Wells Fargo Coms - Manage Your Inventory And Make Payments Through A Secure Online Banking System

Wells Fargo coms, which was founded in 1852 during the California gold rush, has played a key role in American banking for 170 years and is the country's fourth-largest bank.

Author:Stefano MclaughlinReviewer:Luqman JacksonJun 22, 2022142 Shares1.8K Views

Wells Fargo coms, which was founded in 1852 during the California gold rush, has played a key role in American banking for 170 years and is the country's fourth-largest bank. After a series of high-profile scandals in the mid-2010s, the bank has been focused on customer service and technology advancements to rehabilitate its image and restore confidence.

Wells Fargo Coms Online

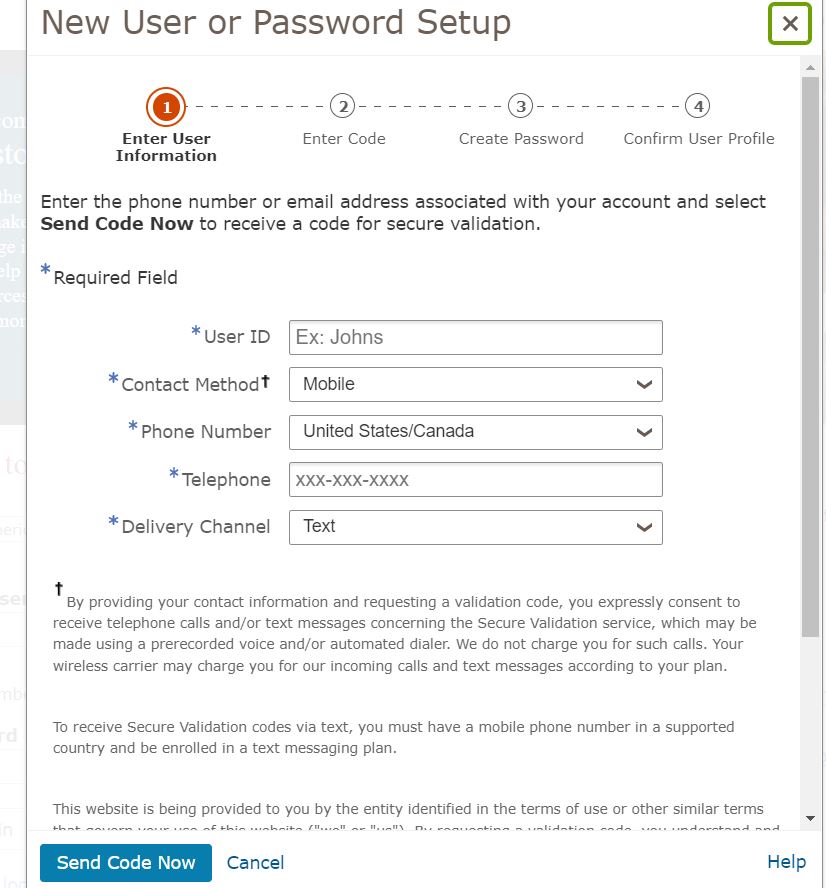

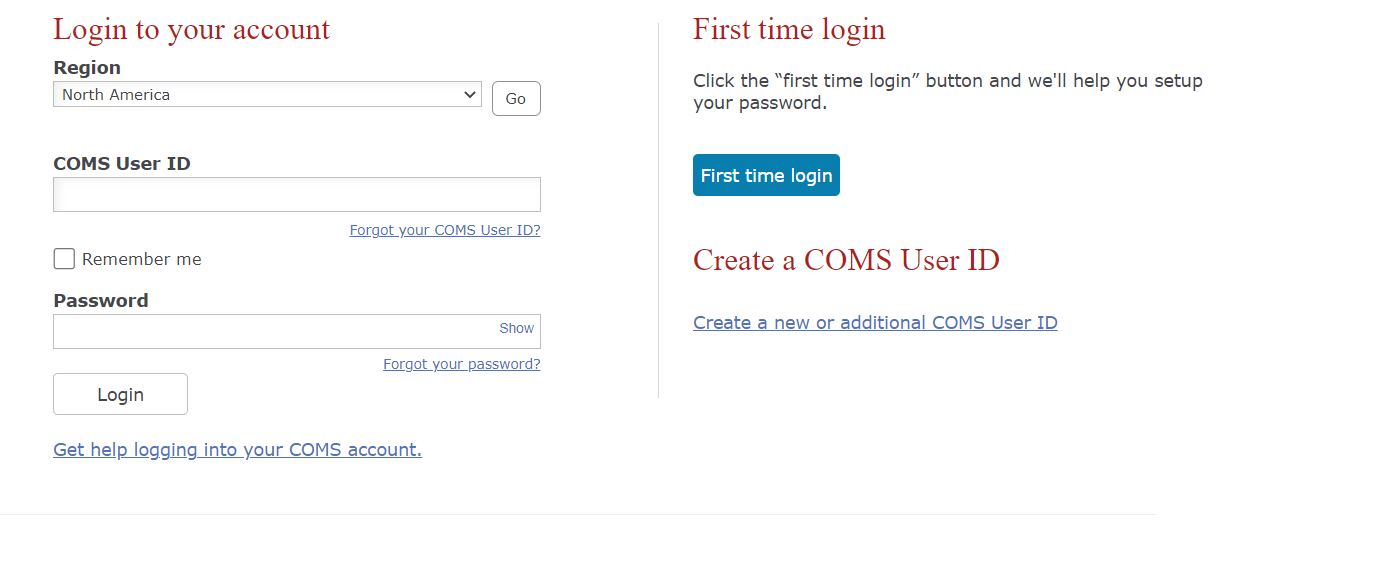

You may use our secure online banking system to make payments, manage inventory, and analyze extensive analytics and reports to assist lead company development using the Customer Online Management System (COMS). Access information on how to manage inventories more effectively using real-time monitoring tools via COMS as well.

Wells Fargo Coms Scandal

Wells Fargo was forced to pay billions in fines imposed by the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, and the Securities and Exchange Commission after it was revealed that employees had engaged in illegal practices for years, resulting in extra charges for customers and the opening of fake accounts, as well as improperly repossessed homes and autos.

Wells Fargo Coms Login Problems

Use our official link to access the Ge Capital Coms Portal official login page. It will open in a new window when you click the link. You can read the tutorial and, if necessary, follow the troubleshooting steps there. Simply enter your username and password.

These must have been supplied to you by Ge Capital Coms Portal, either when you signed up or by your Ge Capital Coms Portal authority. You should now get a notification that says "successfully logged in." Congratulations, you have successfully signed in to the Ge Capital Coms Portal. If you are unable to access the Ge Capital Coms Portal website, please refer to our troubleshooting instructions, which may be found here.

Wells Fargo Com Saving Account

It only costs $25 to open the Wells Fargo Way2Save Savings Account, but there is also a $5 monthly service charge. If you keep your balance of at least $300 a day or set up recurring transfers from other Wells Fargo bank accounts, the service charge can be waived. In addition, for account holders under the age of 24, Wells Fargo doesn't charge them a fee each month.

The Save As You Go transfer, which transfers $1 from your Wells Fargo checking account to your Way2Save account with each qualified transaction, is another savings incentive. Any non-recurring debit card purchases, as well as any bill payments made using the Wells Fargo online bill pay service, are included in these transactions. According to Wells Fargo, customers with checking accounts may now use their Way2Save account as overdraft protection.

Wells Fargo will move money from your Way2Save account into your checking account to cover an overdraft if you sign up for this optional service. However, you will still be charged a $12.50 overdraft fee once every business day if you use this service. If a cover transfer or deposit is made on the same business day, the charge is waived. The current APY for Way2Save accounts is 0.01 percent, with no minimum amount necessary to earn it. The Platinum Savings account from Wells Fargo allows you to make checks. They also don't limit the number of withdrawals you may make from your account each month.

Conclusion

Customers who desire a well-established conventional bank with a broad geographic reach will like Wells Fargo Coms. It will be ideal for those who:

- Want to manage your accounting and financial affairs using Mint, QuickBooks Online, or TurboTax Online?

- To save money, they may only keep a certain amount in their checking and savings accounts.

- You'll need a bank with branches across the United States, including the District of Columbia.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles