Everything You Need to Know About the War Between Reddit Vs Wall Street

In September 2019, Keith Gill, an armchair investor, sat down at his computer and began to talk about his findings in the stock market. How did that that singular act launch one of the most effective revolutions in financial history?

Author:Luqman JacksonReviewer:Liam EvansFeb 17, 202194.8K Shares1.5M Views

For years, the world as we know it has continued to turn into a very strange place to prove that anything can happen. It did the same in 2021. In early January, a battle that went viral, occurred in the least of places expected: the stock market. Perceived to be a monumental conflict between investors on the Internet and large hedge funds, it was a battle that has been highly publicized and given the media coverage it deserves.

But what exactly was the full story behind the battle and what consequences are both players and spectators expecting to see?

Everything began in September 2019 when Keith Gill, an armchair investor,sat down at his computer and signed into YouTube, and began to talk about the interesting thing he noticed happening in the stock market. He didn’t stop there. He also took to Reddit and started posting about his observations. Like expected whenever new and strange things are being revealed, no one took Gill seriously. In fact, most of the people on the forum laughed at him. But Keith believed that the payoff would be huge. Nobody at that time understood what he was doing. But his observations and the decision he took to share and talk about them would set in motion one of the most insane moments in financial history, beginning from America. It would bring multi billion dollar hedge funds to their knees and sparked a social rebellion between the public and Wall Street that has never been seen before.

This is the story of how one, humble Reddit user kicked off a revolution that rocked the financial world.

Prelude

In one swift move in 2000, Bill Clinton signed the Commodity Futures Modernization Act, an act that ushered in the age of financialization. If anything, this proved to be one of the most uncalculated decisions of his administration.

Within a short time of signing the act, the financial sector began to have an increasing influence over the overall economy. Instead of producing goods or services, large sectors of the economy were more dedicated to engineering creative ways to make money with money.

Although it came far too late, Bill Clinton later admitted that he made a huge mistake. The floodgates for market speculation were opened. Everywhere, more unusual but fancy financial products were invented and sold to the public. Where the banks and financial players were supposed to have regulated themselves, they did exactly the opposite. Financial products would be traded privately without supervision, completely eliminating connection to any actual underlying asset. However, the risks that were created in the financial systems were real and had material implications.

In 2008, everything went out of control, ushering in the crises in the global financial system. There were millions of bailouts for the banks and hedge funds, while millions of ordinary people lost their jobs. As more and more works became scarce and many were finding it hard to provide for their families, people were becoming fed up with the system.

The anger intensified three years later, motivated by inequality in wealth and political corruption. A movement called Occupy Wallstreet, soon erupted on September 17 2011 intending to protest against the bankers and show them that they couldn’t get away with gambling with other people’s money.

While all this was going on, something else was happening: within a year, it seemed that everyone lost focus on the financial issue, and instead of challenging the banks and holding them to account, society began to fight one another over their differences. Meanwhile, the financial institutions could breathe at the turn of events.

Present Day

In 2020, a global pandemicwould trigger a lockdown around the world, changing the lives of families forever. In the United States, about 47% of jobs come from small businesses. So, naturally, shutting down the economy would only bring about economic devastation. With people out of work, and many others growing restless with their situation, it didn’t take them long to notice that massive corporations such as Amazon, Walmart, and others were thriving financially while the ordinary people’s businesses were shut down and their jobs were gone. They were simply suffering during a financial markets boom. The rich were, once again, getting richer while the poor lost everything. Extracting wealth from the little man to the financialized economy was something that has happened many times before in history. And it always comes with terrible consequences. With jobs gone, with nothing to do, and with only limited government support in the form of stimulus checks, the ground for the battle of the poor against the financial institutions has been set.

The Wall Street Bets Forum

In 2012, thirty-year-old Jamie Rogozinski was browsing a forum called Reddit from time to time. He had made some extra cash at that time while working in Washington DC. He started a subReddit called r/WallStreetBetsin order to gather a community around investing, and for the first few years, the r/WallStreetBets forum only managed a few thousand users. Then, in 2019, some brokerage giants eliminated trading commissions for their apps. They made trading free and accessible. Shortly after this move, retail investments exploded into the scene.

The number of r/WallStreetBets quickly drew past over 500 thousand, then 1 million in March 2020. But, this time, the Reddit community was operating with a mind of its own. Jamie, its original creator, voiced his concerns that it was spiraling out of control. In a move to correct this, he deleted some moderators as he saw fit. Apparently, this didn’t go down well with the other moderators who ejected him from the forum. This means only thing: This was now bigger than Jamie. In a statement to the Wallstreet Journal, he noted that r/WallStreetBets is no longer what it used to be.

It was around this time that all this was going on that Keith Gill, a user in the r/WallStreetBets forum, began to share the interesting thing he noticed happening in the stock markets.

The Seeds Of The Rebellion

On his YouTube channel, Keith Gill laid out his game plan: to buy a stock of the company called GameStop, an unassuming store founded in 1984 and familiar to most people in the United States. GameStop had a simple business model: to sell video games and gaming equipment out of its physical store locations. Logically, this model becomes less lucrative as more games have moved to online purchases and, from what it seemed, GameStop was on the verge of bankruptcy.

Keith Gill overlooked and felt that the fear of GameStop going bankrupt was completely overblown. Although the company was closing stores, by looking at their “10-Q” quarterly financial reports, they actually had a lot of cash and could pay off their debts. And the company could recover, just with some good management.

On his YouTube channel, Keith would prove his point with evidence: he was reading blogs, press releases, seeking out articles, company notes, and more, just to prove that the stock was essentially undervalued. He knew that new games were coming out soon, and this would be great for GameStop sales. He also theorized that the move to digital was also a lot slower than people were thinking and this would be important for the company over the next couple of years. He put up articles and videos of people talking about a physical game disk versus physical downloads. He also realized that there were still a lot of demands for physical games, meaning even more revenue for GameStop.

While doing all this, Keith Gill was diligent and left no stone unturned to make his case. In September of the same year, he invested $53000 in GameStop.

“„“…the train is clearly going toward digital. But this is my point. I just need to make sure that GameStop isn’t going bankrupt. And that people are still buying discs and that there are still demands for GameStop for just a couple of years. If that’s the case, then GameStop is likely undervalued.”

A small number of Redditors who also agreed with Keith also noticed something even more peculiar. 84% of GameStop stock was held at a short position. That is, betting that the price would fall. This was highly unusual. It turned out that hedge funds had collided in selling shorts of the stock, publicly stating that the price would go down, therefore, making them millions of dollars. They sold over 137% of the GameStop short stock. At this moment, once they had discovered this, the Redditors acquired for themselves a unique position in financial history. If they played their cards right, they could hatch a popular financial movement that would disrupt the status quo.

What Is Short Selling?

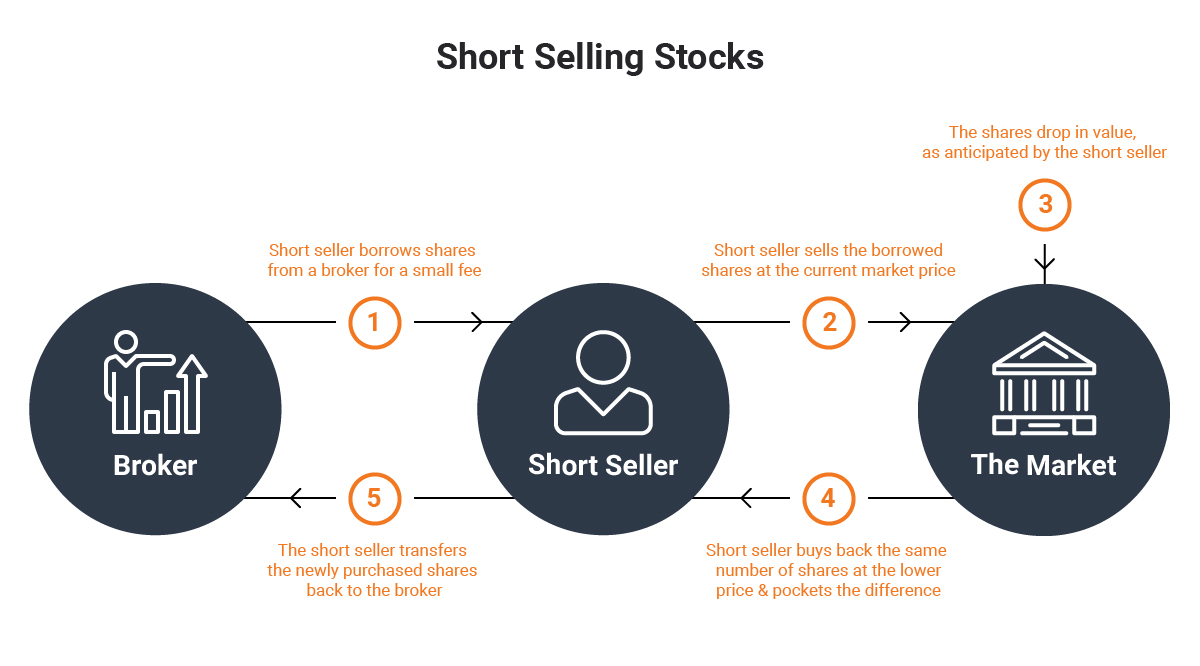

James borrows some vintage baseball cards from his friend, Anderson, for about $400, but promises to give the card to him (Anderson) next week. After Anderson gives James the baseball card, James sells those same baseball cards to a dealer for $400 because that’s the market price of the card. He does this because he expects the price to drop. In time, the market price drops to $300. James buys the baseball cards from the dealer at the new price of $300. Since he had sold it to the dealer originally for $400, he now has a $100 leftover. After this, he returns the card to Anderson. That’s basically what Short Sellingmeans.

But there’s more. James has to pay interest to Anderson for borrowing the cards. Now, here’s the decisive factor: If after a week, the market price of the cards just rises to $500, then $100 will be out of James’ pocket by the time he gives the cards back to Anderson. But the thing is if the price of the cards keeps rising, and there are a lot of people in the same position as James, they would all want to buy their cards back from their dealers and sell them back to their friends to limit their losses.

Mass buying of cards actually raises the market value of the cards. Once the demand is greater than the supply, here’s what happens: the longer they wait, the more they have to pay. This is called a Short Squeeze. That last scenario is what happened to these hedge funds. In essence, with short selling, the losses are almost limitless

Back To GameStop

The fatal mistake the hedge funds made with GameStop was they were greedy. They could have brought the GameStop stock down to $50 and bought it back at $5. But they would hang in there without selling, seemingly, because they wanted every cent from their bet. It seems like they were just waiting for GameStop to get bankrupt. Unfortunately for the hedge funds, this left themselves exposed and wide opened for an attack

The Big Short Squeeze

While Keith was posting his findings, another Reddit Forum user posted a 7-point document titled Bankrupting Institutional Investors for Dummies, ft. GameStop. In the document, the user pointed out that the hedge funds were fatally exposed.

The r/WallStreetBets forum loved the idea. It was brilliant! The risk to the investors was limited. The worst that could happen is that the stock goes to zero and they lose all their money. On the other hand, the risk to the hedge funds was immense: they could lose more money than they put in. Worse still, they had borrowed money to short sell.

The plan was simple but effective: the Reddit army would keep buying GameStop stocks, drive at the price and ensure that the hedge funds lose more money than they would be forced to abandon their positions and cover their losses by buying shares from the markets to return them to their lenders.

This very act, like the baseball hats example earlier in James’ case, drives up the prices even more. It was an event leading to a dramatic rise in the stock price in a very short period. It was almost like a bug in a video game being exploited. As the stocks kept rising and hedge funds kept losing money, Redditors realized that this was the perfect opportunity to bring the hedge funds down to their knees. It was a digital form of protests, one that would have a huge impact if carried out well! This was something partially new and exciting– the masses were playing the banks’ and hedge funds’ games against them.

By January 26, GameStop was the single most traded stock in the US Stock Market, with volumes matching that of the 5 biggest stock giants combined. Its sole share price spiked from just a few dollars in 2020 to a peak of over $490, transforming a firm that was valued at less than $200 million in April 2020 into a company worth more than $28 billion!

Because this is the kind of news the average people loved, the buzz began to build around the story and the news made it around with the narrative of the people taking back control by playing back the game of the bank against them.

“It’s amazing that the average person can now actually get a fair shake against the hedge funds.” Jordan Belfort (AKA The Wolf of Wall Street)

But as they would soon see, there may be more to the story.

According to the Ortex data, by the 28 of January, the hedge funds and short-sellers have lost $70 billion. 5000 US firms had been affected. It was an all-out war.

The Battle Picks Up Steam

As news of the GameStop rebellion spread around the world, billboards in major cities in America began to appear, telling the public what to do: Buy GameStop’s Stock.

The first billboard was in New York. But soon, more billboards appeared in San Diego, Salt Lake City, Dallas, Orlando, and more.

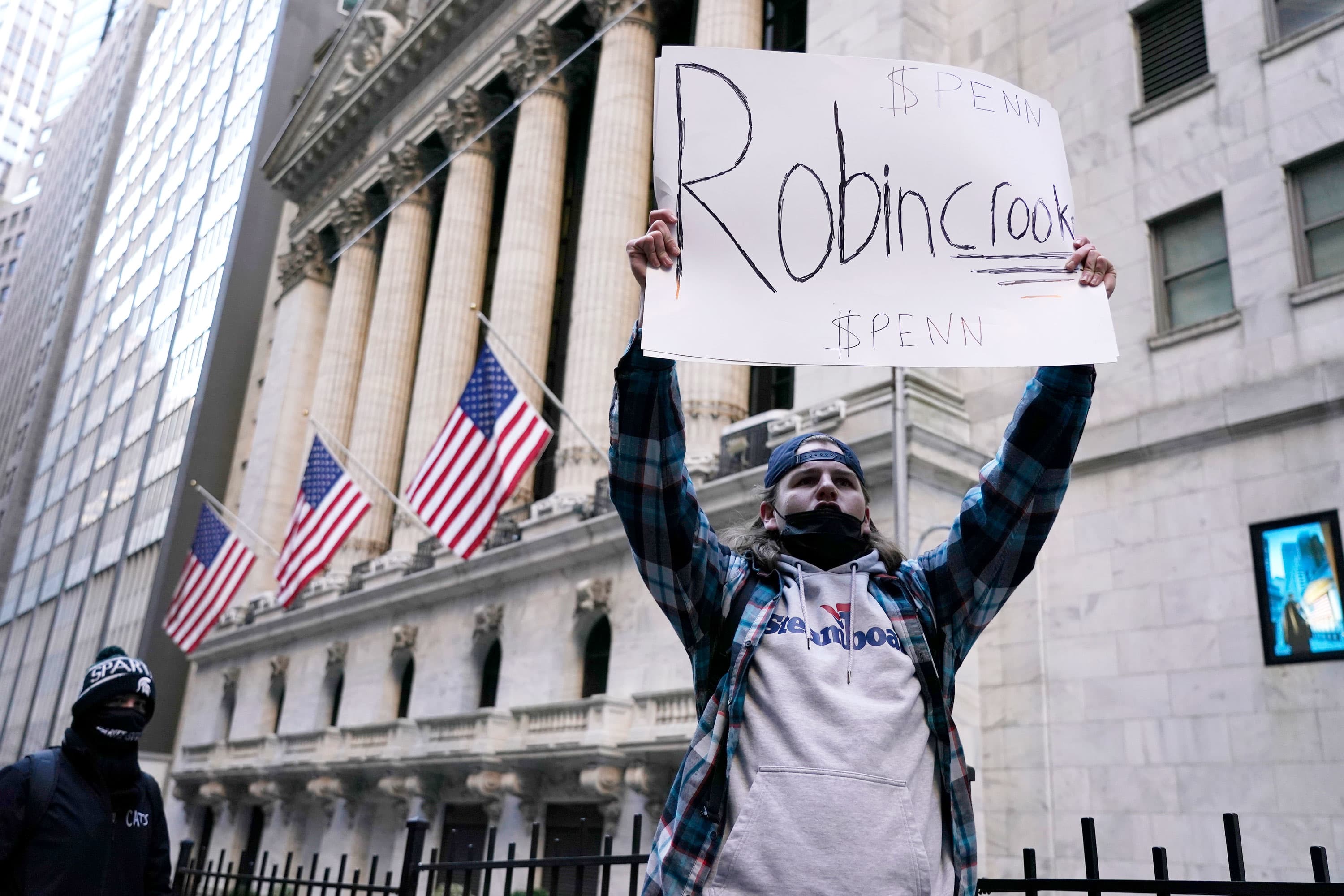

If the hedge funds thought they had seen it all, they were mistaken. The protest was taking another form. On the 28 of January, a small physical protest occurred right on Wall Street itself! Meanwhile, online, the singular outcry for Redditors was to refuse to sell, but hold strongly, no matter what– a term that they called Diamond Hand.

The plan was that the longer the Redditors hold out, the more damage they would do to the hedge funds. This would be in the order of millions and, possibly, billions of dollars, due to a large amount of interest they had to pay.

The situation was getting out of hand, and the market was being out of control. The news soon reached the White House. And while this was happening, it wasn’t just the Redditors that were making money. The big guns of the market also sensed an opportunity. Larger trading professionals joined the fight, but only for their profits. In a matter of days, BlackRock Inc. and eight other Wall Street titans made a combined $16 billion GameStop stock “Squeeze!”

There’s A Key Point In The Story: Wall Street Always Finds A Way To Win.

Other Redditors noticed that other companies in bad shape were also being heavily shorted. These included AMC, Nokia, and more. They initiated other coordinated attacks to beat up these prices, too. And this seems to be working. According to Bloomberg, Melvin capital, a heavy short seller, was a large-scale casualty. They had to bail out to the tune of $2.7 billion by Citadel, another heavy hedge fund.

In the meantime, three of GameStop’s biggest investors gained over $2 billion in personal wealth from the frenzy. Another subReddit called r/WSBGivesBack– WallStreetBets Gives Back–donated their earnings to charities and organizations. As for Keith Gill, he had only invested around $53,000 back in 2019. His bet on GameStop had now turned into a fortune of $48 million at the heart of the stock rally.

But, whether they had thought this or not, it soon became clear that none of this would be smooth sailing for him and many others.

Battle Lines Are Drawn

Discord set in and banned communication between the Redditorson their platform citing hate speech. But this only added fuel to fire. The r/WallStreetBets forum went from 5 million subscribers to 8 million subscribers in a couple of days.

Facebook was next to step in, banning the Robinhood trading group, which has over 157,000 members. The claim? Robinhood allegedly violated policies unrelated to stock price surges! The popular trading app, Robinhood, made it to number one on the App Store before banning retails from buying GameStop stock. Nokia, AMC, and other stocks were also included in the ban. Only selling was allowed. The action by Robinhoodenraged the general public who was, by now, fully aware of the situation. Multiple class-action lawsuits were launched, and politicians and celebrities alike got involved. Blocking people from buying stocks and only letting sale would be pushing the price down unofficially. This could have been foreseen as a form of market manipulation.

The perception was that Robinhood was on the side of the large hedge funds as they do receive funding from citadel and others. In return, the hedge funds get a massive amount of data from the small investors. From that, they could easily figure out how to make money. In fact, Robinhood had made $700 million by selling user data to hedge funds!

During all of this, an ACC investigation was also triggered.In his company’s defense, according to CEO, Vlad Tenev, because of the unprecedented market condition, Robinhood was forced to raise 1 billion dollars to keep things running. Elon Musk would make headlines when he granted Vlad Tenev an interview. Business Insidercalled the interview “bizarre”.

“„Elon: Seems weird that you get a sudden 10 billion dollars demand to rebuild suddenly out of nowhere. Is anyone holding you, hostage, right now?VT: We had no choice in this case. We had to conform to a regulatory capital requirement.EM: Basically, what people are wondering is that did you sell your clients down the rough road or you have no choice? And if you have no choice, that’s understandable. But then, we have to find out why you have no choice and who are these people saying you have no choice.

This all raises questions. If this chaos hit Robinhood from just a few stocks, what would happen if there was widespread volatility across the whole markets? As February rolled around, the sentiments changed. The GameStop stock began to drop and fear spread throughout the Redditors’ message board. Some users had lost hundreds of thousands of dollars, and some, even millions.

Keith Gill had now lost over $14 million. But he and the others all held their positions. They strongly believed that, sooner or later, the hedge funds would have no choice but to buy back their positions to cover their shorts. Once they did this, the price would rise once again.

Though it’s possible that the Redditors held, the big shorts had already sold. It’s hard not to commend the strong conviction of the Redditors in doing what they believed was right. But many of them had from the start broken the number one rule of investing: Only invest what you’re willing to lose.

Though some of them have thrown up a donation to a good cause rather than an investment, as the stock price began to come down, a new circle began to emerge: The Redditors were now moving from GameStop unto silver. Many physical silver dealers threw a massive increase in demand and the silver price shot up. But this outcome was not possible by Reddit alone. The silver market was too large and even the Redditors knew this.

Many on the forum, who saw the move to silver as just a distraction from GameStop posted, advising others to stay away from silver. They all agreed on one thing: the news media was lying and that they were the ones causing the silver rush. This sudden understanding brought about a mistrust in the media for many who understood what was going on.

By this stage, r/WallStreetBets forums were on fire. There were reports of large institutions failing to deliver borrowed GameStop stocks, and hedge funds using the technique called “A short ladder attack.” This is when hedge funds sell 100 shares increment back and forth to each other to drop the price. The rumor was swelling and it became almost impossible to truly determine what was happening? There would be, no doubt, be more calls for regulations.

Fallout And Consequence

In the CNBC interview, NASDAQ CEO, Adena Friedman, called for the monitoring of Social Media Chatter to match up against unusual coordinated stock moves. Robinhood would slowly open up the buying of the stocks but not before Vlad was ordered to testify in front of Congress. Janet Yellen, former chairwoman of the Federal Reserve, and Treasury Secretary was going to call a regulator trade meeting over the GameStop rebellion. Yellen had formerly received over $700 thousand in speaking fees for Citadel. This makes it a conflict of interest. She is currently seeking a waiver to conduct the hearing.

The Bigger Picture

The GameStop rebellion had set a precedent: this is the very first instant of the intersection between social media and the financial system. The idea is now global. Bloomberg had reportedthe targeting of shortage stocks from Amsterdam to Sydney. In Europe, some of the most shortage stocks jumped 20% or more.

In Tokyo, shorts selling stocks jumped to about 70% or more. On another note, there could be implications for the wider markets. In the future, if another short squeeze was organized and a big firm was to blow up, it could end up being deemed too big to fail by the government and, once again, another taxpayer-funded bailout could occur. This isn’t to mention systems at risk.

The financial system is completely entangled, complex, and fragile. As hedge funds need capital to cover their shorts, this could cause some selling elsewhere.

A Broken System Laid Bare

Trust in the financial system is at an all-time low. Over 23.6% of all US dollars in existence were printed in 2020. Meanwhile, 40% of Americans don’t have $400 in the bank for emergency expenses. This is coming from a country that is the world’s reserve currency. So, this has global implications.

This story has revealed how unstable and detached from the realities stocks can be these days. Low-interest rates, stimulus, excessive financialization, and quantitative easing have transformed the global economy from productive, innovative, and focused to a decaying hoax of speculations and financial engineering. For years, companies were buying back their stocks so the price would go up and look good on paper. When the cost of borrowing money is cheap, no one cares about risks.

The GameStop Rebellion Was A Wake-up Call And Rich People Aren’t Happy With This. They Are Saying: You Can’t Keep Doing This To Us!

There’s a great quote by Warren Buffet: Price is what you pay, value is what you get.

The r/WallStreetBets crowds destroyed their relationship. But the thing is it could be argued that the relationship between price and value has been destroyed and manipulated all the way back 20 years ago when President Bill Clinton made that swift move to usher in the age of financialization.

January of 2021 marked the shift in the way that the financial market is viewed. For the Reddit users that were tired of the system and wanted nothing but a change to happen, their objectives may have already been achieved. People are once again talking about the unfairness of the financial system.

But would the new regulations that stemmed from this shut down the little guy? That remains to be seen.

But, regardless, one day, this story would be told in business schools around the world no matter the outcome. And is the story of how one guy, an arm-chair investor on Reddit, launched a financial revolution. This is a story that is still unfolding.

Luqman Jackson

Author

Liam Evans

Reviewer

Latest Articles

Popular Articles