How Should I Invest My Money - Ways To Investing Your Money With Low Risk

The question of "How should I invest my money?" cannot be avoided because investing none of it is a tacit choice. The best response would be very individualized, but anyone can consider this topic with the necessary risk knowledge.

Author:Habiba AshtonReviewer:Gordon DickersonApr 09, 202318 Shares436 Views

The question of "How should I invest my money?" cannot be avoided because investing none of it is a tacit choice. The best response would be very individualized, but anyone can consider this topic with the necessary risk knowledge.

When it comes to investments, risk of loss can be thought of on a continuum: some securities, like US Treasury savings bonds, can be safely considered to carry no risk; others, like diversified stock funds, have moderate risk; and still others, like hedge fund purchases of distressed debt, carry extreme risk, including the risk of total loss.

The options with the lowest risk yield modest, steady returns. With the prospect of significantly greater profit, stock market index funds need the client to endure significant volatility.

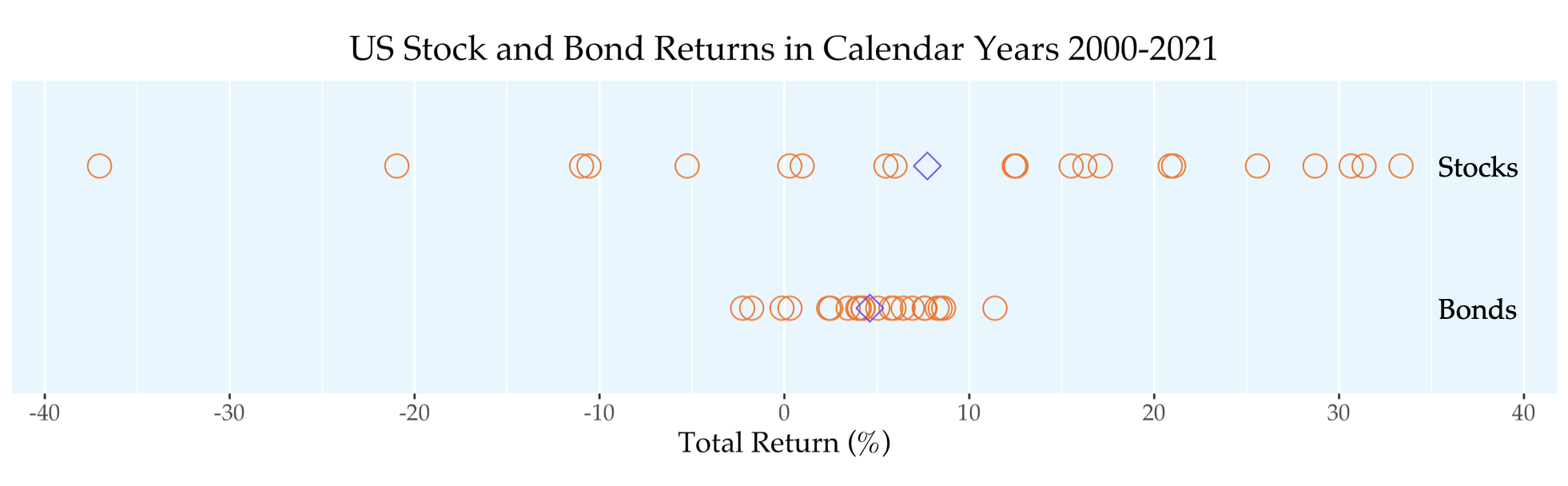

See the graph below, which shows the US stock and bond markets' annual returns since 2000. Take note of how most annual stock returns deviate greatly from the average (the purple diamond).

US Stock And Bonds Returns

The returns on US aggregate bonds were more closely clustered around the average, but the average return was lower in exchange for the benefit of lower volatility. During this time, the average return on US aggregate bonds was 4.6%, compared to a 7.7% return on US cap-weighted stocks. This is very similar to the 8% global average for stocks since 1900.

A negative bond return occurred in 13% of rolling years during this 22-year period, and a negative stock return occurred in 24% of rolling years. Only looking at annual returns obscures a lot of volatility; we can focus on monthly and daily returns. 33% of rolling months and 38% of days for US bonds were negative.

In the case of US stocks, 36% of rolling months and 45% of days were bearish. This exemplifies one of the most important realities of investing in volatile assets: short-term returns are frequently negative - a single day for stocks is virtually a coin flip. Diversified investors, on the other hand, can be confident that as they invest over time, the likelihood of a good return approaches 100%.

The statistical phrase "expected return" denotes the average return from the distribution of alternative returns. The anticipated value of rolling a six-sided die is 3.5, because that is the average of the possible results 1,2,3,4,5,6, and they are all equally likely.

Even though it is not a feasible outcome, the expected value is 3.5! Stocks may have an "expected return" of 8%, but we rarely expect anything close to that. Because stock returns are widely spread around the mean, you should expect substantially higher or lower returns than 8% far more frequently than returns around 8%. Watch the video below to know more.

What Are Normal Stock Returns?

What Are The Benefits Of Investing?

You can generate an income to live comfortably by working as a professional, a business owner, or a paid employee. Additionally, you probably have some extra money after meeting all of your immediate necessities.

What are you going to do with this extra cash? Do you indulge in a few luxury items? Do you keep it in your bank or hold it as cash? Or do you use it effectively to get a respectable return? The query "how to invest money" arises in this situation.

Just as crucial as having a source of income is investing your money. By assisting you in attaining your financial objectives for the now and the future, wise investments aid in the financial security of your life.

You may increase your wealth, develop a second source of income, and get returns that outperform inflation by investing. After retirement, when your normal income quits, it guarantees that you continue to live well.

Beginner's Guide To Investing

The described list below of investment options is not particularly comprehensive. All of these, meanwhile, might not be appropriate for beginners in investing.

If you are unfamiliar with the complexities of various investment options, investing money can be difficult for novices. Limiting your investments to PPF, fixed deposits, mutual funds, and financial instruments connected to insurance may make sense.

Investment Options

Insurance Plans

Young novices with a reliable source of money will benefit greatly from these devices. You can choose pure protection options like term insurance that offer your family financial security in the tragic event of your untimely passing. The alternative is to choose strategies that combine insurance and savings, such as Unit Linked Insurance Plans (ULIPs). Health plans, critical sickness plans, and accidental insurance plans are some other types of insurance.

Mutual Funds

For novice investors, mutual funds are a popular investment option. You have the benefit of participating in stock markets indirectly through mutual funds thanks to the knowledge of experienced managers. You might not have the time to follow the stock market and make any direct investments if you are too busy with your work, career, or business. Mutual funds can be useful in situations like this. You have a variety of options, including debt and equity mutual funds, balanced funds, and other similar vehicles. You also have plans that provide possibilities for growth or dividend income. Depending on your financial objectives and risk tolerance, you can choose.

Numerous alternatives exist with mutual funds to manage liquidity, income, growth, and safety.

Provident Fund (PF), Fixed Deposits, And Modest Savings

Small savings accounts, Provident Fund (PF), and fixed deposits are safe investments with mediocre returns. These provide greater safety and liquidity. If you earn a salary, you have the option of choosing voluntary PF in addition to employee PF. Small savings plans are also appropriate for novices to make a respectable living.

Tax Benefits

There are tax breaks for investing in different ways. When you invest, you need to think about how tax breaks and returns compare to each other.

A Step-by-step Lesson On How To Invest Money In The Best Manner

Each person's financial condition is different. Your personal tastes, coupled with your financial situation both now and in the future, will determine the ideal investment strategy for you. When creating a strong investment strategy, it's critical to have a thorough awareness of your income and expenses, assets and liabilities, obligations, and goals.

You can decide how to invest your money right now using the following five steps:

- Determine your financial objectives, timetable, and feelings around risk.

- Choose between a "do it yourself" and a "manage it for me" strategy.

- Select the investment account type you'll use, such as a 401(k), IRA, taxable brokerage account, or education investment account.

- Get a bank account.

- Select a portfolio of investments that provides diversification and matches your risk tolerance (stocks, bonds, mutual funds, real estate).

You'll need a fundamental understanding of how to invest your money properly before you put your hard-earned money into an investment vehicle. However, there isn't a universal solution to this. Whichever strategy works best for you is the greatest approach to invest your money. You should think about your investing style, your spending limit, and your risk tolerance when determining that. Now, let's discuss different ways you can invest money with low risk.

Your Personal Style

How Much Time Are You Willing To Devote In Your Financial Decisions?

When it comes to the many ways to invest money, there are two main camps in the investing world: active investment and passive investing. Both approaches, in our opinion, have merit - as long as you keep an eye on the big picture and don't only consider the here and now. However, you might have a preference for one type depending on your way of life, finances, risk tolerance, and interests.

The term "active investing" refers to the practice of independently conducting market analysis, building, and monitoring a portfolio. You intend to be an active investor if you intend to buy and sell individual stocks via an online broker. You will need three elements in order to properly engage in active investing.

- Time- Active investing necessitates extensive research. You'll need to discover investment prospects, perform some basic analysis, and monitor your investments once you've purchased them.

- Knowledge- Having all the time in the world won't help you if you don't know how to analyze investments and study companies properly. Before investing in stocks, you should at least be conversant with the fundamentals of stock analysis.

- Desire- A lot of individuals just don't want to put in that kind of time with their assets. And, because passive investing have historically provided high returns, there is nothing wrong with this strategy. Active investing has the potential for higher returns, but you must be willing to put in the work to get it right.

Instead of flying an airplane manually, passive investment is comparable to setting it on autopilot. Over time, you'll still obtain good outcomes, and it takes far less work.

In a nutshell, passive investing entails using investment vehicles where the hard work is already being done by someone else; mutual fund investing is an example of this method. Or you could employ a mixed strategy. For instance, you may employ a robo-advisor to create and implement an investing strategy on your behalf instead of hiring a financial or investment advisor.

| Passive Investing | Active Investing |

| More simplicity, more stability, more predictability | More work, more risk, more potential reward |

| Hands-off approach | You do the investing yourself (or through a portfolio manager) |

| Moderate returns | Lots of research |

| Tax advantages | Potential for huge, life-changing returns |

Your Budget

What Kind Of Financial Commitment Can You Make?

Although you might believe that you need a significant number of money to establish a portfolio, you can start investing with just $100. The most crucial factor is to ensure that you are financially prepared to invest and that you consistently make investments over time, not the amount of money you start with.

Establishing an emergency fund is a crucial step before investing. This is money that has been set aside in a way that allows for a speedy withdrawal. You never want to find yourself having to sell (or divest) your investments in a time of need. All investments, whether stocks, mutual funds, or real estate, have some level of risk. Your safety net to prevent this is the emergency fund.

The majority of financial experts recommend that the ideal amount for an emergency fund be sufficient to cover costs for six months. The issue is that you just don't want to have to liquidate your investments every time you have a flat tire or have some other unforeseen expense show up. While this is unquestionably a good aim, you don't need this much set aside before you can invest.

Before beginning to invest, it's a good idea to pay off any high-interest debt (like credit card debt). Consider this: Over lengthy periods of time, the stock market has historically generated returns of 9%–10% every year. You place yourself in a position to lose money over the long run if you invest your money at these types of returns and pay your creditors interest rates of 16%, 18%, or greater at the same time.

Your Capacity For Risk

What Level Of Financial Risk Are You Ready To Accept?

Investments don't always turn out well. Each investment type carries a unique level of risk, but returns and risk are frequently associated. It's crucial to strike a balance between increasing your financial returns and determining how much risk you can tolerate.

Bonds, for instance, yield comparatively low returns of just 2% to 3% but offer consistent returns with very low risk. Contrarily, stock returns can differ significantly depending on the company and time period, but the overall stock market typically returns close to 10% annually.

There might be significant variations in risk even between the broad categories of stocks and bonds. A Treasury bond or a corporate bond with a AAA rating, for instance, is a very low-risk investment, although these are likely to offer low interest rates.

Even lower risk, but with less profit, is represented by savings accounts. A high-yield bond, on the other hand, has a higher income potential but a higher default risk. The level of risk varies significantly between penny stocks and blue-chip companies like Apple (NASDAQ:AAPL) in the world of stocks.

People Also Ask

What Is The Best Thing To Invest In 2022?

Some of these are:

- High-yield savings accounts

- Short-term certificates of deposit

- Short-term government bond funds

- Series I bonds

- Short-term corporate bond funds

Where Should I Invest My Money To Grow?

Well, here we are at the difficult subject, and the bad news is that there is no easy solution. How you want to put your money to work determines what kind of investment is ideal. You should be in a much better position to choose where to put your money after reading the preceding suggestions.

One option is to invest in individual stocks, which can be beneficial if you have a high risk tolerance, the time to do so, and the motivation to learn the ropes. Bond investments (or bond funds) could be a good option if you have a low risk tolerance but yet desire larger returns than you'd get from a savings account.

Is Bitcoin Is A Good Investment?

Investing In Bitcoin In 2022... A Good Idea?

If you want to enhance your portfolio's exposure to cryptocurrencies and have a high risk tolerance, you should consider investing in Bitcoin, the most valuable cryptocurrency by market capitalization. But it's not a guarantee.

Some people see red signals in its excessive price volatility, regulatory uncertainty, and limited utility. Skeptics contend that the price at which it is offered dramatically overstates its genuine value, despite the fact that it makes it possible for individuals to conduct worldwide business at a relatively low cost and preserves users' privacy through the inventive application of a decentralized blockchain. Others claim it is useless and will eventually burst like a bubble.

To lower your overall risk exposure if you decide to invest, it's crucial to keep a diversified portfolio with a variety of investments. Don't put more than 10% of your portfolio into hazardous investments like Bitcoin, as a general guideline.

Final Say

Most investors benefit from fund investing since it takes time and expertise to assemble a diversified portfolio of individual stocks and bonds. Since it may only take four or five funds to create an appropriate level of diversification, index funds and ETFs are frequently inexpensive and simple to handle.

However you wanto to invest and handle your money is up to you. Just do proper research first before you dive in to anything and spend your hard earned money.

Habiba Ashton

Author

Gordon Dickerson

Reviewer

Latest Articles

Popular Articles