Everything You Want To Know About Epic Games Stock

Epic Games' creator and CEO, Tom Sweeney, controls more than half of the company's shares. Tencent Holdings, a Chinese corporation, is Epic Games' second-biggest shareholder (TCEHY). The world's biggest video gaming business, Tencent, controls about 40% of Epic Games' shares.

Author:Elisa MuellerReviewer:James PierceNov 15, 202148.1K Shares1.2M Views

Epic Games' creator and CEO, Tom Sweeney, controls more than half of the company's shares. Tencent Holdings, a Chinese corporation, is Epic Games' second-biggest shareholder (TCEHY). The world's biggest video gaming business, Tencent, controls about 40% of Epic Games' shares.

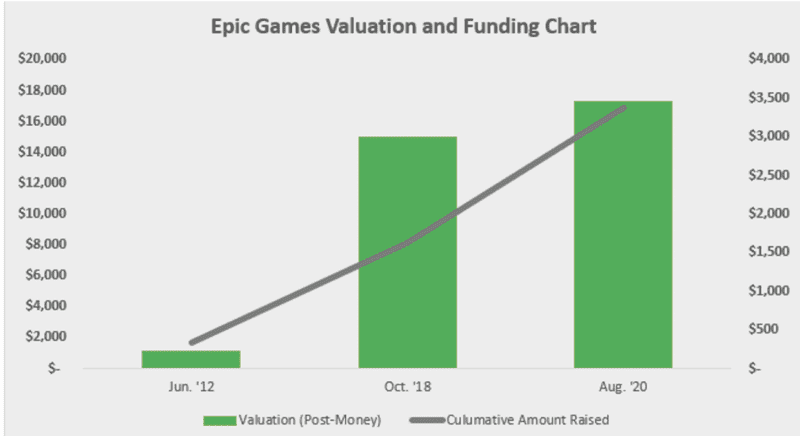

Baillie Gifford, Fidelity, Lightspeed Venture Partners, the Ontario Teachers' Pension Plan Board, T. Rowe Price, Blackrock, David Tepper, KKR, and Smash Ventures are among Epic's major investors. Epic Games' most recent fundraising round, which closed in August 2020, garnered $17.3 billion from private investors, indicating that the company can obtain massive sums of money without issuing shares.

Epic Games Stock Price

Epic Games' stock price is presently unknown since it is not traded on any stock market. Tom Sweeney, the company's creator, as well as venture capital firms, and Tencent Holdings, one of the world's biggest video businesses, hold 100% of the company. To purchase Epic Games stock, you must first purchase Tencent Holdings shares.

Epic Games Stock Symbol

Epic Games does not have a stock symbol since it is a privately owned business that is not presently traded on any worldwide stock market. Because the stock ticker EPIC is presently unavailable in the United States, EPIC would be an excellent symbol for Epic Games shares. Epic Games will not have a stock symbol until it files for an IPO.

Does Epic Games Have Stock?

Yes, Epic Games has equity, but the company's shares are kept privately. As a result, as a retail investor, you will be unable to purchase Epic Games shares via a stock exchange or brokerage account. You'll have to put your money into businesses that hold Epic Games shares.

The Epic Games Value Proposition

Epic generates revenue by selling a broad range of games on its website. Users purchase a chance to participate in the games after downloading them. Some of the games, like "Medium", are very expensive.

On February 2, 2021, for example, users paid $44.99 to get Medium. Bloodlines 2 was another game that sold for $59.99. Epic also offers games from other companies, such as Rockstar's Red Dead Online and Electronic Arts' Star Wars games.

Epic Games earns more money from its own games by charging a commission on the outside titles it sells. Epic is hoping that customers who go to Epic Games' shop to purchase such games will also go to Epic Games' store to buy Epic's games.

Epic Games generates money by allowing players to play their massively multiplayer online games for free. Epic sells additional weapons and accouterments to players who desire them. According to SuperDataResearch, Epic Games earned $1.8 billion in sales from Fortnite in 2019.

According to Sensor Tower, Fortnite earned over $25 million in its debut month on the Apple App Store in 2018. Because Epic Games introduced an in-app payment mechanism that circumvented the App Shop's 30% charge, Apple (AAPL) kicked Fortnite off of the App Store in April 2020, causing criticism and highlighting Apple's misuse of power in the monology app store it controls.

Because the Apple Store is the world's biggest software marketplace, this move may harm Epic. Fortnite has also been removed from Alphabet's (GOOG) Google Play, the world's second-largest app store.

When Can I Buy Epic Games’ Stock?

You'll have to wait until Epic Games files for an IPO or does a reverse merger with an existing "blank check" special purpose acquisition company, or SPAC, if you're a non-accredited investor (those meeting the Securities and Exchange Commission's definitions of annual income or total net worth limits). Epic Games' initial public offering (IPO) does not seem to be in the cards for 2021.

Tim Sweeney hasn't said when he plans to file for an IPO, but Epic Games won't need to rely on public funds since private investors have come up to buy the company. Furthermore, Tim Sweeney has spoken out against revenue-enhancing techniques like loot boxes and user manipulation to boost monetization that he believes are detrimental to customers.

These tactics are prevalent in publicly listed businesses' games. Tim Sweeney still has a controlling share in the company after 30 years, indicating that he prefers to be in charge. In the end, accessing the public markets means relinquishing power, and it's conceivable that he sees quarterly shareholder demands as incompatible with his long-term goals.

Epic Games Stock Market And Ipo

The business will not be going public anytime soon since it already has a large footprint that allows it to generate money without having to go public. In the present situation, Mr. Sweeney, the founder, owns everything but Tencent's money in his hands.

If Epic goes public on a stock exchange, the whole control structure will be altered. It is not necessary to become public until it is unable to raise funds via private sources. Epic is the newest tech unicorn, generating enough revenue from memberships and sales to keep them afloat for years. However, if someone wishes to invest, there are a few options available.

The Three Most Effective Methods To Invest In Epic Games And Other Alternatives Are As Follows

Tencent Holdings & Epic Games

Tencent Holdings and Epic Games are the first two companies on the list. So what if Epic Games' IPO isn't successful? Tencent does, and since they own almost 40% of the company, it's a fantastic opportunity to indirectly participate in it.

Its stock symbol is TCEHY, and it is the world's biggest video gaming business, backed by a Chinese multinational corporation. League of Legends, a riot game, is one of Tencent's most well-known games.

According to PCGamer, it is the most played computer game of all time. In reality, 115 million people played the game in 2020, generating a staggering $1.5 billion in income. Furthermore, Tencent owns 100% of the company, making it a lucrative investment for investors.

Tencent also owns an 80 percent stake in Grinding Gear Games, which owns Path of Exile, which had approximately 240,000 players in January 2020 and has grown by 11% since then.

Tencent was valued at $16.2 billion by Macrotrends in the second quarter of 2020, and its gross profit was projected to be 142.12 billion Yuan by Statista. Tencent recorded an operational profit of 109.400 billion yuan, or $16.93 billion.

When we look at these numbers together, we can see that Tencent is a big business with a lot of potentials. Due to the currency conversion, it is difficult to determine additional figures such as net profits and income, but the worth of this business speaks for itself.

Mr.Market has valued its shares at $93.90 as of February 3, 2022, which is ideal for this Chinese holding, and their profile is worth noting if you're seeking to invest in a business similar to theirs.

Though some investors may be concerned about their agreements with the Chinese Communist Party, others will be confident in the Chinese government's security. Also, if someone believes that investing in Tencent would cause the American economy to falter, they should be aware that Tencent paid out a dividend on May 14, 2020.

Leading Competitor Electronic Arts

This company, which trades under the symbol EA, is one of the largest gaming businesses that is also publicly traded. NFL, FIFA, Star Wars, Need For Speed, UFC, The Sims, Apex Legends, NHL, and Medal Of Honor are just a few of the major games available.

According to Statista, Apex Legends from EA has over 70 million players globally in 2019. The business is quite successful at generating money from games, and on September 30, 2020, it announced a quarter's gross profit of $865 million, with an operating income of $149 million.

Its revenue for the same quarter was reported as $1.151 billion on the same day. However, as compared to 2019, the figures in this announcement were lower. It reported $1.593 billion in quarterly sales that year, but the little discrepancy shouldn't influence your choice since the numbers still indicate a very lucrative potential.

Mr. Market estimates that its shares will be worth $138.06 apiece on February 4, 2022. This is a higher value than in 2019 when their stock was only worth $107.7.

These prices do not determine their buzz; their functionality does, and when we examine it, it is undeniably a fantastic method to add additional value to your current investment portfolio.

Activision Blizzard, Inc.

Activision Blizzard, the firm behind the popular Candy Crush Saga, is a worthwhile investment. Its stock symbol is ATVI. Call of Duty, World of Warcraft, and Overwatch are also included. World of Warcraft is a well-known game with 4.74 million users in 2022, despite being ridiculed.

According to Statista, the business has issues with player consistency. According to the statistics, World of Warcraft had 5.67 million members in 2016, and by 2023, the number will be much lower.

However, Call of Duty and Candy Crush share the same failure, with Candy Crush having 273 million active players as of 2020 and Call of Duty having 110 million active users. Activision claimed a 25% increase in player count between the third and fourth quarters of 2019 and 2020, as well as a 46% increase in in-game sales.

The firm conducts a lot of business; its operating income for the quarter ended September 30, 2020, was $778 million, and its gross profit for the same period was $1.485 million.

The figures were higher than in 2019 when the company's quarterly operating income was $454 million. The company's gross profit rose by $1.33 billion. In 2020, however, sales dropped from $1.986 billion to $1.954 billion.

Nonetheless, sales are expected to increase by 52% in the coming year, according to Stockrow. This is significant since the anticipated rate in June 2020 was 38.4 percent, but in December 2019, it was -16.62 percent.

In September 2020, its ending cash flow was estimated to be $1.077 billion, while its long-term debt was reported to be approximately $3.065 million for the same month and year.

It also paid an annual dividend in April 2002, which was greater than the one paid in 2019. If you don't want to invest in Epic Games, this stock is a great option; the prices are increasing slowly but consistently. If you don't want to invest in a gaming business with a volatile stock, Activision is a secure bet.

Elisa Mueller

Author

James Pierce

Reviewer

Latest Articles

Popular Articles