The Death of HAMP

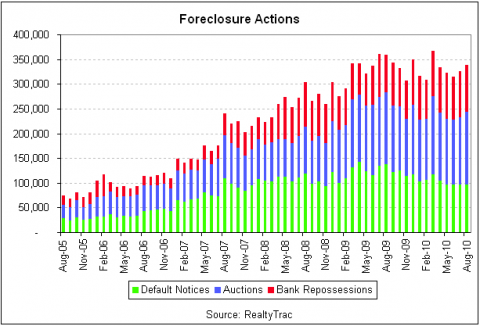

The foreclosure crisis is far from over. Rather, as this chart from Daniel Indiviglio at The Atlantic shows, it is in some ways just peaking. Last month, banks

Jul 31, 202057.9K Shares1M Views

The foreclosure crisis is far from over. Rather, as this chartfrom Daniel Indiviglio at The Atlantic shows, it is in some ways just peaking. Last month, banks foreclosed on more homes than ever before. More than a million families are predicted to lose their homes this year.

The signature Obama program to ameliorate this crisis was the Home Affordable Modification Program, or HAMP, which helps homeowners modify their mortgages for lower monthly payments.

But the program has proven frankly disastrous — in many cases hurting the families it was meant to help. The administration expected it to help 3 to 4 million homeowners. It has aided a fraction of that, completing just 434,700 permanent modifications, according to the last scorecard. The process frequently takes months and requires applicants to file extraordinary amounts of paperwork. About half of applicants are rejected during the trial modification period. Worst, for many HAMP participants, their monthly mortgage payment barely goes down. Those homeowners often keep paying a mortgage they can’t afford for a while before defaulting anyway, meaning the bank is the real winner.

Now, rather than doubling down and helping homeowners, the administration is shuttering, or at least shrinking, the program. As David Dayen noticed, a recent Treasury report on the Troubled Asset Relief Program tucks in the detail that the government is granting HAMP just half of the funds it originally allocated.

“„As for President Obama’s mortgage modification program, the CBO estimates that the Treasury Department will use no more than $20 billion of TARP funds, less than half of the $50 billion originally allocated. That’s because the CBO expects many fewer people will participate in the program than the government originally expected, a view held by many housing industry observers.

“„When Obama announced the program in February 2009, he said up to 4 million people could save their homes through the loan modification program, which lowers eligible borrowers’ monthly payments to no more than 31% of their pre-tax income. But more recently, officials have backtracked and said up to 4 million people could qualify for trial modifications, during which loan servicers assess their borrowers’ eligibility and ability to pay.

“„Through February, around 170,000 distressed homeownershave received long-term modifications under the program. Another $1.5 billion in TARP funds will be used to provide grants to state housing agenciesin California, Arizona, Nevada, Florida and Michigan. These agencies are tasked with coming up with programs to assist the unemployed, the underwater who owe more than their homes are worth, and the second-lien holders.

All I can say is that I hope they funnel the additional $30 billion into other, better initiativesto help homeowners.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles