Real Estate Investment in Portugal

The real estate industry has so much to offer to long-term investors. Because it is one of the more stable investments on the market, many people are putting their money into real estate rather than another investments and aside from stability, high rates of return are also favorable to property investors.

Author:Luqman JacksonReviewer:Liam EvansMay 25, 202137.4K Shares585.3K Views

- It’s good to invest in real estate in Portugal,

- Some of the top places where you can invest are Lisbon, Porto, Algarve, and Cascais.

- Rental yields depend on many factors such as the type of the property you are renting out and the location of your property.

- There are taxes involved when you invest in real estate such as property taxes, tax on rentals, property purchase tax, and capital gains tax.

- Your profit from renting out your property can be as high as 7% yearly.

- Lisbon right now is the most expensive city where people can rent compared to other cities in Europe like Paris and Amsterdam.

The real estate industry has so much to offer to long-term investors. Because it is one of the more stable investments on the market, many people are putting their money into real estate rather than another investments and aside from stability, high rates of return are also favorable to property investors. Imagine your commercial or residential property increasing in value in just a year. What more if you own land that doesn’t depreciate?

If you are in Portugal and you’re thinking about getting your property investment, there are factors to consider, such as the location, pros and cons, fees, costs, net profit, and so on. If you want to know more about these things to make sure you are spending your money wisely while you are in Portugal, let’s continue.

Where Should You Invest

Purchasing real estate located in Portugal is one of the best investments you will make right now. It has progressed in advancement over time. Portugal is even regarded as one of the best countries in the world to retire.

Property prices in Portugal are now at a point where they are suitable for investment.

However, there are a few places where you may want to consider investing your money. The property market in Portugal is well-established. The ability to purchase real estate is not restricted, and the majority of property and land is sold freehold.

The property registry system in the country is organized and extremely reliable. Land, property ownership, as well as the right to use and use one's own land are all protected by the constitution.

In case you want to know where you can invest in Portugal, here are a few places.

Investing In Lisbon

The majority of people who are considering purchasing an estate in Portugal depend on Lisbon as their first option. Because it is the country's most well-known and famous city.

However, further investigation reveals that this is not the most cost-effective alternative.

All is determined by cost and return on capital. The prime market in Lisbon is now selling for about 10,000 euros per square meter. They are quite similar to similar markets such as Madrid and Barcelona, suggesting that they are approaching a valuation ceiling.

Lisbon also offers the best prospects for entrepreneurs, with the highest and most qualified customer market. However, the life quality here is excellent, as is the wonderful atmosphere.

Lisbon has all of the amenities that you'd expect from a world-class, well-developed community. This is why it is one of the top locations in Portugal to invest in real estate.

Pros Of Investing In Lisbon

Lisbon's public transportation system is outstanding. Throughout the district, there is a metro system, funiculars, city buses, and ferries. As a result, you will have no trouble getting around the district.

Lisbon's cultural scene is vibrant and diverse. As a European capital, the area offers a wide range of concerts, theater, art museums, music festivals, and just about every other type of cultural activity you might imagine.

There are also numerous fine dining establishments in the area. There are numerous bars, cafes, and pubs in Lisbon. All is within walking distance, whether by bus, vehicle, or foot. There is a wide range of neighbourhoods to choose from. Each has its own distinct personality and charm. There is a wide range of home types and prices to fit all tastes in Lisbon.

So, is it simple to sell a house in this city? Certainly! Since it is such a large city, buying and selling property would not be difficult.

Cons Of Investing In Lisbon

Lisbon has a large population, and robberies and thefts are common. As a result, you'll have to take security precautions to safeguard your house.

Investing In Porto

Porto's rates are also inviting, with room for appreciation, from about 2,500 to 5,000 euros per SQM. Investors here expect to earn 12 to 14 euros a year on average from the regular prices sold in Porto for every 100 euro spent on a tourist house.

In Porto, an investment of 100,000 euros would yield 260,000 euros in 20 years. The yield (gross gain on invested capital) for 20 years would be 260 percent.

Porto's visitor numbers have almost increased since the introduction of low-cost airlines.

Over 11 million passengers have now passed through the airport's new and modern terminal.It is a major city with a heavy industrial and agricultural base, with a population of 1.7 million people in the metropolitan area.

It's no surprise that Porto is among the safest areas in Portugal to invest in real estate.

Liquidity is increasing. This ensures you'll have a simpler time finding a decent home than if you were purchased in Lisbon. Furthermore, Porto is much superior for those seeking expense and labor advantages.

Pros Of Investing In Porto

Porto has a large and varied transportation network. Even though the area is tiny and can be explored on foot, a bus or a nearby taxi can be quickly obtained.

Also, Porto offers a diverse range of activities. The Clerigos Tower, the Crystal Palace Gardens, and the Serra do Pilar are all worth seeing.

Houses are also simple to sell. It just depends on how much you're willing to pay.

Cons Of Investing In Porto

Since the real estate market in Porto isn't as active as it is in Lisbon, you'll have to work harder to sell your home next time you decide to move.

Investing In The Algarve

The Algarve is a renowned vacation rental destination throughout the summer. Both municipalities offer a variety of choices. Long-term rentals account for a substantial portion of the overall housing industry, as well as residential home and villa rentals.

After a bad summer season, these owners sometimes put their assets on sale as a last resort and stay competitive with long-stay hotel accommodations, and include a variety of guest options not found in a private property. Private renting is a cost-effective and versatile way to give yourself time to make long-term choices.

The majority of rental assets, however, are summer rentals, and large property websites such as Homeaway, Holiday Lettings, and Rightmove Overseas appear to be the most popular rental sites. In order to compensate for the lack of summer rentals, property owners inflate costs while advertising assets as winter rentals.

In general, the weekly rental prices of properties infamous tourist areas in the winter are close to those in the summer.

Pros Of Investing In The Algarve

One of the pros is the city’s system of transportation. Public transit is the main means of transportation in the Algarve. Every 30 minutes, buses run around the city.

The Ponta de Piedade, the Praia da Falesia, and Cape St. Vincent are only a few of the great locations to explore. With this, tourism is surely one of the advantages of investing in the Algarve.

Cons Of Investing In The Algarve

It's better to speak with the real estate agent and there are stringent rules on who may purchase homes. Also, there isn't a lot of demand for real estate in this town. Should you wish to sell your property soon, you will have to wait and be patient in selling.

Investing In Cascais

Cascais is a town in Portugal's Lisbon District. In 2011, the population had risen to just over 200,000, and the area is a famous tourism destination. People who would like a beautiful view of the coast should consider living by the marina.

However, you should be aware that when you move closer to the city center or the marina, property prices begin to increase. The municipality is perceived to be one of Portugal's richest.

As a result, the property prices that you may be quoted may be among the highest in the world.

Cascais is among the top locations to purchase property in Portugal if you're searching for a high-end home. It is critical that you determine if investing in real estate in Cascais is a good investment. Many people purchase real estate because they intend to move there, whilst some do it to secure their investment. So, if you really can sustain it, you can be certain that the property value in Cascais can only increase.

Pros Of Investing In Cascais

There are many things to do and sites to see in Cascais, like the Museu Condes de Castro, the Praia da Rainha, and, of course, the Old Town.

Since Cascais is so close to Lisbon, it won't be hard for someone like you to sell your home.

The Disadvantages Of Investing In Cascais

Local cabs and buses are the only modes of transportation accessible. This is the only disadvantage of investing in Cascais. The transportation is limited.

How Much Is The Rental Yield

Lisbon and Porto receive the majority of the property investment flowing into Portugal via the Golden Visa. Cities such as Braga and the suburbs of Lisbon, on the other hand, have rather appealing commercial and industrial real estate properties. The Algarve, with its Atlantic beaches and golf courses, is one of Portugal's most famous holiday destinations. With this info, you may be wondering about the rental yields in these places on average.

Rental yields in Lisbon, Portugal, vary from 4.5 percent to 6.7 percent, with smaller apartments yielding the highest percentages. Apartments in smaller cities such as Cascais and Oeiras should predict yields of about 6.7% and 6.15%, both. In recent years, property owners in Northern Portugal have been particularly interested in renting out their assets in the short-term rental sector. It enables the tenor to benefit from higher rental rates as well as more versatility.

What About Taxes

There are two major real estate taxes that you have to be reminded of: property taxes and rental taxes.

Property Taxes

If you buy land in Portugal but are not a Portuguese citizen, you may have to pay certain taxes.

If you don't spend 183 days or more a tax calendar year in Portugal, or if your main address is not there, you are found to be not residing in Portugal.

As a non-resident in Portugal, you are levied on the wages earned in Portugal, and married couples are taxed jointly. When you buy a home in Portugal, you will be entitled to the following taxes:

Tax On Rentals

If you plan to rent out the house once you've bought it, you'll have to pay taxes on the rental revenue. Net rental revenue is charged at a fixed rate of 15%, deferred at the point of sale. The taxable revenue is determined by subtracting the gross rent from all operating charges, associated expenditures such as health premiums and local levy, and any repair bills that might have occurred. You are unable to subtract any interest expenses accrued when you purchased the home.

Property Taxes

You would be required to pay property tax if you own property in Portugal (Immovable Property Tax, IMI). Each municipality sets its own fee, which is set by the local assembly. The IMI Tax is payable by the person or corporation that possesses the building on the last day of the tax year.

Property Purchase Tax

IMT is a land sales tax that is determined based on the latter of the deed valuation or the rateable value. The rate is subjective and is determined by the form of property and its valuation.

Capital Gains Tax

In Portugal, there is a levy on capital gains. When a non-resident puts a property for sale in Portugal, they are subject to a flat tax of 25%. If the proceeds from a transaction are reinvested, capital gains tax would apply to just half of the total taxable profits. To figure out how much you owe in taxes, subtract the transaction price from the purchase price, all expenses accrued after the transition of land, plus any land maintenance costs accumulated within the last five years.

How Are Landlords Regulated

In Portugal, both landlords and tenants are regulated. They have obligations to each other once the contract between them starts. Here are the regulations for both parties.

Tenants Vs. Landlords Regulations

Both the owner and the occupant have responsibilities and privileges. It's critical to be mindful of these before signing a rental agreement.

Notice Period

For the following purposes, the landlord can issue a notice:

- The landlord requires the space for personal reasons.

- The landlord plans to carry out extensive renovation projects

A landlord can also end a tenancy agreement if:

- Leasing has not been charged.

- The homeowner uses or permits the usage of the property for a reason other than that which was settled upon with the landlord.

- The structure is being used for immoral and criminal activities.

- The layout of the property is significantly altered by the occupant.

- The occupant sublets or loans the house, in whole or in part, without the consent of the owner. The tenant pays an illegal rent from the sub-tenant.

- The room isn't being used.

The statute makes it easier for landlords to evict renters who haven't settled their rent for 3 months or over: The owner doesn't have to file a lawsuit and written contact with the occupant is adequate in the eyes of the law. The occupant then has 3 months to settle the rent or vacate the premises.

As for the tenant, without providing a justification, he may avoid the automatic renewal of the rental contract by giving notice. Here are the notices applicable in this case:

- If the agreement has been in effect for more than a year, the contract must be terminated 120 days prior to the scheduled termination date.

- If the arrangement has been in effect for up to 1 year, 60 days prior to the scheduled termination.

What To Be Careful About

The rule of subrogation is a major stumbling block for consumers from other countries.

This ties loans to the land more than the creditor, which means if you're not patient, you might wind up owing ten years' worth of back taxes, three years' worth of utility bills, as well as a large mortgage or debts secured on the property.

Risks Of Investing In Real Estate In Portugal

Aside from the law of subrogation, there are also risks involved when you invest in real estate in Portugal.

A potential issue with investing in Portugal-less so with modern or newer homes, but surprisingly common with rural houses-is ownership dispersion. Frequently, land is handed down through the generations, with cousins, aunts, and grandchildren both having minor stakes in the farm. Since Portugal has a strong emigration rate, it's possible that a cousin residing in Brazil, Bordeaux, or Basildon owns a portion of the property and may prevent the sale.

In terms of title deeds, rural land can be a bit of a headache. A property can be made up of a number of small plots, some of which are very small strips. Any properties may have never been leased or split.

It's quite possible that structures were erected with little institutional record. That could mean your pigsty needs to be demolished, which isn't so bad, but it might be devastating if it impacts the building itself or a structure you were hoping to convert.

There's one more minor legal issue when it comes to payments. If you pay your deposit in the UK, you will give it to a solicitor. In France, you'll pay an agent who has a notary. In Portugal, they do not provide financial assurances. If the entity goes out of business, you could lose your deposit.

The Cost Of Buying And The Fees Involved

Buying costs are a part of any property acquisition in Portugal. They differ depending on the property's price and, in certain cases, the form of construction.

Here is a breakdown of all expenses and what they include.

Transfer Tax (IMT) and Stamp Duty are taxes levied by the Portuguese government for all real estate purchases.

Lawyers' Fees: A lawyer will handle any of the legal questions that come about while buying a home in Portugal. They will protect your rights at all levels of the process, ensuring that all permits are in effect, contracts are ready to sign, and any legal concerns you might have are answered.

Notary Fees: The Notary is an official government agency that can provide you with official approved paperwork proving the ownership of the land.

Stamp Duty on Mortgages: This is an extra tax depending on the amount of loan you can carry out.

Fees for registration: The land register will document you as the legitimate property owner and provide formal documentation to the lawyers.

Overall, the cost of buying a property in Portugal can range from 2.40% to 10.80% of the total contract price.

How Much Net Profit Should You Expect? (Airbnb Model Business Vs. Complete Rental Vs. Room Rent)

The profit depends on how you use your property as a source of income. If you are going to rent out your property, then you have the option to rent it to different kinds of clients, such as tourists, students, and families.

Renting To Tourists (Airbnb Model Business)

Tourism now accounts for 10% of Portuguese GDP and is a significant source of income for the real estate industry, with sales up 70% since 2011. According to INE, the total occupancy of short-term rental (local accommodation) assets in the major tourist centers is 78 percent, with average daily prices of 127 euros in Lisbon and 105 euros in Porto.

The rent is paid by marketplaces (platforms) like Airbnb and Booking, which charge commissions ranging from 3% to 15%. The property maintenance may be fully outsourced to a team that can bill between 20% and 30% of sales for anything from setting rates to cleaning the sheets.

With this Airbnb business model or if you rent your property to tourists, you can earn as much as 7% of 200,000£ if this is your property acquisition cost and considering all the expenses on average.

Renting To Students (Room Rent)

Just 12% of the 113,813 students who study away from home in Portugal are served by government housing; the remainder must depend on a sector with insufficient new supply. The calculation is straightforward. And if all proposed private, visitor, and school buildings were solely targeted at students, that would still be insufficient. Last year, there were 3,000 new students in Porto alone, with a total of 2,200 units to be installed in the student sector.

If you rent your property to students, you can generate at least 6% of your total investment per year. This is based on all expenses on average with an initial investment of 200,000£. Surely, this can increase depending on how many properties you have and how many rooms you are going to rent out.

Residential Homes

Land maintenance is the cheapest of all, with a fee of 10% of sales in residential homes. The occupant is responsible for water, power, and petrol, leaving the payment of cable, IMI (similar to IPTU), condominium, insurance, and upkeep to the landlord. When people are exploited, the income tax is a single rate of 28 percent on revenues without any deductible expenditures.

That pretty much sums up how rented residential homes are run.As an owner, you don’t have to oversee the day-to-day events that are happening on your property since you are letting someone or a family take over it. Basically, you will only bear the taxes and other expenses like repairs and maintenance if included in your contract.

With residential homes, you are more likely to gain 3% if your initial investment is around 200,000£ and the other expenses are computed at an average.

City Vs. Countryside

Since Portugal offers affordable properties in general, there’s not much difference when you go to a city or the countryside. However, as a real estate investor, you should still aim to have your own property in the city as rents here are more in-demand. The majority of the country's universities and major tourist attractions are usually located in the city/.If you have your own real estate, for example, in Lisbon, you can generate more income from AirBnbs and room rents for students.

Meanwhile, the countryside is a good location for families. So, if you want to rent out a residential home, then properties in the countryside are a good option since most families who move to Portugal want a cheaper cost of living.

Comparisons With Other Cities

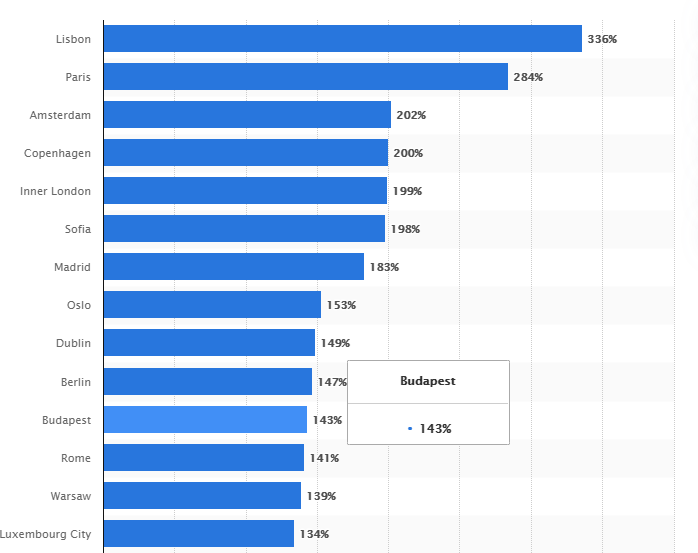

Based on Statistica, Lisbon is considered the most expensive city compared to other cities in Europe, like Paris, Amsterdam, and Copenhagen.

The graph above shows the percentage of real property prices in a given city. In 2019, rates in Lisbon were the most disproportionate to the state median of all European capital cities.

A new house located in Portugal's capital is roughly 330 percent more expensive than one outside the region. Paris, Amsterdam, and Copenhagen were the next cities on the list.

In Zagreb and Riga, the price deviations were the smallest.

Future Growth

The property sector in Portugal is still booming. However, as the COVID-19 disease outbreak has had a negative impact on the country's overall economy, the pace of house price rises is now slowing.

According to estimates published by the Instituto Nacional de Estatistica, residential property prices in Portugal grew 6.32 percent (6.56 percent in real terms) in the year to November 2020, to an average value of €1,144 (US $1,381) per sq meter (sq. m), a sharp slowdown from the previous year's 11.16 percent rise (INE).

Property values in Portugal began to rise in 2014 and have continued to rise since then.

In 2015, home prices increased by 4.5 percent, 4.8 percent in 2016, 4.6 percent in 2017, 6.1 percent in 2018, and 8.3 percent in 2019.

Due to the downturn in tourism activity, demand is projected to moderate over the next several years, though financial conditions may stay accommodative. As a result, the combination of a slowing in demand and increased supply would lead to a slowing in price development.

Jump to

Where Should You Invest

Investing In Lisbon

Investing In Porto

Investing In The Algarve

Investing In Cascais

How Much Is The Rental Yield

What About Taxes

How Are Landlords Regulated

What To Be Careful About

Risks Of Investing In Real Estate In Portugal

The Cost Of Buying And The Fees Involved

How Much Net Profit Should You Expect? (Airbnb Model Business Vs. Complete Rental Vs. Room Rent)

Renting To Tourists (Airbnb Model Business)

Renting To Students (Room Rent)

Residential Homes

City Vs. Countryside

Comparisons With Other Cities

Future Growth

Luqman Jackson

Author

Liam Evans

Reviewer

Latest Articles

Popular Articles