Best Ways To Retire Rich - Fortune Favors The Prepared

Discover the best ways to retire rich with our comprehensive guide on the best strategies and practices. Explore investment tips, savings plans, and financial advice to secure a prosperous retirement. Start your journey to financial success today!

Author:James PierceReviewer:Camilo WoodNov 10, 2023163 Shares23.2K Views

Discover the best ways to retire richand tips for achieving a prosperous retirement with our comprehensive guide. Explore smart investment options, financial planning advice, and practical insights to secure a financially abundant retirement for a brighter future.

Embarking on the path to a financially secure retirement is a goal cherished by many. In the quest for the golden years, the significance of adopting the best strategies cannot be overstated. The landscape of retirement planning is vast, filled with potential pitfalls and opportunities.

This guide is your compass through the maze, offering insights into the best ways to retire rich. From savvy investment approaches to disciplined savings plans, we unravel the secrets that can pave the way to a prosperous and worry-free retirement.

Retiring as a millionaire is a dream many aspire to achieve. While the path to financial freedom may seem daunting, breaking it down into actionable steps can make the journey more manageable and achievable. In this comprehensive guide, we'll explore ten key steps that, when followed diligently, can pave the way for a comfortable and financially secure retirement.

Here are some best ways to retire rich as a millionaire:

Define Your Retirement Goals

Defining your retirement goals is the pivotal first step towards crafting a financial roadmap for your golden years. It involves envisioning the lifestyle you desire, considering travel aspirations, and contemplating any legacy you wish to leave behind. Clearly delineating these objectives provides the clarity needed to tailor your retirement plan accordingly.

Your goals act as the guiding stars, influencing decisions on savings, investments, and budgeting. Whether it's achieving a specific income level, enjoying extensive leisure activities, or supporting charitable endeavors, defining your retirement goals ensures that your financial strategy is purposeful and aligned with your aspirations.

As you embark on this journey, the act of defining your goals not only sets the trajectory for a secure retirement but also adds a sense of purpose and direction to your financial planning endeavors.

Create A Budget And Stick To It

Creating a budget and adhering to it are foundational steps in achieving financial stability, especially in preparation for retirement. Crafting a budget involves a comprehensive analysis of income, expenses, and financial goals.

It provides a clear overview of where your money goes, allowing for strategic allocation towards savings and investments. The real power, however, lies in the commitment to sticking to the budget. Discipline is key; it transforms the budget from a mere plan into a dynamic tool that guides daily financial decisions.

By adhering to your budget, you cultivate a habit of responsible spending, ensuring that your financial resources are directed purposefully, and contributing significantly to achieving long-term goals like a comfortable and prosperous retirement.

Maximize Retirement Account Contributions

Maximizing retirement account contributions is a pivotal strategy in securing a robust financial future, particularly in the context of retirement planning. By contributing the maximum allowable amount to retirement accounts such as 401(k)s or IRAs, individuals capitalize on valuable tax advantages and expedite the growth of their nest egg.

These contributions not only reduce current taxable income but also harness the power of compounding over time. The disciplined commitment to reaching contribution limits signifies a proactive approach to wealth accumulation, enhancing the potential for a financially secure retirement.

Whether through employer-sponsored plans or individual retirement accounts, maximizing contributions represents a tangible commitment to building a substantial retirement fund, setting the stage for a comfortable and prosperous post-work life.

Diversify Your Investments

Diversifying your investments is a fundamental principle that serves as a risk management strategy and a cornerstone for financial success. By spreading your investments across different asset classes such as stocks, bonds, and real estate, you reduce the impact of a poor-performing asset on your overall portfolio.

Diversification is a dynamic approach that safeguards against market volatility and helps optimize returns. It aligns with the timeless adage of not putting all your eggs in one basket. This strategic distribution of investments allows for a balanced and resilient portfolio that can weather various economic conditions.

Embracing diversification empowers investors to navigate uncertainties, potentially enhancing the stability and performance of their investment portfolio over the long term, a crucial consideration for those planning for retirement and seeking sustained financial growth.

Leverage Employer Benefits

Leveraging employer benefits is a strategic move with profound implications for financial prosperity, particularly in the realm of retirement planning. Employers often offer valuable benefits, such as 401(k) matching contributions, health insurance, and stock options.

By maximizing these benefits, individuals can significantly boost their overall compensation and accelerate their journey towards financial security. Employer-sponsored retirement plans, in particular, like 401(k)s, represent an opportunity to grow wealth with the added advantage of employer contributions.

Taking full advantage of these benefits not only enhances current financial well-being but also lays a robust foundation for a comfortable retirement. It reflects a proactive approach to wealth-building, recognizing and capitalizing on the additional resources provided by the employer, thus optimizing the potential for a prosperous financial future.

Stay Informed And Seek Professional Advice

Staying informed and seeking professional advice are indispensable practices in the realm of financial planning, especially when considering retirement. Financial landscapes evolve, and staying abreast of market trends, economic changes, and investment opportunities is crucial.

Regular self-education empowers individuals to make informed decisions about their financial future. Additionally, seeking advice from financial professionals provides personalized insights tailored to individual circumstances. Financial advisors can offer expert guidance on retirement planning, investment strategies, and risk management.

Their expertise helps individuals navigate complex financial scenarios, ensuring that their retirement plans align with their unique goals and tolerance for risk. By staying informed and seeking professional advice, individuals can make strategic, well-informed decisions that contribute to a secure and prosperous retirement.

Pay Down High-Interest Debt

Paying down high-interest debt is a pivotal step in securing financial stability, particularly as one plans for retirement. High-interest debts, such as credit card balances, can be a significant financial burden, impacting one's ability to save and invest for the future.

By prioritizing the repayment of high-interest debts, individuals free up resources that can be redirected towards building a substantial retirement fund. This strategic approach not only reduces the overall cost of debt but also accelerates the accumulation of wealth. It aligns with a broader financial goal of achieving a debt-free and financially secure retirement.

By tackling high-interest debt head-on, individuals take a crucial stride towards creating a solid financial foundation, setting the stage for a more comfortable and prosperous retirement.

Continuously Reassess And Adjust Your Plan

Continuously reassessing and adjusting your financial plan is a dynamic and essential practice, especially in the context of retirement preparation. Life is dynamic, and financial goals, market conditions, and personal circumstances change over time.

Regularly revisiting your plan allows for adaptability, ensuring it remains relevant and effective. Adjustments may be necessary as you progress through different life stages, welcoming new opportunities or facing unforeseen challenges. By staying proactive and responsive, you maintain financial agility, optimizing your strategy to align with evolving objectives.

This continuous reassessment empowers you to make informed decisions, enhancing the likelihood of achieving a financially secure and fulfilling retirement. Flexibility and responsiveness in financial planning are key components of a resilient strategy that can withstand the complexities of life's ever-changing landscape.

Consider Additional Income Streams

Considering additional income streams is a strategic approach that can significantly bolster financial stability, particularly in the context of retirement planning. Beyond traditional sources of income, exploring supplementary avenues such as side businesses, freelance work, or investments can provide an extra layer of financial security.

These diversified income streams not only contribute to increased savings but also offer a safety net in unpredictable economic climates. As retirement approaches, having multiple sources of income can be instrumental in maintaining a comfortable lifestyle and offsetting unexpected expenses.

This forward-thinking approach aligns with the modern paradigm of financial resilience, ensuring individuals have the flexibility to adapt to changing circumstances and enhancing their overall financial well-being in retirement and beyond.

Stay Disciplined And Be Patient

Staying disciplined and being patient are indispensable virtues in the pursuit of long-term financial goals, especially in the context of retirement planning. Disciplined financial habits, such as consistent saving and prudent investing, form the bedrock of wealth accumulation.

By adhering to a well-structured plan, individuals can navigate market fluctuations and stay focused on their objectives. Patience is equally crucial, recognizing that building substantial wealth is a gradual process. Resisting the urge to succumb to short-term market volatility or impulsive financial decisions allows for the power of compounding to work its magic over time.

This steadfast approach not only fortifies financial resilience but also sets the stage for a secure and prosperous retirement, emphasizing the importance of a measured and enduring commitment to one's financial journey.

Building A Substantial Nest Egg For Retirement - A Strategic Approach

Retiring with a substantial nest egg involves a combination of disciplined saving, prudent investing, and strategic financial planning. As individuals navigate the journey toward financial independence, several key principles can guide them in building a nest egg capable of sustaining a comfortable retirement.

The adage "the early bird catches the worm" holds true in retirement planning. Starting early allows for the power of compounding to work its magic. Consistently contributing to retirement accounts, such as 401(k)s or IRAs, enables individuals to take advantage of market growth over an extended period, amplifying the overall savings.

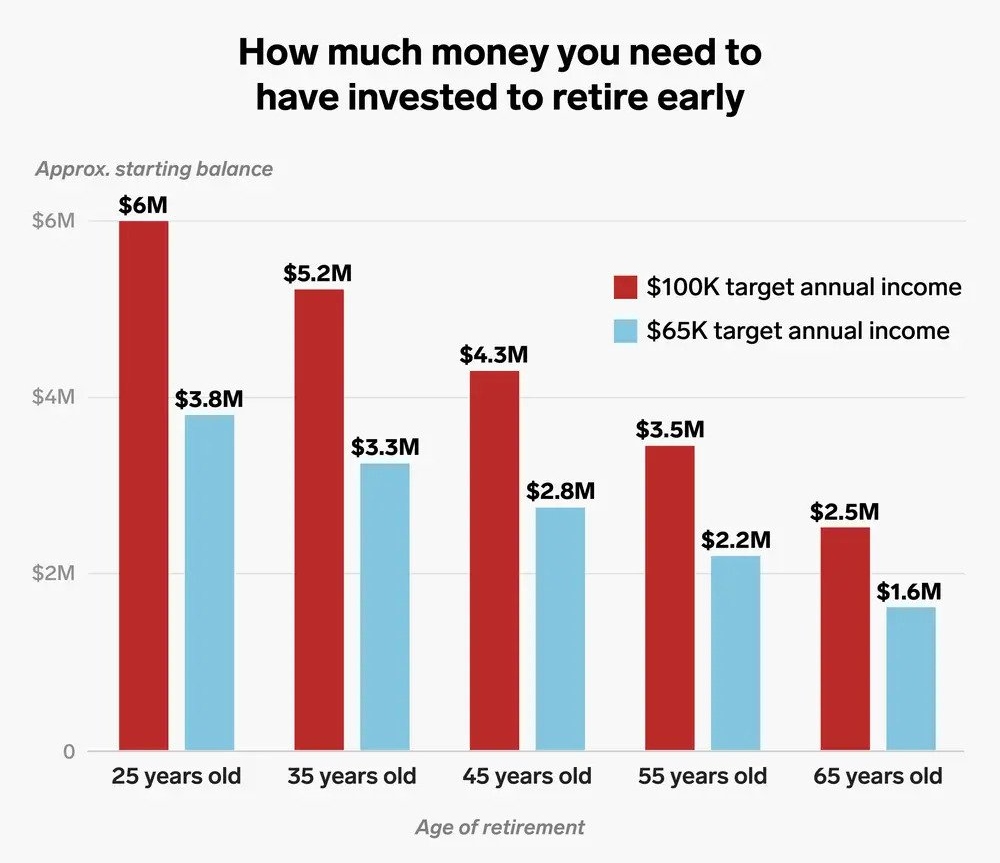

Establishing realistic savings goals is pivotal. Analyze your desired retirement lifestyle, estimated expenses, and the age at which you plan to retire. With these factors in mind, set achievable savings targets. This approach ensures that your contributions align with your financial objectives, striking a balance between enjoying the present and securing the future.

Diversification is a cornerstone of effective wealth building. Spread investments across various asset classes to mitigate risk and optimize returns. Consider a mix of stocks, bonds, and real estate, tailoring your portfolio to match your risk tolerance and time horizon. Regularly reassess and rebalance your investments as market conditions evolve.

Maximize employer-sponsored retirement benefits, such as 401(k) matching contributions. Employer matches represent an immediate return on investment, significantly accelerating the growth of your nest egg. Be aware of the specific benefits your employer provides and ensure you capitalize on these opportunities to augment your retirement savings.

Adopting a frugal lifestyle can free up more funds for savings. Additionally, prioritizing the elimination of high-interest debt, such as credit card balances, is paramount. Reducing financial burdens accelerates your ability to save and invest, redirecting money that would otherwise be spent on interest payments towards building your nest egg.

The financial landscape evolves, necessitating periodic reviews of your retirement strategy. Life changes, market fluctuations, and economic shifts may impact your financial plan. Stay proactive by reassessing your goals, adjusting your budget, and ensuring your investment portfolio remains aligned with your objectives.

Best Ways To Retire Rich - FAQs

What Are The Best Investment Options For Retiring Rich?

Diversified portfolios, including stocks, bonds, and real estate, offer a balanced approach to maximize returns while managing risk.

Are There Specific Retirement Accounts That Can Help Me Retire Rich?

Yes, tax-advantaged accounts like 401(k)s and IRAs can provide significant benefits, allowing your money to grow tax-free or tax-deferred.

What Role Does Budgeting Play In Retiring Rich?

Budgeting is crucial; it helps you control spending, allocate more to savings, and stay disciplined in achieving your financial goals.

What Impact Does Inflation Have On Retirement Savings?

Inflation erodes purchasing power over time, emphasizing the need for investments that outpace inflation to retire rich.

Are There Strategies For Retiring Rich For Those Close To Retirement Age?

Consider catch-up contributions to retirement accounts, explore downsizing, and optimize your investment portfolio for stability.

Conclusion

Retiring rich involves a multifaceted strategy encompassing savvy financial decisions and disciplined planning. The best ways to retire rich include prioritizing early and consistent savings, maximizing contributions to tax-advantaged retirement accounts, and embracing strategic investments

This exploration into the best ways to retire rich, the overarching theme is clear - thoughtful planning and informed decision-making are the keys to unlocking a secure and fulfilling best retirement.

Whether it's making strategic investments, diligently saving, or seeking expert advice, the journey toward financial prosperity in retirement is a marathon, not a sprint. By implementing these proven strategies, you pave the way for a retirement that is not only financially robust but also allows you to savor the fruits of your hard work and dedication. Seize control of your financial destiny, and retire with confidence and abundance.

Jump to

Define Your Retirement Goals

Create A Budget And Stick To It

Maximize Retirement Account Contributions

Diversify Your Investments

Leverage Employer Benefits

Stay Informed And Seek Professional Advice

Pay Down High-Interest Debt

Continuously Reassess And Adjust Your Plan

Consider Additional Income Streams

Stay Disciplined And Be Patient

Building A Substantial Nest Egg For Retirement - A Strategic Approach

Best Ways To Retire Rich - FAQs

Conclusion

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles