Crypto Lender Celsius Is On Pace To Run Out Of Cash - Celsius Investors Petition Bankruptcy Judge

Author:James PierceReviewer:Camilo WoodAug 16, 20220 Shares385 Views

Imagine making an investment in a cryptocurrency bank in order to ensure your financial stability, only to be informed that you won't be able to withdraw your money and the bank would shut down over the next few months.

This would be a nightmare scenario for many! And that's happening right now in Celsius.

Celcius promoted itself as a form of crypto bank, inviting customers to deposit their digital currencies with the company so that it could make money by either borrowing or lending against the customers' crypto holdings.

The crypto lender celsius is on pace to run out of cashand looks to be in a much more difficult financial situation than was previously stated in July.

How Does Celcius Network Make Money?

How Celsius earns yield

Receiving interest payments on your investment is the major method of profit generation available to you through Celsius Network.

To take part, all you need to do is transfer cryptocurrency into a wallet provided by Celsius.

When you've finished doing that, interest will be added to your wallet on the first Monday of every week.

The Celsius Network Downfall

Celsius was affected by what we called the "crypto crisis" that happened this year, which resulted in the suspension of withdrawals and the bankruptcy of a number of lenders, exchanges, and investment companies.

In June, Celsius put an end to all user withdrawals, claiming "extreme market conditions" as the reason.

The CEO of the crypto lender, Alex Mashinsky, stated that the company had $25 billion in assets under management at its peak in October 2021.

Now, Celsius has only $167 million "in cash on hand", which the company claims will offer "ample liquidity" to continue operations while the company is in the process of reorganization.

According to the bankruptcy filingthat Celsius has made, to company owes its customers approximately $4.7 billion.

What Went Wrong With Celsius?

In order to provide users with access to low-interest financing options, Celsius gets leverage through permissionless on-chain money marketplaces like MakerDAO.

This requires collecting deposits from users in the form of assets such as $WBTC and placing them in a fund from which $DAI can be borrowed.

As stated in the most recent statement, Celsius has cash on hand that is only able to last for a little over two months, and it is expected that the company will be out of money by the end of October.

Going To Bankruptcy - Running Out Of Cash

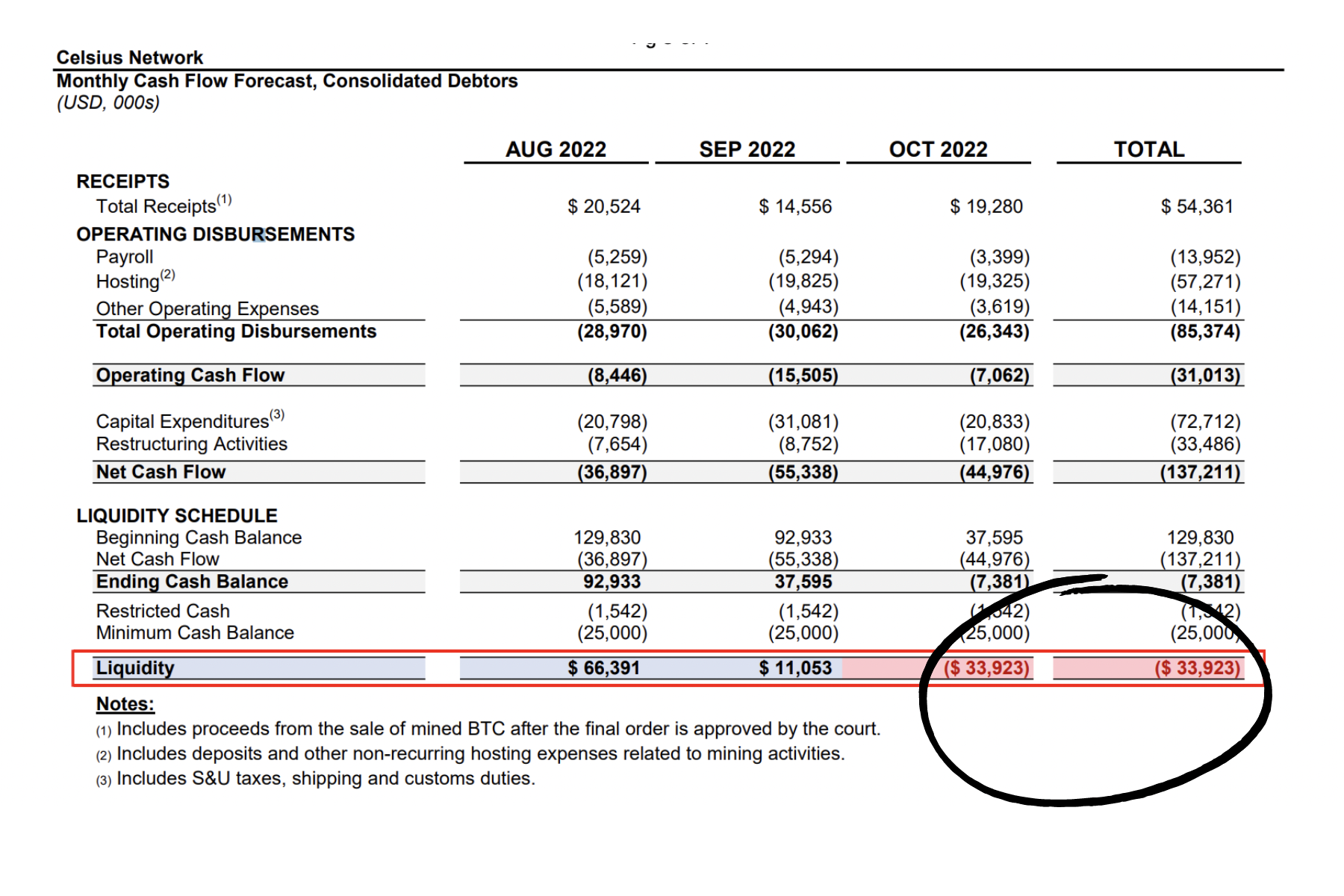

The company reported in its monthly cash flow estimate that it had a beginning cash balance of over $130 million at the beginning of the month of August.

In light of the fact that it is expected that the company's operational expenses and other costs, including expenditures for transformation activities, will total $137 million over the course of the following 3 months, the balance will turn negative in the month of October.

By that time, the company expects that it will have negative liquidity or "cash flow" of $33.9 million.

Problems With CEL Token

In accordance with the filing, Clecius has 658 million CEL tokens (the platform's utility token) in its treasury.

Celcius owes 279 million tokens to clients, so the company, hence the company has a surplus of 379 million.

At current market prices, the CEL net position would be worth almost $1 billion, which is more than double what's in the document.

This is because the token is in the middle of a short squeeze attempt that is being driven by social media.

Celsius Network - Game Over for CEL?

Yet, the increase in prices does not help the corporation in resolving the issue with its financial sheet.

The overwhelming bulk of the token's supply is held on the platform, and exchanges offer only a limited amount of liquidity.

Prices are likely to drop if the company makes an effort to sell CEL in order to fill some of the gaps that appear on its balance sheet.

Braziel said:

“„The asset side of the CEL holding is probably worth zero.

Adding that the liabilities are still there since CEL token owners will probably try to come after Celsius and claim for $1 per token.

Investors Are Crying For Help

Ostheimer, one of the investors in Celsius wrote:

“„It is in your hands, honorable judge to make this a different case were not the lawyers, the attorneys, the big corporations and managers get paid out first but the little man, the mom and pop, the college grad, the granny and grandpa — all those many small unsecured creditors — so that they are not like usual at the end of the chain where they lose everything.

Jeanne Y Savelle, who characterized herself as a "little retired old lady" living on a limited income, stated that she went to Celsius in desire of a strategy to supplement her monthly social security check in order to stretch her dollar in the face of unprecedented levels of inflation.

“„I purchased my small amount of crypto hoping just to earn enough to help me weather a few years, kind of a safety net,” said Savelle. “Yes, I know, buyer beware but I agree that there has been way too much deception.

Additionally, Raphael DiCicco, also one of the investors wrote:

“„I believed in all the commercials, social media, and advertising that showed Celsius was a high-yield, low-risk savings account. We were ensured that our funds are safer at Celsius than in a bank. This money is pretty much my life savings ... I hope you can find it in the best interest of all parties involved to pay back the smaller investors first ... before any restructuring occurs.

Others have suffered a complete and total loss.

People Also Ask

Which Bank Works Best With Crypto?

- BankProv - Best for Crypto Businesses.

- Juno - Best for cashback and interest in crypto.

- Revolut - Best for Crypto Investments.

- Wirex - Best Support for Multiple Cryptocurrencies.

- Ally Bank - Best With US Crypto Exchanges.

- USAA - Best for Coinbase.

- Nuri - Best for Saving in Bitcoin.

Do You Need A Bank Account For Cryptocurrency?

In order to purchase cryptocurrency, you will first need to ensure that there are sufficient funds in your trading account. You might fund your cryptocurrency account by attaching it to your bank account, authorizing a wire transfer, or even making a payment using a debit or credit card. These are just some of the options available to you.

How Do I Start A Crypto Bank?

- Get money for your venture.

- Find a company that can help you with technology.

- Connect your exchange to others to get more money moving through them.

- Work with a company that handles payments.

- Use the best security methods.

- Beta testing is a way to go live.

Conclusion

Celsius Network broke the hearts of many.

Investors trusted them with their savings that would save their future.

We are hoping that these people get some return in order to start with their lives.

There are lots of crypto banks that can be trusted; all you have to do is find the right one!

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles