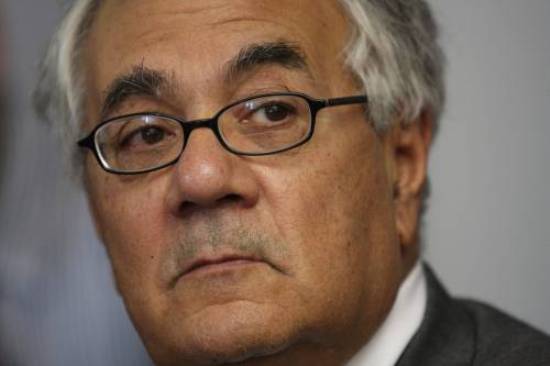

Barney Frank’s Crusade

The House Financial Services Committee chairman applauds recent moves by Freddie Mac, Fannie Mae and banks to modify mortgages and keep borrowers in their homes. But companies that service loans aren’t doing enough, he says, and that needs to change.

Jul 31, 20201.2K Shares647.9K Views

Barney Frank, chairman of the House Finance Committee. (WDCpix)

Mortgage servicers have not done enough to help struggling homeowners avoid foreclosure, a leading Democrat said Wednesday, and Congress must now step in with new legislation to help them salvage their troubled loans.

“We have not seen servicers participating in any significant way,” Rep. Barney Frank (D-Mass.), chairman of the House Financial Services Committee, said during a panel hearing on the foreclosure crisis. “I believe we now have a situation that requires legislation.”

Frank’s call comes on the heels of news that some of the nation’s largest mortgage lenders — including Fannie Mae, Freddie Mac and several large banks — are streamlining programs to modify loans to strapped borrowers.

Illustration by: Matt Mahurin

Frank applauded these institutions for their “constructive steps.” But the powerful lawmaker did not similarly compliment servicers, companies that buy from lenders the rights to manage mortgages. The result has been that more folks are losing their homes.

“We are getting some progress where the legal authority to modify is clear,” Frank said. “We have not had that where there are servicers.”

The congressman’s comments come as Washington’s economic bailout strategy shifts from Wall Street to Main Street. Experts have long contended that the sinking housing market — and skyrocketing foreclosures — are at the core of the financial turmoil. Still, even as lawmakers have pumped more than $1 trillion into the nation’s financial institutions and insurance companies, they have largely ignored struggling homeowners and consumers. That approach, policy-makers are beginning to acknowledge, treats only the symptoms.

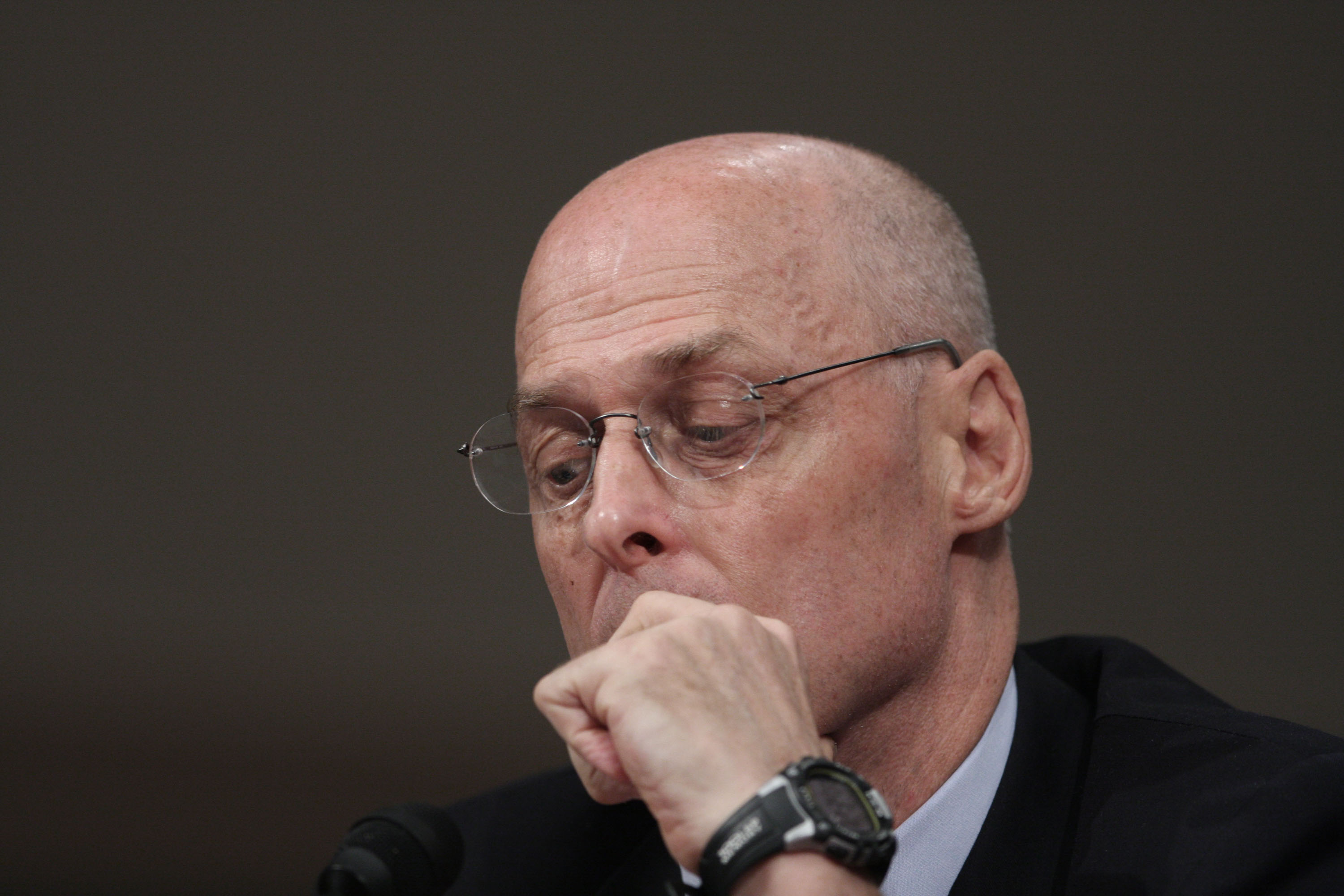

Treasury Sec. Henry M. Paulson Jr. revealed Wednesdaythat the remaining half of the $700 billion allocated for the bailout of the financial system would be spent largely on easing consumer credit markets. The move would make it easier for consumers to finance car purchases, get student loans and obtain credit cards, he said.

“This market is currently in distress,” Paulson said. “Costs of funding have skyrocketed, and new issue activity has come to a halt.”

The first $250 billion of the bailout went to recapitalize financial institutions. In exchange, the government took equity stakes. The idea was to bolster their balance sheets, which have been pummeled by big investments in toxic mortgage-backed securities. But with thousands of Americans continuing to lose their homes to foreclosure, many lawmakers and housing advocates say the trickle-down strategy of helping homeowners by funding banks has not worked.

Testifying before Frank’s panel Wednesday, finance-industry representatives emphasized that servicers are beholden to investors, not homeowners. That argument didn’t sit well with the financial services chairman. “The servicers have the power to [modify loans],” Frank said, “but we get every indication, anecdotally and statistically, that it is not being done.”

“Servicers do have the legal authority, right and responsibility to modify loans,” said Thomas Deutsch, deputy executive director of the American Securitization Forum, a trade group. But those decisions “must also be in line with the contractual rights and commercial expectations of institutional investors, such as pension funds and mutual funds.”

Michael Gross, managing director of Bank of America’s loan administration loss mitigation, agreed. “Servicers are contractually obligated to choose the home-retention or loss-mitigation option which provides the best return to the investor,” Gross said. “That is a contractual obligation.”

Writing in The New York Times yesterday, the business analyst Joe Nocera summarizedthis tension between loan owners, servicers and borrowers:

“„The situation borders on the absurd. Investors will not allow mortgage modifications that would hurt them more than some other investors — thereby insuring that everyone gets hurt even more as foreclosures continue. And as foreclosures continue, the financial crisis continues to deepen because foreclosures on Main Street mean billion-dollar write-offs on Wall Street. And struggling homeowners can only pray that their mortgage is still held by the bank and not sold to Wall Street — in which case they are out of luck. It is like flipping a coin to see if you can hold onto your home.

Faced with this reality, Frank said Congress has to intervene to help people stay in their homes. The “appropriate” role of the federal government, Frank said, is “to induce those who hold the loans to recognize that they are holding loans that are not going to be repaid in full, to calculate that in many cases this would be a worse economic problem if they foreclosed, and to write down the terms of the loan, either by interest or principal or some combination, to a point where that borrower could repay.”

Treasury Secretary Henry Paulson (WDCpix)

His suggestion raised immediate concerns among panel Republicans, who are wary of more government intrusion into private markets. “I am all for encouraging the parties to work together, if they’re willing,” said Alabama Rep. Spencer Bachus, the highest-ranking Republican on the Financial Services Committee. “[But] I’m very hesitant to try to force the parties to an agreement.”

Several programs to modify troubled mortgages are already up and running. The Hope for Homeowners initiative, for example, which launched Oct. 1, puts qualified borrowers into new, 30-year fixed-rate mortgages. But for lenders, it’s a voluntary program — and not a popular one. According to Rep. Steven LaTourette (R-Ohio), only 42 loans have been submitted under the program for modification, and none have been accepted. “All I can say is, what a mess this is,” LaTourette said.

Meanwhile, foreclosure filings for the third quarter topped 765,000, up 71 percent from a year ago, according to RealtyTrac, an online foreclosure database. The situation is likely to worsen. As TWI’s Mary Kane pointed out last week, the subprime crisis is just three-quarters through, and defaults on Alt-A, or “liar”, loans won’t hit a peak until next year.

Yesterday, Freddie Mac, Fannie Mae and other major lenders announced that they will begin streamlining their loan modification processes for borrowers who are either in foreclosure or at least 90 days late on their mortgage payments.

Some lawmakers cheered the announcement. Yet there remains the fear that even those programs could fall short of addressing the immensity of the problem. Rep. Carolyn Maloney (D-N.Y.) called the Freddie and Fannie effort “timid and tiny,” saying it will help only a fraction of homeowners in need.

“We need to be thinking in an order of a magnitude that is much bigger,” Maloney said. “Not hundreds of thousands, but millions.”

Hajra Shannon

Reviewer

Latest Articles

Popular Articles