Getting Familiar With TD Card Services Activate

TD Card Services is a type of financial service that offers great convenience to its customers. It is both user-friendly and reliable. There are plethora of advantages and benefits of using this platform.

Author:James PierceReviewer:Camilo WoodAug 19, 202216 Shares988 Views

Are you looking for a reliable financial partner?

If the answer is yes then you should look into the process of TD Card Services Activate.

This financial platform is delivering on its promise of making its customers’ lives better.

Their services are highly reliable.

We will review these services in much more detail in this article.

Origins Of TD Card Services

TD CardServices: TD Card Services is a well-known Canadian provider of financial services that offers its customers several tools for managing their money.

The service provider also offers PayPal as a kind of electronic transfer for purchasing goods or paying bills.

In this article, we will discuss how you can effectively use this platform for your needs and betterment.

Initial Steps In Using The Platform

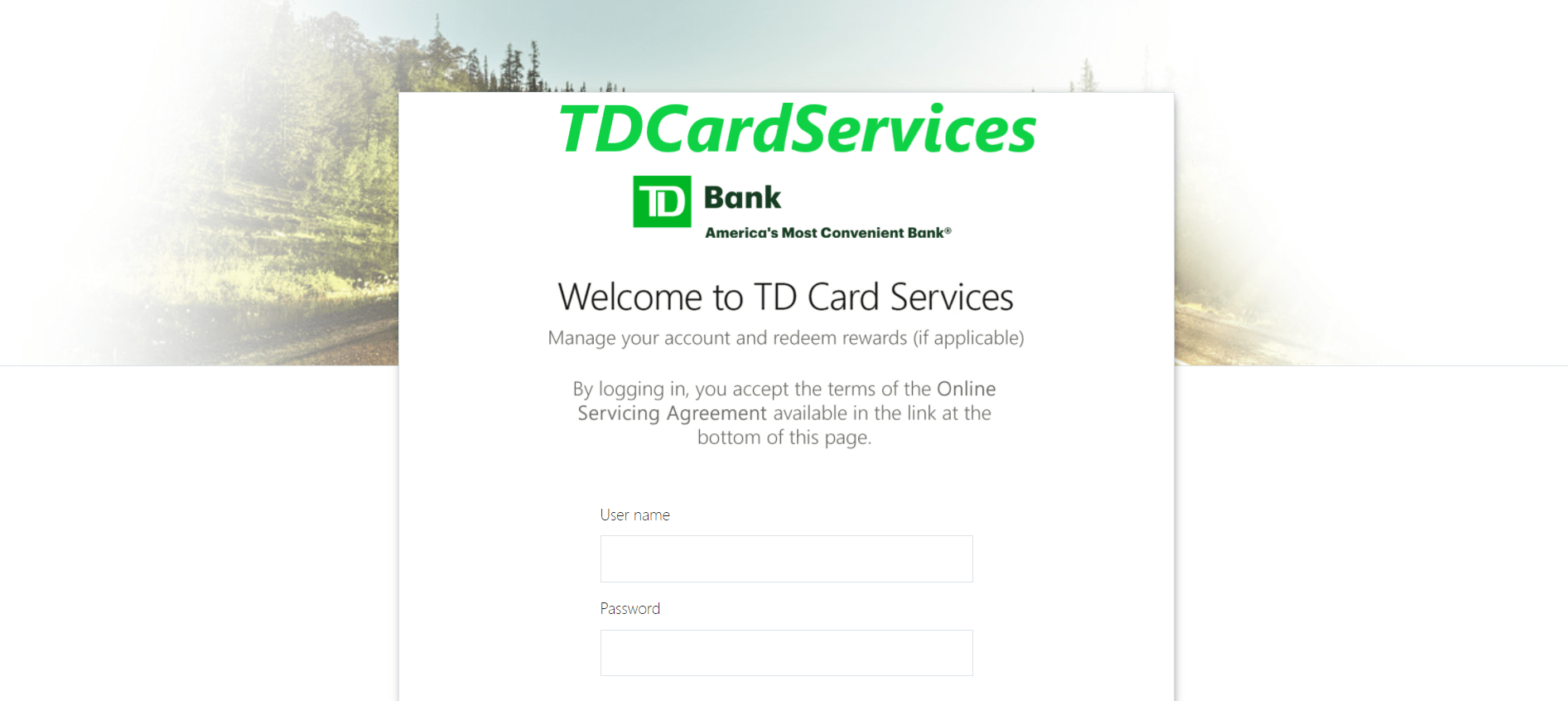

Check the login information at www.tdcardservices.com and manage your account.

Once logged in, look for your login information.

There is a link that says "uid."

To log into your account, you should click on this link.

Use the "Change Your Password" link at the top of the page if you are unsure of your username or password.

Selecting a bank: Since you enrolled with TD Credit Card Services, finding your bank will be simpler for you.

To choose your bank, go to the 'My Account' page, which is located on the home page.

Make sure the branch you choose is included in the list of TD branches.

Login Process Detail

Visit the online portal for TDCardServices.

For the equivalent, see the link provided below.

On your screen, the tdcardservices login page will appear.

Selecting erratically is ok, so click the Signup button.

You will proceed to approach the page and enter your card number.

You will need to enter your personal information on the following page to access your TD Bank credit cards, such as your phone number, the last four digits of your security code, and other details.

Please press the Submit button.

You will receive a confirmation link or code that you must enter to use the TDCardServices.

You will be pleased to tdcardservices.com check in to your record by visiting a similar link after your record is created.

Your Username and Password, which you entered while selecting, will be requested of you.

Navigating TD CardServices

Create an account Once you have logged in, look in the upper right corner for the bills tab.

Choose the "Bills" tab and "My Bills" as the appearance for the section.

You should see a list of all your bills if you have used the credit card services from TD Bank to pay your payments on time.

Use the 'Payments' page if there are any bills displayed that you have not paid yet.

You will use technological means, such as the internet, to pay your past-due invoices.

If you have a specific agency holding your account, you must use the "tdcardservices.com Cancellation" and "Collections" tabs.

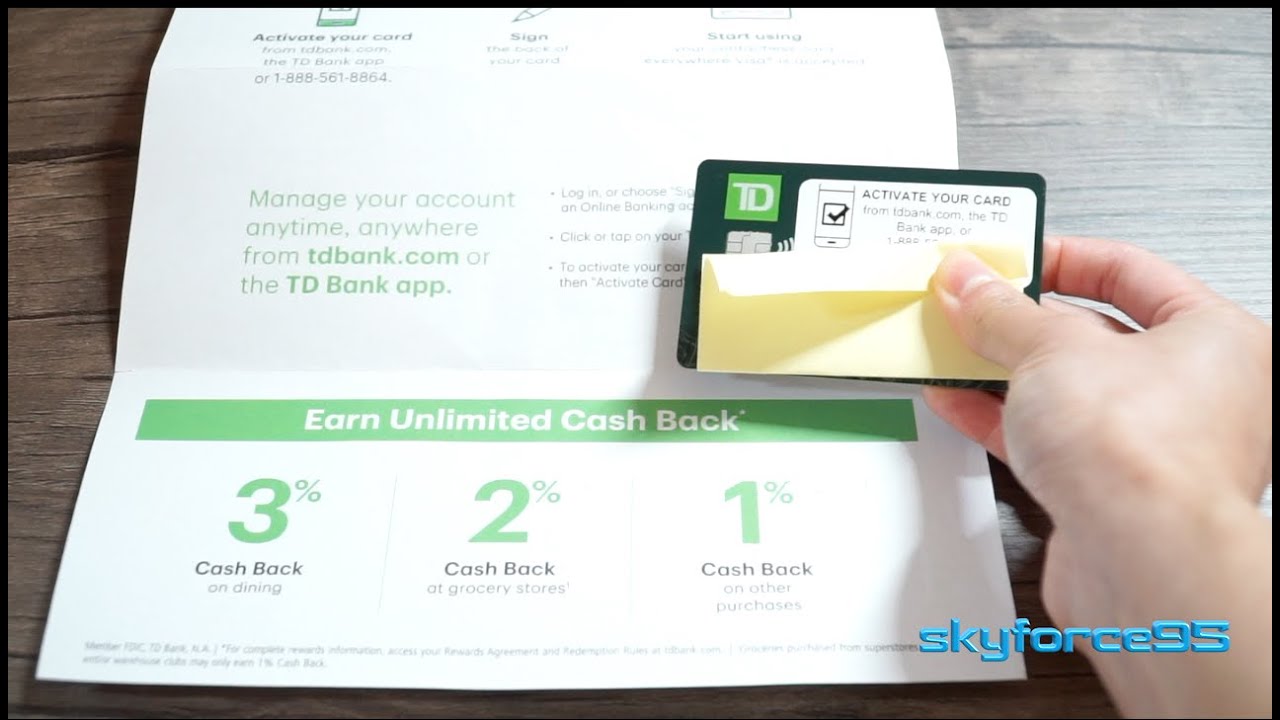

TD Bank Cash Credit Card Unboxing

Look for reward features; Toronto has many ATMs with reward programs.

For every dollar you withdraw or spend at TD branches, you will earn extra points if you have a bank account with TD Bank credit card Services.

Gas stations, pharmacies, and restaurants all offer a selection of these reward programs.

There are incentive programs for regular customers at grocery stores, supermarkets, coffee shops, and pharmacies.

Payment Methods

There are three other methods you can use to pay with your TD credit card.

You can use the web-based user interface or the portable program to roll around in the hay.

Additionally, you can transfer funds from your TD Bank account and your TD Bank credit card.

Always pay attention to the intricacies.

Direct Method

The first method is from direct atm to TD account.

You should first input your tdcardservices login credentials to access your record.

Select Account from the menu now.

Then select Transfers from the left sidebar's menu.

Select the record type to shift money from by opening the From menu.

Now select the TD Bank credit card from the To menu.

You must enter the amount that will be transferred from your record to your TD Bank Mastercard account.

Finally, examine your subtleties, payment total, and remaining payment.

TD Bank Credit Card

Open your TDcardservices account and log in.

After choosing the Accounts tab, choose the Payee alternative from the left sidebar. Choose Pay Canadian Bills from the list of options.

Select "Add Payee" from the menu.

You will need to provide all the details to the TD Bank Business Direct, such as the Payee name, Mastercard Number, and other personal information.

Tdcardservices Review your nuances, then click the Add button to highlight a different payee, such as your MasterCard.

By selecting the new payee option from the list to tdcardservices activate a card, you may now easily pay tabs using your TD Bank Mastercard.

The third option is to Select the Activity page after visiting the official website.

Choose the Pay with Rewards option.

You can purchase items from Cashback and Reward focuses for just $25.

Three different credit card types, each with unique features and advantages, are offered by TD Cards Services.

You will have access to the appropriate credit card options based on your needs.

Fortunately, each of those credit cards has a unique offer that will give you extra advantages and benefits.

TD Card Plans

You can earn up to 30,000 Aeroplan Miles and have the first and first Additional Cardholder's annual fee waived if you apply for the TD Aeroplan Visa Infinite Card by May 31st, 2020.

- a $120 annual fee for the card

- Interest rates for purchases are 19.99 percent.

- Cash advance rates: 21.99%

For the first three months after making a complete purchase of $2,000, you can earn up to 6% Cash Back with the TD Cash Back Visa Infinite Card on all purchases.

If you apply for this Card before May 31st, 2020, there will not be an annual fee for the primary Cardholder or any additional Cardholders.

- $120 annual fee for the card

- Interest rates for purchases are 19.99 percent.

- Cash advance rates: 21.99%

Customer Service

The platform has excellent customer service and offers its customers different helplines.

For instance, there is one for personal banking and then there is one for Direct Investing.

Use the bank's customer service department to obtain answers: Your bank's customer service department is a great place to go for solutions to all your questions.

For instance, you can use the customer service area to request assistance if you are experiencing problems making a payment.

You can call the customer service hotline, send an email to the TD Card Services Activate Card help desk, or start a phone conversation if you have any additional queries.

Quintessential Rewards Program

Look for the TDCardServices' reward features.

Some TDCardServices offer free checks in addition to reward programs.

Since they are not required to purchase the check, this is frequently excellent news for regular consumers.

Even better, utilizing a check to pay your bills online does not incur any monthly fees.

After activating your card, you should first review the prize options.

The TDCardServices online application is ultimately the most effective method for obtaining a card.

However, there are several crucial measures you should do before submitting your application.

Build Credit With TD Card

If you use the TD Cash Secured Credit Card sensibly, such as by making on-time payments and paying off the entire balance each month, it can help you improve your credit if you have less-than-perfect credit.

Cashback is another perk of the TD Cash Secured Credit Card.

One percent cashback is available on qualifying purchases, which is a considerable benefit for a secured credit card.

However, the TD Cash Secured Credit Card has an annual cost of $29 and needs a security deposit, just like many secured credit cards.

You will be required to make a deposit equal to your authorized credit limit, which may be between $300 and $5,000.

Top Notch In The Industry

We looked into several major-rewards credit card categories that many other banks provide, such as bonus category cash back, travel rewards, and everyday cash back, when choosing our categories for the top TD Bank credit cards.

We also considered additional typical credit card usage that the typical consumer could require, such as business credit cards and cards for credit recovery.

We examined every credit card that TD Bank currently provides to determine the best TD Bank credit cards in each category.

After reviewing TD Bank's credit card options, we evaluated them against the parameters mentioned above and chose the best card in each category.

State Of The Art Technology

The card has the most recent EMV chip technology, which is intended to protect a cardholder's account information better.

Both an annual charge and foreign transaction fees are absent from the card.

For the first twelve billing cycles, the introductory APR is 0%; after that, it fluctuates between 13.24 percent, 18.24 percent, and 23.24 percent depending on your creditworthiness.

The minimum amount that can be transferred is $250, and there are four percent balance transfer fees, or a minimum of $10, for each transfer.

Dependable Services

An online financial institution called TD Card Services has offered a variety of financial services to its customers.

The business collaborates with other banks, credit unions, and businesses to provide special services to cardholders.

They are one of the biggest in the sector with more than 1 million registered consumers in 189 nations.

They provide a variety of trustworthy and simple services.

For people who wish to keep their funds organized and make payments quickly and efficiently, they are the ideal answer.

People Also Ask

What Is TD Bank Retail Card Services?

A division of TD Bank, N.A., TD Retail Card Services offers and manages retail card programs for a range of retail merchants, including national retailers, department shops, and sports franchises.

Is TD Set Up For Google Pay?

It is simple to begin: From the Google Play Store, get the Google Pay app. It only takes a photo to add your TD Bank Visa cards. Activate and pay - When you unlock your Android device, you are prepared to tap and pay at any business that accepts Google Pay.

How Do I Cancel A Pre Authorization?

You must advise your bank that you desire to suspend the payment at least three working days before the transfer's planned time. The bank could need you to confirm the request in writing, but you can still give the notice verbally.

Conclusion

TDCard Services is a great platform that serves all your financial needs of you.

The interface is quite user-friendly and they are highly reliable.

Setting it up is also very easy and no non-sense.

So, what are you waiting for?

Set up your account today and start availing services.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles