Are You A Stock Or A Bond? - Understanding Stocks, Bonds, And Human Capital

Two popular choices are stocks and bonds, each with its own characteristics and potential benefits. Let's explore the fundamentals of stocks and bonds and delve into their distinctions. By the end, you'll gain insights into these investment vehicles and discover which one aligns with your unique financial goals and risk tolerance. So, are you a stock or a bond?

Author:Gordon DickersonReviewer:Habiba AshtonJun 08, 202313.5K Shares329.3K Views

When it comes to investing your hard-earned money, the choices can be overwhelming. With numerous investment options available, it's essential to understand the differences between them to make informed decisions.

Two popular choices are stocks and bonds, each with its own characteristics and potential benefits. Let's explore the fundamentals of stocks and bonds and delve into their distinctions. By the end, you'll gain insights into these investment vehicles and discover which one aligns with your unique financial goals and risk tolerance. So, are you a stock or a bond?

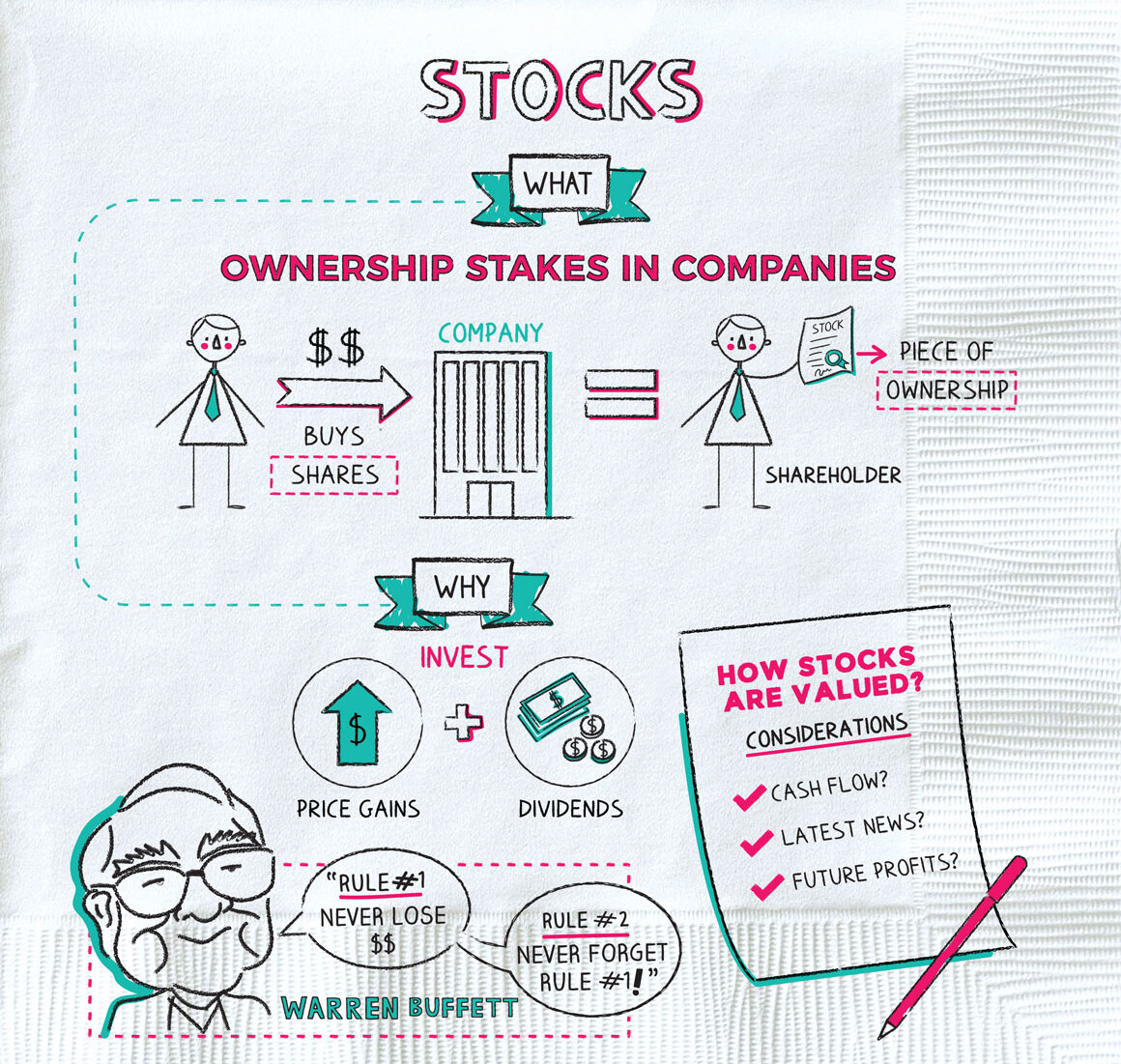

What Are Stocks?

Stocks, also known as equities, offer an opportunity to become a shareholder and own a piece of a specific company. Companies like Apple (AAPL), Tesla (TSLA), and Intel (INTC) are prime examples of stocks that investors can purchase.

As a stockholder, you can potentially benefit from capital appreciation as the stock price increases. Moreover, some companies share their earnings with stockholders through dividends, providing an additional source of income.

But remember, stocks come with higher risk due to market volatility, and their prices can fluctuate rapidly.

Types Of Stocks

Common Stocks - Common stocks entitle you to receive dividends and allow you to vote at shareholder meetings.

Preferred Stocks - Preferred stockholders receive dividend payments before common stockholders but do not have voting rights. In case of bankruptcy and asset liquidation, preferred stockholders have priority.

Stocks are traded on stock exchanges such as the Nasdaq or the New York Stock Exchange. While stocks offer the potential for high returns, they also come with higher levels of risk. Stock prices can be volatile and can decline rapidly, leading to potential losses for investors.

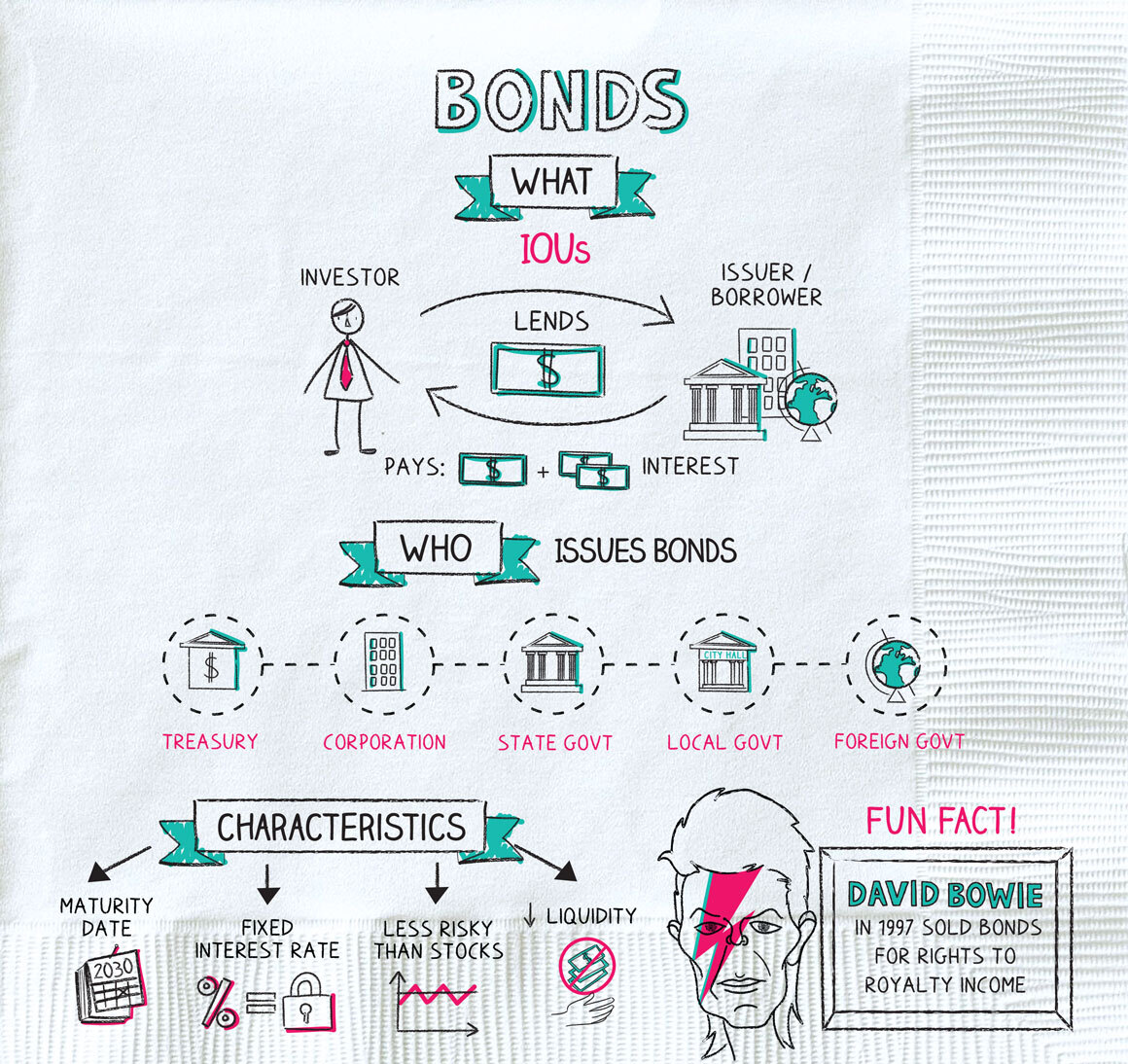

What Are Bonds?

On the other hand, bondsare considered debt securities. By investing in bonds, you lend money to the issuing company or organization. Bonds are commonly used by corporations, municipalities, and governments to raise funds for various projects.

In return, you receive regular interest payments on top of the bond's principal. Bonds offer stability and predictable income, making them attractive to conservative investors.

While they come with their own set of risks, such as default or inflation, bonds are generally considered less volatile than stocks.

Types Of Bonds

Corporate Bonds - Corporate bonds are issued by private and public companies.

Municipal Bonds - Municipal bonds are issued by states, cities, and counties.

Treasury Bonds -Treasury bonds are issued by the U.S. Department of the Treasury on behalf of the federal government. They are considered relatively safe investments since they are backed by the government.

Investing in bonds provides a predictable and reliable stream of income through regular interest payments. If you hold the bond until its maturity date, you will also receive the full principal amount. Bonds are often used to balance out riskier investment options, such as individual stocks, as they offer stability and protection against market volatility.

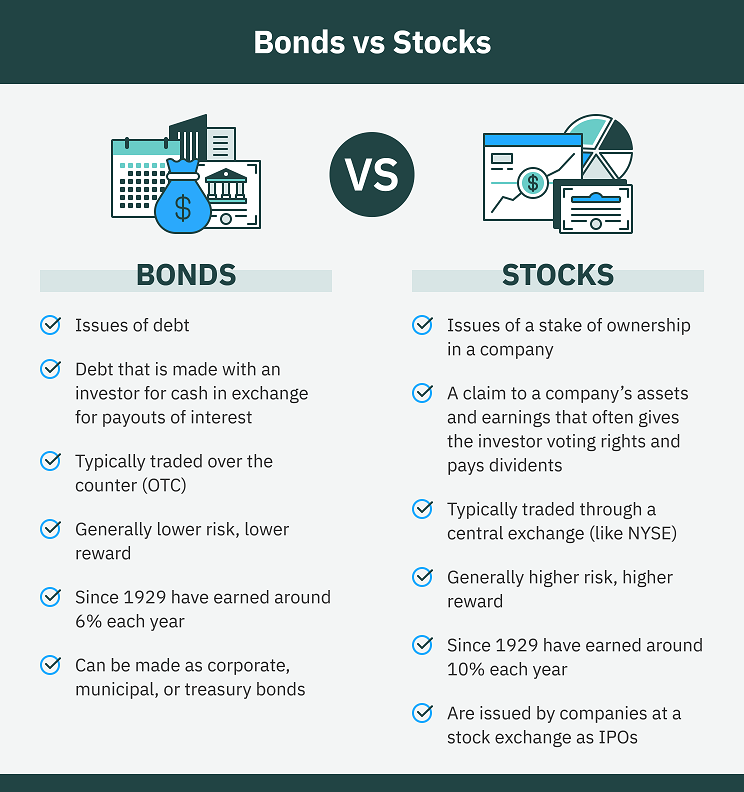

Stocks Vs. Bonds - Key Differences

While both stocks and bonds are popular investment options, there are significant differences between them. Understanding these differences is crucial for making informed investment decisions.

Here are some key distinctions:

Returns

Historically, stocks have provided higher returns compared to bonds. The stock market has generated an average annual return of around 10% over the long term, as per the U.S. Securities and Exchange Commission (SEC). On the other hand, the average annual return on bonds is approximately 5%.

Risk

Stocks carry higher levels of risk compared to bonds. Stock prices can fluctuate significantly due to various factors, including external circumstances beyond a company's control. Supply chain disruptions, economic conditions, and natural disasters can all impact a company's performance and cause stock prices to plummet.

Bonds, on the other hand, offer a relatively safer investment option. As debt securities, they function as an IOU, with the issuer promising to pay interest and return the principal amount. While bonds are not completely risk-free, they are considered less volatile than stocks.

Taxes

Tax treatment is another important consideration when comparing stocks and bonds. Stocks are subject to capital gains taxes when you sell them at a profit, as well as taxes on dividends received. Bonds, on the other hand, are taxed on the interest earned and any capital gains.

The tax treatment varies depending on the type of bond:

- Corporate bonds - The interest earned on corporate bonds is generally taxable as income.

- Municipal bonds - Interest earned from municipal bonds is usually exempt from federal income taxes. State municipal bonds may also be exempt from state income taxes, but out-of-state bonds may be subject to both state and local taxes.

- Treasury bonds- Interest from treasury bonds is exempt from state and local income taxes but taxable at the federal level.

It's important to consult a tax professional to understand the specific tax implications of your investments and ensure accurate tax reporting.

Are You A Stock Or A Bond? Evaluating Your Risk Profile

When making investment decisions, it's crucial to consider your human capital. Your job and its stability influence the level of risk you can afford to take. This concept is explored in Moshe Milevsky's book entitled "Are You a Stock or a Bond?".

RR #122 - Prof. Moshe Milevsky: Solving the Retirement Equation

Human capital refers to a person's knowledge, skills, and talents, which have a significant influence on earnings over a working life.

Some individuals have bond-like human capital, meaning they have a stable income and job security. This includes professions like tenured professors, medical professionals, and government employees.

Others have stock-like human capital, where their income is more variable and at risk during adverse economic conditions. This includes professions like commissioned salespeople and individuals working in industries prone to economic volatility.

For instance, let's compare a tenured university professor and a commissioned salesperson.

The professor, with a stable job and predictable income, possesses bond-like human capital. This stability allows the professor to embrace more risk in their investment portfolio.

Conversely, the salesperson, with variable income dependent on market conditions, exhibits stock-like human capital. Due to the economic vulnerability of their line of work, the salesperson would need to have a higher risk tolerance to maintain the same ratio of stocks to bonds in their investment portfolio.

Professions that are economically vulnerable, such as those in the restaurant, casino, tourism and hospitality, real estate, and investment banking industries, should consider allocating a larger portion of their portfolio to high-quality bonds.

This approach helps protect against the potential risk of job loss during stock market downturns. On the other hand, recession-resistant positions like tenured professors, teachers, medical professionals, government employees, and skilled tradespeople can afford to hold a higher proportion of stocks in their portfolios due to the stability of their human capital.

Understanding the nature of your human capital is crucial in determining the appropriate allocation between stocks and bonds in your investment portfolio.

Bond-like individuals with stable incomes can afford to take more risks in their portfolios and hold a higher proportion of stocks.

Stock-like individuals, on the other hand, should consider a more conservative approach with a higher allocation to bonds to mitigate the risk associated with their variable income.

The Importance Of Diversification

Investors should also consider the benefits of diversification. Diversifying your portfolio means spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This helps to reduce the overall risk and potential impact of any single investment on your portfolio.

To further emphasize the importance of risk management and diversification, let's explore a real-life example.

Stephan Paternot's Financial Dilemma

On an episode of the Odd Lots podcast, the hosts interviewed Stephan Paternot, the co-founder of theGlobe.com, an early social network that went public in 1998. During the dot-com boom, the stock price of theGlobe.com experienced a meteoric rise, catapulting Paternot's net worth to as much as $100 million on paper.

However, the dot-com bubble eventually burst, and theGlobe.com, like many speculative tech companies, faced a significant decline in its stock price. In the interview, Paternot revealed that after the company's failure, he found himself in a dire financial situation, with a staggering $1 million in debt. This outcome highlighted the consequences of poor risk management.

186. TheGlobe.com Story with Stephan Paternot

Paternot acknowledged that two decisions led to his financial downfall.

- Firstly, he invested heavily in other tech startups whose fortunes were closely correlated with that of his own company. By placing a substantial portion of his portfolio in similar high-risk assets, he failed to diversify and protect against the volatility of the tech sector.

- Secondly, he compounded this risky investment strategy by borrowing money to finance these speculative ventures. As a result, when the value of his own company and his other dot-com investments plummeted, he was left with significant debt and little to no assets.

By diversifying, you can potentially benefit from the growth potential of stocks while also having the stability and income stream provided by bonds. This balanced approach can help mitigate the volatility and risks associated with investing solely in one asset class.

People Also Ask

What Are The Advantages Of Investing In Stocks?

Investing in stocks offers several advantages, including the potential for high returns over the long term, the opportunity to become a partial owner of a company, the possibility of receiving dividends, and the ability to participate in the growth of successful businesses.

What Are The Benefits Of Investing In Bonds?

Investing in bonds provides stability, reliable income through interest payments, and the return of the principal amount upon maturity. Bonds are generally considered less volatile than stocks and are often used to balance out riskier investments in a portfolio.

How Can Diversification Help Mitigate Investment Risk?

Diversification involves spreading investments across different asset classes, industries, and regions. By diversifying, investors can reduce the impact of any single investment on their portfolio. It helps to mitigate risk because different asset classes may perform differently under varying market conditions, reducing the overall volatility of the portfolio.

What Is The Role Of Risk Tolerance In Investment Decisions?

Risk tolerance refers to an individual's ability and willingness to endure fluctuations in the value of their investments. It plays a crucial role in determining the allocation between stocks and bonds in an investment portfolio. Investors with a higher risk tolerance are more comfortable with volatility and may have a higher proportion of stocks in their portfolio, while those with a lower risk tolerance may prefer a larger allocation to bonds for stability.

How Can One Determine The Right Mix Of Stocks And Bonds For Their Portfolio?

Determining the appropriate allocation between stocks and bonds depends on various factors, including investment goals, time horizon, risk tolerance, and individual circumstances. It is advisable to consult with a financial advisor or professional who can assess your specific situation, help identify your goals, and recommend an asset allocation strategy that aligns with your needs and preferences.

Conclusion

In the world of investing, understanding the differences between stocks and bonds is crucial for constructing a well-balanced and diversified portfolio. Stocks offer the potential for high returns but come with greater volatility and risk. Bonds, on the other hand, provide stability, reliable income, and capital preservation, making them suitable for more conservative investors.

To determine the right investment strategy for your unique financial goals, it is essential to assess your risk tolerance and evaluate your human capital. Just as Stephan Paternot's experience demonstrates, aligning your investment choices with the stability of your income can be crucial in managing risk and achieving long-term financial success.

So, are you a stock or a bond? The answer lies in understanding your risk profile, job security, and the level of risk you can afford to take. It's important to consult with financial professionals who can provide personalized advice and help you navigate the complexities of the investment landscape.

Remember, a well-diversified portfolio that combines stocks and bonds, along with other asset classes, can help you achieve a balance between growth and stability. By making informed investment decisions and regularly reviewing and adjusting your portfolio as needed, you can position yourself for financial resilience and progress toward your financial goals.

Gordon Dickerson

Author

Habiba Ashton

Reviewer

Latest Articles

Popular Articles