How To Solve For Interest Rates On Student Loans

Student loans can be an effective solution to bridge financial gaps associated with higher education costs, but they come at a cost. Interest rates on student loans impact how much money you'll eventually repay, so it's critical to understand what your rate is and how it affects your loans.

Author:Gordon DickersonReviewer:Frazer PughJun 18, 202210 Shares285 Views

Student loans can be an effective solution to bridge financial gaps associated with higher education costs, but they come at a cost. Interest rates on student loansimpact how much money you'll eventually repay, so it's critical to understand what your rate is and how it affects your loans.

Undergraduate student loans currently carry an interest rate of 3.73 percent, while graduate students' unsubsidized and PLUS loans carry interest rates of 5.28 percent and 6.28 percent, respectively. Interest rates on private student loans range from 1% to 13% and are determined by your credit score.

What Is Percentage Of Interest?

Percentage Interest is a fraction stated as a percentage that, with regard to each note holder, has the numerator equal to the note principal balance of the note held by such note holder and the denominator equal to the total of the note principal balances of all of the notes.

How Do You Find The Interest Rate?

The interest rate formula can be used to determine the interest rate, which is a percentage of the principal amount, that the lender or bank charges the borrower for the use of its assets or money for a specified time period.

(Simple Interest 100) / (Principal Time) = Interest Rate

How Do You Find The Interest Rate Without A Rate?

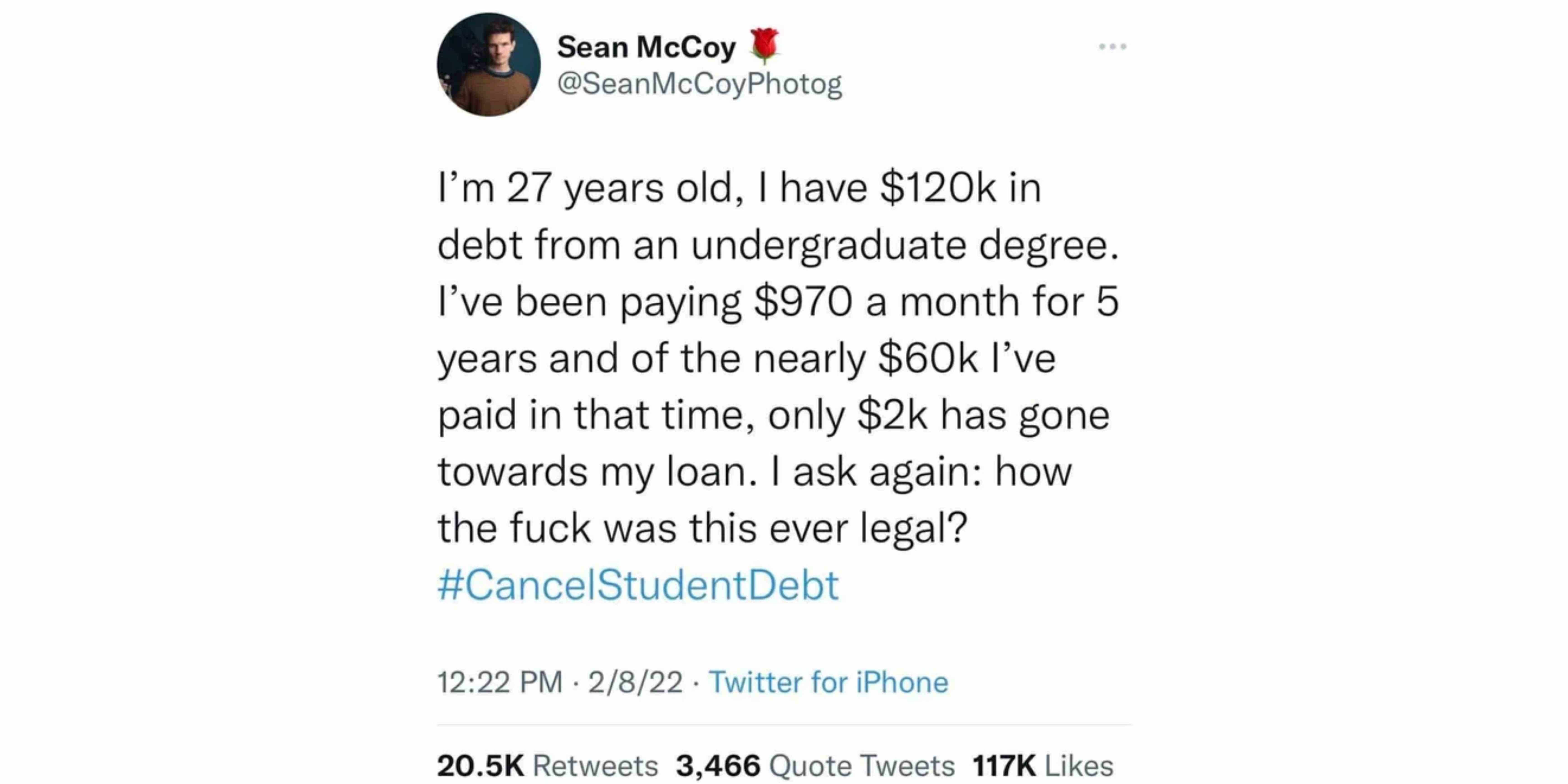

Here we have a tweeted student problem from @SeanMcCoyPhotog. Let's try to solve it.

In this situation, the monthly principle repayment is approximately $33.33 (2000/60). Thus, the monthly interest payment is approximately $936.67 (970 33.33). This equates to 9.37 percent per year (936.67*12/120000).However, this interest rate is calculated using the flat interest method, which is often not used by banks.

If the method of lowering balances is adopted, the interest rate will be 9.44 percent. To use as a reference, enter the following formula in Excel: =RATE (60,970,-120000, 118000)*12.

Current Interest Rates On Student Loans

Interest rates vary according to the type of student loan you currently have or are considering. With interest rates ranging from 3.73 percent to 6.28 percent, federal loans account for nearly 90% of student loan debt. Private student loan interest rates, on the other hand, typically range between 2.99 percent and 12.99 percent fixed and 0.94 percent to 11.98 percent variable. While federal student loan rates are uniform for all borrowers, private student loan rates vary significantly by lender, interest rate type (fixed or variable), and borrower credit score.

Final Tips

If you want to lower the interest rate on your student loan, you have a few options:

- Improve your credit score before applying: If you're seeking a loan from a private lender, your rate will almost certainly be determined by a credit check. The higher your credit score, the lower your rate will be.

- Submit an application with a co-signer: Many student loan borrowers lack credit, so if this is the case for you, you may want to consider adding a co-signer to your loan. By adding a co-signer with good credit, you can increase your creditworthiness and possibly qualify for reduced interest rates.

- Decide on a variable rate: Although it is hazardous, choosing a variable rate over a fixed rate may result in your interest rate decreasing during economic downturns. Bear in mind, though, that you are also taking on the danger of your interest rate increasing.

- Refinance existing loans: If you took out a student loan during a period of high interest rates, you may be able to refinance it at a cheaper rate. This is especially true if your credit score has improved since you first applied. Simply keep in mind that refinancing a federal student loan will result in the loss of perks such as coronavirus forbearance and income-driven repayment programs.

If you're considering a student loan, the easiest way to secure a competitive interest rate is to shop around with multiple lenders. While it is generally advisable to begin your search with federal student loans, particularly since interest rates are at record lows, private student loans can be a useful supplement. While you will pay a higher interest rate if your credit score is lower than ideal, there are lenders who specialize in lending to individuals with terrible credit.

Gordon Dickerson

Author

Frazer Pugh

Reviewer

Latest Articles

Popular Articles