Credit Default Swap - How Does It Work?

A financial derivative known as a credit default swap (CDS) enables an investor to exchange or off-set their credit risk with that of another investment. The lender purchases a CDS from another investor who agrees to pay them back if the borrower defaults in order to swap the default risk. Similar to the recurring premium payments required for an insurance policy, the majority of CDS contracts are maintained by an ongoing premium payment.

Author:Stefano MclaughlinReviewer:Luqman JacksonAug 04, 20238.8K Shares121.2K Views

A financial derivative known as a credit default swap(CDS) enables an investor to exchange or off-set their credit risk with that of another investment. The lender purchases a CDS from another investor who agrees to pay them back if the borrower defaults in order to swap the default risk.

Similar to the recurring premium payments required for an insurance policy, the majority of CDS contracts are maintained by an ongoing premium payment. A CDS is often used by a lender to swap or offset the risk that a borrower won't pay back a loan.

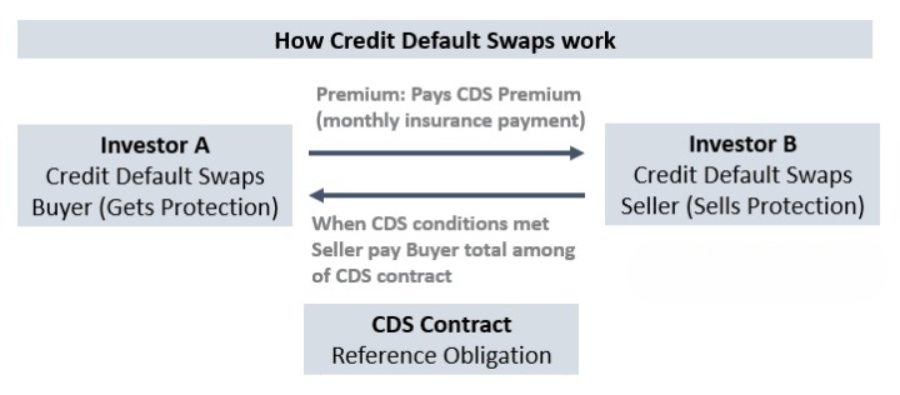

The Working of Credit Default Swap

A derivative transaction known as a credit default swap transfers the credit exposure of fixed income instruments. Bonds or other types of securitized debt, which are derivatives of loans sold to investors, may be involved.

Consider the scenario when a business sells a bond to a buyer with a $100 face value and a 10 year maturity. The business can agree to pay back the $100 at the end of the ten-year period and make interest payments every year.

The investor takes on the risk since the debt issuer cannot guarantee that it will be able to repay the premium. A debt buyer might buy a CDS to move the risk to another investor who will pay them if the debt issuer stops making payments.

Debt instruments sometimes have longer maturities, which makes it more difficult for investors to calculate the risk of an investment.

A mortgage, for example, can have a 30-year term. It is impossible to predict whether the borrower will be able to make payments for that length of time.

These contracts are therefore a well-liked method of risk management. Up until the contract's maturity date, the CDS buyer makes payments to the CDS seller.

You might be thinking that CDS and an insurance policy are the same. But NO, they are not.

Credit Default Swaps Explained in 2 Minutes in Basic English

CDS And Insurance Policy

Unlike insurance policies, which only pay out to compensate for a loss, the buyer of a CDS is qualified to get the compensation without incurring any loss (and possibly realizing a gain) (and not potentially realizing a gain).

There is one major difference between a CDS and an ln insurance policy: the CDS is marked to market every day.

This means that as the creditworthiness of Sattylite diminishes, then the money is paid to the owner of the CDS, even though it has not actually gone bust. And by contrast, if things start to improve, then money goes the other way.

In other words, imagine an auto insurance product where the money went back and forth between you and the insurer, depending on how you drove every single day.

People Also Ask

Who Buys A Credit Default Swap?

Institutional investors, such as banks or hedge funds, typically invest in credit default swaps. However, exchange-traded funds (ETFs) and mutual funds are other ways that regular investors might participate in swaps.

How Do Credit Default Swaps Payout?

In a CDS, the buyer pays the seller on a regular basis in exchange for a payout in the event that the underlying financial instrument defaults or has another type of credit event.

What Triggers A Credit Default Swap?

Most single-name CDSs use the following credit events as trading triggers:

- Bankruptcy.

- Failure to pay.

- Obligation acceleration.

- Repudiation.

- Moratorium.

Conclusion

Even if a default may not have occurred or may never have occurred, credit default swap change in value during the course of their lives as the credit quality of the reference firm varies, which results in gains and losses for the counterparties. As the maturity of the CDS draws near, CDS spreads become closer to zero.

Stefano Mclaughlin

Author

Luqman Jackson

Reviewer

Latest Articles

Popular Articles