Introduction To Candlesticks

To comprehend my techniques in the next part, we first need to analyze the price movement and the foundations of candlestick charts. Technical analysis and early candlestick charts were first used by the Japanese in the 17th century while trading rice between the country and the West.

Author:James PierceReviewer:Camilo WoodMar 10, 20225.8K Shares581.7K Views

To comprehend my techniques in the next part, we first need to analyze the price movement and the foundations of candlestickscharts. Technical analysis and early candlestick charts were first used by the Japanese in the 17th century while trading rice between the country and the West. Trader Homma from Sakata, Japan, is widely acknowledged as the father of candlestick creation and charting.

Many of the guiding concepts of early versions of technical analysis and candlestick charts are comparable to those of modern forms, notwithstanding the differences. After 1850, candlestick charting as we know it now began to emerge. Over the course of many years of trading, Homma's ideas may have evolved into the technique of candlestick charting that we use today.

How To Create Candlestick Charts?

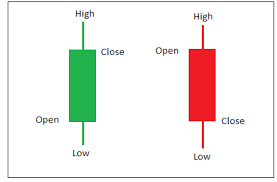

To construct a candlestick chart, you'll need a collection of data that includes the beginning price, the highest price during the time period you've selected, the lowest price during that time period, and the closing price for each period you'd want to see.

Daily, 1-hour, 5-minute, 1-minute, or any other period you want may be used as a time frame for this experiment. In the context of candlesticks, the term "body" refers to the component that is either hollow (white) or filled (red). High/low range is represented by the long thin lines above and below the body and is known as "shadows" (also known as "wicks" and "tails"). There is a high and a low, which can be seen through looking at the shadows.

As long as the stock price rises above its opening level, a hollow candlestick is drawn with its bottom pointing to where it was when it opened, and its top pointing to where it was when it closed. The top of the candlestick represents the opening price and the bottom of the candlestick represents the closing price if the stock's price closes lower than its initial price.

Examples Of Candlesticks

Bars, lines, and point-and-figure charts may all depict price movement in addition to the candlestick style. My preference is for candlestick charts because of their aesthetic appeal and ease of understanding. There is a clear image of price movement in each candlestick. The open and close, as well as the high and low, may be promptly compared by a trader. Essential information about candlesticks may be found in the connection between open and closed.

Candlesticks- When To Buy And Sell

Buying pressure is indicated by hollow candlesticks, which have a higher close than an open. Filling candlesticks, in which the closing is lower than the open, signal a strong selling bias.

Buyers, sellers, and indecisive traders all exist simultaneously in the market at any one time. In the end, the pricing of transactions are determined by the decisions made by the buyers, sellers, and those who aren't sure yet.

A group of people that are seeking for bargains and want to get into a transaction as cheaply as possible. Selling at the highest possible price, on the other hand, is important for shareholders who wish to offload their shares. It's a universal human trait. Customers in various nations and cultures are expected to haggle and negotiate over the price of goods when they go shopping.

Ask And Bid Price

A product seller wants to earn as much money as possible whereas a product buyer wants to spend as little money as feasible. The bid-ask spread is the name given to the difference between the two prices in day trading. The seller's "ask" is the price he or she is willing to accept, while the buyer's "bid" is the amount they are willing to pay.

A third element that might effect pricing is the indecisive consumer and the undecided trader, both in the marketplace and in day trading. A trader's indecisiveness may be seen in their eyes as they wait to see which side would triumph on their computer screens.

Summary

The price will rise or fall depending on how many traders remain indecisive. Traders mistrust them since they're so well-known. Consider the last paragraph's depiction of a marketplace once again. When you enter a shop and find a product you like, you make a low-ball offer on it to get it. You, the customer, are in charge of making the purchase. Your proposed pricing isn't going down well with the vendor.

Your goods is being offered at a higher price than what you had originally proposed to purchase it. A tour bus rolls up and a swarm of people pours into the business just as you are debating on a counter-offer. That's the one thing you'd really want to get your hands on. Is it better to pay the greater price and hope one of these visitors (the unsure) doesn't purchase it instead? You're under a lot of stress since the time is ticking.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles