SPAC Investments, Reverse Mergers: Key things you need to know in 2021

The writer takes a look at Special Purpose Acquisition, and provides answers to some of the troubling questions raised by people interested in it.

Author:James PierceReviewer:Camilo WoodApr 30, 20214.6K Shares467.8K Views

It was in the papers that you read of an old colleague who had quit the job a long time ago as you casually leafed through the pages one evening. You read of his quietly-amassed wealth and you start to ask all the questions that neither you nor your cat has answers to.

Suddenly, you want to make a large investment, one that you have never thought of doing in the past. You want more than what previously you considered is enough for you and, perhaps, your loved ones. You want to move into a less noisy neighborhood. And you have just also recently realized you are long overdue for a new car. You start thinking of the vacations you couldn’t travel abroad but hauled up at a bar nearby. You want more. But you think that is for those who have a seemingly unlimited budget, to begin with, and suddenly you have a small windfall and you are confused about how to begin investing.

There are many investments out there and there are many ways to invest. Some are riskier than others. Investments like SPACs are considered less risky, it is kind of a win-win investment in that when it is successful, your returns increase. And when not successful, your initial investment is returned to you. Sounds safe right!

But what are SPACs? When it comes to SPACs, people tend to have more questions than answers. For those in banking and finance or similar industries, it is not a new topic. If however, you are among those who have little or no an idea what it is, let's quickly take a look at some of the questions that people raise about SPAC, even as we clarify certain things.

What Is A Special Purpose Acquisition Company (SPAC)?

Simply put, a Special Purpose Acquisition Company is a company with no commercial operations, it is formed specifically to acquire an existing company. Also known as a "blank check company", SPAC is a shell company set up by investors with the primary aim of raising money through an Initial Public Offering (IPO), to eventually acquire another private company.

These companies are usually listed on the Securities and Exchange Commission (SEC) and are expected to within a set time frame, raise funds enough to acquire another company or finance a merger.

How SPAC Originated

SPACs themselves aren’t new. However, Milos Vulanovic, a professor at EDHEC Business School who studied SPACs for years reported that they have existed in their current form since 2003.

The ideology behind SPACs operations is not entirely new. It was a common occurrence in medieval times for a group of business moguls to pool money together to finance an even bigger business.

It is believed that both GNK securities and EarlyBirdCapital were born as an exemption for listing blank check companies. Since then, over 500 SPACs have been PAC’s recorded history beginning with David Nussbaum in 1993, a time when blank check companies were prohibited in the US. David Nussbaum along with co-founders, Roger Gladstone and Robert Gladstonestarted it with an investment bank, GKN Securities, and would go on to create EarlyBirdCapital with Steve Levine and David Miller and who developed the template.

listed, in the process raising more than $100 billion. While those were initially small, at less than $100 million, they have become much more established today with an average raise of about $380 million.

SPACs have existed in various fields as technology, health care, logistics, media, telecommunications industries, and much more.

The problem in the 1990s was, the pump-and-dump approach used. But a lot changed in 2003, when the lack of opportunities for public investors together with an up-sizing private equity funds trend, pushed entrepreneurs to seek alternative means of securing equity capital and growth financing.

At the same time, the rapid growth of hedge funds and assets and the lack of encouraging returns in assets led institutional investors to popularize the SPAC structure.

The Securities and Exchange Commission has further endorsed the SPAC structure through its governance of the SPAC. Increased involvement of high-profile investment banking firms such as Citigroup, Merrill Lynch, and Deutsche Bank has also done SPAC some good and has thus created a greater sense that this technique of companies going public will prove useful over the long term.

How Do Special Purpose Acquisition Work?

Companies are continuously looking to grow, and they grow through funding and funding comes via raised capital. Capital can be raised through SPAC or IPO.

However, to have a better understanding of how SPAC works, we shall briefly consider how IPO works.

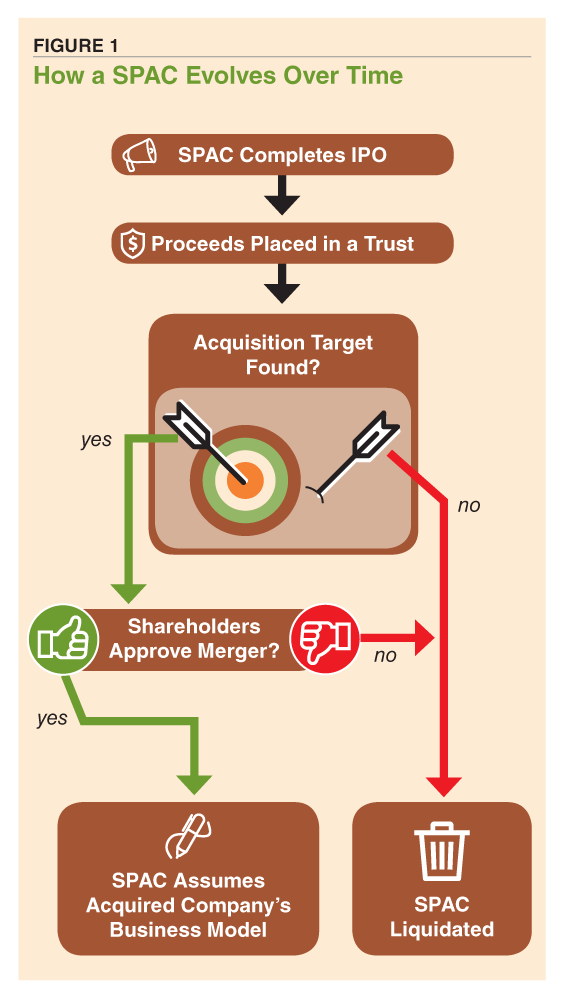

- Formation of SPACA SPAC is formed by a group of sponsors, often well-known investors and industry experts, private equity firms, or venture capitalists. These are also shareholders and the board who run it and would do anything to find a deal.

- SPAC IPOSPACs go through the typical IPO process. The sponsors of SPAC don’t publicly identify companies they are intending to acquire, to avoid a more complicated process with the Securities and Exchange Commission.

- Search for private company AcquisitionSPACs normally have a two-year time frame to search for a private company wishing to go public to either merge with it or acquire it entirely, bringing it public in the process as it becomes part of the publicly traded SPAC. If the SPAC fails to search and complete an acquisition deal within two years, the money is returned to shareholders. This makes SPACs less risky than the traditional IPOs - money-back guarantee If an acquisition doesn’t materialize. On the other hand, traditional IPOs grant you publicly traded stock that offers no guarantee of a return of investment.

- Finalizing the acquisitionWhen the sponsors on SPAC identify a company they wish to acquire, they formally announce it and a majority of shareholders must approve the deal. The SPAC may need to raise additional money (often by issuing more shares) to acquire the company. Once that’s all finalized, the target company is listed on the stock exchange.

Raising Capital Through IPO

A company, privately listed can raise capital in many ways, but the most common way is through Initial Public Offering. Through an IPO, the company raises capital by selling its shares publicly to investors - both institutional and retail. This is also a form of stock assurance.

A company is considered private before it has gone through an IPO. This means that while the company is still privately owned, it has a limited number of investors, most of which are its founders, family members, friends, and a handful of business investors. When a company goes public, however, the general public is then able to buy shares and even own a part of the company.

In an IPO, a company that intends to go public discloses a lot of details about its business operations such as historical financial statements and much more leading to investors pooling money into that company in exchange for the company shares.

The company engages the services of an investment bank or banks tasking them with handling the IPO - providing underwriting services and advising the company.

The management team, auditors, accountants, lawyers, Securities and Exchange Commission experts all come together to carry out the underwriting process. A bunch of other paper works such as due diligence (registration statement) involving market due diligence, financial diligence, legal diligence, tax diligence is required to verify the company’s registration.

Pre-analysis meetings are held to educate bankers and analysts about the company. They are also briefed on how to sell the company to investors. At the end of these meetings, a preliminary prospectus is drafted.

Next, a pre-marketing work is carried out to determine if the institutional investors like the sector and the company as well as the price they would sell a unit of shares. A price range is decided here.

In simple terms, an IPO process involves selecting an investment bank, carrying out due diligence, determining the price, stabilization, and transition.

One of the major benefits of investing in an IPO is that those investors get the opportunity to pick a potential underpriced stock early, even before brokerages take hold of large stock positions. IPO investors can keep track of upcoming IPOs to maximize their benefits.

An increased awareness/raised company profile and additional capital are some of the major benefits of an IPO. The raised capital, for instance, can be used by the company to expand its reach, acquire additional property, fund research, and pay off some debt.

Some of the biggest IPOs in the US in recent history are Facebook in May 2012 worth $16 billion, Alibaba Group in September 2014 worth $25 billion, General Motors in November 2017 worth $5.8 billion.

And although there are benefits of this method, there are equally drawbacks, chief of which is the time it takes to complete the process. This could take anywhere from six months to one year.

Raising Capital Through SPAC

As David Erickson himself said, SPACs are another way for companies to get late-stage growth capital.

A special purpose acquisition company is a shell company formed by a group of experienced business executives who are confident that their reputation, experience, and knowledge will help them identify a profitable company to acquire. Since the SPAC is only a shell company, the founders become the selling point when sourcing funds from investors.

The founders of SPAC provided the starting capital and thus stand to gain from a sizable stake in the company to be acquired. Moreover, they often hold an interest in a specific industry when starting a special purpose acquisition company.

In SPAC, the process is completely different and unlike the traditional IPO. The Investors first come together, with no idea what company they are investing in, they put their money together. The investors here are mostly the founders of the SPAC.

Because the shell company has no commercial operations - does not produce or sell anything and has no prior financial records, the required financial disclosures are easier than those in a typical IPO. And that is simply because a pile of money has no business operations, hence nothing to be described.

When issuing the IPO, the management team of the SPAC hires an investment bank. Like the traditional IPO process, the banks are tasked with the responsibility of handling the SPAC IPO.

Banks are selected according to their reputation and expertise in the industry. Top investment banks such as Goldman Sachs, Morgan Stanley, JP Morgan, Blackstone, Wells Fargo, Deutsche Bank, Citi, Macquarie, HSBC are some of the popular banks often charged with handling the SPAC IPO. The investment bank and the management team of the company then agree on a fee to be charged for the service, usually about 10% of the IPO proceeds.

This is followed by a prospectus document providing information about the company, its sponsors, its management team, and other related information that investors would like to know. The prospectus document covers less on company history and revenues since the SPAC lacks prior financial operations.

The SPAC goes through an IPO, raising money through convincing people to invest in the company by buying shares into an eventual acquisition. Proceeds from the IPO are held in a trust account for the time the search acquisition is to go on. The SPAC, through its management team, then goes out and looks for an operating company that wants to make a leap from private to public, and they merge. They typically have 18 to 24 months to identify a target company and complete the acquisition. The period may also vary depending on the company and industry. If the SPAC fails to identify and complete an acquisition before the stipulated time elapses, the SPAC is dissolved and all proceeds in the trust account are returned to investors.

What Is The Future For SPACs?

SPAC IPOs have seen resurgent interest since 2014, with increasing amounts of capital flowing to them too.

- 2014: $1.8 billion across 12 SPAC IPOs

- 2015: $3.9 billion across 20 SPAC IPOs

- 2016: $3.5 billion across 13 SPAC IPOs

- 2017: $10.1 billion across 34 SPAC IPOs

- 2018: $10.7 billion across 46 SPAC IPOs

- 2019: $13.6 billion across 59 SPAC IPOs

- 2020: $83.3 billion across 248 SPAC IPOs

SPACs records show a remarkable resurgence in popularity. In 2021, that upward trend shows no signs of slowing down. In 2019, 59 SPACs hit the market. That number soared to 248 SPACs in 2020 with funds amounting to $83.3 billion as compared to the $1.8 billion six years prior.

As funds continue to increase in SPAC operations, institutional investors heighten their expectations as well. However, regulations such as the implementation of independent oversight are put in place within the fund structure, to provide investors with the comfort that an independent advisory committee has been appointed to manage potential conflicts of interest. The committee is also tasked with the responsibility of ensuring a corporate governance and compliance framework is in place to allow the sponsor management team to focus on the important task - identifying and investing in target companies.

It is safe to say that, with the increasingly global interests in SPACs, they are here to stay with more companies looking to adopt this approach of going public. The titan of co-working space, WeWork is just the latest in a growing list of companies to go through SPAC. Other big companies are Virgin Galactic, DraftKings, Opendoor, and Nikola Motor Co. Over 240 SPACs went public in 2020, raising well over $80 billionin total funding.

For 2021 though, SPACs already lined upinclude Butterfly Network, a portable ultrasound start-up backed up by Bill Gates, and DNA-testing start-up 23andMe is reportedly in talksof going public via a $4 billion deal. There is also news of digital media companies like BuzzFeed, Vice Media, Bustle Media Group, and others going public via SPAC.

According to SPACInsider, nearly 180 SPACs had filed IPOs just two months into 2021, totaling more than $54 billion.

So, beyond the success of 2020, there are all indications that plenty of capital will readily be deployed in the industry. Thus, a significant rise in mergers could be announced over the next couple of years as SPACs will certainly continue to be an important capital-raising scheme.

Why SPACs Are Suddenly Gaining So Much Popularity

It is believed that the three main factors listed below have influenced the recent surge in popularity of SPACs:

- Supply and demand:Because the stock exchanges make their money by bringing on new companies, they pushed for more SPACs to be brought into the market. The number of public companies has gone down drastically over the last couple of years, but the amount of money flowing into the public markets has somehow continued to increase.

- The private equity market:The amount of capital invested in private equity has also seen a huge increase to roughly over $2 trillion today, but the number of exits has seen a decline. Private equity-backed portfolios are always on the lookout for opportunities to exit and make a return, hence they are huge advocates of the SPAC model.

- SEC regulations:Since the SEC has become more involved in regulating SPACs, the investment industry has received a boost.

Best SPAC To Invest In Right Now

Here are some of the few hottest names to consider right now.

TWC Tech Holdings II Corp (TWCT)

Last year, TWC Tech Holdings II Corp filed with the SEC to raise $525 million in an IPO. It targets an enterprise within the technology-enabled services sector, specifically with a transaction value between $1 billion and $10 billion.

Previously, the team behind TWCT completed a deal with Open Lending, which has performed very well so far.

GigCapital2 Inc. (GIX)

GigCapital2 raised $285 million as part of its definitive agreement with UpHealth Holdings Inc. and Cloudbreak Health LLC.

Churchill Capital Corp. IV (CCIV)

Reported as one of the most exciting SPAC of this year, Churchill Capital Corp. IV is expected to merge with luxury electric vehicle manufacturer Lucid Motors. Automotive analysts say that Lucid may represent the first real competition for Tesla.

Social Capital Hedosophia IV (IPOD)

The shares of Social Capital Hedosophia IV have soared despite not being able to find a takeover prospect but for good reason — IPOD is famed venture capitalist Chamath Palihapitiya’s 4th blank-check company. Taking Palihapitiya’s previous successes into consideration, many pre-deal investors are banking on his golden touch.

Apollo Strategic Growth Capital (APSG)

Apollo Strategic Growth Capital has garnered significant interest. This is largely due to its over 30-year history and strong management team.

Ajax I

The company has an all-star management team led by former CEOs and founders of popular companies such as Anne Wojcicki founder of 23andMe, Kevin Systrom founder of Instagram.

Are SPAC Good Investments?

Just like any private equity investment, there are risks and there are rewards. Here, the management team of the SPAC can target and acquire a quality company that measures the profitability of the investment. It is worth remembering that, before an IPO, the SPAC has no business to assess and therefore the investment decision can be made based on the management team behind the SPAC.

Hence, acquiring a quality and/or undervalued company would provide a better safeguard for a shareholder’s investment and provide a satisfactory return.

Recently, there has been an increase in seasoned fund managers entering the industry and acting as the sponsor of their SPACs. These firms use their experienced teams and credible track records as a yardstick to attract current and new investors.

Their expertise in the industry comes as an advantage as these teams can work with governance and on the management of the post-merger company to help minimize disruption.

In terms of performance, returns can be mixed. An assessment of 56 SPAC transactions over the last two years in a recent report from Goldman Sachs for instance, showed that the SPACs typically outperform the market in the first few months and extremely wide variations in returns following after.

It is also worth remembering that investing in SPAC is most times less profitable for individual investors. An investor’s ability to get an allocation on IPO shares in a traditional IPO is equally important. Take Warren Buffett, a seasoned investor, for example, may get special allocations of IPOs coming to market. In the end, that leaves the average investor at a disadvantage as they contend with the masses of what's left when companies first start trading on exchanges.

The price of shares of new IPO companies usually increases substantially above the initial market listed price, even in the first few minutes or hours of public trading. By the time an average investor can get a share, the price may be remarkably higher than what was advertised.

Prices don’t stay up high that long, at least in the short term and average investors might end up buying high at a price that won’t be matched again for a long time. But, even if prices continue to rise, average investors end up seeing their investment grow in less percentage than investors who got a head-start through the special allocations. That brings us back to SPAC being a good investment.

Most SPACs often underperform the market and eventually fall below the IPO price. And Given such a poor track record, average investors should be cautious of investing in them else just focus on investing in pre-acquisition SPACs.

Experienced investors may use their expertise in the industry to back the most skilled sponsors who likely have a higher propensity to succeeding.

Depending on what company and who runs what allocation one can get, investing in SPAC is lucrative, that is evident in the big names all wanting to start SPAC. Because in doing so they get a ton of money in return. Analysis shows that investor returns on SPACs post-merger are almost uniformly heavily negative except of course sponsors of the SPAC who can earn excess.

Why Do Companies Use SPACs?

There is some degree of success that awaits a company when it successfully changes status from private to public. Hence, a company may choose to go public through a SPAC instead of an IPO. This is because the process of going public via a SPAC can be achieved faster. And this is accompanied by lesser costs and relatively few financial disclosure requirements.

With SPAC, the financial statements in the IPO registration statement are brief and could be ready in a matter of weeks as compared to months it will take for an operating business. In essence, there is no financial history of note to be disclosed or assets to be described.

From the decision to proceed with an IPO, the entire IPO process of SPAC can be completed in as little as eight weeks.

It is worth noting also that, there is usually a time set for a SPAC to carry out its purpose. SPACs usually have two to three years to make a deal - buy a private company, before they have to return the funds to its investors. That time-frame, for instance, gives sponsors an incentive to find an acquisition target and finalize a deal.

With a traditional IPO, there is a lengthy and cumbersome process involved as well as a greater financial commitment. There is also the possibility that smaller companies can be kept private for as long as IPO reporting requirements and courtship process tarries.

Some SPACs go public with a target industry or company in mind while others do not. With SPACs also, investors are banking on a SPAC's management's ability to be successful, hoping to rake in a good deal of profits.

Companies are increasingly opting to go public by using SPAC because, with a SPAC, the IPO is already done. This means that all the negotiating for a takeover is done by one party. The company valuation is already known, there is no roadshow needed. The whole process is way faster as compared to a traditional IPO and existing investors can cash out. There is little paperwork involved, a clear pitch to follow, less risk involved, fewer expenses, and the best of them all, the time it takes.

Can You Lose Money On A SPAC?

Can one lose money on SPAC? The answer is yes. It is a business and, in every business, there will always be profits and losses. With a SPAC, it is a 50-50 deal. Except you are a sponsor or financing a SPAC, you stand a higher chance of losing money.

When you invest in SPAC as an average investor, you are counting on the ability of the management team to search and acquire a profitable company. In essence, how the SPAC will perform is hinged on a particular group of people, the team managing it. Investing in a SPAC translates to a bet on the sponsors, the reputation they have, and whether a deal can successfully be done in two years or less.

When investing in an individual stock, you research a company’s financial records first, but with a SPAC you instead research the team behind the SPAC and what industry they may be targeted for acquisition.

An analysis from the Financial Timesfrom 2015 and 2019 shows that the majority of the SPAC IPO traded below their original price of $10 a share. A similar analysis reported by The Wall Street Journal of SPACs from 2015 to 2016, showed that 33 SPACs did IPOs with 27 of them doing a merger. But by 2019, 20 of those companies traded below their IPO price.

Most SPACs start with share prices of around $10, this price can rise substantially due to the portfolios of those behind them or the announcement of their target acquisitions.

If you end up paying more than the initial offering price of $10, you could stand to lose more than your initial investment if no deal materializes. You would still lose even if you only recoup the $10 per share price you initially invested. This is minus the expenses. And even if you bought it at the initial offering price, you have lost opportunity cost to contend with. This is simply because your initial investment is now tied up in a low-paying investment for up to two years when that money could have been invested elsewhere more profitably.

On average, between 2010 and 2017, SPACs performed about 3 percent more poorly than the broader market. Some of that may be due to the escrow accounts used to store the pre-merger cash where interest rates were low while the market was frothy.

SPACs also have a bad reputation when it comes to fraud. A Greek streaming company, Akazoo, for instance, was listed on the markets in 2019. The company’s board launched an internal investigation when Gabriel Grego, a short-seller, found that the subscriber numbers Akazoo had given were inaccurate. He concluded that the company’s previous management had participated in a sophisticated scheme to falsify the company’s books and records, including the documents that were presented when acquiring a SPAC.

You have to carry out thorough research first should you decide to buy into a SPAC, and as well keep in mind that while investing in SPACs offer a certain guarantee of return on your investment, they aren’t without risk if they don’t acquire or merge with a company within two years.

And when they do successfully acquire a company, the SPAC becomes just as risky as any other single stock, if not riskier.

Keep in mind also that while some startups offer incredible returns on investment, others fail or offer undervalue returns.

How To Invest In SPAC

With the increased media craze on SPACs, it is only a matter of time before ordinary people start asking how they too can be part of the industry.

Getting the necessary awareness of a SPAC is followed by exposure before investing in it. Make sure to do your homework on the SPAC’s management team and the sector they are interested in. You should be able to do it through your normal broker or investment platform.

Go to an online brokerage, search for the ticker symbol you want and execute a market or limit order.

Before a SPAC initiates a letter of intent with the proposed buyout target, you don’t know what management is considering. Hence, treat them as private equity ventures which are invariably high-risk, high-reward vehicles.

When SPAC goes public, it is registered with the SEC and becomes a publicly-traded company hence it is listed on major exchanges, such as New York Stock Exchange (NYSE) and NASDAQ. These two have dedicated sections for IPOs and have proven reliable.

Other exchanged websites provide access to official IPO prospectuses such as IPO monitor, IPO scoop. However, they can only provide recent news around exchanges after proper verification.

You can also take a diversified approach and invest in a basket of SPACs by buying an exchange-traded fund (ETF)focused on SPACs.

What Kinds Of SPAC Investment Opportunities Exist?

There are three different ways to participate in a SPAC, depending on your investment level.

- Sponsors:SPACs are sponsored by senior investors who have a track record of buying or running companies successfully.

- SPAC IPO:Investing directly into a SPAC IPO is a great opportunity for retail investors, especially considering the advantage of being able to get their money back.

- PIPE:When a SPAC identifies its target company, sponsors sometimes raise money through private investment in public equity (PIPE), to provide insurance on the capital raised previously in the IPO.

Potential Risks

As SPAC has become popular and more funds have flooded the industry, it is worth saying that there are risks involved just like every business venture out there.

SPACs have become so popular that they are now taking the traditional IPO as the route to going public, but investors need to do their homework. The first thing to consider about taking a risk with a SPAC is thus:

Management team: Have an idea who founded the SPAC and if they have a good track record. The first risk, and one that perhaps many investors may likely overlook, is in the management of any given SPAC.

Targeted Industries: SPACs that are forthcoming in their description of what types of private companies and specific industries they would be willing to target are likely to erase little doubts. Also, a SPAC that simply chased profit wherever it might be is one to invest in.

When you have carefully studied the above, you would have reduced the risk of being defrauded by the company. You would also have reduced the risk of market underperformance.

The Good And Bad Sides Of SPAC

As with any investment decision, there are pros and cons when it comes to investing in a SPAC.

The Good Sides

- SPAC is a way for a company to go public without all the paperwork of a traditional IPO hence it is straightforward and less cumbersome.

- SPAC achieves faster than a traditional IPO. The traditional process of going public could take years, in some cases. With SPAC, it could take as little as two months to be completed.

- Because a SPAC is registered with the SEC and a publicly-traded company, the general public can buy its shares before the merger or acquisition takes place. They level the playground for ordinary investors.

- SPAC stocks can attract certain high-profile investors.

- SPACs are less expensive to execute unlike traditional IPOs, they also pay for most of the costs, saving a significant amount of money for the company.

- SPAC deals are identified ahead of time, and the valuation is agreed upon by both parties. Hence, there is certainty around them.

The Bad Sides

- SPACs are great for those running the company and not entirely profitable to investors. This a win or lose investment for average investors.

- With most SPACs, the founders get to keep 20% of the equity.

- Also, the SPAC sponsor only gets to keep their 20% if they complete a deal within two years. Otherwise, they must return the capital. Thus, it’s in their interest to complete a deal at almost any price.

- There are so many SPACs in the market today that popular private companies have many SPAC suitors. As a result, popular private companies may set up “SPAC-offs,” just to drive up the price through competition.

- SPACs are good for the company that is being acquired, but it is bad for investors in the SPAC. The higher the acquisition price, the lower the future return SPAC investors can expect.

Jump to

What Is A Special Purpose Acquisition Company (SPAC)?

How SPAC Originated

How Do Special Purpose Acquisition Work?

What Is The Future For SPACs?

Why SPACs Are Suddenly Gaining So Much Popularity

Best SPAC To Invest In Right Now

Are SPAC Good Investments?

Why Do Companies Use SPACs?

Can You Lose Money On A SPAC?

How To Invest In SPAC

What Kinds Of SPAC Investment Opportunities Exist?

Potential Risks

The Good And Bad Sides Of SPAC

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles