validation and security.

Altcoin Relationships

Bitcoin's dominance in the cryptocurrency market often leads to fluctuations in the prices of other digital assets. Bitcoin halving events can influence market sentiment across the entire cryptocurrency space, with altcoins experiencing both positive and negative effects based on investor perceptions and market dynamics.

Technological Developments

Halving events also coincide with ongoing technological developments and upgrades to the Bitcoin protocol. These improvements aim to enhance scalability, security, and overall functionality. Technological advancements can contribute to increased confidence in the Bitcoin ecosystem and, subsequently, positive market sentiment.

Long-Term Implications

While the immediate effects of Bitcoin halving are often scrutinized for their impact on prices and market dynamics, it's essential to consider the long-term implications. The gradual reduction in new Bitcoin issuance contributes to the cryptocurrency's maturation, establishing it as a deflationary asset with an increasingly limited supply.

Bitcoin Halving Effects - FAQs

What Is Bitcoin Halving And Why Does It Occur?

Bitcoin halving is a programmed event reducing miner rewards by half every four years to control supply and limit total coins to 21 million.

What Are The Benefits Of Bitcoin Halving?

The halving of Bitcoin helps keep the ecosystem's unsustainable inflation under control. Reducing the block reward slows down the rate at which fresh Bitcoin enters the market.

Does Bitcoin Go Up After Halving?

After previous halvings, bitcoin prices have usually increased. Six months after the initial price cut in 2012, it increased from $12 to $126.

How Does Bitcoin Halving Affect The Market?

The law of simple supply and demand explains how the price of Bitcoin is most directly affected by its halving. Assuming that demand either stays the same or rises, the price of Bitcoin should climb if fewer are made accessible.

What Are The Effects Of Bitcoin Halving On Miner Incentives?

Miner incentives are halved during Bitcoin halving events, requiring miners to adapt to reduced rewards and potentially impacting the overall hash rate.

What Are The Long-term Implications Of Bitcoin Halving On The Cryptocurrency Ecosystem?

Bitcoin halving contributes to the cryptocurrency's maturation, establishing it as a deflationary asset with a limited and increasingly scarce supply, shaping its future trajectory.

Conclusion

Bitcoin halving is a pivotal event that reverberates throughout the cryptocurrency ecosystem, affecting supply dynamics, miner incentives, market sentiment, and technological developments. Understanding the multifaceted Bitcoin halving effects is crucial for investors, analysts, and enthusiasts alike. As Bitcoin continues to evolve, the effects of halving events will play a significant role in shaping the future of this groundbreaking digital currency.

Jump to

Camilo Wood

Author

James Pierce

Reviewer

Latest Articles

Popular Articles