Best Cryptocurrency Exchange In 2023

A cryptocurrency is a digital or virtual currency that is protected by encryption, making counterfeiting and double-spending practically impossible. Many cryptocurrencies are built on blockchain technology, which is a distributed ledger enforced by a distributed network of computers. Because cryptocurrencies are not issued by a central authority, they are theoretically immune to political influence and manipulation.

Author:Stefano MclaughlinReviewer:Camilo WoodOct 08, 202330.4K Shares482.8K Views

Top 10 Most Popular Cryptocurrencies

What Is Cryptocurrency?

A cryptocurrency is a digital or virtual currency that is protected by encryption, making counterfeiting and double-spending practically impossible. Many cryptocurrencies are built on blockchain technology, which is a distributed ledger enforced by a distributed network of computers. Because cryptocurrencies are not issued by a central authority, they are theoretically immune to political influence and manipulation. In cryptography, virtual "tokens" are used to make secure online payments. These tokens are represented by ledger entries on the system's ledger. Various encryption methods and cryptographic approaches, such as elliptical curve encryption, public-private key pairs, and hashing functions, are referred to as "crypto."

- A cryptocurrency is a type of digital asset that is based on a network that spans a huge number of computers. They are able to exist outside of the control of governments and central authorities because of their decentralized structure.

- The term "cryptocurrency" comes from the encryption techniques used to keep the network safe.

- Many cryptocurrencies depend on blockchains, which are organizational mechanisms for preserving the integrity of transactional data.

- Blockchain and similar technology, according to many experts, will disrupt numerous industries, including finance and law.

- Cryptocurrencies have been chastised for a variety of reasons, including their usage for unlawful operations, exchange rate volatility, and the infrastructure that underpins them being vulnerable. Their mobility, divisibility, inflation resistance, and transparency, on the other hand, have been lauded.

Types Of Cryptocurrency

Bitcoin was the first blockchain-based cryptocurrency, and it is still the most popular and most valuable one in the world today. There are tens of thousands of alternative cryptocurrencies available today, each with its own unique features and purposes. Some are Bitcoin clones or forks, while others are brand-new currencies created from the ground up.

Types Of Cryptocurrency Exchanges

Centralized and decentralized exchanges are the two primary types of bitcoin exchanges (DEXs). The majority of bitcoin exchanges used by investors are centralized exchanges, meaning they are controlled by a single entity. Coinbase, Gemini, Binance, and eToro are some of the most prominent centralized exchanges.

DEXs are often less efficient and difficult to use than centralized exchanges. Off the blockchain, centralized exchanges control your assets, making transactions speedier and less expensive. You must pay miners transaction fees and wait for the blockchain to authenticate your transaction while transacting on the blockchain, which increases the cost and time it takes to transact crypto. Despite the fact that DEXs are less efficient and costlier than centralized exchanges, many investors prefer them because of their distinct advantages. DEX allows you to trade cryptocurrencies directly from your crypto wallet using smart contracts in a permissionless and trustless manner. Smart contracts are immutable and unmanageable by a single party because they are stored on the blockchain. As a result, you don't have to entrust your assets to a third party, and you don't have to join up or give any kind of proof to use a DEX.

Crypto investors who possess governance tokens, in contrast to centralized exchanges, vote to update decentralized exchanges. Trading on DEXs cannot be interrupted because they are not controlled by a central entity. You also don't have to be concerned about crypto assets being delisted from the exchange because no single individual or entity has the authority to do so.

Brief History

Bitcoin was created in 2009 by a person or organization who goes by the pseudonym "Satoshi Nakamoto".

There were about 18.8 million bitcoins in circulation in August 2021, with a total market cap of around $858.9 billion, according to the most recent figures. There are only 21 billion bitcoins in existence, which prevents inflation and manipulation. Litecoin, Peercoin, and Namecoin, as well as Ethereum, Cardano, and EOS, are some of the rival cryptocurrencies produced by Bitcoin's success. By August 2021, the entire value of all cryptocurrencies will have surpassed $1.8 trillion, with Bitcoin accounting for roughly 46.5 percent of that total.

Cryptocurrency Exchanges Vs Crypto Wallets

You can trade cryptocurrency on cryptocurrency exchanges. As an investor, one of your primary considerations should be the security of your cryptocurrency exchange. If you keep your money on an exchange, you face the risk of being hacked. Many cryptocurrency exchanges have been hacked in the past, so don't dismiss this possibility. Despite the fact that many crypto exchanges have excellent security safeguards, there have been some attacks in the past. You should keep your cryptocurrency holdings safe by storing them in a cryptocurrency wallet.

Wallets for cryptocurrencies can be software or hardware. Hardware wallets are physical devices that store your crypto offline, whereas software wallets are computer apps that securely store your coin. Hardware wallets are the most secure sort of bitcoin wallet since they are unavailable to online hackers. If you want to buy a bitcoin wallet, you need think about the pricing, security, and features of the hardware wallet you want. The Ledger Nano S is our pick for the best all-around crypto wallet. It's the only hardware wallet you'll ever need because it supports thousands of different coins. You won't have to buy many crypto wallets because you'll be able to safely store all of your crypto assets in one spot.

How Does It Work?

Cryptocurrencies allow you to buy and sell goods and services for a profit. According to CoinMarketCap.com, a market research website, more than 10,000 different cryptocurrencies are traded publicly. And cryptocurrencies continue to grow in popularity, with initial coin offerings, or ICOs, being used to raise funds. According to CoinMarketCap, the total value of all cryptocurrencies was more than $1.9 trillion on Aug. 18, 2021, down from a peak of $2.2 trillion in April. The entire value of all bitcoins, the most widely used digital currency, was estimated to be over $849 billion, up from recent lows. Despite this, bitcoin's market value has fallen from a high of $1.2 trillion in April.

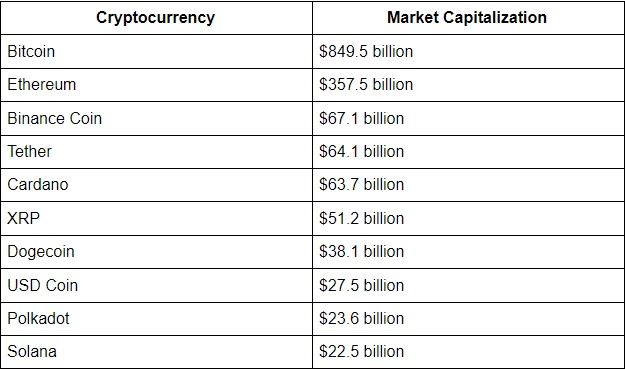

Cryptocurrencies With The Highest Market Capitalization

According to CoinMarketCap, a cryptocurrency statistics and analytics firm, these are the top ten trading cryptocurrencies by market capitalization.

For a number of reasons, cryptocurrency advocates are drawn to it. Here are a few of the most well-known:

- Supporters regard cryptocurrencies like Bitcoin as the currency of the future, and they're rushing to buy them before they grow more valuable.

- Some proponents prefer the idea that bitcoin frees central banks from controlling the money supply because central banks tend to devalue money over time through inflation.

- Other advocates favor the blockchain technology that underpins cryptocurrencies because it is a decentralized processing and recording system that is potentially more secure than traditional payment systems.

- It's true that some investors are attracted to cryptocurrencies because they're expected to rise in value, but they don't care about the currencies' long-term acceptance.

Are Cryptocurrencies A Good Investment?

The value of cryptocurrencies may increase, but many investors consider them as simply guesses, not actual investments. What is the explanation for this? Cryptocurrencies, like actual currencies, have no cash flow, thus in order for you to profit, someone else must pay more for the currency than you did.

This is known as the “greater fool” investment theory. In contrast, a well-managed business grows in value over time by increasing profitability and cash flow.

“„“For those who see cryptocurrencies such as bitcoin as the currency of the future, it should be noted that a currency needs stability.”

The investment community as a whole has urged potential investors to stay away from them. Warren Buffett, the famed investor, likened Bitcoin to paper checks, saying, "It's a pretty effective way of moving money and you can do it anonymously and all that. A check can also be used to send money. Is it true that cheques are worth a lot of money? Just because they have the ability to send money?"

For those who believe that cryptocurrencies like Bitcoin will be the currency of the future, it's important to remember that a currency needs to be stable in order for merchants and customers to know what a fair price for goods is. Throughout much of their history, Bitcoin and other cryptocurrencies have been everything but stable. For example, after trading near $20,000 in December 2017, Bitcoin's value plummeted to around $3,200 a year later. It was trading at record levels again by December 2020. This price fluctuation is a problem. People are less inclined to spend and circulate bitcoins now if they are worth a lot more in the future, making them less viable as a currency. Why spend a bitcoin when it could be worth three times its current value the following year?

Can Cryptocurrency Be Converted To Cash?

Cryptocurrency has become a popular investment choice for millennials, but you can't exactly use it to pay for your supper. You can if you want to choose from a few limited possibilities (as more big firms join in), but most consumers still need to convert their crypto into cash. The good news is that it's incredibly simple to accomplish. However, before converting cryptocurrency to cash, an individual should think about a few things. Because digital tokens are extremely volatile and their values fluctuate frequently, you risk losing money if your timing is off. In any case, here's everything you need to know about exchanging your Bitcoin for cash. Just keep in mind that if you cash out, you'll have to pay taxes on your winnings – while cryptocurrency is technically illegal in India, that doesn't mean that profits earned from investing in it aren't subject to taxation.

How Can You Turn Your Cryptocurrency Into Cash?

Let's look at Bitcoin as an example of a cryptocurrency that you'd like to convert into cash. Remember that converting any cryptocurrency to cash will result in taxation as well as an exchange fee charged by a third-party broker based on the number of digital tokens converted. Remember that transferring money to your bank account through a third-party broker may take a day or two. As of 10 a.m. IST on August 16, the price of bitcoin in India was Rs. 36.53 lakhs.

There are two main methods through which you can convert your cryptocurrencies into cash.

- Through an exchange or broker

Currency exchange systems at airports are comparable to this. The broker will transfer the money to your bank account when you deposit your digital currency and request a withdrawal. However, because brokers are subject to money laundering regulations, you must withdraw your funds from the same bank account that you used to deposit.

The most significant downside of this conversion process is the amount of time it takes. Experts believe it's safe and secure, although the funds may take some time to appear in your bank account. In addition, the exchange charges a fee for the transaction, which varies from brokerage firm to brokerage firm and country to country.

- Through an exchange or broker

Individuals can use a peer-to-peer platform to change their digital currency into cash by simply selling it, which is considered a faster and more anonymous approach. In comparison to a third-party brokerage, there is a lower cost and the prospect of a better exchange rate. Having said that, you must be cautious of scammers.

Before releasing your bitcoin, you should request proof of identification and payment.

You can also use a peer-to-peer platform that locks your digital tokens until the money is credited to your bank account.

What Is The Most Accurate Crypto Exchange?

You can swap your cryptocurrency for USD, stablecoins, or other altcoins on cryptocurrency exchanges. The price of a crypto asset is determined by buy and sell orders on these exchanges. You might also use a crypto brokerage, which is similar to a cryptocurrency exchange but differs somewhat. The price of crypto assets is set by crypto brokerages based on the asset's market price, while the price of crypto on exchanges is directly controlled by investors' buy and sell orders. In technical terms, Robinhood is a cryptocurrency broker, whereas Coinbase is a cryptocurrency exchange.

For most crypto investors in the United States, Coinbase is the best option. It's the first public crypto exchange in the United States, so you can rest easy knowing your money is safe. The trading platform keeps 98 percent of its assets in a cold wallet, which is more secure than most cryptocurrency exchanges. Coinbase also features an excellent user interface for newcomers. Coinbase Pro may be right for you if you want a more complex interface.

Which Cryptocurrency Exchange Is The Best In The World?

Let’s discuss the pros and cons of each one.

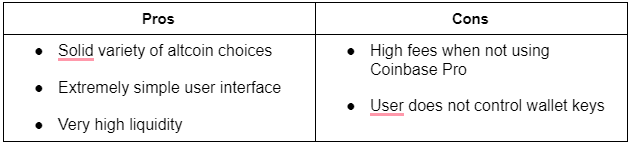

Coinbase And Coinbase Pro-Best For Investors

- Number of Currencies: 64

- Transaction Fees: $0.99 to $2.99 (Coinbase), Up to 0.50% (Coinbase Pro)

- Wallet Included: Yes

Coinbase was recommended because it makes purchasing and selling cryptocurrencies simple and secure, with transparent pricing. Coinbase also offers Coinbase Pro, which has a cheaper price structure and much more charting and indicator tools. Coinbase has generally avoided any scandal in the cryptocurrency market, which has been plagued by counterfeit coins and dodgy exchanges. Coinbase provides an incredibly user-friendly exchange, lowering the barrier to entry for cryptocurrency investment, which is often perceived as complex and perplexing.

Investors and traders can also put their funds in Coinbase's insured custodial wallets. They have a data breach and hacker insurance, and your money is kept in FDIC-insured bank accounts. Coinbase owns the private keys to the coins, not the investor, therefore these custodial accounts are incredibly helpful for newbie users just getting their feet wet. Coinbase also offers the free Coinbase Pro version, which has a different but lower fee structure and much more charting and indicator options. Coinbase Pro is a great next step for individuals who've gotten their feet wet with Coinbase, and it helps complete out the whole offering by providing features that a more advanced user would appreciate.

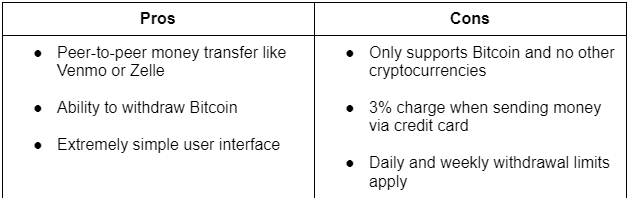

Cash App- Best For Beginners

- Number of Currencies: 1

- Transaction Fees: Varies

- Wallet Included: Yes

Cash App, like Venmo, is a peer-to-peer money transfer service. Users can use Cash App to divide food, pay rent to a roommate, and even shop online at stores that accept Cash App. Users can have their own Cash App debit cards and utilize Cash App like a bank account. This service is convenient enough on its own, but Cash App adds even more functionality. Similar to Robinhood, Cash App allows users to buy in stocks, ETFs, and Bitcoin. This exchange's mobile-first interface is simple to understand and operate, making it perfect for first-time investors.

While its major feature, similar to Venmo, is money transfers, it also features a simple crypto investment tool, similar to Robinhood. We chose Square's Cash App over Robinhood as the best alternative for beginners wanting to acquire Bitcoin since it allows customers to withdraw cryptocurrency deposits to their own wallets.

In the bitcoin world, the ability to withdraw cryptocurrency from an exchange is critical. You can invest and trade cryptocurrencies using Robinhood, but you can't withdraw or spend it. One disadvantage of Cash App, similar to Coinbase, is that you still don't have access to the private keys. This principle is known in the crypto field as "not your keys, not your coin." This means that if you don't have the private keys to the wallet where the coins are held, you don't own them.

Bisq- Best Decentralized Exchange

- Number of Currencies: 63

- Transaction Fees: 0.05% to 0.70%

- Wallet Included: Yes

Bisq was selected because it is a decentralized, open-source exchange that does not require KYC. The fundamental idea of Bitcoin is that it provides open and unrestricted access to a unit of account. Banking services, such as a checking or savings account, are only available if you have a legally verifiable official identity. This isn't necessary with Bitcoin, as it may be accessed independently of nationality or location, and without requiring any identification. While some argue that this accessibility allows for illegal conduct (the same could be said of utilizing cash), it also provides citizens in nations with less established banking institutions with rapid access to units of account. Millions of people throughout the world are unable to open bank accounts or trade because their governments lack the necessary financial infrastructure, or because they lack government-issued identification. In these situations, Bitcoin combined with a decentralized exchange like Bisq can be a good answer.

Bisq is a peer-to-peer decentralized Bitcoin and cryptocurrency exchange that may be downloaded. This means that, like Bitcoin, Bisq has no single point of failure and cannot be taken down. Bisq is non-custodial, meaning no one other than the user touches or controls the user’s funds.

If you're thinking of a centralized exchange such as Coinbase, this is different, because Coinbase manages your cash in a custodial account for which you don't have the private If Coinbase believes your account behavior is questionable, it has the power to seize your funds, whether or not the action is unlawful in your area.

Because there is no registration process or KYC (Know Your Customer) rule, Bisq is instantaneously accessible to anyone with a computer or smartphone. This makes it suitable for those seeking privacy, as well as dissidents living under oppressive regimes or those who lack government-issued identification. Bisq allows users to trade a variety of fiat currencies, including the US dollar and Bitcoin, as well as a variety of cryptocurrencies. Low trading volumes and slower transactions may be a result of its decentralized and peer-to-peer nature, but for others, this is well worth it.

How To Choose A Crypto Exchange?

Below are five important aspects and things to look for while choosing the best cryptocurrency exchange for you:

- Geographical location and restrictions

- Transaction fees

- Security, anonymity, and support

- UI and ease of use

- Volume and liquidity.

Jump to

What Is Cryptocurrency?

Types Of Cryptocurrency

Types Of Cryptocurrency Exchanges

Brief History

Cryptocurrency Exchanges Vs Crypto Wallets

How Does It Work?

Cryptocurrencies With The Highest Market Capitalization

Are Cryptocurrencies A Good Investment?

Can Cryptocurrency Be Converted To Cash?

What Is The Most Accurate Crypto Exchange?

Which Cryptocurrency Exchange Is The Best In The World?

How To Choose A Crypto Exchange?

Stefano Mclaughlin

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles