How Do Credit Card Companies Make Money - Build Credit And Save Money In Your Pocket

Do you know that credit cards are the products that have been sold the most aggressively in the history of the human race? The marketing of these cards requires tens of thousands of dollars to be spent.

Author:Luqman JacksonReviewer:Liam EvansAug 12, 2022157 Shares2.4K Views

It's common knowledge that corporations that issue credit cards make a lot of money.

But have you ever considered how do credit card companies make money?

Credit cards simplify the process of spending money, offer beneficial protection against fraud, and may even come with additional incentives, such as cashback or travel discounts.

Although it is possible to pile up debt with credit cards, some people choose not to pay the interest on their balances.

If you make responsible use of credit cards, you can reduce the amount of profit that is made by credit card companies from their customers.

What Is A Credit Card?

Credit Cards 101 (Credit Card Basics 1/3)

It's the money you borrow from your credit card company to buy things and pay your bills.

Since it's not your money, you have to give it back with interest in a certain amount of time.

You will be charged a late fee if you can't return this amount on time.

Why Do You Need A Credit Card?

Credit cards, sometimes known as charge cards, are a type of payment card that can be used to make purchases as well as pay bills.

If you find yourself in a financial bind or need anything right now, you can turn to this option.

You can also use them to take advantage of the incentives that credit card issuers provide for their customers who carry a balance on their cards.

You are able to perform any of the following with a credit card:

- Spend money on goods that are out of your price range.

- Pay your bills without deducting the amount from your bank account.

- Ensure the safety of your financial dealings conducted online.

How Do Credit Card Companies Work?

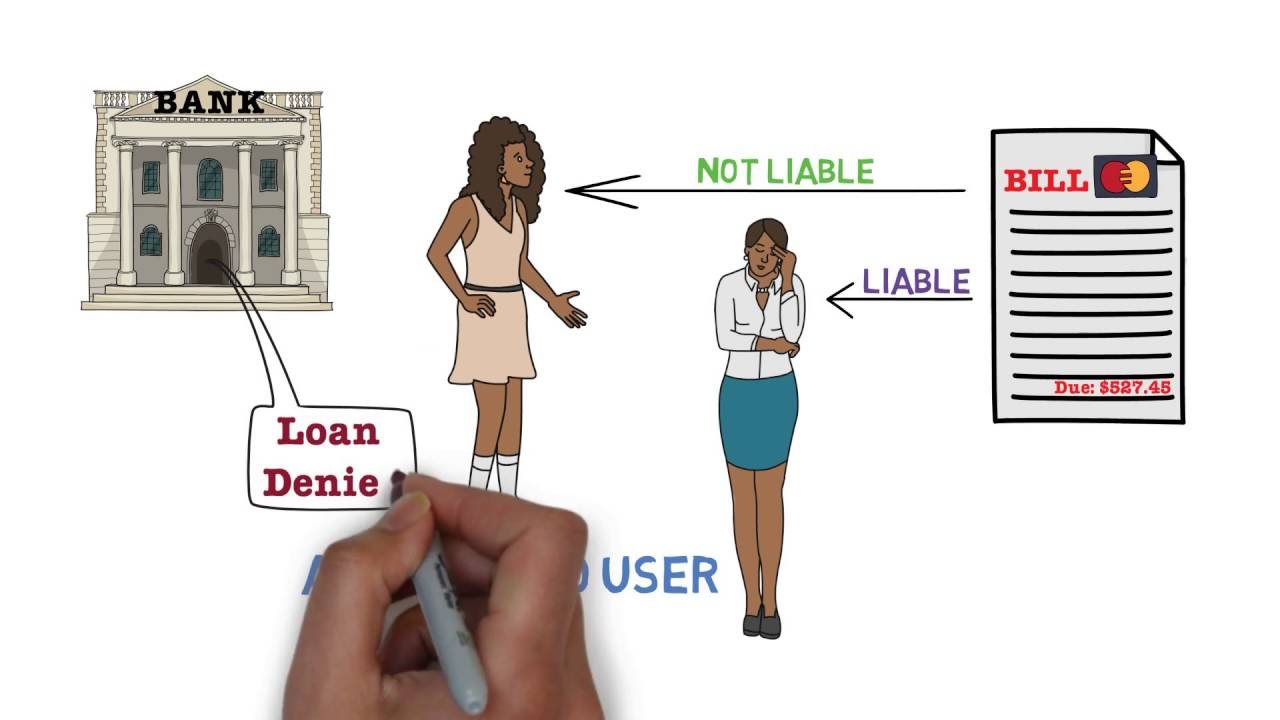

When trying to figure out how credit card companies work, it's important to know the difference between credit card issuers and credit card networks.

The bank or credit union that gives out the credit card and lends the money used in a transaction is the credit card issuer.

Chase, Citi, and Capital One are well-known companies that give out credit cards.

Co-branded credit cards, like those from airlines or hotels, are an example of how issuers work with other companies to make a card that gives customers a specific benefit.

Each credit card transaction is handled by a credit card network, such as Mastercard, Visa, American Express, or Discover.

These networks handle the technical parts of moving money around electronically.

American Express and Discover are both card issuers and networks.

This means that in addition to processing transactions, they also lend the money used in those transactions.

Card issuers and networks have different ways of making money.

Most of the time, networks get their money from merchants, who pay a fee to accept credit card payments electronically.

According to the credit card agreements, the issuers make money from the consumer by charging them interest and fees.

How Do Credit Card Companies Make Money?

How do Credit Card Companies Make Money? $$

Every time you use your credit card, whether you have a balance or not, the company that issued it and the payment network make money.

Learning how the system works can help you figure out how you pay for things and how the businesses you buy from charge you.

Interest Charges

Interest fees are probably not a big surprise when you hear that credit card companies make money from them.

Credit card rates are known to be high, and minimum payments don't make much of a dent in your loan balance.

This lets your debt stay around and makes money for the credit card company.

Some people pay off their credit cards every month.

So, they don't pay any interest, but still, make money from those customers.

Interchange Fees

Interchange fees are harder to understand than interest charges because you don't pay them directly.

But people who run businesses that accept credit cards are used to the idea.

Interchange fees, which are also called "swipe fees," are usually between 1% and 3% of the amount you spend.

No matter if you carry a balance or not, this is how credit card companies make money: When you buy from a business or organization, they have to pay their payment processor fees, and it can be expensive to accept credit cards.

Some businesses add surcharges to credit cards to cover their costs and discourage customers from using them, but most merchants see the fee as a cost of doing business.

Compare the fees that come with credit cards to the fees that come with debit cards, which are limited by federal law.

Most debit card swipe fees are less than 1%, so it's likely that stores would rather you use your debit card.

Most of the time, but not always, American Express processing fees are higher than Visa, MasterCard, and Discover fees.

Annual Fees

Some cards have fees every year, while others don't.

If you have to pay, the amount could be anywhere from $25 to $500 or more.

Cards with higher annual fees usually come with perks like travel points or cash back.

Penalty Fees

You can avoid penalty fees, just like you can avoid interest charges, but it's easy to forget when you're busy or struggling financially.

For example, if you miss your payment due date, you can expect to pay a late payment fee.

If you charge more than your card's credit limit, you may have to pay an over-limit fee.

You can turn off this "feature," which is probably a good idea.

Balance Transfer Fees

When you move debt to a new card with 0% interest, you can sometimes save money.

Balance transfer offers often promise interest-free or low-interest borrowing for 12 months, but there's a catch: You may have to pay a balance transfer fee to take advantage of the offer.

Most of the time, these fees are between 3% and 5% of the amount you transfer, and they add to the balance of your loan.

How Credit Card Companies Profit From Merchants?

Have you ever attempted to make a purchase at a store that would only accept a specific kind of credit card, such as American Express or Discover, but you were unable to do so?

Because these and other credit card networks charge merchants fees to process card transactions, some retailers choose to accept cards that are affiliated with only one or a select few networks.

These fees can be anywhere from 1% to 3%, depending on the network, but normally fall somewhere in that range.

How Can You Spend Less On Credit Cards?

Video unavailable

This video is unavailable: Original link to video

Now you know how do credit card companies make money.

But what can you do to keep from making a big difference in the bottom line of the company that gave you the card?

You can build your credit while keeping more money in your pocket by doing the following:

Minimize Fees

Look for credit card offers that have the fewest fees.

Find a card with no balance transfer fees or annual fees if you can.

But Nerdwallet says that you should only apply for a credit card offer with an annual fee if "the rewards you'll get from the card will be worth more than the cost."

Remember that rewards and sign-up bonuses can give you money, but card fees and interest can eat it right up.

Do the math before picking a card with a lot of rewards but a lot of fees.

Do Not Carry A Balance

Every month, you should pay off your balance in full and on time.

This is the simplest way to avoid paying interest.

If you must carry a balance, make sure you pay more than the minimum each month.

Naturally, the less you owe, the less interest you'll have to pay.

Stay Away From Cash Advances

Again, getting a cash advance is probably the most expensive thing you can do with a credit card.

Cash advances have fees that are meant to be hard to pay.

You might have to pay both a flat transaction fee and a percentage-based fee (usually between 2% and 5%) on the total amount you borrow.

Not only that, but the interest rate on the resulting balance would probably be higher than the interest rate on a credit card purchase balance.

Cash advances should be avoided unless you really need the money.

Have Good Credit

This is the most important thing you can do to cut down on how much money you end up giving to credit card networks and issuers.

Promotional periods of 0% interest on credit card payments are usually only available to people with good to excellent credit.

The same goes for credit card offers with lots of rewards and no annual fees.

A borrower with a lower credit score will usually only be able to get credit card offers with higher interest rates, annual fees, and fees for things like transferring a balance.

People Also Ask

How Do Credit Card Issuers Make Money?

According to the credit card agreements, the issuers make money from the consumer by charging them interest and fees.

Credit card companies make money off of their customers in a number of ways, including interest, annual fees, and other charges like late payment fees.

How Much Do Credit Card Companies Make Per User?

Based on data from 2022, each active account brings in an average of $180 per year for credit card companies.

Again, credit card companies make most of their money from the interest that builds up on each account and the interchange fees.

How Do Credit Card Companies Make Money Without You?

Credit card companies can't make money without customers like you, but you can limit how much they make off of you.

Pay off your balance in full every month to avoid interest charges and save money.

You can avoid late fees by setting up electronic alerts that let you know when payments are due.

Conclusion

Credit cards are a business worth billions of dollars.

Credit card companies get a lot of money from you, way more than you can spend.

It's important to remember that you shouldn't just use credit cards to pay for everything.

There are many other ways to save and spend money that doesn't involve cash.

Now you know how do credit card companies make money.

When using credit cards, it's best to pay on time and avoid the things you shouldn't do.

If you use credit cards in a smarter way, you can do it for a long time without getting tired.

Luqman Jackson

Author

Liam Evans

Reviewer

Latest Articles

Popular Articles