Consumer Groups Praise Financial Reform – But Cautiously

As the bill heads to conference committee, consumer advocates have identified loopholes and weak points where a merged bill could be watered down.

Jul 31, 202079.1K Shares1.2M Views

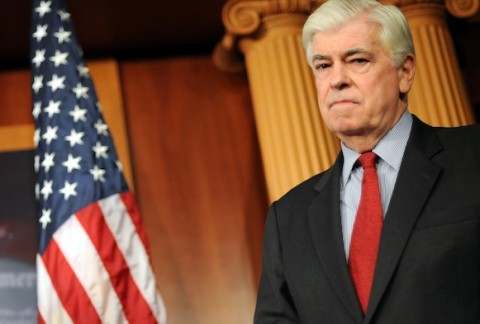

Sen. Chris Dodd (D-Conn.) (EPA/ZUMApress.com)

Last week, the Senate passed a sweeping overhaul of the regulation of banks and financial institutions. The bill, authored by Sen. Chris Dodd (D-Conn.), does not just focus on Wall Street firms, changing leverage limits and capital requirements. It focuses on Main Street banks and lenders as well. The bill empowers a new oversight council to create and enforce rules specifically on behalf of regular consumers: the Consumer Financial Protection Agency, housed in the Federal Reserve in the Senate bill and an independent federal agency in the House bill, which now need to be merged.

[Economy1]By and large, consumer watchdogs — some of the bill’s fiercest critics and biggest supporters — were happy with the final Dodd legislation. “We are pleased the Senate has passed this momentous bill that will rein in big banks’ reckless behavior and bring transparency to our financial system and protect consumers,” Heather Booth, the consumer advocate and director of the Americans for Financial Reform, said in a statement. “[This bill] ensures the financial system operates to support needs of working families, promotes business growth and economic mobility rather than the interests of the speculators who view the economy as a huge casino.”

But as the Dodd bill heads to conference committee — where members of Congress will reconcile the Senate financial regulatory reform proposal with the House’s bill, passed last year — consumer advocates have identified loopholes and weak points where a merged bill could be watered down, leaving American workers and families overpaying for financial services or otherwise vulnerable. Consumer advocates primarily cite the purview of the CFPA — the companies it will be able to regulate, and the extent to which it will be able to enforce rules — as the primary yardstick of real reform.

Travis Plunkett, the legislative director of the Consumer Federation of America, points to investor protections as the “big hole” remaining in the bill. “The House legislation is stronger on making sure that financial professionals are responsible for the advice they give,” he says. But the CFA is also focusing on ensuring a strong, independent CFPA comes from the conference committee process. He named a loophole in the Senate bill regarding the CFPA’s ability to monitor small non-bank lenders, like payday lenders, as problematic. “We’d like to see the House language triumph there,” he said, noting that the difference would amount to millions for low-income Americans.

The Center for Responsible Lending, a nonpartisan research group, cites whether auto lenders are under the CFPA’s oversight as an issue to watch. The Center estimates that consumers spend $20 billion more a year on their car loans because they borrow through dealerships — whose contracts can be usurious and difficult to understand — rather than banks or credit unions. Kathleen Day, a spokesperson for the organization, notes that the House bill exempts auto lenders from CFPA regulation and that car companies are lobbying hard to keep it that way in the final legislation.

Sen. Sam Brownback (R-Kans.) attempted to push the same exemption into the Senate bill, but the Senate ultimately did not vote on his amendment. Today, the Senate plans to take a nonbinding “sense of Congress” vote on the measure. “It isn’t binding, but these things are taken into account in conference committee,” Day says. “Currently, the Senate bill is better than the House bill on that, so we don’t want to see a shift there.” Plus, it is a point of hard lobbying. Last year, Ford Motor Company alone made more than $1 billion through its financing arm.

Day also says the CRL hopes Congress removes a Senate provision allowing small non-bank companies to preview and comment on CFPA rules “before they see the light of day.” “That’s behind the scenes, and would lead to the kind of cozy relationships between regulated companies and regulators that led to this crisis in the first place.”

Consumer watchdogs also cite preemption — the ability of the federal government to quash strong local rules — as a major issue to watch as the bills are merged. “It [is] really in the weeds,” Day says, “and a hard one to tamper with, but important.”

Mike Konczal, a fellow at the Roosevelt Institute and specialist in banking regulation, explains that reformers want states to retain the ability to create and enforce strong consumer-protection standards within their borders — and had to fight for the provision in both the House and Senate. “The New Democrats [in the House] could have probably killed the CFPA or at least turned it into a toothless panel,” he says. “But they let it go and then pushed hard [for] pre-emption, which would allow the Office of the Comptroller of Currency” — a primary government banking regulator — “to break state consumer protection laws.”

Therefore, preserving the ability to police consumer protection at the local level remains a priority for advocacy groups in Washington.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles