Should You Consider Investing in 3D Printing Stocks? Here Are Some of the Best Companies to Invest In

All in all, the 3D printing industry has outperformed the wider economy. In addition, in 2020, the two largest winners were both the two greatest winners in the last 5 years and at least earned a spot on investor watch lists.

Author:Habiba AshtonReviewer:Gordon DickersonMay 27, 202128.1K Shares598.5K Views

All in all, the 3D printing industry has outperformed the wider economy. In addition, in 2020, the two largest winners were both the two greatest winners in the last 5 years and at least earned a spot on investor watch lists.

There is cause to expect that certain long-term champions would be at the party. According to Statista, the global demand for 3D printing goods and services is projected to hit close to $41 billion by 2024, with a sharp annual growth pace of more than 26 percent.

If you want to know the hottest 3D printing stocks right now, here’s a helpful guide for you.

What Are 3D Printing Stocks?

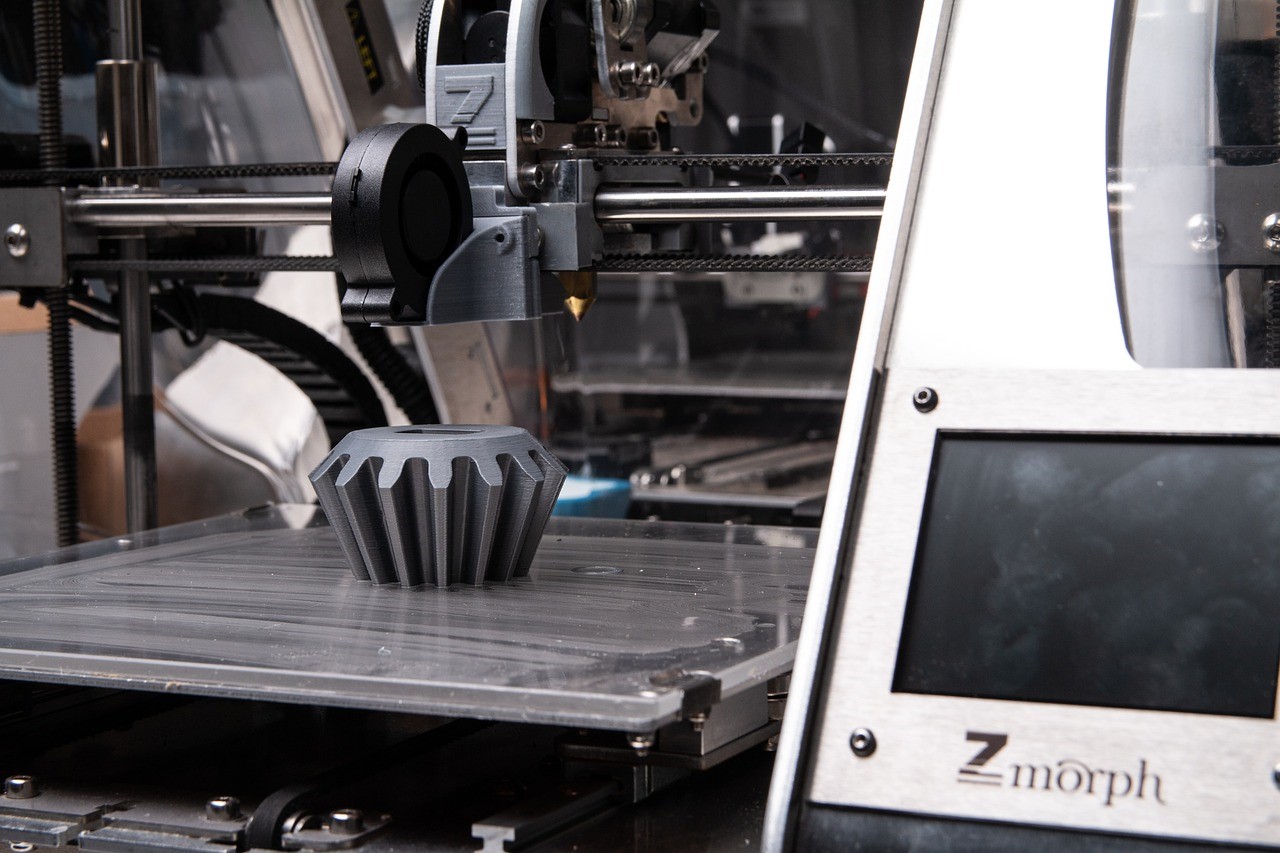

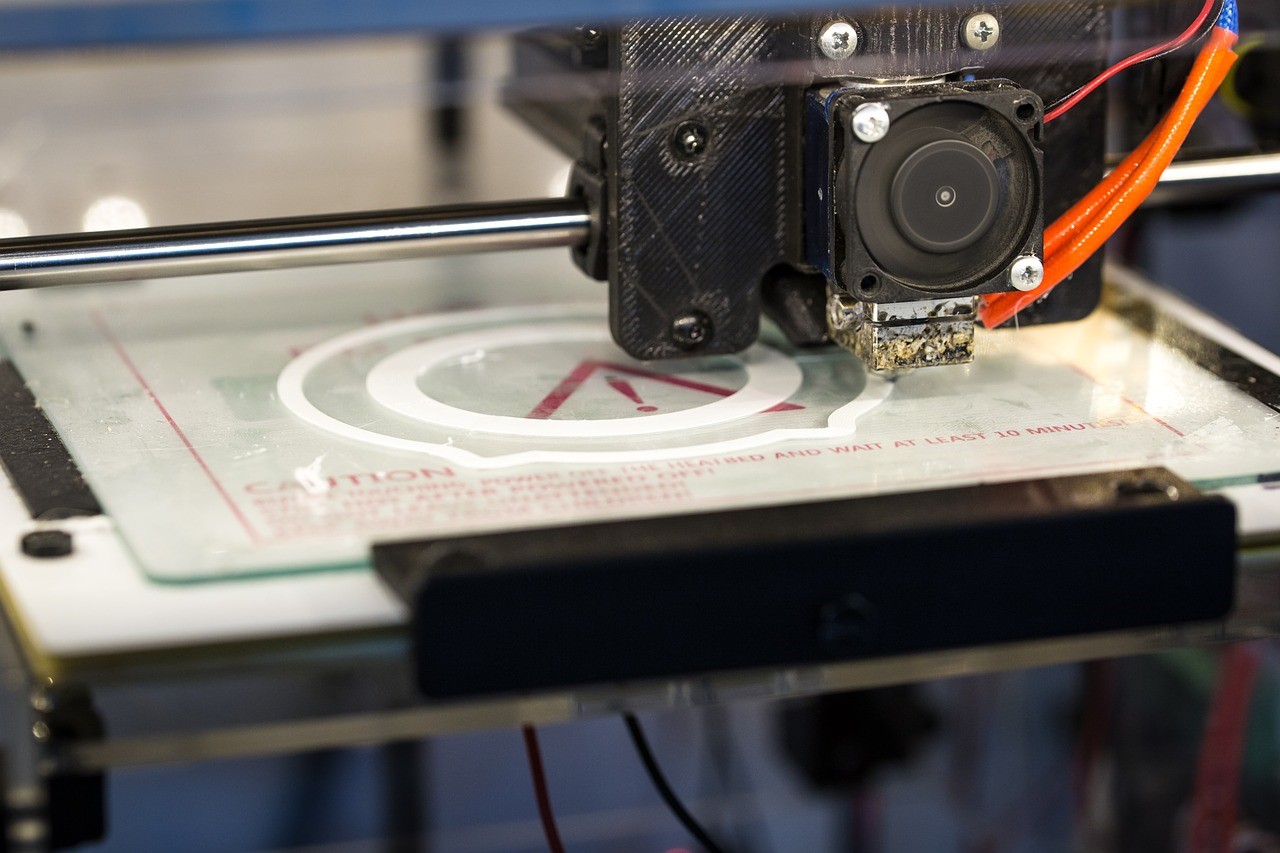

The 3D printing market is defined as companies that offer a range of products and services. 3D printing, commonly known as additive production, produces digital tangible structures. The method of printing operates by laying thin layers of substance in the shape of liquid or powdered plastic, cement, or metal and fusing them together.

While it is still too sluggish to use in industrial production, this technology is innovative and will challenge the industrial logistics and stock storage industries. There are just a couple of companies in the3D printing business, like Proto Labs Inc. (PRLB) and Faro Technologies Inc. (FARO).

Why Are 3D Printing Stocks So Popular?

Global 3D printing investment is booming. In the last 12 months, the market has received hundreds of millions – with emerging businesses thriving from the surge of financing. Among the major announcements made in the first few months of FY20 are Desktop Metal (160 million dollars), Markforged (82 million dollars), and 3D Hubs (18 million dollars). With the additive production industry increasingly catching investors' interest, what does this imply for the rest of 3D printing?

The Early Hype In 2010

3D printing was very exciting and hyped in the early 2010s. This was fueled in part by the expiry of different patents and the prospect of the 3D consumer printing movement. Proponents say that this revolution will take 3D printers into all homes and allow users to print 3D items on request.

Industrial Printing

According to the Smartech Publishing business consulting group, the 3D printing industry rose to $9.3 billion in 2018. By 2022, the very same study forecasts an increase of $20 billion in the market to indicate a very promising outlook for the industry.

But from where did this resurgence come?

Response:3D industrial printing.

Hardware Investment

In addition, manufacturing has moved to production. 3D printing technologies are really exciting.

The ultimate goal of 3D printing was high-volume manufacturing, with reduced prices and higher speeds. Hardware manufacturers are rapidly designing modern production-oriented technologies to fulfill this vision.

Moving Forward

While hardware tends to get the largest part of the investment slice, on-demand digital manufacturing systems still have a great deal of appeal. These networks provide consumers with links to a network of suppliers of 3D printing services that enable producers to generate parts quicker and closer to the requirements.

If the networks and services evolve, the platforms will potentially become a major driver of the development of the supply chain. This future promise is a core factor behind the rising excitement among shareholders in on-demand production platforms.

Top 3D Printing Stocks To Invest In

Materialize (MTLS)

- Revenue (TTM): 205.3 million

- Net Income (TTM):-2.7 million

- Market Cap: 1.9 billion

- Total Return of 1-Year Trailing: 94.8%

- NASDAQ

*All figures in dollars

Materialize works worldwide, with its headquarters in Belgium. There are 3 segments: 3D printing applications, 3D printing facilities, and medical printing services. The above covers 3D medical instruments, 3D medical printing systems, and 3D tools for medical purposes.

The corporation was not profitable in the following 12 months from the point of view of net income or benefit but produced positive free cash flow (FCF) for the same time. For some time, its company has been stronger than 3D Systems and Stratasys, while Proto Labs has done the best of all these businesses.

Like other 3D printing firms, the total financial production of Materialise was affected by the COVID-19 pandemic this year.

3D Systems (DDD)

- Revenue (TTM): 566.6 million

- Net Income (TTM):-78.4 million

- Market Cap: 632.3 million

- Total Retrun of 1-Year Trailing:-24.6%

- New York Stock Exchange

*All figures in dollars

The ETF 3D Printing, which started trading in 2016, is the only exchange fund based on this field. It is not an actual investment, it tracks a measure.

As of December 2020, it had 51 stock portfolios. Many firms are listed openly in the USA, while some are exchanged exclusively on international markets. The top ten holdings weighed approximately 52 percent, making them moderately focused. As of December 2020, the six best shares are 3D Systems (7.3% in weight), SLM Solutions (6.5%), Stratasys (5.5%), Proto Labs (5.5%), HP Inc. (5%), and Materialise (4.9 percent).

3D Systems and Stratasys also offer 3D printing facilities on request, including scanners, applications, and supplies. Centered in Germany and mentioned on the Frankfurt stock exchange, SLM Solutions specializes in the production of metal 3D printers. HP joined the business of 3D printers in 2016.

Many smaller firms in the ETF are businesses that use 3D printing in their processes instead of supplying 3D printing materials. An indication of this is the 18th highest holding of Align Technology, which accounts for about 1.6 percent of the portfolio. Align utilizes 3D printing to produce dental dentures in plain plastic.

Photo Labs (PRLB)

- Revenue (TTM): 451.0 million

- Net Income (TTM): 58.6 million

- Market Cap: 3.9 billion

- Total Return of 1-Year Trailing: 58.2%

- New York Stock Exchange

*All figures in dollars

Proto Labs is a technology-enabled, fast-turn manufacturing company of plastic and metal prototypes and short-run components headquartered in Minnesota. It provides both standard and 3D printing facilities to customers and works in the U. S., Europe, and Japan.

The 3D printing corporation competes with 3D Systems and Stratasys and other smaller competitors. However, Proto Labs is also a client of 3D Systems and Stratasys because there are 3D printers from several vendors in our factories.

In the third period of 2020, the 3D printing sales of Proto Labs contributed to 15.1% of the overall sales. While this is a comparatively small number, it grew faster than the overall conventional manufacturing services of the group.

FARO Technologies Inc. (FARO)

- Sales (TTM): 334.7 million

- Net Income (TTM):-79.7 million

- 1.0 billion in market capitalization

- Trailing for 1-year Total Return: 20.6%

- NASDAQ

*All figures in dollars

FARO specializes in 3D measurement as well as other architectural, technical, and design services. FARO 'started with a 40-year tradition until the introduction of 3D printing. The items of the firm include coordinating equipment, laser tracking systems, and projectors, mappers, scanners, and applications. In addition, FARO represents the aircraft, manufacturing, and electricity sectors.

The ExOne Co. (XONE)

- Sales (TTM): 52.9 million.

- Net Incomes (TTM):-14.5 million

- Cap Market: 238.2 million

- Total return of 1-year trail: 48.3 percent

- NASDAQ

*All figures are in dollars

ExOne specializes in the production of 3D robots for consumers in different industries. It also manufactures 3D printed components for commercial customers. ExOne 3D Printers use binder jetting technology to fuse onto molds, cores, and other components powder particles such as metal or sand.

Habiba Ashton

Author

Gordon Dickerson

Reviewer

Latest Articles

Popular Articles