$5000 Savings Challenge - How To Do It?

Discover the essentials of the $5000 Savings Challenge, a practical and achievable method to save $5,000 in a year. Learn about customizable saving strategies, tips for success, and answers to frequently asked questions.

Author:Camilo WoodReviewer:Emmanuella SheaJan 08, 2024480 Shares43.6K Views

Embarking on a savings journey like the $5000 Savings Challengeis a transformative experience, blending financial discipline with personal growth. This challenge typically spread over 52 weeks, offers a structured approach to amassing a significant savings sum within a year. Here's a detailed exploration of this challenge, including strategies, tips, and an alternative challenge for those seeking variety.

What's The $5000 Savings Challenge More Commonly Known As The 52-Week Savings Challenge?

Want some tips on budgetingand saving $5000 specifically? The 52-Week Money Challenge is an exercise in incremental saving, where the amount saved increases gradually every week. The beauty of this approach lies in its simplicity and adaptability. For instance, the first week might involve setting aside just $1, the second week $2, and so on. This gradual increase eases you into the habit of saving without causing a significant impact on your weekly budget. By the year's end, these small amounts accumulate into a substantial sum, reflecting the power of consistent, incremental action.

For those looking to stretch their financial goals further, the advanced version of this challenge ramps up the stakes. This variant involves saving larger amounts each week, usually between $50 and $150, targeting a total of $5,000.

$5000 Savings Challenge Strikeout List

- Week 1 - Save $50 | Total: $50

- Week 2 - Save $50 | Total: $100

- Week 3 - Save $50 | Total: $150

- Week 4 - Save $50 | Total: $200

- Week 5 - Save $75 | Total: $275

- Week 6 - Save $75 | Total: $350

- Week 7 - Save $75 | Total: $425

- Week 8 - Save $75 | Total: $500

- Week 9 - Save $100 | Total: $600

- Week 10 - Save $100 | Total: $700

- Week 11 - Save $100 | Total: $800

- Week 12 - Save $100 | Total: $900

- Week 13 - Save $110 | Total: $1,010

- Week 14 - Save $110 | Total: $1,120

- Week 15 - Save $110 | Total: $1,230

- Week 16 - Save $110 | Total: $1,340

- Week 17 - Save $130 | Total: $1,470

- Week 18 - Save $130 | Total: $1,600

- Week 19 - Save $130 | Total: $1,730

- Week 20 - Save $130 | Total: $1,860

- Week 21 - Save $150 | Total: $2,010

- Week 22 - Save $150 | Total: $2,160

- Week 23 - Save $150 | Total: $2,310

- Week 24 - Save $150 | Total: $2,460

- Week 25 - Save $130 | Total: $2,590

- Week 26 - Save $130 | Total: $2,720

- Week 27 - Save $130 | Total: $2,850

- Week 28 - Save $130 | Total: $2,980

- Week 29 - Save $110 | Total: $3,090

- Week 30 - Save $110 | Total: $3,200

- Week 31 - Save $110 | Total: $3,310

- Week 32 - Save $110 | Total: $3,420

- Week 33 - Save $100 | Total: $3,520

- Week 34 - Save $100 | Total: $3,620

- Week 35 - Save $100 | Total: $3,720

- Week 36 - Save $100 | Total: $3,820

- Week 37 - Save $90 | Total: $3,910

- Week 38 - Save $90 | Total: $4,000

- Week 39 - Save $90 | Total: $4,090

- Week 40 - Save $90 | Total: $4,180

- Week 41 - Save $80 | Total: $4,260

- Week 42 - Save $80 | Total: $4,340

- Week 43 - Save $80 | Total: $4,420

- Week 44 - Save $80 | Total: $4,500

- Week 45 - Save $75 | Total: $4,575

- Week 46 - Save $75 | Total: $4,650

- Week 47 - Save $75 | Total: $4,725

- Week 48 - Save $75 | Total: $4,800

- Week 49 - Save $50 | Total: $4,850

- Week 50 - Save $50 | Total: $4,900

- Week 51 - Save $50 | Total: $4,950

- Week 52 - Save $50 | Total: $5,000

This list will help you keep track of your savings each week, ensuring you reach your target of $5,000 by the end of the year.

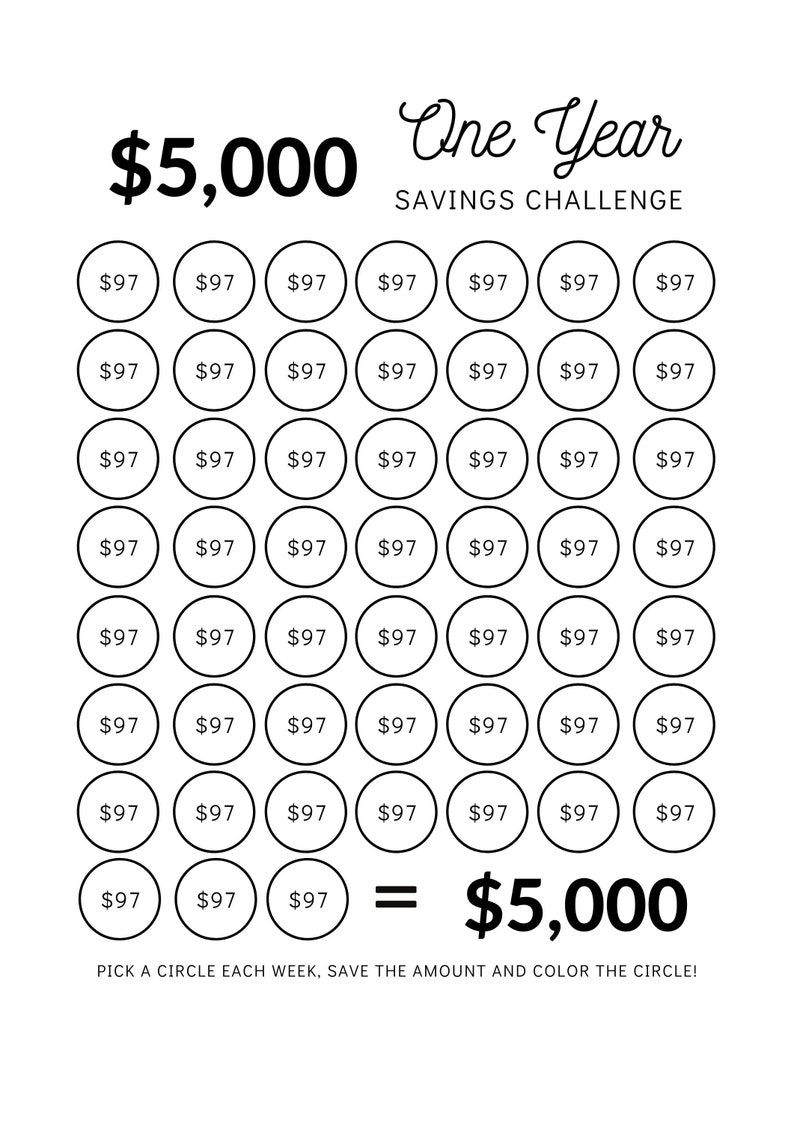

An alternative approach within this advanced version is to save a flat amount, such as $97 every week, which simplifies the process while ensuring you hit the $5,000 mark by year-end.

$5000 Savings Challenge Strikeout List (Flat $97 Weekly Savings)

- Week 1 - Save $97 | Total: $97

- Week 2 - Save $97 | Total: $194

- Week 3 - Save $97 | Total: $291

- Week 4 - Save $97 | Total: $388

- Week 5 - Save $97 | Total: $485

- Week 6 - Save $97 | Total: $582

- Week 7 - Save $97 | Total: $679

- Week 8 - Save $97 | Total: $776

- Week 9 - Save $97 | Total: $873

- Week 10 - Save $97 | Total: $970

- Week 11 - Save $97 | Total: $1,067

- Week 12 - Save $97 | Total: $1,164

- Week 13 - Save $97 | Total: $1,261

- Week 14 - Save $97 | Total: $1,358

- Week 15 - Save $97 | Total: $1,455

- Week 16 - Save $97 | Total: $1,552

- Week 17 - Save $97 | Total: $1,649

- Week 18 - Save $97 | Total: $1,746

- Week 19 - Save $97 | Total: $1,843

- Week 20 - Save $97 | Total: $1,940

- Week 21 - Save $97 | Total: $2,037

- Week 22 - Save $97 | Total: $2,134

- Week 23 - Save $97 | Total: $2,231

- Week 24 - Save $97 | Total: $2,328

- Week 25 - Save $97 | Total: $2,425

- Week 26 - Save $97 | Total: $2,522

- Week 27 - Save $97 | Total: $2,619

- Week 28 - Save $97 | Total: $2,716

- Week 29 - Save $97 | Total: $2,813

- Week 30 - Save $97 | Total: $2,910

- Week 31 - Save $97 | Total: $3,007

- Week 32 - Save $97 | Total: $3,104

- Week 33 - Save $97 | Total: $3,201

- Week 34 - Save $97 | Total: $3,298

- Week 35 - Save $97 | Total: $3,395

- Week 36 - Save $97 | Total: $3,492

- Week 37 - Save $97 | Total: $3,589

- Week 38 - Save $97 | Total: $3,686

- Week 39 - Save $97 | Total: $3,783

- Week 40 - Save $97 | Total: $3,880

- Week 41 - Save $97 | Total: $3,977

- Week 42 - Save $97 | Total: $4,074

- Week 43 - Save $97 | Total: $4,171

- Week 44 - Save $97 | Total: $4,268

- Week 45 - Save $97 | Total: $4,365

- Week 46 - Save $97 | Total: $4,462

- Week 47 - Save $97 | Total: $4,559

- Week 48 - Save $97 | Total: $4,656

- Week 49 - Save $97 | Total: $4,753

- Week 50 - Save $97 | Total: $4,850

- Week 51 - Save $97 | Total: $4,947

- Week 52 - Save $97 | Total: $5,044

This consistent weekly saving method makes it easier to manage and track your savings, leading to a total of $5,044 by the end of the 52nd week, slightly over the $5,000 target.

Planning And Budgeting For Success

Establishing Achievable Goals

Setting realistic goals is crucial. Begin by evaluating your monthly income and expenses. This analysis will help you determine how much you can comfortably save each week without straining your finances. Break down your target into smaller milestones, such as weekly or monthly savings goals. This breakdown makes the process less daunting and provides regular checkpoints to celebrate your progress.

Crafting A Sustainable Budget

Effective budgeting is the cornerstone of this challenge. Start by categorizing your expenses and identifying areas where you can cut back. For example, reducing dining out, unsubscribing from unused services, or switching to more affordable alternatives for utilities can free up more funds for your savings. Allocate a specific portion of your income to savings as soon as you receive your paycheck. This practice, known as 'paying yourself first,' ensures that you prioritize your savings goal.

3 Effective Strategies For Reaching Your $5,000 Goal

1. Maintaining Focus And Consistency

The key to succeeding in this challenge lies in consistency and focus. Keep a visual representation, like a savings tracker or a chart, to maintain a clear view of your progress. This visual aid not only serves as a constant reminder of your goals but also provides a sense of accomplishment as you watch your savings grow.

2. Embracing Automation

In our busy lives, it's easy to forget or skip a savings deposit. Setting up automatic transfers to your designated savings account can mitigate this risk. Automating the process ensures that you consistently save the predetermined amount, making it a hassle-free part of your financial routine.

3. Adapting To Financial Changes

Your financial situation may change during the year, necessitating adjustments to your savings plan. Regularly review your financial status and be prepared to modify your savings amounts or strategy. This flexibility is crucial in maintaining the challenge's viability, regardless of changing circumstances.

Boosting Your Savings Potential

Minimizing Expenditure

Reducing your expenses is an effective way to boost your savings. Analyze your spending habits in detail and identify areas where you can realistically cut back. Small changes, like preparing meals at home instead of eating out, can accumulate substantial savings over time. Also, consider renegotiating or shopping around for better deals on recurring expenses like insurance, utilities, and subscriptions.

Augmenting Your Income

If reducing expenses isn't sufficient, look for ways to increase your income. Opportunities like freelance work, part-time jobs, or selling items you no longer need can provide additional funds. These extra earnings can be directly channeled into your savings, accelerating your progress towards the $5,000 goal.

Navigating Financial Obstacles

Handling Unforeseen Expenditures

Life is unpredictable, and unexpected expenses can arise. To avoid derailing your savings challenge, maintain a separate emergency fund. This fund should cover sudden costs like car repairs or medical emergencies. If you do need to adjust your savings plan to accommodate an unexpected expense, do so with the intention of returning to your original plan as soon as feasible.

Sustaining Enthusiasm

Staying motivated throughout a year-long challenge can be tough. Joining online forums or local groups undertaking similar savings challenges can offer support and encouragement. Celebrating your progress at regular intervals, such as every $1,000 saved, can also provide a psychological boost and reinforce your commitment.

Choosing The Right Savings Vehicle

Selecting the right place to keep your savings is crucial. High-yield savings accounts offer higher interest rates compared to standard accounts, allowing your money to grow faster. Cash management accounts offer a blend of the features of checking and savings accounts, providing both interest earnings and easy access to funds. For those willing to take on more risk for potentially higher returns, investment accounts like IRAs or brokerage accounts might be suitable.

Bonus Alternate Approach - The Bi-Weekly $5,000 Savings Plan

Concept Of Bi-Weekly Savings

The Bi-Weekly $5,000 Savings Plan is a variant of the traditional challenge, tailored for those who receive bi-weekly paychecks. This plan simplifies the saving process by aligning it with your income schedule. In this approach, you save a fixed or variable amount every two weeks, rather than weekly. The bi-weekly rhythm can make it easier to manage larger savings amounts and adjust to your financial cycle.

Sample Saving Schedule

To implement this plan, you might start by saving $50 in the first bi-weekly period, then gradually increase the amount. For instance, you could save $100 in the next period and $150 in the following one. Continue this pattern, adjusting the amounts based on your financial capacity and circumstances.

$5000 Savings Challenge FAQs

Who Should Attempt The $5,000 Savings Challenge?

Anyone looking to build savings, improve financial discipline, or work towards a specific financial goal is well-suited for this challenge. It's particularly beneficial for those who struggle with saving consistently or who want to establish a habit of saving. The challenge is adaptable to different income levels and lifestyles.

Can I Customize The $5,000 Savings Challenge?

Yes, the challenge is highly customizable. You can adjust the weekly or bi-weekly saving amounts based on your financial situation. Some people might prefer saving a consistent amount each week, while others might find it easier to increase the amount gradually. The key is to find a saving pattern that fits your budget and lifestyle.

What Should I Do If I Miss A Week In The Challenge?

If you miss a week, don't be discouraged. You can either adjust the following week's savings to cover the missed amount or extend the challenge by a week or two to make up for it. The challenge is about developing saving habits and flexibility is important to accommodate life's unpredictability.

Where Should I Keep My Savings For The Challenge?

It's advisable to keep your savings in an account separate from your regular checking account. A high-yield savings account is a good option as it offers higher interest rates than standard accounts, allowing your money to grow. Alternatively, you could consider a money market account for higher interest earnings while maintaining access to your funds.

Conclusion

The $5000 Savings Challenge offers a structured yet flexible approach to accumulate a significant savings amount. Whether you opt for the traditional 52-week format or the bi-weekly variant, the key to success lies in consistent saving, disciplined budgeting, and the willingness to adjust your plan as needed. By adopting these strategies and maintaining focus on your financial goals, you can effectively navigate this challenge and achieve significant savings, paving the way for greater financial security and independence.

Jump to

What's The $5000 Savings Challenge More Commonly Known As The 52-Week Savings Challenge?

Planning And Budgeting For Success

3 Effective Strategies For Reaching Your $5,000 Goal

Boosting Your Savings Potential

Navigating Financial Obstacles

Choosing The Right Savings Vehicle

Bonus Alternate Approach - The Bi-Weekly $5,000 Savings Plan

$5000 Savings Challenge FAQs

Conclusion

Camilo Wood

Author

Emmanuella Shea

Reviewer

Latest Articles

Popular Articles