What Is Fisher Effect And Why You Should Care

You may think the Fisher effect is not important and it won't affect you, but it can and it will. Let's dive in and see what it's all about.

Author:Frazer PughReviewer:Gordon DickersonJan 09, 202310.8K Shares374.5K Views

You may think the Fisher effectis not important and it won't affect you, but it can and it will. Let's dive in and see what it's all about.

What Is The Fisher Effect?

Irving Fisher, an economist, came up with a theory called the Fisher Effect that shows how inflation affects both real and nominal interest rates. It shows how inflation affects both real and nominal interest rates.

When the fisher talks, he says that the real rate of interest is equal to or can be found by subtracting the nominal interest rate from the rate of inflation. Because of this, when the nominal rate of interest changes, the real rate of interest changes as well.

Because the Fisher Effect talks about how inflation and interest work together, we can say that it's an economics theory. We're talking about both the nominal and real rate of interest at the time, though.

Nominal Interest Rates And Real Interest Rates

- Nominal interest rates - A person who invests his money in a business can see how much money he makes. The nominal interest rates show us this.

- Real interest rate - To gauge a company's ability to buy, we look at its real interest rate.

Real interest rates show how quickly money grows, whereas nominal interest rates show how quickly money grows, which is why nominal interest rates are used here, although real interest rates show how quickly money grows over time.

Fisher Effect Equation

The relationship between inflation and interest rates can be illustrated or explained using the Fisher effect equation. Because the nominal interest rate is equal to the real interest rate plus inflation, this connection can be represented mathematically by the following equation:

i ≈ r + Pi

In the following fisher equation,

- i - the nominal rate of interest

- r - the real rate of interest, and the

- Pi - the inflation or the expected inflation rate

Or it can also be depicted by the following equation:

I = r + πe

Where:

- r - refers to real interest rate,

- i - refers to nominal interest rate, and

- πe - refers to expected inflation.

There are many applications for the Fisher Equation in business and finance, including determining investor or lender demand, a company's buying power, a company's growth, and profitability, to name a few. Fisher's equation is also used to analyze the fisher effect in international finance or currency trading and the market demand for money.

How To Calculate The Fisher Effect?

The formal used for calculation is as follows:

(1 + nominal interest rate) = (1 + real interest rate) * (1 + inflation rate)

The formula In mathematical notation, can be written down as:

(1 + i) = (1 + r) * (1 + Pi)

Where the words I, r, Pi stands for:

- i - the nominal interest rate

- r - the real interest rate

- Pi - the inflation rate

So, we can derive out the formula of fisher as follows:

i ≈ r + Pi

Fisher Equation Example 1

A 1.75 percent return was achieved by a portfolio. And the rate of inflation last year was around 8%. You'll also need to figure out how much money you've made from the portfolio.

We utilized the fisher effect equation to get the true rate of return, which is as follows:

(1 + i) = (1 + r) (1 + π)

This equation can also be written down as follows, by rearranging the equation,

r = (1 + i) / (1 + π) – 1

And, now putting the values in the equation as:

I = 1.75 Percent

Π = 8 Percent

We get, r = (1 +1.75 Percent) / (1 + 8 Percent) – 1

= 6.25 Percent

So, you will earn a return of 6.25 percent on your investments.

Fisher Equation Example 2

What is the nominal interest rate if the real interest rate is 3.6 percent and the inflation rate is 2.2 percent?

We will utilize the fisher effect formula to determine the nominal interest rate using the fisher equation, which states that:

Nominal Interest Rate = Real Interest Rate + Inflation

And putting down the values in the above formula as,

Real Interest Rate = 3.6 Percent and Inflation = 2.2 Percent

we get, the equation as follows:

Nominal Interest Rate = 3.6 Percent+ 2.2 Percent= 5.80 Percent

As a result, the nominal interest rate is 5.80 percent, as computed using the Fisher calculation.

What Is The International Fisher Effect (IFE)?

Instead of using or demonstrating the relationship between pure inflation and the present and future risk-free nominal interest rates, the international fisher effect argues that the present and future risk-free nominal interest rates. The fisher's application has been expanded to include FX trading and investigation. As a result, we use it to forecast and identify present and upcoming spot currency values and their market movements.

Here, the international fisher effect formula is applied to the formula or equation below.

RR nominal=(1+RRreal) ∗ (1+inflation rate)

Where:

- RR nominal refers to the Nominal rate of return

- RR real refers to the real rate of return

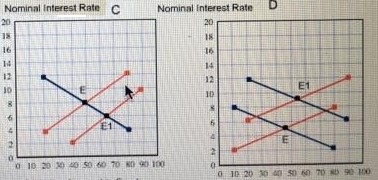

The Fisher Effect Diagram

The relationship between the real rate of interest and inflation is depicted in the fisher effect diagram above. Assume I is the nominal interest rate line, and is the constantly changing inflation rate. So, the horizontal line shows us or indicates the real rate of interest. And i=r, or the real and nominal rates of interest are equal, is the point where the nominal rate of interest intersects the real rate of interest.

The nominal interest rate is on the vertical axis, and the rate of inflation is on the horizontal axis. In contrast, line A in the diagram above depicts monetary policy, or the amount of money available in the market. In the shown fisher's diagram, the dotted line B depicts the link between the nominal interest rate and inflation rates. And we have assumed real interest rate to be 2 Percent.

The point E in the diagram is the equilibrium point where the real rate of interest is equal to 2 Percent, which is the equilibrium rate in the long term or where the nominal rate of interest is equal to the real rate of interest.

The Fisher Effect Graph

When the predicted inflation rate of 0% was achieved by matching supply with demand, The nominal interest rate at the time was 4%, but with the increase in demand and availability of loanable funds, the inflation rate has also risen.

This graph by Fisher shows that the nominal rate of interest rises in tandem with rising supply and demand or inflation. As a result, the nominal interest rate and inflation have an inverse relationship.

Advantages Of The Fisher Effect

- It shows a clear picture of the difference between the nominal rate of interest and the real rate of interest, making it easy to see.

- It helps the economy grow in a long-term way.

Disadvantages Of The Fisher Effect

- Can make interest rates rise by cutting nominal interest rates, which can make them rise.

- Because prices keep going up, the real rate of interest can go up.

Conclusion

There you have it. We now see how the Fisher effect can affect you and me and how important it is. Hopefully, this article has given you enough insights on the matter.

Frazer Pugh

Author

Gordon Dickerson

Reviewer

Latest Articles

Popular Articles