Banking Regulation Changes (2000-2020 Decades)

The first two decades of the 21st century witnessed significant shifts in the landscape of banking regulations worldwide. This period, from 2000 to 2020, was marked by a series of events and policy changes that reshaped the financial sector. In this article, we delve into the key banking regulation changes during this time span.

Author:Stefano MclaughlinReviewer:Luqman JacksonJan 27, 20247.9K Shares105.3K Views

The first two decades of the 21st century witnessed significant shifts in the landscape of banking regulations worldwide. This period, from 2000 to 2020, was marked by a series of events and policy changes that reshaped the financial sector. In this article, we delve into the key banking regulation changesduring this time span.

Understanding Key Financial Concepts

In the realm of finance, certain concepts serve as pillars that shape the landscape of monetary systems and regulatory frameworks. Before delving into the intricate details of banking regulation changes from 2000 to 2020, it's crucial to establish a foundational understanding of key terms and institutions that play a central role in these developments.

Central Bank

A central bank stands as a linchpin in a nation's financial architecture, wielding significant influence over its monetary system. In the United States, the Federal Reserve System takes on this pivotal role. With a mission guided by the Federal Reserve Act, its objectives include promoting maximum employment, maintaining stable prices, and ensuring moderate long-term interest rates. Understanding the functions and powers of a central bank is essential to grasp the broader context of banking regulation changes.

National Bank

National banks, chartered by the U.S. Treasury and members of the Federal Reserve System, constitute a vital component of the American financial landscape. Institutions such as Bank of America, Chase Bank, Citibank, PNC Bank, U.S. Bank, and Wells Fargo fall under this category. Recognizing the role of national banks is integral to comprehending the intricate network of financial institutions and their interactions within the regulatory framework.

Dodd-Frank Act

The Dodd-Frank Act, formally known as the Dodd-Frank Wall Street Reform and Consumer Protection Act, emerged as a cornerstone of financial reforms in the aftermath of the Great Recession (2007-2009). This comprehensive legislation addressed various aspects, including speculative trading restrictions, heightened government oversight of the banking sector, and empowered the government to liquidate struggling banks. Moreover, it gave rise to the Consumer Financial Protection Bureau, emphasizing consumer protection within the financial realm.

The Evolution Of Banking Control In The United States

Since the inception of the United States, the trajectory of its banking system has been marked by a continuous quest to strike a balance between decentralization and centralized control. The journey unfolds against the backdrop of historical events, reflecting the ever-shifting dynamics of power, regulation, and the recognition of the need for a cohesive financial framework.

Pre-Civil War Dynamics

In the early years of the nation, attempts to centralize control and regulate the banking system faced resistance. Fears rooted in concerns about concentrated power and political corruption acted as formidable barriers. The pre-Civil War era, marked by a fragmented financial landscape, witnessed various attempts at centralization but struggled to gain widespread acceptance.

The Civil War Era (1860s)

The crucible of the Civil War in the 1860s became a catalyst for change in the realm of banking. As the nation grappled with the exigencies of war, the imperative for greater regulation and federal control over the banking system gained traction. The exigencies of war prompted the creation of a nationalized banking system, a pivotal step toward a more unified and regulated financial structure.

Birth Of The Federal Reserve (1913)

The early 20th century witnessed a pivotal moment in the history of U.S. banking with the creation of the Federal Reservein 1913. This marked a deliberate move toward establishing a central authority to regulate and stabilize the financial system. The Federal Reserve System was endowed with the responsibility of mitigating financial panics, fostering stable prices, and promoting employment—a mandate that reflected the evolving needs of a maturing economy.

New Deal Reforms (1930s-1940s)

The tumultuous period of the Great Depression in the 1930s necessitated bold and comprehensive reforms. The New Deal initiatives introduced by President Franklin D. Roosevelt sought to address the economic challenges of the time, including those within the banking sector. These reforms aimed at restoring confidence in the financial system, enhancing regulatory oversight, and establishing mechanisms to prevent a recurrence of the devastating economic downturn.

Now it's time to review the stages across the 2000 and 2020 decades.

Post-Financial Crisis Reforms (2008-2010)

The years following the 2008 global financial crisis were marked by a pressing need for systemic changes to prevent the recurrence of such a devastating event. During this period, international efforts were initiated to fortify banking regulations, with two significant developments standing out.

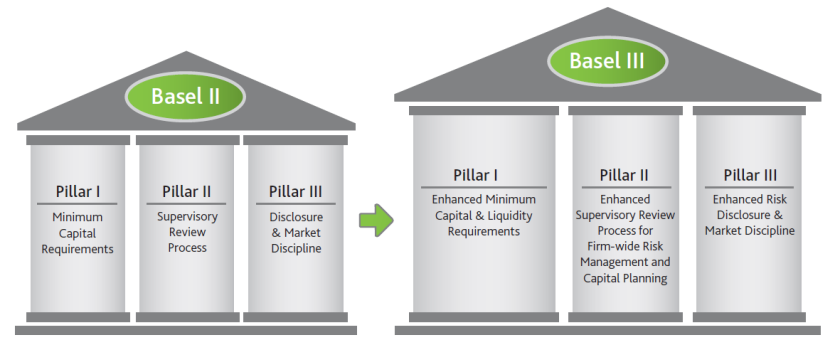

Basel III Framework Implementation

The Basel III framework, introduced in 2010, emerged as a global response to the vulnerabilities exposed by the financial crisis. The primary objective was to enhance the stability and resilience of the global banking system. Basel III introduced a set of key provisions that addressed critical aspects of banking operations:

Higher Capital Requirements

Basel III mandated higher capital requirements for financial institutions. The rationale behind this was to ensure that banks maintain a more substantial capital buffer, acting as a safeguard against unexpected losses. This requirement aimed to make banks more resilient and capable of weathering financial downturns.

Improved Risk Management

Recognizing the deficiencies in risk management practices that contributed to the crisis, Basel III placed a heightened emphasis on improving risk management within financial institutions. This involved enhancing methodologies for assessing and mitigating various types of risks, including credit, market, and operational risks.

Increased Focus On Liquidity Ratios

Liquidity risk played a significant role in the 2008 crisis, prompting Basel III to introduce measures to address this aspect. The framework established liquidity ratios that required banks to maintain a sufficient level of high-quality liquid assets, ensuring they could meet their short-term obligations even in times of financial stress.

The implementation of the Basel III framework marked a crucial step towards creating a more resilient and stable global banking system.

Dodd-Frank Act In The United States

In tandem with international efforts, the United States took a comprehensive approach to financial reform through the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. This landmark legislation aimed to address various systemic issues that contributed to the financial crisis:

Systemic Risk Oversight

Dodd-Frank established the Financial Stability Oversight Council (FSOC), tasked with identifying and addressing systemic risks within the financial system. This council plays a crucial role in monitoring and responding to emerging threats that could have widespread implications.

Consumer Protection Measures:

Recognizing the need to protect consumers from predatory practices, Dodd-Frank created the Consumer Financial Protection Bureau (CFPB). This independent agency focuses on safeguarding consumers in financial transactions, ensuring fair and transparent practices by financial institutions.

Regulation Of Financial Institutions:

Dodd-Frank introduced measures to regulate and supervise financial institutions more effectively. It outlined provisions for enhanced prudential standards, stress testing, and resolution plans to prevent the disorderly failure of large financial institutions.

Technological Advancements And Regulatory Challenges (2010-2015)

The second half of the first decade of the 21st century witnessed a surge in technological advancements, particularly in the financial sector. These developments brought about transformative changes, along with a set of regulatory challenges that required careful navigation.

Fintech Innovation And Regulatory Response

The rapid rise of financial technology (fintech) companies disrupted traditional banking models and introduced new ways of conducting financial transactions. However, this wave of innovation presented regulatory bodies worldwide with the intricate task of finding a delicate balance between fostering innovation and safeguarding consumer interests.

Challenges To Traditional Banking Models

Fintech innovations, such as peer-to-peer lending, mobile payments, and blockchain technology, challenged the conventional structures of the banking industry. The agility and efficiency of fintech companies posed a threat to traditional financial institutions, prompting regulators to reassess existing frameworks.

Balancing Innovation And Consumer Protection

Regulatory bodies grappled with the challenge of encouraging fintech innovation while ensuring adequate consumer protection. Striking the right balance became crucial to foster a competitive and innovative financial landscape without compromising the security and rights of consumers.

Diverse Approaches To Fintech Regulation

Recognizing the need for flexibility, countries implemented diverse approaches to fintech regulation. Some jurisdictions established regulatory sandboxes, providing a controlled environment for testing new financial products and services. Others opted for specific regulatory frameworks tailored to address the unique risks and challenges posed by fintech.

The period saw an ongoing dialogue between fintech innovators and regulators as both sought to adapt to the evolving financial landscape.

Cybersecurity Regulations

As technological advancements brought about increased connectivity, the financial sector became more susceptible to cyber threats. Banking regulators, acknowledging the growing frequency and sophistication of cyberattacks, directed their attention towards fortifying cybersecurity measures within financial institutions.

Mandating Robust Cybersecurity Measures

In response to the evolving threat landscape, new regulations were introduced to mandate financial institutions to adopt robust cybersecurity measures. These measures aimed to safeguard sensitive customer data and maintain the integrity of financial systems. Institutions were required to implement advanced cybersecurity protocols to detect, prevent, and respond to cyber threats effectively.

Focus On Customer Data Protection

With the increasing digitization of financial services, protecting customer data has become a paramount concern. Cybersecurity regulations emphasize the need for financial institutions to implement measures to secure customer information, thereby ensuring trust and confidence in digital financial transactions.

Global Cooperation And Coordination (2015-2018) - Strengthening The Financial Framework

The years spanning from 2015 to 2018 marked a critical juncture in the evolution of global banking regulations. The increasing interconnectivity of financial markets underscored the imperative for collaborative efforts to address cross-border challenges and enhance the integrity of the financial system.

International Coordination On Cross-Border Regulations

Financial Stability Board (FSB) Initiatives

As financial markets transcended national borders, the need for harmonized regulatory standards became more pronounced. Initiatives such as the Financial Stability Board (FSB) took center stage during this period. The FSB, an international body comprising central banks, regulators, and finance ministries, played a pivotal role in fostering international cooperation. Its mission was to harmonize regulatory standards and address cross-border challenges that could potentially threaten global financial stability.

Consistent And Coordinated Approach

The period witnessed concerted efforts to establish a more consistent and coordinated approach to banking regulation worldwide. Recognizing that financial crises could emanate from vulnerabilities in one jurisdiction affecting others, regulatory bodies engaged in dialogues aimed at creating a cohesive framework. The goal was to ensure that regulatory measures were not only effective within individual jurisdictions but also collectively reinforced the resilience of the global financial system.

Anti-Money Laundering (AML) And Counter-Terrorist Financing (CTF) Regulations

Heightened Focus On Financial Crime

During this period, the fight against financial crime gained prominence on the global stage. Governments and regulatory bodies intensified their efforts to combat money laundering and terrorist financing, recognizing the pivotal role of the financial sector in these illicit activities. The interconnected nature of global finance underscored the need for collaborative and stringent measures to safeguard the integrity of the financial system.

Stricter Compliance Requirements And Increased Scrutiny

Financial institutions found themselves under increased scrutiny as AML and CTF regulations were strengthened. Governments implemented measures to tighten compliance requirements, ensuring that financial institutions implemented robust mechanisms to prevent illicit activities. The focus was not only on punitive measures but also on proactive steps to identify and mitigate risks associated with money laundering and terrorist financing.

Regulatory Rollbacks And Adjustments (2018-2020)

The closing chapters of the second decade of the 21st century brought about shifts in regulatory dynamics, driven by both economic considerations and unforeseen global challenges. The regulatory landscape experienced adjustments that aimed to balance the need for economic growth with the imperative of maintaining financial stability.

Deregulation In The United States

Shift Towards Deregulation

In the latter part of the period, the United States underwent a discernible shift towards deregulation. This involved the rollback of certain provisions of the Dodd-Frank Act, a comprehensive piece of financial legislation enacted in the aftermath of the 2008 financial crisis. The focus of these rollbacks was to ease regulatory burdens, particularly on smaller banks.

Debate Over Systemic Risks

While proponents of deregulation argued that these changes would stimulate economic growth, critics expressed concerns about the potential increase in systemic risks. The rollback of regulations, particularly those designed to safeguard against risky financial practices, sparked a contentious debate about finding the right balance between fostering economic expansion and preventing a recurrence of financial instability.

Response To The COVID-19 Pandemic

Unprecedented Economic Challenges

The emergence of the COVID-19 pandemic presented unprecedented economic challenges globally. In response, regulatory bodies and central banks implemented a series of measures to mitigate the economic fallout and stabilize financial markets.

Central Bank Interventions

Central banks played a pivotal role in responding to the economic impact of the pandemic. Measures such as interest rate cuts and liquidity support were implemented to bolster economic activity and prevent a severe downturn. These interventions aimed to provide financial institutions with the necessary tools to navigate the uncertainties and disruptions caused by the pandemic.

Regulatory Relief Measures

Recognizing the operational challenges faced by financial institutions during the pandemic, regulatory relief measures were introduced. These measures provided temporary flexibility to financial institutions, allowing them to adapt to the evolving circumstances while maintaining financial stability. The intent was to strike a balance between regulatory compliance and the need for operational resilience during a period of unprecedented disruption.

Banking Regulation Changes - FAQs

What Are The New Banking Restrictions?

The specifics of new banking restrictions depend on the regulatory environment and the country in question. Generally, banking restrictions may include measures related to capital requirements, risk management, liquidity ratios, anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, consumer protection, and more. Governments and regulatory bodies may introduce new restrictions to address emerging risks, ensure financial stability, and protect consumers.

Why Are Banks Changing Their Policies?

Banks may change their policies for various reasons:

- Regulatory Changes:New regulations or amendments to existing ones may require banks to adjust their policies to ensure compliance.

- Economic Conditions:Changes in economic conditions, such as recessions or economic downturns, can influence banks to reassess their risk tolerance, lending practices, and overall policies.

- Technological Advancements:The evolution of technology, including fintech innovations, may prompt banks to update their policies to adapt to the changing financial landscape.

- Consumer Needs:Shifting consumer preferences and demands may lead banks to modify their policies to better meet customer expectations and remain competitive.

- Global Events:Extraordinary events like financial crises, geopolitical tensions, or health emergencies (e.g., the COVID-19 pandemic) can necessitate policy adjustments to navigate unforeseen challenges.

What Happens If The Banks Collapse?

If a bank faces financial insolvency and collapses, several consequences may unfold:

- Depositor Losses:Depositors may lose access to their funds, and uninsured deposits may not be fully recovered.

- Economic Impact:Bank failures can have a broader economic impact, leading to a decrease in lending, reduced economic activity, and potential job losses.

- Government Intervention:Governments often intervene to prevent systemic risks. They may implement measures such as bailouts, nationalization, or the establishment of resolution mechanisms to stabilize the financial system.

- Market Confidence:Bank failures can erode public confidence in the banking system, leading to a loss of trust and increased financial instability.

- Regulatory Reforms:Bank failures may trigger regulatory reforms to address weaknesses in the financial system and prevent similar issues in the future.

Conclusion

The period from 2000 to 2020 was characterized by a dynamic regulatory environment in the banking sector. From post-financial crisis reforms to addressing the challenges posed by technological advancements and global coordination, regulatory changes played a crucial role in shaping the resilience and adaptability of the banking industry. As we look ahead, continued vigilance and adaptability will be essential to navigate the evolving landscape of banking regulations.

Jump to

Understanding Key Financial Concepts

The Evolution Of Banking Control In The United States

Post-Financial Crisis Reforms (2008-2010)

Technological Advancements And Regulatory Challenges (2010-2015)

Global Cooperation And Coordination (2015-2018) - Strengthening The Financial Framework

Regulatory Rollbacks And Adjustments (2018-2020)

Banking Regulation Changes - FAQs

Conclusion

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles