Global Inflation - How It Is Affecting The Economy In 2022

According to a recent UN Development Program estimate, the global inflation rises caused by the Ukraine crisis might force more than 71 million people into poverty.

Author:Hajra ShannonReviewer:Paula M. GrahamJul 09, 2022652 Shares81.5K Views

According to a recent UN Development Program estimate, the global inflationrises caused by the Ukraine crisis might force more than 71 million people into poverty.

Poverty, as measured by the number of people living on less than $3.20 per day, rose faster in the first three months of the conflict than it did in the first 18 months of the epidemic, according to The Washington Post, quoting George Gray Molina, the United Nations Development Agency's senior economist.

"As interest rates increase in reaction to rising inflation, there is a danger of triggering more recession-induced hardship, escalating the crisis and accelerating and deepening poverty globally," the UN stated in a press release.

According to the paper, "targeted and time-bound cash transfers are the most effective policy option for addressing what it refers to as a "cost-of-living crisis."

Price Hike And Global Healthcare System

Price hike in other nations is widely used in their healthcare systems, to the disadvantage of patients and the discovery of novel therapies.

Canadian patients, for example, wait an average of 19.8 weeks from referral to treatment. In contrast, 77% of Americans get treatment within four weeks after referral, while just 6% wait longer than two months.

In the United Kingdom, there was a shortfall of 10,000 physicians and 43,000 nurses in 2019, with 9 out of 10 National Health Service managers stating that a lack of doctors and nurses posed a risk to patients.

When it comes to medical innovation, the United States is now the global leader. According to the Galen Institute study, 290 novel medicinal compounds were introduced globally between 2011 and 2018. The United States had access to 90% of these therapies, a percentage significantly higher than similar international nations. In contrast, the United Kingdom had access to 60% of drugs, Japan had 50%, and Canada had just 44%.

Price limits would result in fewer new drugs being developed. The Council of Economic Advisors calculated that price limitations might result in 100 fewer vital drugs over the next decade, reducing the average American's life expectancy by four months.

Following the coronavirus epidemic, everyone should recognize the need for robust medical innovation. Manufacturers in the United States have developed COVID-19 vaccines and treatments at some of the quickest rates ever. Price limits would stymie medical innovation and jeopardize our capacity to combat future pandemics.

Price limits jeopardize the economy and quality manufacturing employment, damaging the healthcare system.

According to Economy Partners, LLC data, medical innovation, directly and indirectly, supports nearly 4 million employment throughout the United States and every state. These are well-paying, high-quality employment; in 2017, the average annual income for a pharmaceutical worker was $126,587, more than twice the average private-sector wage of $60,000.

Price Control On Drugs In The USA

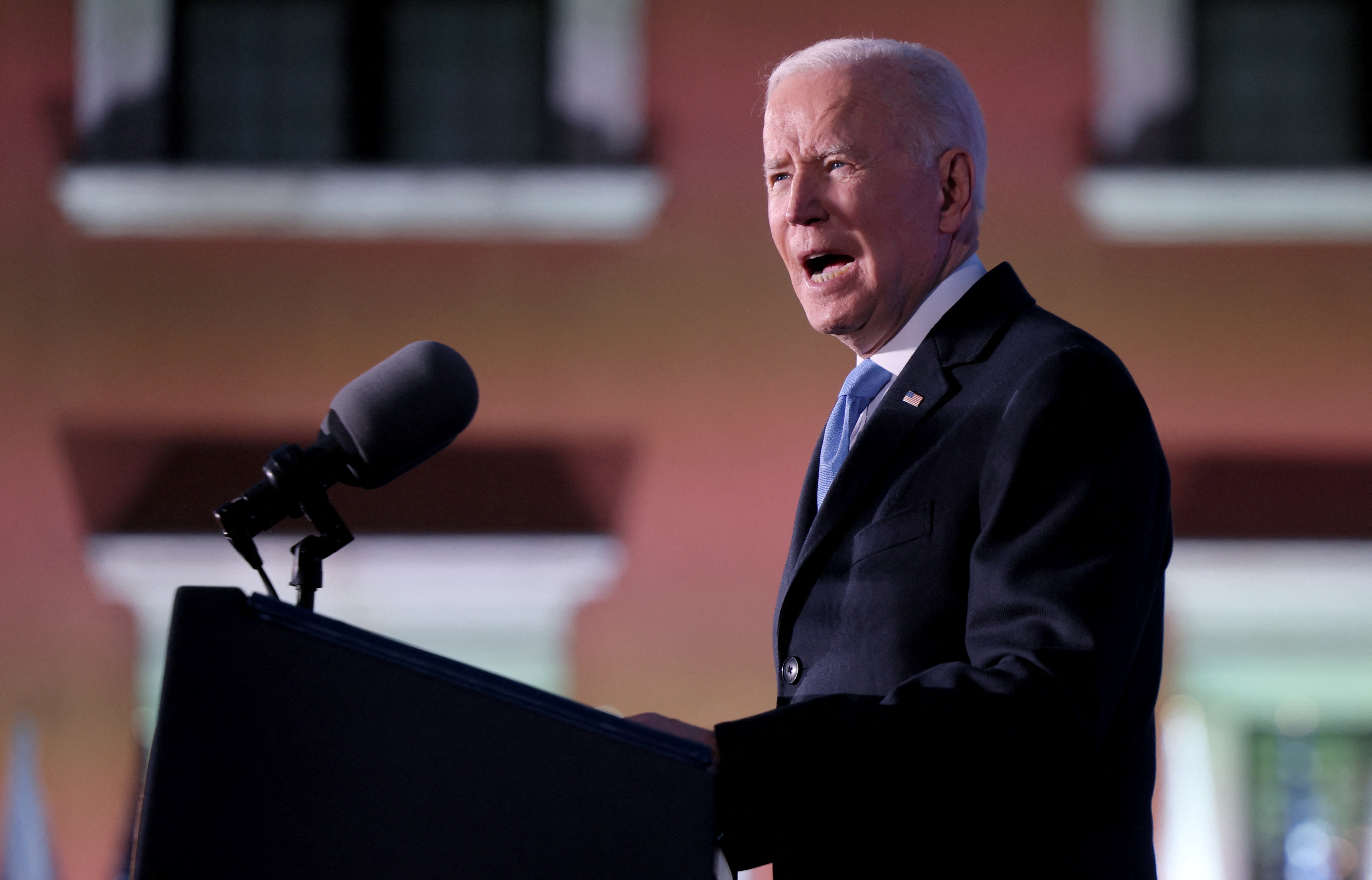

Inflation is wreaking havoc on Americans, yet prescription medications are one of the few products whose costs have stayed steady under the Biden administration.

According to the Bureau of Labor Statistics, prescription medicine prices climbed by just 1.9 percent over the last year consumer price index for all products, on the other hand, grew by 8.6 percent. And who in the Biden administration thinks it makes sense to impose price limits on a commodity whose price is rising by 1.9 percent?

The Biden administration is still pushing for a trillion-dollar tax-and-spend proposal. After rejecting growing inflation as "transitory" in the second half of 2021, the government now says that spending more money and hiking higher taxes help lower inflation.

They claim that one way it wit will do this socialist pricing controls on the healthcare system, which would (at first) lower the cost of prescription pharmaceuticals.

Price restrictions have never been successful. While they may temporarily cut product costs, they rapidly lead to shortages and eventually hurt customers. For example, when gas price limits were implemented in the 1970s, they resulted in lengthy lineups and shortages at petrol stations.

Price limits, rather than helping to lower prices, would hurt the economy and imperil high-paying industrial employment.

The idea would give federal bureaucrats the authority to determine drug prices. If a producer does not adhere to this government-mandated pricing, they face a 95 percent excise tax on the drug's earnings.

This would result in a massive new tax and regulatory framework that could be extended to the whole healthcare system, ultimately leading to socialized medicine.

Inflation In USA Under Biden's Administration

According to a recent Gallup survey, Americans' trust in the president has dropped 15 points under President Biden, to 23%. The worst inflation in four decades is a contributing factor. Biden discovered that inflation wouldn't lessen this week because Americans have scarcely touched the trillions in excess savings they've piled up because of his disastrous American Rescue Plan.

Weekly selection of thought-provoking ideas and conversations. Biden's first act as president was to pass $1.9 trillion in social spending disguised as pandemic relief, sending millions of Americans stimulus checks, providing the largest child tax credit ever, and extending ludicrously generous unemployment supplements that paid many Americans more to stay home than to work.

In December 2020, Congress authorized a $900 billion economic stimulus package on top of covid-19 measures.

Biden approved the American Rescue Plan, investing $1.9 trillion. Even liberal experts warned him that his proposal would cause inflationary pressures not seen in a decade.

Personal savings rates rose with Washington's free money. By 2021, U.S. families will have saved $2.7 trillion more than they would have without a pandemic, according to Moody's Analytics.

Millions of Americans decided they could afford to remain at home due to the flush of government money, causing a record labor shortage. People began buying again after epidemic lockdowns, but companies couldn't keep up with demand because they couldn't find labor. Inflation was not witnessed since the 1970s.

Today's labor deficit remains. Nearly 11.3 million positions remain empty in the U.S., virtually the same as in March. 60% of small firms can't fill available positions. The labor shortfall won't end until surplus funds are depleted.

When stimulus cheques ceased in 2021, many anticipated Americans would spend their savings and return to work. No way. The Wall Street Journal revealed last week that U.S. households had only used $114 billion of the $2.7 trillion in surplus pandemic savings. That's more than Biden's American Rescue Plan's $2.586 trillion. This fiscal cushion keeps many from working.

Once initiated, inflation is hard to stop. Biden continues stoking the fire with more expenditure and more money from Washington. Only losing Congress will halt the Democratic Party's economic pyromaniacs.

People Also Ask

What Causes Inflation?

Inflation measures an economy's rate of increasing prices for goods and services. Inflation may occur when the cost of manufacturing, such as raw materials and salaries, rises. Increased demand for goods and services may lead to inflation because customers are ready to pay more.

What Country Has Highest Inflation 2022?

Turkey had the highest inflation rate among the nations surveyed in the first quarter of 2022, at 54.8 percent.

What Is The Inflation Rate Of The World?

In 2020, the global inflation rate was around 3.18 percent higher than the previous year.

What Causes Global Inflation?

Global inflation is rising, with food and energy costs reaching all-time highs. The increase has been fueled mainly by pent-up consumer demand after the epidemic and Russia's invasion of Ukraine.

Bottomline

Inflation is pressing world economies to re-adjust as gasoline prices soared by 48%, bacon prices jumped by 15%, and eggs costs increased by 32%. Used automobiles and trucks grew by 16%, airfare jumped by 38%, and milk increased by 16%.

Hajra Shannon

Author

Paula M. Graham

Reviewer

Latest Articles

Popular Articles