20 Ways To Make Money Without A Traditional Job

Learn 20 ways to make money without a traditional job in our comprehensive guide. With 20 different ways to choose from, you're sure to find the perfect opportunity for you. Start your journey to financial freedom today!

Author:Gordon DickersonReviewer:Habiba AshtonOct 11, 20237.5K Shares188.4K Views

Exploring avenues to generate income without the confines of a traditional job has become an increasingly popular pursuit. This guide delves into 20 ways to make moneywithout actually working, offering a diverse array of strategies for those seeking alternative income streams.

From smart investments to creative ventures, each approach is designed to leverage assets, skills, or resources in ways that require less conventional 'work' but still yield financial returns. Whether you're interested in passive income, entrepreneurial endeavors, or investment opportunities, this comprehensive list provides a range of options to consider for achieving financial independence.

Are you tired of working a 9-to-5 job? Do you want to find a way to make money without having to trade your time for money? If so, you're not alone. Millions of people around the world are looking for ways to make money without actually working.

The good news is, there are many different ways to do this. In this article, we'll explore 20 ways to make money without actually working. Whether you're looking for a side hustle or a full-time income, there's something for everyone on this list.

We'll take a closer look at each of these 20 ways to make money without actually working. We'll provide you with all the information you need to get started, including tips on how to be successful.

1. Conduct Extensive Market Surveys

Market surveys are a type of research that companies use to gather information about their customers and potential customers. This information can be used to improve products and services, develop new marketing strategies, and make better business decisions.

Market surveys can be conducted in a variety of ways, including online surveys, phone surveys, in-person surveys, and focus groups. Online surveys are the most common type of market survey, as they are relatively inexpensive and easy to conduct.

To participate in a market survey, you will typically be asked to provide some demographic information, such as your age, gender, income level, and location. You will then be asked to answer a series of questions about your opinions on a variety of topics. These topics may include products, services, brands, marketing campaigns, or general social issues.

Market surveys are typically very short and can be completed in just a few minutes. However, some surveys may take longer, depending on the complexity of the questions being asked.

Most market surveys are conducted by market research companies. These companies are hired by businesses to collect data on their behalf. Market research companies typically have a large database of potential survey participants, which allows them to get a representative sample of the population.

Market surveys are an important tool for businesses, as they provide valuable insights into what customers want and need. By participating in market surveys, you can help businesses to improve their products and services, and you can also earn some extra money.

Here are some tips for participating in market surveys,

- Be honest in your answers- The goal of market surveys is to gather accurate data, so it is important to be honest in your answers.

- Be thoughtful in your answers- Don't just rush through the survey. Take some time to think about your answers and provide thoughtful responses.

- Be aware of scams- There are some scams that involve market surveys. Be careful about providing personal information, such as your Social Security number or credit card number, to any company that you are not familiar with.

If you are interested in participating in market surveys, there are a number of websites where you can sign up. Some popular market survey websites include,

- Swagbucks

- Survey Junkie

- InboxDollars

- Opinion Outpost

- YouGov

These websites typically require you to create an account and provide some basic demographic information. Once you have created an account, you will be able to start participating in surveys.

You will typically be rewarded with points or cash for participating in surveys. The amount of points or cash that you earn will vary depending on the length and complexity of the survey. You can then redeem your points or cash for gift cards, merchandise, or cash payments.

Market surveys are a great way to earn some extra money and to help businesses improve their products and services. If you are interested in participating in market surveys, there are a number of websites where you can sign up.

2. Lease A Vacant Room

Renting out a spare room is a great way to make extra money, especially if you live in a high-cost-of-living area. It can also be a great way to meet new people and build relationships.

Here are some tips on how to rent out a spare room:

- Set a fair price -When setting the price for your spare room, it is important to consider the cost of living in your area, the size and amenities of your room, and the demand for rental housing. You can do some research online to see what other people are charging for similar rooms in your area.

- Take good photos -When you are listing your room online, it is important to include clear and high-quality photos. The photos should show the room from all angles and should highlight its best features.

- Write a detailed description -In the description of your room, be sure to include all of the important information, such as the size of the room, the types of amenities that are included, and the rules for the house. You should also mention any nearby attractions or public transportation options.

- Screen your tenants -It is important to screen your tenants carefully before renting out your spare room. This will help to ensure that you are renting to someone who is responsible and respectful. You may want to ask for references, run a credit check, and do a background check.

Once you have found a tenant, you will need to create a lease agreement. This agreement should outline the terms of the rental, such as the rent amount, the security deposit, and the length of the lease.

It is also important to have a rental insurance policy in place. This will protect you in the event that your tenant damages your property or fails to pay rent.

If you follow these tips, you can successfully rent out your spare room and make some extra money.

Here are some additional tips:

- Be transparent -Be upfront with your potential tenants about the rules of the house, such as whether or not they are allowed to have guests or pets. This will help to avoid any misunderstandings down the road.

- Be communicative -Be responsive to your tenant's needs and concerns. This will help to build a good relationship with your tenant and make them more likely to stay in your room for the long term.

- Be professional -Even though you are renting out your spare room to a friend or family member, it is important to maintain a professional relationship with them. This will help to avoid any awkward situations or disagreements.

Renting out a spare room can be a great way to make extra money and to meet new people. By following these tips, you can increase your chances of success.

3. Allocate Capital Into A Business

Investing in a business can be a great way to make money, but it is important to do your research and understand the risks involved. Here are some things to consider when investing in a business:

- The type of business -There are many different types of businesses, each with its own risks and rewards. Some common types of businesses to invest in include restaurants, retail stores, service businesses, and technology startups.

- The management team -When investing in a business, it is important to consider the management team. The management team is responsible for running the business and making decisions that will affect its profitability. Make sure that the management team has experience and a track record of success.

- The financial health of the business -It is also important to consider the financial health of the business before investing. Look at the company's financial statements to get a sense of its profitability, debt levels, and cash flow.

- The exit strategy -It is also important to have an exit strategy in place before investing in a business. This means having a plan for how you will eventually sell your investment.

There are two main ways to invest in a business: equity and debt.

- Equity investments -involve purchasing a share of the ownership of the business. This gives you the right to a portion of the company's profits and losses. Equity investments are typically the riskiest type of investment, but they also have the potential to yield the highest returns.

- Debt investments -involve lending money to the business in exchange for interest payments. Debt investments are typically less risky than equity investments, but they also offer lower potential returns.

If you are considering investing in a business, it is important to speak to a financial advisor. A financial advisor can help you assess the risks and rewards of different investment opportunities and develop an investment strategy that is right for you.

Here are some additional tips for investing in a business:

- Start small -Don't invest more money than you can afford to lose.

- Diversify your portfolio -Invest in a variety of different businesses to reduce your risk.

- Hold for the long term -Don't expect to get rich quick from investing in a business. It takes time for businesses to grow and become profitable.

- Be patient -Investing in a business can be a roller coaster ride. There will be ups and downs along the way. Be prepared to hold your investment for the long term and ride out the tough times.

Investing in a business can be a great way to make money, but it is important to do your research and understand the risks involved. By following the tips above, you can increase your chances of success.

4. Opt For Credit Cards Offering Substantial Cashback

Credit cards with high cash back can be a great way to save money on your purchases. When you use a high cash back credit card, you earn points or miles for every dollar you spend. These points or miles can then be redeemed for cash back, statement credits, travel rewards, or other merchandise.

There are a number of different high cash back credit cards on the market, so it is important to compare them before you choose one. Here are some things to consider when choosing a high cash back credit card:

- Cash back rate -The cash back rate is the percentage of your purchases that you will earn back in rewards. Some credit cards offer a flat-rate cash back rate on all purchases, while others offer bonus cash back rates in certain categories, such as groceries, gas, or travel.

- Annual fee -Some high cash back credit cards have an annual fee, while others do not. If you choose a credit card with an annual fee, make sure that the rewards you earn outweigh the cost of the fee.

- Welcome offer -Many high cash back credit cards offer a welcome bonus to new cardholders. This bonus is typically a statement credit or a large number of points or miles that you can earn after spending a certain amount of money on the card in the first few months of opening your account.

- Other benefits -In addition to cash back rewards, some high cash back credit cards also offer other benefits, such as purchase protection, travel insurance, and extended warranties.

When you are comparing high cash back credit cards, it is important to consider all of these factors to choose the card that is best for you.

Here are some of the best high cash back credit cards on the market in 2023:

- Chase Freedom Unlimited -This card offers 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% cash back on dining and drugstores, and 1.5% cash back on all other purchases.

- Citi® Double Cash Card -This card offers 2% cash back on all purchases, 1% when purchases are made and another 1% when paid off.

- Discover it® Cash Back -This card offers 5% cash back on rotating quarterly categories (requires activation), 1% cash back on all other purchases, and a cash back match at the end of your first year.

- Blue Cash Preferred® Card from American Express -This card offers 6% cash back at U.S. supermarkets (on up to $6,000 per year in purchases, then 1%), 3% cash back at U.S. gas stations and on U.S. transit & commuting (including ride-hailing services), and 1% cash back on all other purchases.

These are just a few of the many high cash back credit cards on the market. It is important to compare different cards before you choose one to find the one that is best for you.

5. Craft An Investment Portfolio

An investment portfolio is a collection of assets that you invest in to achieve your financial goals. Your investment portfolio may include stocks, bonds, mutual funds, ETFs, cash, and other assets.

To create an investment portfolio, you should first consider your investment goals. What are you saving for? Retirement? A down payment on a house? Your child's education? Once you know your goals, you can develop an investment strategy that will help you achieve them.

Your investment strategy should take into account your risk tolerance and time horizon. Risk tolerance is how much risk you are comfortable with. Time horizon is how long you have to invest before you need to access your money.

If you have a long time horizon and a high-ris: tolerance, you may want to invest in stocks. Stocks are the riskiest type of investment, but they also have the potential to generate the highest returns.

If you have a shorter time horizon or a lower risk tolerance, you may want to invest in bonds. Bonds are less risky than stocks, but they also offer lower returns.

You may also want to invest in mutual funds or ETFs. Mutual funds and ETFs are baskets of securities that are managed by professional investors. They can be a good way to diversify your portfolio and reduce your risk.

Once you have developed an investment strategy, you can start to build your investment portfolio. You can open a brokerage account and start buying and selling investments.

Here are some additional tips for creating and managing an investment portfolio,

- Rebalance your portfolio regularly -As your investments grow and change, you will need to rebalance your portfolio to ensure that it remains aligned with your investment strategy. Rebalancing typically involves selling some of your winners and buying more of your losers.

- Don't try to time the market -It is impossible to predict when the market will go up or down. Trying to time the market is a risky strategy that can lead to losses.

- Invest for the long term -Don't panic sell if the market takes a downturn. The stock market is cyclical, and it will eventually recover.

Creating and managing an investment portfolio can be a complex task, but it is important to your financial future. By following the tips above, you can create a portfolio that will help you achieve your financial goals.

If you need help creating or managing an investment portfolio, you may want to consider working with a financial advisor. A financial advisor can help you develop an investment strategy that is right for you and help you make investment decisions.

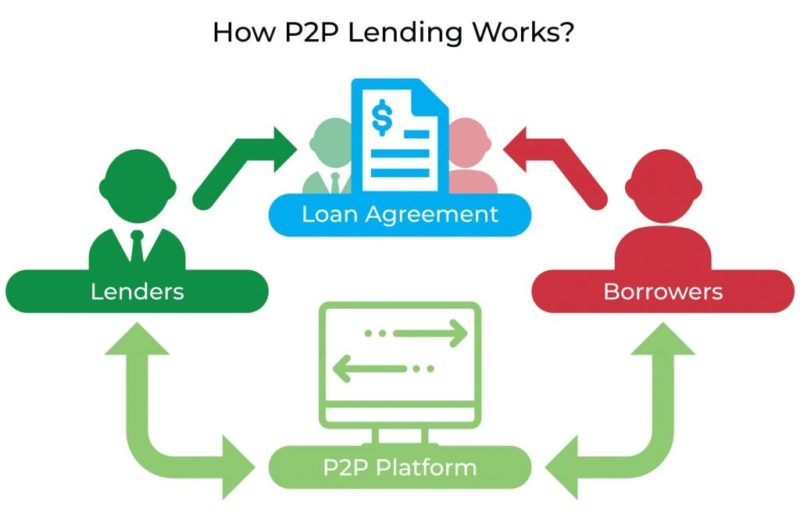

6. Facilitating Peer-to-Peer Lending

Peer-to-peer (P2P) lending is a type of lending in which individuals lend money to other individuals or businesses without going through a traditional financial institution, such as a bank. P2P lending platforms connect borrowers with lenders and facilitate the lending process.

P2P lending has become increasingly popular in recent years, as it offers a number of advantages for both borrowers and lenders. For borrowers, P2P lending can offer lower interest rates and more flexible repayment terms than traditional loans. For lenders, P2P lending can offer the opportunity to earn higher returns on their investments than they could get from a savings account or certificate of deposit.

There are a number of different P2P lending platforms available, and each platform has its own unique features and requirements. When choosing a P2P lending platform, it is important to consider factors such as the platform's track record, the interest rates and repayment terms that are offered, and the fees that are charged.

If you are considering P2P lending, it is important to do your research and understand the risks involved. P2P lending is a relatively new asset class, and there is always the risk of losing money. It is important to diversify your investments and only invest money that you can afford to lose.

Here are some of the benefits and risks of P2P lending,

Benefits

- Lower interest rates -P2P lending platforms often offer lower interest rates than traditional banks and other financial institutions.

- More flexible repayment terms -P2P lending platforms often offer more flexible repayment terms than traditional loans.

- Higher returns for lenders -P2P lending can offer lenders the opportunity to earn higher returns on their investments than they could get from a savings account or certificate of deposit.

- Access to capital for borrowers -P2P lending can provide borrowers with access to capital that they may not be able to obtain from traditional financial institutions.

Risks

- Risk of default -There is always the risk that a borrower may default on their loan. This can lead to financial losses for lenders.

- Risk of fraud -There is also the risk of fraud on P2P lending platforms. It is important to carefully research any platform before you invest.

- Lack of regulation -P2P lending is a relatively new asset class and is not as heavily regulated as traditional financial institutions. This means that there is less protection for investors if something goes wrong.

P2P lending can be a good way to borrow or lend money, but it is important to understand the risks involved before you get started.

7. Set Aside Your Excess “change”

Putting away your spare change is a great way to save money without even realizing it. There are a few different ways to do this.

One way is to simply start saving any loose change that you have at the end of the day. You can put it in a jar, a piggy bank, or even just a pile on your dresser. Once you have saved up a decent amount of change, you can take it to the bank and deposit it into your savings account.

Another way to save your spare change is to use a micro-savings app. There are a number of different micro-savings apps available, and each one has its own unique features. Some micro-savings apps round up your purchases to the nearest dollar and save the difference. Other micro-savings apps allow you to set up specific savings goals and then automatically save towards those goals each time you use your debit or credit card.

No matter which method you choose, putting away your spare change is a great way to save money without even realizing it. Over time, the small amounts of change that you save can add up to a significant amount of money.

Here are some tips for putting away your spare change,

- Make it a habit -Set aside a few minutes each day to put away your spare change. This will help you to make it a habit and you will be less likely to forget.

- Find a convenient place to keep your change -Put a jar or piggy bank in a place where you will see it often, such as on your dresser or next to your front door. This will make it easy for you to drop your change in every time you come home.

- Set a goal -Set a goal for how much money you want to save. This will help you to stay motivated and on track.

- Take it to the bank regularly -Once you have saved up a decent amount of change, take it to the bank and deposit it into your savings account. This will help you to avoid losing it and it will also help you to see how much money you are saving.

Putting away your spare change is a great way to save money without even realizing it. By following these tips, you can start saving money today.

Here are some additional tips for saving money,

- Create a budget -A budget will help you to track your income and expenses so that you can make sure that you are not spending more money than you are earning.

- Cut back on unnecessary expenses -Take a close look at your budget and see where you can cut back on unnecessary expenses. This could include things like eating out less, canceling unused subscriptions, or shopping around for cheaper insurance rates.

- Pay off debt -If you have any debt, focus on paying it off as quickly as possible. This will free up more money in your budget for savings.

- Automate your savings -Set up a recurring transfer from your checking account to your savings account each month. This will help you to save money without even having to think about it.

Saving money can be challenging, but it is important to remember that every little bit counts. By following these tips, you can start saving money today and reach your financial goals sooner.

8. Secure A Lottery Victory

To win the lottery, you need to match all of the winning numbers. The odds of winning a jackpot vary depending on the lottery, but they are generally very low. For example, the odds of winning the Powerball jackpot are 1 in 292,201,338.

There is no guaranteed way to win the lottery, but there are a few things you can do to increase your chances of winning,

- Play more often -The more often you play, the more chances you have of winning.

- Choose your numbers wisely -Avoid picking popular numbers, such as birthdates or anniversaries. Instead, try to choose a random set of numbers.

- Join a lottery pool -A lottery pool is a group of people who pool their money to buy lottery tickets. This increases your chances of winning, but it also means that you will have to share the winnings if you win.

If you do win the lottery, it is important to be prepared. Here are a few tips,

- Sign your ticket immediately -This will prevent someone else from claiming your prize.

- Don't tell anyone you won -This could lead to unwanted requests for money.

- Hire a financial advisor -A financial advisor can help you manage your winnings and make sure that you make sound financial decisions.

Winning the lottery can be a life-changing event. By following these tips, you can increase your chances of winning and be prepared for what happens next.

However, it is important to remember that the lottery is a form of gambling, and there is always the risk of losing money. If you are considering playing the lottery, please gamble responsibly.

9. Initiate A Small Business To Capitalize Your Hobbies

Starting a small business to monetize your hobbies can be a great way to turn your passion into profit. It can also be a rewarding and fulfilling experience.

Here are some tips for starting a small business to monetize your hobbies,

- Choose a hobby that you're passionate about -This will make it more enjoyable to work on your business and it will also show in your products or services.

- Identify your target market -Who are you selling to? What are their needs and wants? Once you know your target market, you can tailor your products or services to meet their needs.

- Create a business plan -This will help you to define your goals, strategies, and financial projections.

- Choose a business structure -This will determine your legal responsibilities and tax liability.

- Get the necessary permits and licenses -This will vary depending on your location and business activity.

- Market your business -Let people know about your business and what you have to offer. You can market your business online, through social media, or through traditional advertising channels.

- Provide excellent customer service -This is essential for any business, but it is especially important for small businesses. Make sure that your customers have a positive experience with your business and that they are happy with your products or services.

Here are some examples of hobbies that can be monetized into small businesses,

- Arts and crafts -If you are creative, you can sell your handmade arts and crafts online or at local craft fairs.

- Baking and cooking -If you love to bake or cook, you can start a catering business or sell your baked goods online or at local farmers markets.

- Photography -If you are a talented photographer, you can sell your photos online or offer photography services for weddings, events, or portraits.

- Writing -If you are a good writer, you can start a freelance writing business or write and sell your own books or ebooks.

- Music -If you are a musician, you can teach music lessons, sell your music online, or perform at gigs and events.

- Teaching -If you have expertise in a particular subject, you can start a teaching business or create and sell online courses.

- Pet sitting and dog walking -If you love animals, you can start a pet sitting or dog walking business.

- Gardening -If you have a green thumb, you can start a landscaping business or sell your plants and produce at local farmers markets.

These are just a few examples of hobbies that can be monetized into small businesses. The possibilities are endless. If you are passionate about your hobby, there is a way to turn it into a profitable business.

Starting a small business is not easy, but it can be very rewarding. If you are willing to put in the hard work and dedication, you can turn your hobby into a successful business.

10. Seek Out Unclaimed Funds

Unclaimed money, also known as abandoned property, is money that has been lost or forgotten by its rightful owners. It can include things like bank accounts, uncashed checks, savings bonds, and insurance proceeds.

There are a few different ways to look for unclaimed money,

- Search your state's unclaimed property website -Every state has an unclaimed property website where you can search for unclaimed money that may be owed to you. To search, you will typically need to provide your name, date of birth, and Social Security number.

- Search the MissingMoney website -The MissingMoney website is a national database of unclaimed money. To search, you will need to provide your name and address.

- Search federal government websites -There are a number of federal government websites where you can search for unclaimed money. These include the Treasury Department's Unclaimed Assets website and the Securities and Exchange Commission's Unclaimed Property website.

If you find unclaimed money that belongs to you, you can typically file a claim online or by mail. You will need to provide documentation to prove your identity and ownership of the money.

Here are some tips for looking for unclaimed money,

- Search for variations of your name -If you have ever changed your name or used a nickname, be sure to search for all variations of your name.

- Search for your relatives' names -Unclaimed money can be passed down to heirs, so it is a good idea to search for your relatives' names as well.

- Search for old addresses -If you have ever moved, be sure to search for unclaimed money at your old addresses.

- Check your mailbox regularly -Unclaimed property offices will often send letters to the last known addresses of unclaimed property owners.

It is important to note that there is no guarantee that you will find unclaimed money. However, it is a good idea to search for unclaimed money just in case. It is free to search and you could potentially find a significant amount of money.

Here are some additional tips for claiming unclaimed money,

- Be patient -It may take some time to process your claim.

- Be prepared to provide documentation -You will need to provide documentation to prove your identity and ownership of the money. This may include things like a copy of your driver's license, Social Security card, or birth certificate.

- Beware of scams -There are some scams that target people who are looking for unclaimed money. Be careful about giving out your personal information or paying any upfront fees.

Finding and claiming unclaimed money can be a great way to boost your finances. By following these tips, you can increase your chances of success.

11. Verify Your Eligibility For Any Benefits

There are many different types of benefits available to people, depending on their circumstances. Some common types of benefits include,

- Social Security benefits -Social Security benefits are available to people who have worked and paid Social Security taxes for a certain number of years. Social Security benefits can provide retirement income, disability benefits, and survivor benefits.

- Medicare benefits -Medicare is a health insurance program for people aged 65 and older and people with certain disabilities. Medicare covers a variety of medical services, including hospital stays, doctor visits, and prescription drugs.

- Medicaid benefits -Medicaid is a health insurance program for low-income individuals and families. Medicaid covers a variety of medical services, including hospital stays, doctor visits, and prescription drugs.

- Food stamps -Food stamps are a nutritional assistance program for low-income individuals and families. Food stamps can be used to purchase food at grocery stores.

- Temporary Assistance for Needy Families (TANF) -TANF is a cash assistance program for low-income families with children. TANF can help families pay for basic necessities such as food, housing, and childcare.

To find out if you are eligible for any benefits, you can contact your local government or a social service agency. You can also use the Benefits Finder tool from the U.S. Department of Health and Human Services.

Here are some tips for checking to see if you are eligible for any benefits,

- Gather your information -When you contact your local government or a social service agency, you will need to provide information about your income, expenses, and family members.

- Be honest and accurate -It is important to be honest and accurate when providing information about your circumstances. If you are not sure about something, ask for clarification.

- Ask questions -Don't be afraid to ask questions about the benefits process or about the specific benefits that you are interested in.

- Be patient -It may take some time to process your application.

If you are eligible for benefits, you can apply online, by mail, or in person. You may need to provide documentation to support your application.

It is important to note that there are many different types of benefits available, and eligibility requirements vary depending on the benefit. If you are unsure about whether or not you are eligible for any benefits, or if you have any questions about the benefits process, please contact your local government or a social service agency for assistance.

12. Acquire Real Estate

Purchasing real estate can be a big decision, but it can also be a great investment. Here are some tips on how to purchase real estate,

- Get pre-approved for a mortgage -This will give you an idea of how much money you can borrow and what your monthly payments will be.

- Find a real estate agent -A real estate agent can help you find the right property for your needs and budget. They can also help you negotiate the price and navigate the buying process.

- Make an offer -Once you have found a property that you are interested in, you will need to make an offer. The offer should include the purchase price, the terms of the sale, and any contingencies.

- Get the property inspected -Once your offer has been accepted, you will need to get the property inspected by a qualified inspector. The inspector will look for any potential problems with the property.

- Close on the property -Once the inspection is complete and you are satisfied with the results, you will need to close on the property. This involves signing the necessary paperwork and transferring the money to the seller.

Here are some additional tips for purchasing real estate,

- Do your research -Before you start looking at properties, it is important to do your research on the real estate market in your area. This will help you to understand the current market conditions and to set a realistic budget.

- Be prepared to compromise -It is unlikely that you will find a property that meets all of your needs and wants perfectly. Be prepared to compromise on some things in order to find a property that you can afford and that you are happy with,

- Don't rush into a decision -Purchasing real estate is a big decision. Don't feel pressured to make an offer on a property that you are not sure about. Take your time and make sure that you are making the right decision for you and your family.

Purchasing real estate can be a complex process, but it is also a very rewarding one. By following these tips, you can increase your chances of success.

Here are some additional things to keep in mind when purchasing real estate,

- Location -The location of the property is one of the most important factors to consider when purchasing real estate. Think about your lifestyle and what is important to you. Do you want to live in a city, suburb, or rural area? Do you want to be close to work, schools, or shopping?

- Condition of the property -It is important to get the property inspected by a qualified inspector before you purchase it. This will help you to identify any potential problems with the property.

- Cost of ownership -In addition to the purchase price, there are other costs associated with owning real estate, such as property taxes, insurance, and maintenance. Be sure to factor these costs into your budget when you are making your decision.

- Financing -There are a number of different ways to finance the purchase of real estate. The best option for you will depend on your individual circumstances. Be sure to speak with a financial advisor to discuss your options.

Purchasing real estate can be a great way to invest in your future. By following these tips, you can increase your chances of success.

13. Transform Your Vehicle Into An Advertising Canvas

There are two main ways to turn your car into a billboard,

- Car wrapping -Car wrapping is a process of applying a vinyl film to the exterior of your car. The film can be customized with any design or image you want. Car wrapping is a relatively inexpensive way to turn your car into a billboard, and it is also easy to remove if you change your mind.

- Digital ,ar signs -Digital car signs are electronic displays that can be attached to the exterior of your car. Digital car signs can be used to display a variety of content, including text, images, and videos. Digital car signs are more expensive than car wrapping, but they also offer more flexibility and the ability to change your ad content on the fly.

If you are considering turning your car into a billboard, there are a few things to keep in mind,

- Choose the right type of advertising -Not all types of advertising are suitable for car wrapping or digital car signs. For example, you would not want to wrap your car in an ad for a product or service that is not relevant to your target market.

- Design your ad carefully -Your ad should be eye-catching and easy to read. It should also be clear and concise.

- Obey the law -There are laws governing the size and placement of car wrapping and digital car signs. Be sure to research the laws in your area before you start advertising.

If you are willing to invest the time and money, turning your car into a billboard can be a great way to earn extra income. By following these tips, you can increase your chances of success.

Here are some additional tips for turning your car into a billboard,

- Target your audience -Think about who you want to see your ad. Are you targeting commuters, shoppers, or tourists? Once you know your target audience, you can choose the right places to drive your car and design your ad accordingly.

- Be creative -Your ad should stand out from the crowd. Use bright colors and bold fonts to grab attention. You can also use humor or eye-catching images to make your ad more memorable.

- Keep it clean -Your car should be clean and well-maintained. A dirty or damaged car will reflect poorly on your business.

- Be professional -If you are using your car for business purposes, it is important to maintain a professional appearance. This means dressing appropriately and driving safely.

Turning your car into a billboard can be a great way to earn extra income and promote your business. By following these tips, you can increase your chances of success.

14. Start Your Adventure As A Rideshare Driver

To become a rideshare driver, you will need to meet the following requirements,

- Be at least 21 years old

- Have a valid driver's license

- Have a clean driving record

- Pass a background check

- Own a car that meets the rideshare company's requirements

Once you have met the requirements, you can sign up to be a driver on the rideshare company's website or app. You will need to provide your personal information, driving record, and car information. You will also need to complete a training program on how to use the rideshare company's app and how to provide safe and reliable rides to passengers.

Once you have been approved as a driver, you can start driving for the rideshare company. You can choose to drive full-time or part-time. You can also choose to drive whenever you want or to set a schedule.

Here are some tips for being a successful rideshare driver,

- Be polite and professional.

- Drive safely and obey the law.

- Keep your car clean and well-maintained.

- Offer good customer service.

- Be familiar with the area in which you are driving.

- Be prepared to deal with difficult passengers.

Ridesharing can be a great way to earn extra income or to make a full-time living. However, it is important to remember that ridesharing is a business. You will need to be professional and reliable in order to be successful.

Here are some additional tips for becoming a rideshare driver,

- Choose the right rideshare company -There are a number of different rideshare companies to choose from. Do some research to find a company that offers the best rates and benefits for drivers in your area.

- Get to know the area you drive in -Learn the best routes to take and the areas to avoid. This will help you to get your passengers to their destinations quickly and efficiently.

- Be available during peak driving times -Peak driving times are typically weekday mornings and evenings and weekends. If you are available during these times, you will be more likely to get rides.

- Promote yourself -Let your friends, family, and coworkers know that you are a rideshare driver. You can also promote yourself on social media.

Becoming a rideshare driver can be a great way to earn extra income or to make a full-time living. By following these tips, you can increase your chances of success.

15. Delegate Your Business Operations

Outsourcing your business is the process of hiring a third-party company or individual to perform tasks or services that were traditionally performed in-house by your own employees. Outsourcing can be done for a variety of reasons, such as to save money, improve efficiency, or gain access to specialized expertise.

There are a number of different ways to outsource your business. Some common tasks and services that are outsourced include,

- Customer service

- IT support

- Accounting and bookkeeping

- Human resources

- Marketing and sales

- Manufacturing and logistics

- Research and development

When deciding whether or not to outsource a particular task or service, it is important to consider the following factors,

- The cost of outsourcing the task or service

- The quality of the work that can be expected from the third-party provider

- The level of control you will have over the work

- The impact on your employees and workplace culture

If you decide to outsource a task or service, it is important to choose a third-party provider carefully. Be sure to research the provider's reputation and experience. You should also make sure that the provider has a good understanding of your business needs and that they are able to meet your expectations.

Here are some tips for outsourcing your business successfully,

- Choose the right tasks or services to outsource -Not all tasks or services are well-suited for outsourcing. Choose tasks that are repetitive, time-consuming, or require specialized expertise.

- Do your research -Before you hire a third-party provider, be sure to research their reputation and experience. You should also make sure that the provider has a good understanding of your business needs and that they are able to meet your expectations.

- Set clear expectations -Once you have chosen a third-party provider, be sure to set clear expectations in terms of the work that needs to be done, the timeline, and the budget.

- Communicate regularly -Once you have outsourced a task or service, it is important to communicate regularly with the third-party provider. This will help to ensure that the work is being done on track and to your satisfaction.

- Monitor the results -It is important to monitor the results of outsourced work to ensure that the third-party provider is meeting your expectations. If you are not satisfied with the results, you may need to make adjustments to the contract or find a new provider.

Outsourcing can be a great way to save money, improve efficiency, and gain access to specialized expertise. However, it is important to choose the right tasks or services to outsource, do your research, set clear expectations, communicate regularly, and monitor the results. By following these tips, you can increase your chances of success when outsourcing your business.

16. Allocate Capital To Dividend-Yielding Stocks

Investing in dividend-paying stocks is a strategy of buying shares of companies that pay out a portion of their profits to shareholders on a regular basis. Dividends can be paid out monthly, quarterly, or annually, and they can be a significant source of income for investors.

There are a number of benefits to investing in dividend-paying stocks. First, dividends can provide a steady stream of income for investors. This can be especially beneficial for retirees or other investors who need a reliable source of income. Second, dividend-paying stocks tend to be more stable than growth stocks. This is because dividend-paying companies are typically more mature and established, and they have a proven track record of profitability. Third, dividend-paying stocks can help to reduce portfolio volatility. This is because dividends can offset losses in other parts of the portfolio during market downturns.

When choosing dividend-paying stocks to invest in, it is important to consider the following factors,

- Dividend yield -The dividend yield is the percentage of a stock's price that is paid out in dividends each year. A higher dividend yield means that you will receive more income from your investment. However, it is important to note that dividend yield is not the only factor to consider when choosing dividend-paying stocks.

- Dividend growth -The dividend growth rate is the percentage by which a company's dividend has increased over time. A higher dividend growth rate means that you will receive more income from your investment in the future.

- Financial strength -It is important to invest in dividend-paying companies that are financially strong and have a good track record of profitability. This is because companies that are struggling financially may be forced to cut or eliminate their dividends in the future.

Here are some tips for investing in dividend-paying stocks,

- Invest for the long term -Dividend investing is a long-term strategy. You should not expect to get rich quick by investing in dividend-paying stocks. Instead, you should focus on building a portfolio of dividend-paying stocks that will provide you with a steady stream of income over time.

- Reinvest your dividends -One of the best ways to grow your dividend income over time is to reinvest your dividends. When you reinvest your dividends, you are buying more shares of stock with the dividend money you receive. This increases the number of shares you own and, therefore, the amount of dividend income you will receive in the future.

- Diversify your portfoli -It is important to diversify your portfolio by investing in a variety of dividend-paying stocks. This will help to reduce your risk and maximize your returns.

Investing in dividend-paying stocks can be a great way to generate income and build wealth over time. However, it is important to do your research and invest for the long term. By following these tips, you can increase your chances of success.

17. Commence A Blog

To start a blog, you will need to,

- Choose a blogging platform -There are many different blogging platforms available, such as WordPress, Blogger, and Wix. Choose a platform that is easy to use and that offers the features that you need.

- Choose a domain name -Your domain name is the address of your blog on the internet. It is important to choose a domain name that is relevant to your blog and that is easy to remember.

- Get web hosting -Web hosting is a service that stores your blog's files and makes them accessible to visitors. There are many different web hosting providers available, so be sure to compare prices and features before you choose one.

- Install WordPress -If you are using WordPress, you will need to install it on your web hosting account. This is a relatively simple process, but there are many tutorials available online if you need help.

- Choose a theme and plugins -A theme will control the look and feel of your blog. Plugins are add-ons that can add new features to your blog. There are many free and premium themes and plugins available.

- Start writing! -Once you have your blog set up, you can start writing posts. Be sure to write about topics that you are passionate about and that your target audience will find interesting.

- Promote your blog -Once you have published some posts, you need to start promoting your blog so that people can find it. You can promote your blog on social media, in forums, and through other websites.

Here are some tips for starting a successful blog,

- Choose a niche -What are you passionate about? What do you know a lot about? Choose a niche for your blog that you can write about with authority and enthusiasm.

- Write high-quality content -Your blog posts should be well-written and informative. Be sure to proofread your posts before you publish them.

- Publish regularly -Try to publish new blog posts on a regular basis. This could be daily, weekly, or biweekly.

- Promote your blog -Share your blog posts on social media, in forums, and through other websites. You can also reach out to other bloggers in your niche and ask them to share your posts.

- Be patient -It takes time to build a successful blog. Don't get discouraged if you don't see results immediately. Just keep writing great content and promoting your blog, and you will eventually start to see traffic and growth.

Starting a blog can be a great way to share your thoughts and ideas with the world, and it can also be a profitable way to make money online. By following these tips, you can increase your chances of success.

18. Compose An E-Book

To write an e-book, you will need to,

- Choose a topic -What do you want to write about? What are you passionate about? What do you know a lot about? Choose a topic that you can write about with authority and enthusiasm.

- Do your research -Once you have chosen a topic, you need to do your research. This will help you to gather information and develop your ideas.

- Create an outline -An outline will help you to organize your thoughts and ideas. It will also help you to stay on track as you write.

- Start writing! -Once you have an outline, you can start writing your e-book. Be sure to write in a clear and concise style.

- Edit and proofread your e-book -Once you have finished writing your e-book, be sure to edit and proofread it carefully. This will help to ensure that your e-book is free of errors.

- Format your e-book -Your e-book needs to be formatted in a way that is easy to read. This means choosing a readable font size and line spacing. You may also want to add images and other visuals to your e-book.

- Publish your e-book -Once your e-book is formatted, you can publish it. There are many different ways to publish an e-book, such as self-publishing on Amazon or selling your e-book on your own website.

Here are some tips for writing a successful e-book,

- Choose a topic that is in demand -There are millions of e-books available online, so it is important to choose a topic that people are interested in. You can use tools like Google Trends and Amazon Kindle Best Sellers to see what topics are trending and popular.

- Write high-quality content -Your e-book should be well-written and informative. Be sure to proofread your e-book carefully before you publish it.

- Design an attractive cover -Your e-book cover is the first thing that potential readers will see, so it is important to make a good impression. Choose a cover that is eye-catching and relevant to your e-book's content.

- Promote your e-book -Once your e-book is published, you need to promote it so that people can find it. Share your e-book on social media, in forums, and through other websites. You can also reach out to other bloggers in your niche and ask them to promote your e-book.

Writing an e-book can be a great way to share your knowledge and expertise with the world. It can also be a profitable way to make money online. By following these tips, you can increase your chances of success.

19. Monetize Your Gift Cards And Vouchers

There are a few different ways to sell your gift cards and certificates,

- Online marketplaces -There are a number of online marketplaces where you can sell your gift cards and certificates. Some popular marketplaces include Raise, CardCash, and GiftCardBin. These marketplaces typically charge a commission on each sale, but they can be a convenient way to sell your gift cards and get cash quickly.

- Buyback websites -Some buyback websites will purchase your gift cards and certificates for a discounted price. This can be a good option if you need to sell your gift cards quickly and don't mind getting a little less than the full value.

- Social media -You can also sell your gift cards and certificates on social media platforms like Facebook and Craigslist. Be sure to post clear photos of the gift cards and certificates, and include all of the relevant information, such as the merchant name, the amount on the card, and any expiration dates.

- Local businesses -Some local businesses, such as pawn shops and consignment stores, may also be willing to purchase your gift cards and certificates. Be sure to call around and compare prices before you sell.

Here are some tips for selling your gift cards and certificates,

- Sell them as soon as possible -Gift cards and certificates can lose value over time, so it is best to sell them as soon as possible.

- Be honest about the condition of the gift cards and certificates -If the gift cards or certificates are damaged or expired, be sure to disclose this to potential buyers.

- Be prepared to negotiate -Some buyers may be willing to negotiate the price of the gift cards and certificates. Be prepared to negotiate a fair price for both you and the buyer.

Selling your gift cards and certificates can be a great way to get some extra cash. By following these tips, you can increase your chances of getting a good price for your gift cards and certificates.

20. Explore Non-Traditional Investment Avenues

Alternative investments are any investments that fall outside of the traditional asset classes of stocks, bonds, and cash. They can include a wide range of assets, such as real estate, commodities, private equity, hedge funds, and collectibles.

Alternative investments can be a good way to diversify your portfolio and potentially generate higher returns than traditional investments. However, they are also generally riskier and less liquid than traditional investments.

Here are some things to consider when looking into alternative investments,

- Your investment goals -What are you hoping to achieve with your investments? Are you looking for income, growth, or both? Alternative investments can be used to achieve a variety of investment goals, but it is important to make sure that they are aligned with your overall investment strategy.

- Your risk tolerance -Alternative investments can be riskier than traditional investments. It is important to understand the risks involved before you invest in any alternative asset class.

- Your time horizon -Some alternative investments, such as private equity, are illiquid, meaning that they can be difficult to sell quickly. It is important to make sure that you have a long-term investment horizon before you invest in any illiquid asset class.

If you are considering investing in alternative investments, it is important to do your research and understand the risks involved. You may also want to consider working with a financial advisor who specializes in alternative investments.

Here are some examples of alternative investments,

- Real estate -Real estate can be a good way to generate income and capital appreciation. However, it is important to note that real estate is a illiquid asset class and can be expensive and time-consuming to manage.

- Commodities -Commodities are raw materials that are used to produce other goods. Examples of commodities include oil, gold, and soybeans. Commodities can be a volatile asset class, but they can also provide a hedge against inflation.

- Private equity -Private equity is a type of investment that involves investing in non-publicly traded companies. Private equity investments can be complex and illiquid, but they can also generate high returns.

- Hedge funds -Hedge funds are investment funds that use a variety of strategies to generate returns. Hedge funds can be complex and risky, but they can also generate high returns.

- Collectibles -Collectibles are items that are valued for their rarity or cultural significance. Examples of collectibles include art, antiques, and rare coins. Collectibles can be a volatile asset class, but they can also generate high returns over the long term.

Alternative investments can be a good way to diversify your portfolio and potentially generate higher returns than traditional investments. However, it is important to understand the risks involved before you invest in any alternative asset class.

20 Ways To Make Money FAQs

How Can I Invest And Make Money Daily?

Your money can make money to provide daily income from investments. Bank accounts, certificates of deposit, stocks, bonds, ETFs and real estate all offer opportunities to earn income without actively having to work for it. Each investment alternative offers a different mix of safety, liquidity and income potential.

How To Earn Money From Google?

Google AdSense provides a way for publishers to earn money from their online content. AdSense works by matching ads to your site based on your content and visitors. The ads are created and paid for by advertisers who want to promote their products.

What Is Active Income?

Active income is income received from a job or business venture that you actively participated in. Examples of active income include wages, salaries, bonuses, commissions, tips, and net earnings from self-employment.

Conclusion

There are 20 ways to make money without a traditional job. Some of these methods are more passive, while others require more active participation. Some of these methods are also more scalable than others.

There are many different ways to make money online. You can start a blog, write an e-book, or sell your own products and services. You can also work as a freelancer or virtual assistant.

You can also make money by investing in yourself or your assets. For example, you can rent out your spare room on Airbnb or teach online courses. You can also invest in real estate or alternative investments.

It is important to choose a method that aligns with your skills, interests, and time constraints. Some methods are more passive and require less time, while others require more time and effort.

It is also important to be realistic about your expectations. It takes time and effort to build a successful business or side hustle. Don't expect to get rich quick.

If you are looking for ways to make money without a traditional job, there are many options available to you. Do your research, choose a method that is right for you, and be patient and persistent.

Jump to

1. Conduct Extensive Market Surveys

2. Lease A Vacant Room

3. Allocate Capital Into A Business

4. Opt For Credit Cards Offering Substantial Cashback

5. Craft An Investment Portfolio

6. Facilitating Peer-to-Peer Lending

7. Set Aside Your Excess “change”

8. Secure A Lottery Victory

9. Initiate A Small Business To Capitalize Your Hobbies

10. Seek Out Unclaimed Funds

11. Verify Your Eligibility For Any Benefits

12. Acquire Real Estate

13. Transform Your Vehicle Into An Advertising Canvas

14. Start Your Adventure As A Rideshare Driver

15. Delegate Your Business Operations

16. Allocate Capital To Dividend-Yielding Stocks

17. Commence A Blog

18. Compose An E-Book

19. Monetize Your Gift Cards And Vouchers

20. Explore Non-Traditional Investment Avenues

20 Ways To Make Money FAQs

Conclusion

Gordon Dickerson

Author

Habiba Ashton

Reviewer

Latest Articles

Popular Articles