Retirement Planning For Millennials - A Guide To Securing Your Financial Future

Retirement planning for millennials is a topic that is often overlooked by many young adults, especially millennials. However, retirement planning is an important aspect of financial planning that should not be taken lightly. The earlier you start planning for your retirement, the better off you will be in the long run.

Author:Stefano MclaughlinReviewer:Luqman JacksonFeb 15, 202381 Shares1K Views

Retirement planning for millennials is a topic that is often overlooked by many young adults, especially millennials.

However, retirement planning is an important aspect of financial planning that should not be taken lightly. The earlier you start planning for your retirement, the better off you will be in the long run.

It is never too early to start thinking about your future, and as a millennial, you have the advantage of time on your side. With the right strategies in place, you can build a secure financial future for yourself and enjoy your retirement years to the fullest.

Start Saving Early

The first and most important step in retirement planning for millennials is to start saving early. The earlier you start saving, the more time your money has to grow and compound over time.

By starting to save early, you can also take advantage of the power of compound interest and maximize your retirement savings. Many financial experts recommend starting to save for retirement in your 20s or 30s and setting aside a certain percentage of your income each month.

Make The Most Of Employer-Sponsored Retirement Plans

If your employer offers a retirement savings plan, such as a 401(k) or a pension plan, make sure to take advantage of it.

Employer-sponsored retirement plans offer several benefits, including tax-deferred growth, employer-matching contributions, and easy automatic deductions from your paycheck.

Take the time to understand the details of your employer's retirement plan and make sure you are maximizing your contributions and taking full advantage of any matching contributions.

Consider An IRA

Individual Retirement Accounts (IRAs) are a great way to supplement your employer-sponsored retirement plan and help you reach your retirement savings goals.

IRAs offer tax benefits, investment options, and flexibility. There are two main types of IRAs: traditional and Roth.

Traditional IRAs offer tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement. Consider speaking with a financial advisor to determine which type of IRA is right for you and your retirement savings goals.

Invest In A Diversified Portfolio

Investing is a key component of retirement planning for millennials. A well-diversified investment portfolio can help you grow your wealth and reach your retirement savings goals.

When investing, it is important to consider your risk tolerance, investment goals, and time horizon. Consider speaking with a financial advisor to develop an investment strategy that is tailored to your individual needs and goals.

Review And Adjust Your Retirement Plan Regularly

Retirement planning is not a one-time event, it is a continuous process. As you move through different life stages, your retirement goals and needs may change.

It is important to regularly review and adjust your retirement plan to ensure that you are on track to meet your goals. Consider speaking with a financial advisor to help you stay on track and make any necessary adjustments to your retirement plan.

The Importance Of Retirement Planning

It is never too early to start thinking about retirement, and for millennials, the earlier you start planning, the better off you will be in the long run.

Retirement planning is an essential aspect of financial planning that helps ensure that you have the resources you need to live a comfortable and secure life in your golden years.

Understanding Your Retirement Goals And Needs

Before you start planning for retirement, it is important to understand your goals and needs.

This will help you determine how much you need to save and what types of investments you should consider. Consider factors such as your desired lifestyle in retirement, any potential healthcare costs, and any outstanding debts or expenses.

Building A Retirement Savings Plan

Building a retirement savings plan is one of the most important steps in retirement planning for millennials. Start by setting a savings goal, determining how much you can realistically save each month, and considering different savings and investment options.

You may also want to consider speaking with a financial advisor to help you develop a customized retirement savings plan.

Maximizing Your Retirement Savings

There are several strategies that you can use to maximize your retirement savings, including taking advantage of employer-sponsored retirement plans, investing in a diversified portfolio, and considering an Individual Retirement Account (IRA).

You may also want to consider ways to increase your income, such as starting a side hustle or pursuing additional education or training to advance your career.

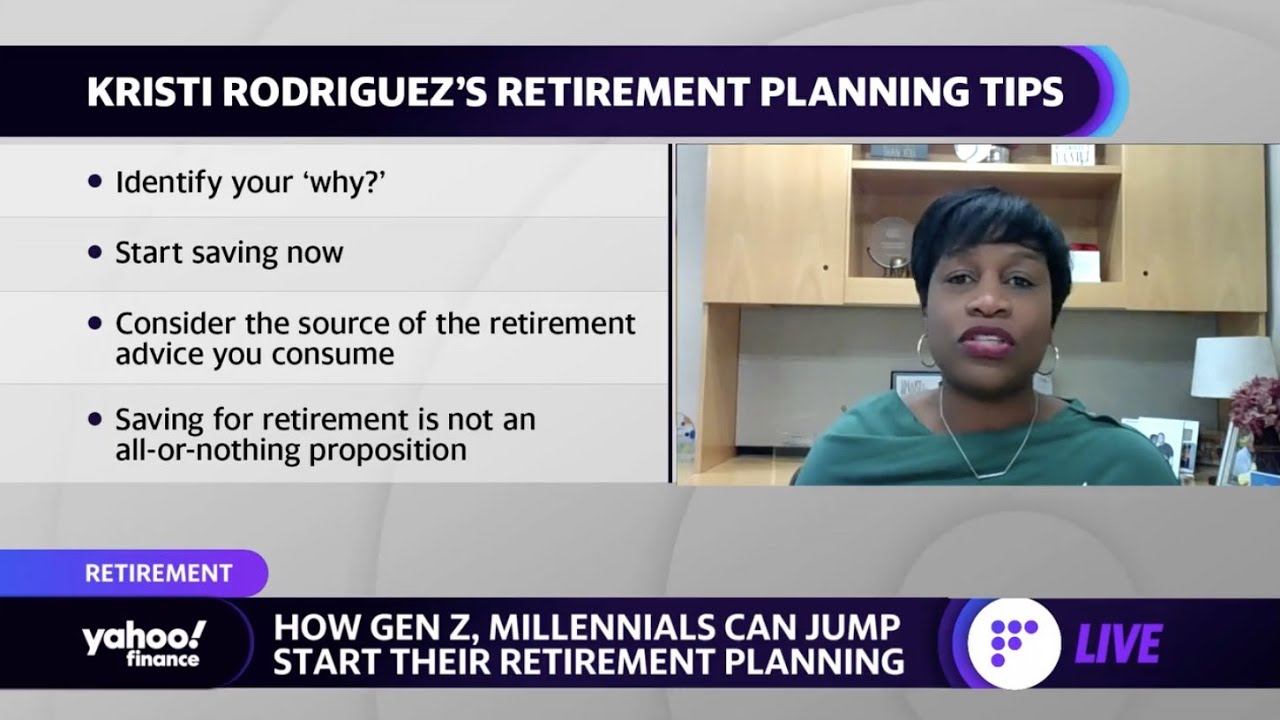

What GenZ and Millennials need to know about retirement planning

Staying On Track With Your Retirement Plan

Retirement planning is a continuous process, and it is important to regularly review and adjust your plan as your life and financial situation change.

Consider speaking with a financial advisor to help you stay on track and make any necessary adjustments to your retirement plan.

Regularly monitoring your retirement savings and investments will help ensure that you are on track to reach your retirement goals and build a secure financial future.

People Also Ask

Why Is Retirement Planning Important For Millennials?

Retirement planning is important for millennials because the earlier they start, the more time they have to build a secure financial future and ensure that they have the resources they need to live a comfortable life in their golden years.

What Steps Can Millennials Take To Start Planning For Retirement?

To start planning for retirement, millennials should first understand their goals and needs, then build a retirement savings plan, consider different savings and investment options, and maximize their retirement savings through strategies such as employer-sponsored retirement plans and IRAs.

Is It Possible For Millennials To Catch Up On Retirement Savings If They Have Fallen Behind?

Yes, millennials can catch up on retirement savings if they have fallen behind. This may involve making changes to their budget, increasing their income, and seeking the advice of a financial advisor to help develop a customized retirement plan.

How Can Millennials Stay On Track With Their Retirement Plan?

To stay on track with their retirement plan, millennials should regularly review and adjust their plan as their life and financial situation change, monitor their retirement savings and investments and consider seeking the advice of a financial advisor to help them stay on track.

Conclusion

In conclusion, retirement planning for millennials is an essential aspect of financial planning that should not be overlooked.

The earlier you start planning, the more time you have to build a secure financial future and ensure that you have the resources you need to live a comfortable and fulfilling life in retirement.

Whether you are just starting your career or are well-established in your job, it is never too early or too late to start thinking about your retirement.

With the right strategies in place, you can maximize your retirement savings, stay on track with your plan, and build a secure financial future for yourself and your loved ones.

By taking the time to carefully consider your goals and needs, and by seeking the advice of a financial advisor when necessary, you can help ensure that you have the resources you need to live the retirement you have always dreamed of.

Jump to

Start Saving Early

Make The Most Of Employer-Sponsored Retirement Plans

Consider An IRA

Invest In A Diversified Portfolio

Review And Adjust Your Retirement Plan Regularly

The Importance Of Retirement Planning

Understanding Your Retirement Goals And Needs

Building A Retirement Savings Plan

Maximizing Your Retirement Savings

Staying On Track With Your Retirement Plan

People Also Ask

Conclusion

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles