Unleash The Power Of Tax-Friendly States - Best States To Retire Taxwise And Maximize Your Financial Freedom

Empower Your Retirement with Tax-Wise Living: Explore the Best States to Retire Taxwise and Live Your Golden Years to the Fullest.

Author:Liam EvansReviewer:Luqman JacksonNov 20, 20234.7K Shares81K Views

Retirement, a horizon beckoning with the promise of tranquility, rests firmly upon the foundation of financial prudence. Across the United States, a diverse tapestry of fiscal landscapes unfolds, each state wielding its tax code as a sculptor's chisel, shaping the contours of a retiree's nest egg with varying degrees of finesse.

"Unleash the Power of Tax-Friendly States" transcends the realm of mere guidance; it is an empowering invitation to wield the knowledge of tax nuances as a strategic tool. This blog post serves as an invaluable compass for those approaching their golden years, illuminating the path to havens where their hard-earned savings can flourish. By meticulously curating a selection of the best states to retire in taxwise, we empower retirees to maximize their financial freedom, ensuring that their retirement income stretches further, unburdened by the often-overlooked fiscal hurdles that can erode the very pillars of their golden years.

As the intricate tapestry of retirement plans unfolds, the devil indeed resides in the details—details that hold the key to safeguarding wealth across state lines. Navigating the labyrinthine web of state income taxes, inheritance taxes, property taxes, and sales taxes can be a daunting yet critical endeavor.

Our exploration into the best states to retire taxwise extends beyond mere academic discourse; it is a practical roadmap to preserving the wealth that retirees have diligently amassed over a lifetime. This article transcends a cursory review of tax rates; it delves into an analytical deep dive, scrutinizing the fiscal policies that define the landscape of retirement in America. It is an essential read for those who aspire to a retirement redefined by financial acumen, guided by the foresight to choose a domicile where their resources are treated with tax code reverence.

Understanding State Tax Policies For Retirement

As individuals approach retirement, carefully navigating the intricate web of state tax policies becomes increasingly important. These policies can significantly impact the overall financial security and well-being of retirees. Understanding the nuances of state income taxes, sales taxes, property taxes, and inheritance and estate taxes is crucial for making informed decisions about retirement planning and relocation.

State Income Tax Considerations For Retirees

State income taxes can vary considerably across the United States. Some states, such as Florida and Texas, have no state income tax, while others impose significant taxes on income earned from various sources, including pensions, Social Security benefits, and investment earnings. For retirees, understanding the state income tax policies in potential retirement destinations is essential for determining the after-tax income they will have available for living expenses and other financial obligations.

The Impact Of Sales Tax On Retirement Budgets

Sales taxes, levied on the purchase of goods and services, can also significantly impact retiree budgets. States with high sales tax rates can erode purchasing power, particularly for retirees living on fixed incomes. Carefully considering sales tax rates when evaluating potential retirement states can help retirees plan accordingly and adjust their spending habits to maintain a comfortable lifestyle.

Property Taxes And Retiree Homeownership

Property taxes, based on the assessed value of real estate, can be a substantial expense for homeowners, including retirees. Property tax rates vary widely from state to state, and in some cases, they can be particularly high in areas with desirable retirement destinations. For retirees considering purchasing a home in retirement, understanding the property tax rates in their chosen location is crucial for budgeting purposes and ensuring they can afford the ongoing property tax obligations.

Inheritance And Estate Taxes - What You Need To Know

Inheritance and estate taxes, levied on the transfer of assets from a deceased person to their beneficiaries, can also have implications for retirees. While some states have no inheritance or estate taxes, others impose significant taxes on these transfers. Understanding the inheritance and estate tax policies in potential retirement states can help retirees plan for the transfer of their assets and minimize the tax burden on their heirs.

Navigating The Complexities Of State Tax Policies

The interplay of state tax policies can significantly impact the financial well-being of retirees. Carefully evaluating state income taxes, sales taxes, property taxes, and inheritance and estate taxes when considering potential retirement locations is essential for making informed decisions that align with financial goals and objectives. Consulting with a tax advisor specializing in retirement planning can provide personalized guidance and help retirees navigate the complexities of state tax policies.

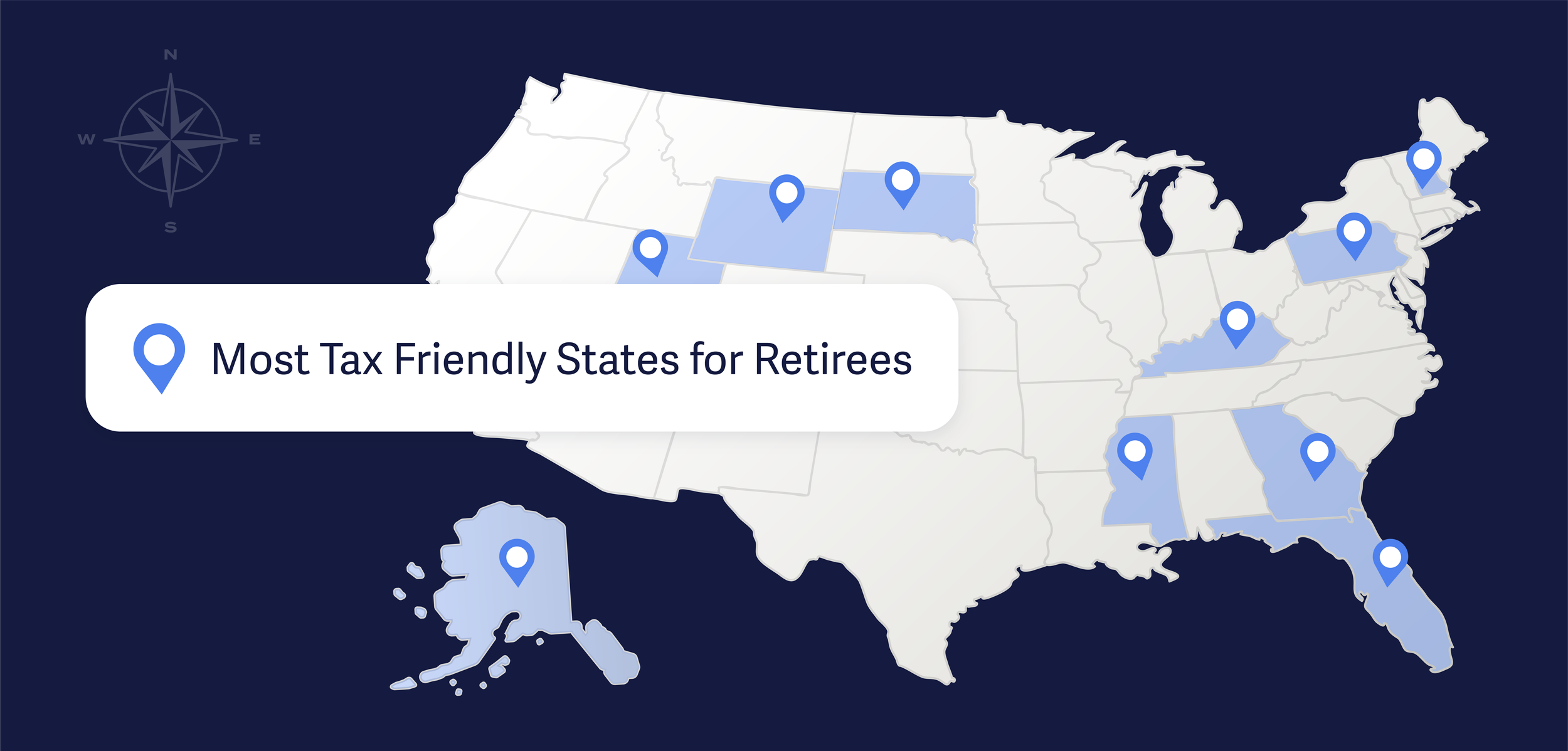

Top Tax-Friendly States For Retirees

As individuals approach retirement, tax considerations become increasingly important. With careful planning, retirees can minimize their tax burden and maximize their financial security. Here's a comprehensive guide to the top tax-friendly states for retirees, exploring no-income-tax states, states with the lowest property taxes, and retirement-friendly sales-tax states.

Analyzing No-Income-Tax States

For retirees seeking to eliminate state income taxes from their financial equation, several states offer a welcome respite. These no-income-tax states include

- Florida -Sunshine and tax savings go hand in hand in Florida, which boasts no state income tax, estate tax, or inheritance tax.

- New Hampshire -Known for its independent spirit, New Hampshire also embraces tax-friendliness, with no state income tax, inheritance tax, or personal property tax.

- Tennessee -Tennessee welcomes retirees with open arms and a tax-friendly environment, featuring no state income tax on most forms of retirement income.

- Wyoming -Wyoming's vast landscapes are matched by its tax-friendly policies, including no state income tax, inheritance tax, or personal property tax.

- Texas -The Lone Star State lives up to its reputation for tax friendliness, with no state income tax, inheritance tax, or personal property tax.

- Washington -Washington's stunning scenery is complemented by its tax-friendly stance, with no state income tax or inheritance tax.

- South Dakota -South Dakota offers a haven for retirees, with no state income tax, inheritance tax, or sales tax.

- Alaska -Alaska's unique tax structure includes no state income tax, inheritance tax, or sales tax, and residents receive an annual dividend from the state's oil wealth.

- Nevada -Nevada's vibrant energy extends to its tax policies, with no state income tax, inheritance tax, or personal property tax.

- Mississippi -Mississippi welcomes retirees with a tax-friendly environment, featuring no state income tax on most forms of retirement income and low property taxes.

States With The Lowest Property Taxes

Property taxes can significantly impact a retiree's budget. Fortunately, several states offer lower property tax rates, providing much-needed relief

- Hawaii -Despite its high cost of living, Hawaii boasts relatively low property taxes, with an effective rate of 0.38%.

- Louisiana -Louisiana's property tax rates are among the lowest in the nation, with an effective rate of 0.47%.

- Alabama -Alabama offers property tax relief, with an effective rate of 0.50%.

- Montana -Montana's vast landscapes are matched by its low property tax rates, with an effective rate of 0.52%.

- Mississippi -Mississippi continues to be a tax-friendly haven, with an effective property tax rate of 0.53%.

Retirement-Friendly Sales Tax States

Sales taxes can add up, but several states offer exemptions for essential items like groceries and prescription drugs, providing relief for retirees

- Oregon -Oregon boasts no state sales tax, making it a haven for sales tax-averse retirees.

- New Hampshire -New Hampshire's tax-friendly policies extend to sales taxes, with no state sales tax.

- Delaware -Delaware offers a unique approach to sales taxes, with no state sales tax but allowing local jurisdictions to levy their own taxes.

- Montana -Montana's low property taxes are complemented by no state sales tax, providing double the savings.

- Alaska -Alaska's tax-friendly environment includes no state sales tax, offering relief on everyday purchases.

Weighing The Pros And Cons Of Each State - A Comprehensive Guide

Navigating the intricate web of state-specific tax codes and their impact on retirement finances can be a daunting task. However, understanding the nuances of each state's fiscal landscape is crucial for making informed decisions that maximize financial security and overall quality of life in retirement. This comprehensive guide delves into the intricate balance between tax benefits, cost of living, climate and location preferences, and access to healthcare in tax-friendly states.

Balancing Tax Benefits With Cost Of Living

While tax-friendly states offer the allure of minimizing tax burdens, it is essential to consider the overall cost of living in each location. A state with lower taxes may have higher housing costs, groceries, utilities, and other expenses, which could nullify the tax savings. Therefore, it is crucial to conduct a thorough cost-of-living analysis to determine the net financial impact of relocating to a tax-friendly state.

Climate And Location Preferences

Retirement is often accompanied by a desire for a lifestyle that aligns with personal preferences, whether it's basking in warm sunshine, enjoying outdoor activities, or immersing oneself in a vibrant cultural scene. Climate and location play a significant role in shaping a retiree's quality of life. Opting for a state that aligns with one's climate preferences can enhance overall happiness and well-being.

Access To Healthcare In Tax-Friendly States

Healthcare is a critical aspect of retirement planning, especially as individuals age and may require more frequent medical care. Assessing the quality and availability of healthcare facilities, as well as the cost of healthcare services, is crucial when choosing a tax-friendly state. Access to affordable and high-quality healthcare can significantly impact a retiree's well-being and overall financial security.

State-Specific Considerations - A Closer Look

To provide a more nuanced understanding of the tax-benefit landscape, let's delve into a few examples of tax-friendly states and their unique considerations

1. Florida -Renowned for its warm climate and sun-drenched beaches, Florida offers a plethora of retirement communities and attractions. While the state does not levy a state income tax, sales taxes can be higher than average. Additionally, property taxes vary significantly across counties.

2. Texas -Known for its low taxes and business-friendly environment, Texas attracts retirees seeking a more affordable lifestyle. The state does not impose income or inheritance taxes, and sales taxes are relatively low. However, property taxes can be higher in certain areas.

3. Wyoming -Wyoming prides itself on its low taxes and stunning natural beauty. The state does not levy income or inheritance taxes, and sales taxes are minimal. However, the cost of living in some areas can be higher due to its remote location and limited amenities.

4. New Hampshire -New Hampshire is another state that boasts low taxes and a vibrant cultural scene. The state does not impose income or inheritance taxes, and sales taxes are among the lowest in the nation. However, property taxes can be higher in certain areas.

Navigating State Tax Exemptions And Credits - A Comprehensive Guide For Tax-Savvy Retirees

As you embark on the exciting journey of retirement, maximizing your financial security becomes paramount. While Social Security benefits and retirement savings play a crucial role in sustaining your golden years, understanding state tax exemptions and credits can significantly enhance your financial well-being. This comprehensive guide will delve into the intricacies of state taxation, empowering you to navigate the complexities of tax regulations and optimize your tax savings.

Demystifying Social Security Taxation - Ensuring Your Benefits Remain Untouched

Social Security, a cornerstone of many retirees' income, is generally exempt from state income taxes in most states. However, a few states do impose taxes on Social Security benefits, often applying a sliding scale that considers income levels and filing status. To accurately assess your Social Security tax liability, it is essential to consult with a tax advisor familiar with the tax laws of your chosen retirement state.

Pension And Retirement Account Exemptions - Safeguarding Your Retirement Savings

Pensions and retirement accounts, such as 401(k)s and IRAs, are designed to provide financial security during retirement. Fortunately, many states offer exemptions or deductions for distributions from these accounts, shielding a portion of your withdrawals from state income taxes. However, it is crucial to note that these exemptions and deductions may vary depending on the state, the type of retirement account, and your income level.

Harnessing The Power Of Tax Credits - Unveiling Hidden Tax Savings Opportunities

Tax credits, unlike deductions, directly reduce the amount of tax you owe. A multitude of tax credits are available to retirees, offering valuable opportunities to lower their tax burden. Some common tax credits for retirees include

- Senior Citizen Credit -This credit provides tax relief to low - and moderate-income taxpayers aged 65 and older.

- Tax Credit for the Elderly -This credit offers additional tax savings to seniors who meet specific income and filing status requirements.

- Credit for the Disabled -This credit is available to individuals with a qualifying disability, including retirees who receive Social Security Disability Insurance (SSDI) benefits.

- Retirement Savings Contribution Credit -This credit incentivizes retirement savings by providing tax relief for contributions made to IRAs and other qualifying retirement accounts.

Unlocking Maximum Tax Savings - A Strategic Approach

To maximize your tax savings, it is essential to adopt a strategic approach to tax planning. Here are some key steps to consider

- Carefully Review Your State's Tax Code -Familiarize yourself with the specific exemptions, deductions, and credits available in your chosen retirement state.

- Consult with a Tax Advisor -Seek guidance from a qualified tax advisor who can provide personalized advice based on your unique financial situation and retirement goals.

- Stay Informed About Tax Law Changes -Keep abreast of any changes to state and federal tax laws that may impact your retirement income or tax liability.

Strategies For Maximizing Retirement Savings

As individuals approach retirement age, financial security becomes increasingly paramount. The years leading up to retirement offer a crucial window of opportunity to optimize savings and navigate the complexities of tax planning. By employing a combination of strategic financial planning, tax-deferred retirement accounts, and professional guidance, individuals can effectively maximize their retirement savings and safeguard their financial future.

Smart Financial Planning For Future Tax Changes

Navigating the ever-evolving landscape of tax regulations can be a daunting task for individuals nearing retirement. The prospect of future tax changes often introduces uncertainty into retirement planning. However, by adopting a proactive approach and staying informed about potential tax law adjustments, individuals can make informed decisions that align with their long-term financial goals.

One key strategy involves diversifying retirement savings across various asset classes, including stocks, bonds, and real estate. This diversification helps to mitigate risk and protect against potential downturns in specific market sectors. Additionally, incorporating tax-deferred retirement accounts, such as 401(k)s and IRAs, can provide significant tax advantages, allowing individuals to defer taxes until they withdraw funds in retirement.

Utilizing Tax-Deferred Retirement Accounts

Tax-deferred retirement accounts offer a powerful tool for maximizing retirement savings. These accounts allow individuals to contribute pre-tax dollars, reducing their taxable income in the year of contribution. The contributions and earnings within these accounts grow tax-deferred until withdrawal, allowing for the accumulation of wealth over time.

401(k)s and IRAs are among the most common types of tax-deferred retirement accounts. 401(k)s are employer-sponsored plans that typically allow employees to contribute a portion of their pre-tax salary. IRAs, or Individual Retirement Accounts, can be opened by individuals or through financial institutions, offering a wide range of investment options.

The Role Of Financial Advisors In Retirement Tax Planning

Seeking guidance from a qualified financial advisor can prove invaluable in navigating the complexities of retirement tax planning. Financial advisors possess the expertise and knowledge to assess an individual's unique financial situation, goals, and risk tolerance. They can provide tailored recommendations on investment strategies, tax-efficient withdrawal plans, and estate planning measures to ensure that retirement savings are optimized and protected.

Preparing For Your Tax-Efficient Retirement - A Comprehensive Guide To Tax-Savvy Relocation And Retirement Planning

As you approach retirement, financial planning takes on paramount importance. Among the many aspects of retirement planning, tax considerations play a crucial role in shaping your financial security and overall well-being. By understanding the intricacies of tax laws and strategies, you can make informed decisions that optimize your tax savings and maximize your retirement income.

Essential Steps To Take Before Relocating

Relocation can significantly impact your tax situation, making it essential to carefully consider the tax implications before making a move. Here are some essential steps to take before relocating for tax-efficient retirement

- Research State and Local Tax Rates -Delve into the tax landscape of your potential new home state and locality. Examine income taxes, property taxes, sales taxes, and any other relevant taxes that may affect your retirement finances.

- Analyze Retirement Account Taxability -Understand how your retirement accounts, such as 401(k)s and IRAs, are taxed in your potential new state. Some states may exempt or partially exempt retirement income from taxation, while others may tax it at varying rates.

- Consider Tax Credits and Deductions -Research tax credits and deductions available to retirees in your potential new state. These incentives can significantly reduce your tax liability and enhance your overall tax savings.

- Consult with a Tax Advisor -Engage a qualified tax advisor to provide personalized guidance on your specific tax situation. A tax advisor can help you navigate the complexities of state and local tax laws and tailor a tax-efficient relocation plan.

Calculating Your Potential Tax Savings

Quantifying your potential tax savings can help you make informed decisions about your retirement relocation and planning. Here are some key steps to calculating your potential tax savings

- Gather Current Tax Information -Collect your current tax returns and any relevant financial documents to accurately assess your current tax situation.

- Estimate Future Taxable Income -Project your future taxable income during retirement, considering factors such as retirement account withdrawals, Social Security benefits, and any other sources of income.

- Evaluate Tax Rates in Potential New State -Research the tax rates in your potential new state for different types of income, including retirement account withdrawals, Social Security benefits, and investment income.

- Calculate Tax Savings -Compare your current tax liability to your estimated tax liability in your potential new state. The difference represents your potential tax savings.

- Consider Additional Tax Implications -Factor in any additional tax implications, such as property taxes, sales taxes, and estate taxes, when evaluating your potential tax savings.

Resources And Tools For Retirement Tax Planning

Numerous resources and tools can assist you in navigating the complexities of retirement tax planning. Here are some valuable resources to consider

- IRS Publications -The IRS provides a wealth of publications on retirement tax planning, including Publication 575, Pension and Annuity Income, and Publication 590, Individual Retirement Arrangements (IRAs).

- Retirement Planning Calculators -Utilize online retirement planning calculators to estimate your potential tax savings, retirement income, and overall financial security.

- Tax Software -Consider using tax preparation software to accurately calculate your tax liability and identify potential tax deductions and credits.

- Financial Advisors -Seek guidance from qualified financial advisors who specialize in retirement planning and tax strategies.

- Government Agencies -Consult with government agencies, such as the Social Security Administration, for specific information on tax implications related to Social Security benefits.

By carefully evaluating your tax situation, researching potential relocation states, and utilizing available resources and tools, you can make informed decisions that optimize your tax savings and pave the way for a financially secure and fulfilling retirement.

Frequently Ask Questions - Best States To Retire In Taxwise

What Is The Best State To Retire In For Tax Purposes?

Alaska is the most tax-friendly state for retirees because it has no state income tax or tax on Social Security. And its sales tax rate is the fourth lowest on our list - the fifth lowest in the U.S. But keep this in mind - The cost of living in Alaska is higher than in most states.

What Is The Best State To Retire Money-wise?

Key takeaways. The best state to retire is Iowa because of its lower cost of living, affordable but high-quality healthcare, and low crime. Delaware, West Virginia, Missouri, and Mississippi round out the top five. The best and worst states for retirees are split geographically.

What Is The Best State To Live In Taxwise?

Wyoming is the most tax-friendly state, where residents pay $3,438. For a typical middle-class family, the tax burden difference between living in the highest-tax state (Illinois) and the lowest-tax state (Wyoming) is $11,340 per year.

Conclusion

Our comprehensive exploration of the best states to retire taxwise has illuminated a wealth of opportunities to maximize your financial well-being, seamlessly blending fiscal advantages with the personal fulfillment of your post-career years. Whether your retirement aspirations are drawn to the sun-drenched shores of a no-income-tax state or the serene landscapes of low-property-tax havens, the power to craft an economically sound retirement lies within your grasp.

This meticulously crafted guide, brimming with insights and expert navigation through the intricate labyrinth of state tax codes, serves as an indispensable tool in your retirement planning arsenal. Keep this invaluable resource bookmarked, share its wisdom with peers embarking on similar journeys, and step confidently into a retirement that promises more than mere rest—a retirement enriched with the financial prudence that tax-friendly states so graciously offer. By strategically leveraging the fiscal advantages of tax-friendly states, you can transform your retirement into a tapestry of financial security, personal fulfillment, and lasting peace of mind.

Jump to

Understanding State Tax Policies For Retirement

Top Tax-Friendly States For Retirees

Weighing The Pros And Cons Of Each State - A Comprehensive Guide

Navigating State Tax Exemptions And Credits - A Comprehensive Guide For Tax-Savvy Retirees

Strategies For Maximizing Retirement Savings

Preparing For Your Tax-Efficient Retirement - A Comprehensive Guide To Tax-Savvy Relocation And Retirement Planning

Frequently Ask Questions - Best States To Retire In Taxwise

Conclusion

Liam Evans

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles