September Is Historically A Tough Month For Stocks - Should Investors Be Concerned?

CNN reported that the month of September won't be as good as we expected. That's what's going on in investment markets right now. In 2022, stocks are going down. Because the stock market has always done the worst in September, which starts on Thursday, September 01. September is historically a tough month for stocks, there's nothing new about it.

Author:James PierceReviewer:Camilo WoodAug 29, 20222 Shares545 Views

CNN reportedthat the month of September won't be as good as we expected.

That's what's going on in investment markets right now.

In 2022, stocks are going down.

Investors are losing money, and it's natural for us to think that this is now the way things are.

Since summer is about to come in the Northern Hemisphere and the sun will soon rise in Australia, they don't have to be comfortable.

Because the stock market has always done the worst in September, which starts on Thursday, September 01.

September is historically a tough month for stocks, there's nothing new about it.

But don't react yet, even though the market as a whole went up in both 2019 and 2020, September was a bad month for the Dowand S&P 500.

That doesn't mean that stocks will lose money in September, though.

Each of the three September before the pandemic, stocks went up.

What Happens When The Dow Goes Down?

For your benefit, when the Dow goes up or down by one point, it shows how the prices of the stocks that make up the Dow have changed.

The index is price-weighted, which means that it moves in the same direction as the prices of its parts, adjusted by a divisor.

Stock Market Crash In 2022 - History Repeats Itself

Video unavailable

This video is unavailable: Original link to video

The time.com page agreesthat the remainder of 2022 will most likely be a bumpy ride But, crash or no crash, recession or no recession, history tells us this is all part of the journey.

But here's something else that could be a bad sign: this is a year with midterm elections.

The Stock Trader's Almanac says that since 1950, 11 of the last 18 September before the midterms have seen the Dow drop.

More Issues To Take Into Account

It's being said that don't rely on past results to tell what will happen in the future.

At the end of the day, investors should pay more attention to what's important than to dates.

Earnings, the economy, and what the Federal Reserve does with interest rates will have a much bigger impact on how stocks do than what month it is.

More issues are about to come, and we should still worry about them.

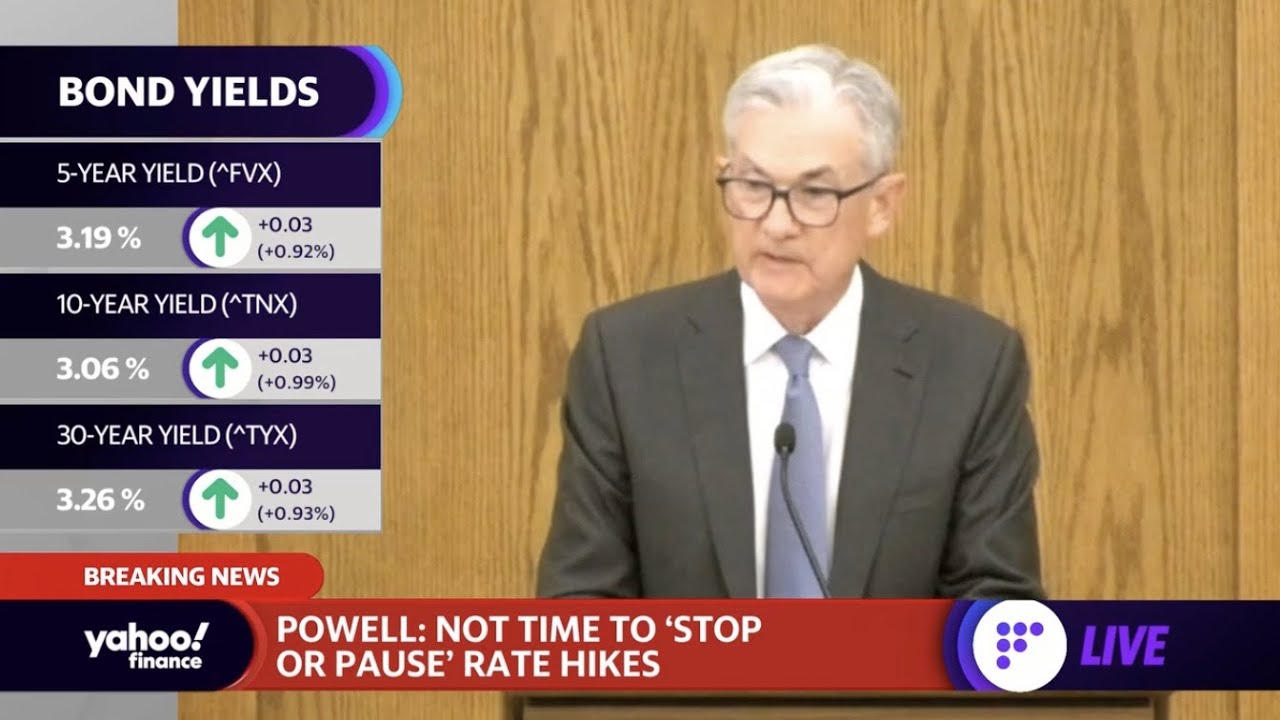

Brad Smith and Brian Cheung of Yahoo Finance discuss the key takeaways from Fed Chair Powell's speech and the market reaction.

Watch the video here:

Stocks decline after Fed Chair Powell’s Jackson Hole speech

On September 21, the Fed will meet again to talk about raising interest rates.

Several important economic reports are coming out soon, which will give investors more information about how the job market is doing and whether inflation pressures are getting better or worse.

Congress will also be back to work right after Labor Day.

Josh Emanuel, a chief investment officer of Wilshire said:

“„There is no question that there are a number of geopolitical concerns and economic data that could lead to volatility. Investors should be prepared for that.

Emanuel said that traders should keep a close eye on the Fed and the economy.

The good news is that there are signs that the job market is still strong and that inflation is finally starting to slow down.

The Fed's Effect On Economy

When the Fed buys bonds on the open market, it increases the amount of money in the economy by giving the public cash in exchange for the bonds.

On the other hand, if the Fed sells bonds instead of cash, it reduces the amount of money in the economy.

By making good decisions about monetary policy, the Fed can keep prices stable, which is good for long-term economic growth and full employment.

That's the reason why Emanuel mentioned that traders should keep a close eye on the Fed and the economy.

Leaning On Consumer And Corporate's Power To Avoid September Swoon And Get Through

The first half of the year was bad for the stock market, which could mean that the recent recovery (the sharp rise in July and the flat, but choppy, August) will keep going.

Emanuel said, "A soft landing could be a plausible scenario," if this trend keeps going. This means that the Fed won't cause a recession by raising rates too quickly.

Alex Chaloff, co-head of investment strategy at Bernstein Private Wealth Management said that the worries about September and October from the past are less important this year.

And that there are more important factors at play.

He added:

“„There are a number of potential catalysts for a fall rally.

Chaloff said that if inflation keeps going down, "the market will cheer that significantly," and the Fed might be more likely to raise interest rates next month by only a half percentage point instead of three-quarters of a point.

Chaloff added that this could be "crucial" to get a rally going.

Chaloff also thinks that the economy could have a "soft recession", or at worst, a "mild recession."

He said that investors shouldn't worry too much about a sharp drop in the country because the strength of consumer and corporate spending will be more than enough to survive.

It means that if the economy keeps going strong and worries about inflation continue to fade, the market might now have a big drop in September.

That's such a piece of good news!

Everyone Is Looking Forward To The Jobs Report

In a speech at Jackson Hole on Friday, Fed chair Jerome Powell said that if price stability isn't restored, it would hurt the economy much more.

Most likely, a small rise in wages won't send up red flags.

But the Fed and investors won't want wages to go through the roof.

In the short term, that might be good news for consumers, but in the long term, it wouldn't be a good thing.

Economists think that wages will go up by 5.3% over the past 12 months in July, which is a slight increase from June's growth rate of 5.2%.

Investors will also pay close attention to the numbers in the jobs report about how much wages have grown.

Any sign that wages are slowing down could be seen as a good thing by investors because it shows that inflation pressures are easing.

The senior portfolio manager at Income Research + Management, Jake Remley, said:

“„The July jobs report was so unabashedly strong that it’s hard to imagine the Fed would be worried about the August numbers. The job market speaks to the underlying strength of the economy.

Reuters says that economists expect payrolls to grow by 285,000 jobs in August and that the unemployment rate will stay the same at 3.5%.

If those predictions come true, the Fed and the markets will probably be happy.

Friday is when the August jobs report is due.

Economists expect hiring to slow down, but they don't think it will slow down enough to make recession alarm bells sound louder.

After the July jobs report was better than expected, people stopped worrying about a recession happening soon.

The government said that 528,000 jobs were created, which was a lot more than anyone expected.

People Also Ask

What Is The September Effect On Stock Market?

The September Effect is the historically bad and weak performance of the stock market in September.

This is not limited to any one country or market.

This unusual thing doesn't have a clear cause-and-effect relationship.

Instead, it can be explained with logical theories.

What Is The Best Month To Buy Stocks?

Rankings:

- #1 - December (Frequency of Growth [79.0%])

- #2 - April (Frequency of Growth [74.3%])

- #3 - October (Frequency of Growth [68.6%])

- #4 - July (Frequency of Growth [61.7%])

Should I Buy Stocks In September?

Instead, you should sell stocks this month.

Some traders think that the best times to sell stocks are in September and October.

The September effect shows that returns have been historically low in the ninth month of the year.

This could be helped by institutional investors closing out their positions from the third quarter.

Conclusion

Stock markets warn investors that September will again make its move to affect stocks.

Should you worry? Of course, your investments are involved in this so-called "stock crisis."

So, instead of buying stocks during this tough month, sell them.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles