Payday Lenders - What They Are And How They Work

Payday lenders are businesses that offer short-term loans to individuals who require quick access to cash. Though they offer huge interest rates, people who are in dire need of money still borrow from them. The practice has become predatory over the years.

Author:Emmanuella SheaReviewer:Camilo WoodMar 13, 20235 Shares254 Views

Ever heard of payday lendersbefore?

Payday lending has become a controversial topic in recent years due to its potential for exploitation and the high interest rates charged to borrowers.

While some see payday lending as a necessary service for those who need quick cash, others view it as predatory and harmful to low-income individuals.

Whether you’re considering taking out a payday loan or simply interested in learning more about this controversial industry, this article will provide an overview of what payday lenders are and how they operate.

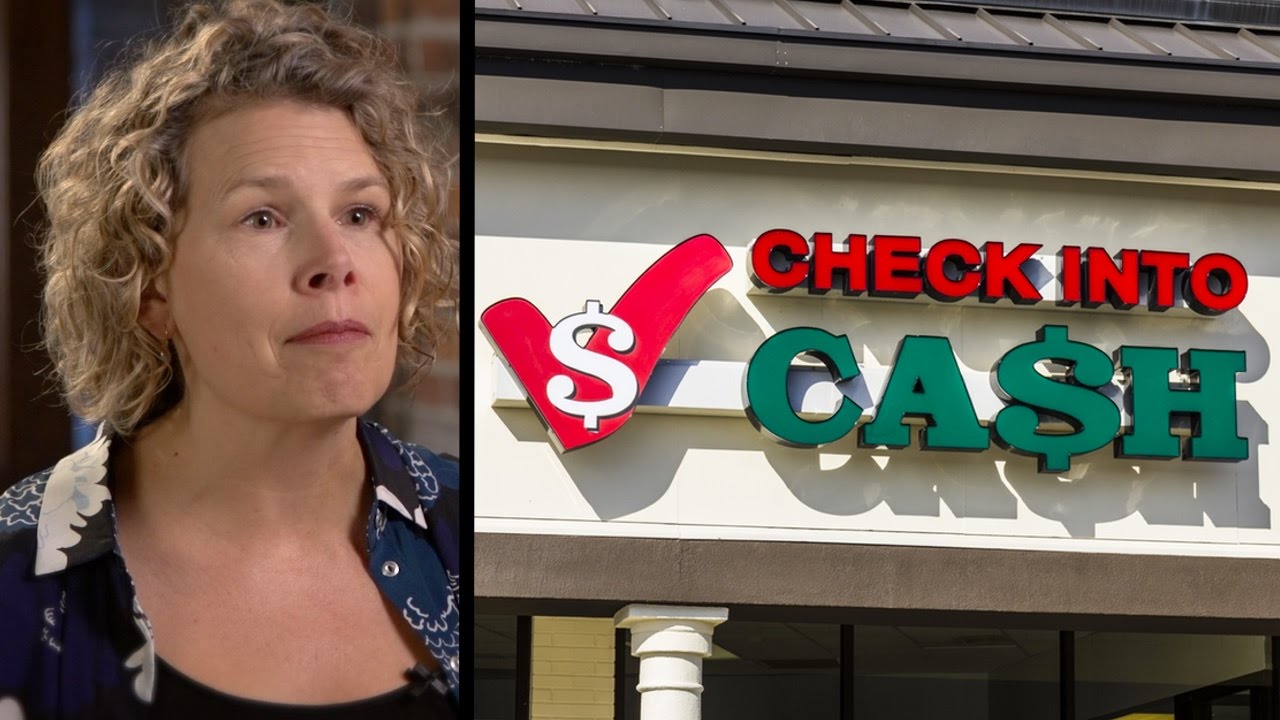

How Payday Lenders & Check Cashers Help the Poor

Payday Lenders Definition

Payday lenders are financial institutions that offer short-term, high-interest loans to borrowers who typically have low credit scores or are unable to access other forms of credit.

These loans are often due on the borrower’s next payday, hence the name “payday loans.”

Payday lenders typically require little to no collateral and rely on the borrower’s income and employment status as proof of their ability to repay the loan.

However, due to the high interest rates and fees associated with payday loans, many borrowers find themselves in a cycle of debt. They get compelled to borrow more money to repay their original loan and accruing additional fees and interest charges.

History Of Payday Lenders

Payday lending is a practice where lenders offer short-term, high-interest loans to borrowers who need quick access to cash.

The practice originated in the United States in the 1990s and quickly spread to other countries, including the United Kingdom, Canada, and Australia.

Payday lending was initially marketed as a solution for people who needed small amounts of cash to cover unexpected expenses, such as car repairs or medical bills.

However, over time, the industry became known for its predatory practices, such as charging exorbitant interest rates and fees, and targeting low-income borrowers who were unable to repay their loans.

How Do Payday Lenders Work?

Here’s how payday lenders typically work:

1. Borrowers apply for a loan.

Borrowers typically apply for a payday loan by filling out an application either online or in person at a storefront lender.

The application usually requires the borrower to provide personal and financial information, such as their name, address, income, and banking information.

2. Lender approves or denies the loan.

The lender reviews the borrower’s application and either approves or denies the loan.

Payday lenders often have less stringent approval requirements than traditional banks, so borrowers with poor credit or limited credit history may still be approved.

3. Borrower receives funds.

If the loan is approved, the lender will typically transfer the funds to the borrower's bank account or provide them with a check.

This process can happen quickly, often within a few hours or even minutes.

4. Borrower repays the loan.

Payday loans typically have a short repayment period, usually two weeks to a month.

The borrower must repay the loan, along with any interest and fees, by the due date. If they cannot repay the loan in full, they may be able to roll it over by paying an additional fee.

5. Lender collects payment.

If the borrower does not repay the loan, the payday lender may attempt to collect payment by depositing the borrower’s check or initiating an electronic debit from their bank account.

If the borrower’s account has insufficient funds, they may be charged overdraft fees by their bank.

Be reminded that payday lenders often charge extremely high interest ratesand fees, which can trap borrowers in a cycle of debt.

Payday Loans Can Trap Consumers With Interest Rates, Hidden Fees

Problems With Payday Lenders

Here are some of the problems with payday lenders:

a. High-interest rates

Payday loans often come with very high interest rates, sometimes as much as 400 percent or more.

This means that borrowers end up paying much more than the original loan amount.

b. Fees and penalties

Payday lenders may charge additional fees and penalties for late payments, which can make it difficult for borrowers to repay the loan on time.

c. Targeting vulnerable populations

Payday lenders often target low-income individuals who may not have access to traditional lending options, and who may be in desperate need of cash.

d. Cycle of debt

Because of the high interest rates and fees, many borrowers find themselves in a cycle of debt, where they continually take out new loans to pay off old ones.

SBS News reportedhow Scott Futcher from Newcastle, Australia made several loans including payday loans that totaled $10,000. He shared how it happened:

“„More bills are coming in, you think, ‘I’ll have to get another loan to pay that.’ You kind of have to get another loan to pay the other loan off as well, just to keep afloat.- Scott Futcher

e. Lack of transparency

Payday lenders may not be transparent about the terms and conditions of the loan, making it difficult for borrowers to understand the full cost of the loan.

f. Predatory lending practices

Some payday lenders engage in predatory lending practices, such as harassing borrowers who are unable to make their payments, or misleading borrowers about the terms and conditions of the loan.

Overall, payday loans can be a risky and expensive way to borrow money.

It’s important for individuals to carefully consider their options and fully understand the terms and conditions of any loan before agreeing to it.

Alternatives To Payday Lenders

There are several alternatives to payday lenders that can help individuals in need of short-term financial assistance. Below are some options:

a. Credit unions

Credit unions offer short-term loans with lower interest rates and fees compared to payday lenders.

b. Personal loans

Personal loans from banks or online lenders may have lower interest rates and fees than payday loans, especially if you have good credit.

c. Cash advances from credit cards

If you have a credit card with available credit, you can use it to get a cash advance. While interest rates may be high, they are still generally lower than payday lenders.

d. Friends and family

You can consider borrowing money from friends or family members who may be able to help you out without charging interest.

e. Employer-based programs

Some employers offer short-term loans or cash advances to their employees.

f. Government assistance programs

Depending on your location, you may be eligible for government assistance programs such as emergency rent or utility assistance, food assistance, or low-interest loans.

It’s important to explore all of your options and compare the terms and fees of each before choosing the best one for your needs.

People Also Ask

What Is The Highest Interest Rate On A Payday Loan?

According to the Consumer Financial Protection Bureau (CFPB), the average annual percentage rate (APR) on a payday loan is around 400 percent.

However, some payday lenders may charge even higher interest rates, up to 500 percent or more.

Why Are Payday Loan Rates So High?

Payday loan interest rates are typically higher than other forms of credit because payday loans are considered high-risk loans.

This means that the lender is taking a greater risk by lending money to someone who may not have a strong credit history or may not have the means to repay the loan.

In addition, payday lenders often have higher overhead costs than traditional lenders because they:

- operate smaller storefronts

- have less sophisticated underwriting systems

- may have to spend more on collection efforts to recoup unpaid loans

Which Is Better Payday Loan Or Installment Loan?

Installment loans (longer-term loans that you repay over a set period of time, usually with fixed monthly payments) often come with lower interest rates and fees than payday loans, making them a more affordable option for many borrowers.

However, installment loans may require a credit check and may have stricter eligibility requirements than payday loans.

Conclusion

Payday lending remains controversial, with critics arguing that it preys on vulnerable consumers and traps them in a cycle of debt.

Those who support payday lenders, on the other hand, argue that they provide an important source of credit for people who might otherwise be unable to access traditional forms of financing.

Many countries already introduced regulations aimed at curbing the worst abuses of the industry.

As for borrowers, they should carefully consider their options before approaching payday lenders and should only do so if they have a plan to repay the loan on time.

Emmanuella Shea

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles