Disability Insurance in the Recession

Two articles this week take a good look at the Social Security disability insurance program, which has swelled along with the recession -- implying that jobless

Jul 31, 20205.2K Shares651.1K Views

Two articles this week take a good look at the Social Security disability insurance program, which has swelled along with the recession — implying that jobless workers, not just the disabled, are taking part. In the Washington Post, Michael Fletcher writes:

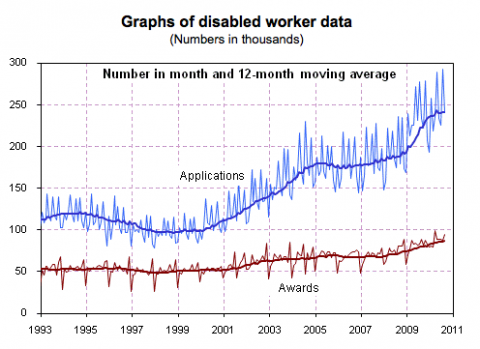

“„Applications to the program soared by 21 percent, to 2.8 million, from 2008 to 2009, as the economy was seriously faltering. The growth is the sharpest in the 54-year history of the program. It threatens the program’s fiscal stability and adds to an administrative backlog that is slowing the flow of benefits to those who need them most. Moreover, about 8 million workers were receiving disability benefits in June, an increase of 12.6 percent since the recession began in 2007, according to Social Security Administration statistics.

The program accepts about half of applicants, and only one percent of recipients return to work, the Congressional Budget Office says. James Ledbetter, writing in Slate, takes a look at the political and fiscal policy implications:

“„With the annual commitments now at about $180 billion, SSDI represents, as the authors of a 2006 economics journal paperput it, a “fiscal crisis.” Equally distressing, it also represents public policy run amok. Over the last few decades, a program that was designed to help a relatively small group of people who were fatally sick or permanently unable to work has evolved into a backdoor welfare program in which a huge number of people are paid not to get jobs. [...]

“„Granted, no one gets rich off SSDI — the average monthly check is about $1,000. But unlike unemployment insurance or the TANF programthat replaced welfare in the 1990s, SSDI benefits are open-ended. Once you qualify for SSDI, you keep getting it until one of three things happens: You die; you reach retirement age (at which point your medical expenses are paid by Medicare); or you stop being eligible, either by getting a job or by getting better. That last criterion accounts for only about 12 percent of those who leave the program in any given year.

I don’t doubt that many of the jobless workers applying for the program exaggerate their conditions and could go back to work. (The link between unemployment and disability is well-established— so much so that some economists suggestexpanding unemployment benefits to make sure workers don’t take the more expensive disability benefits.) But joblessness does cause worse health outcomes: Losing your job makes you sick. And the longer the duration of employment, the higher the risk of declining health, especially mental health.

So, I would love to see more data on the causal and correlative links between long-term unemployment, poor health and disability programs. It is not coincidence that 500,000 more Americans have taken SSDI due to a recession where 6.6 million Americans have been out of workfor more than six months, and millions more have simply dropped outof the labor force.

And, as an aside, this chart on disability applications seems good grist for the “lost decade” phenomenon — after 2000, applications start growing much more quickly.

Hajra Shannon

Reviewer

Latest Articles

Popular Articles