HUD and Treasury’s New Monthly Housing Scorecard Shows Continued HAMP Slowdown

Today, the Department of Housing and Urban Development and the Treasury Department unveiled a new monthly scorecard on the administration’s efforts to stabilize

Jul 31, 202041K Shares594.8K Views

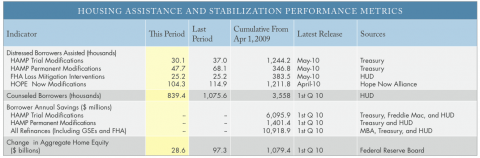

Today, the Department of Housing and Urban Development and the Treasury Department [unveiled](New monthly housing scorecard w/ market indicators and impact of Admin’s unprecedented housing recovery efforts: http://hud.gov/scorecard/) a new monthly scorecard on the administration’s efforts to stabilize the national housing market, taking the place of the old monthly Making Home Affordable Program Servicer Performance Report. As Daniel Indiviglio has notedover at The Atlantic, Treasury and HUD have changed up the format of these reports a number of times. This might sound like a niggling complaint — but it really does make it a bit harder to figure out how the programs are going. This scorecard, for instance, initially focuses on mortgage affordability and housing-price stabilization, rather than the most pressing concerns: the completion rate of modifications and the success of those modifications at keeping homeowners out of foreclosure chief among them. This chart comes from the index, and shows a continued and exaggerated slowdown in modifications over the past few months.

The number of trial modifications is down 18.6 percent month-on-month. The number of permanent modifications is down 30 percent. The number of counseled borrowers has fallen by more than 200,000 from last quarter. The program continues to drop more than half of homeowners before their modifications become permanent. (Under the terms of the program, a homeowner and bank agree on lowered payments. The modification enters a trial period, where the homeowner has to demonstrate her earnings and ability to make payments. If she cannot, the modification is dropped.) The one silver lining is that around half of those dropped borrowers have received help from their banks’ modification programs, and only 7 percent have ended up in foreclosure.

Still, the report is sobering. HAMP has helped 346,000 homeowners receive a permanent modification — a good number, but a fraction of the number of homeowners the administration initially hoped to aid. The housing market remains weak, with 10 million homeowners underwater. And a recent Fitch Ratings reportpredicted that most borrowers who receive permanent modifications under HAMP will redefault anyway, because “the median ratio of total debt payments to pretax income is still 64 percent.” From the Wall Street Journal storyon the Fitch report:

“„Fitch based the redefault forecast on the performance of loans that were modified in the first quarter of 2009. Those modifications were done outside of HAMP, which took effect later in the year. But [Diane Pendley, a managing director at Fitch] doesn’t expect a major difference between the results of HAMP modifications and those made under lenders’ programs.

“„Even if two-thirds of the loan modifications fail, Ms. Pendley said, that doesn’t mean HAMP is a failure. “If you can save one-third of the borrowers, I think it is worth the exercise,” she said. She also said the HAMP program, announced in early 2009, had provided a basic outline for loan servicers to follow in modifying loans. Loan servicers, often owned by banks, collect payments and handle foreclosures. Previously they were “all over the place” in their methods for dealing with foreclosures, Ms. Pendley said.

Cold comfort: At least if housing double-dips, loan servicers will be better at modifications. I think I’d prefer preemptive cramdownlegislation.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles