About CureVac and why people are investing in it

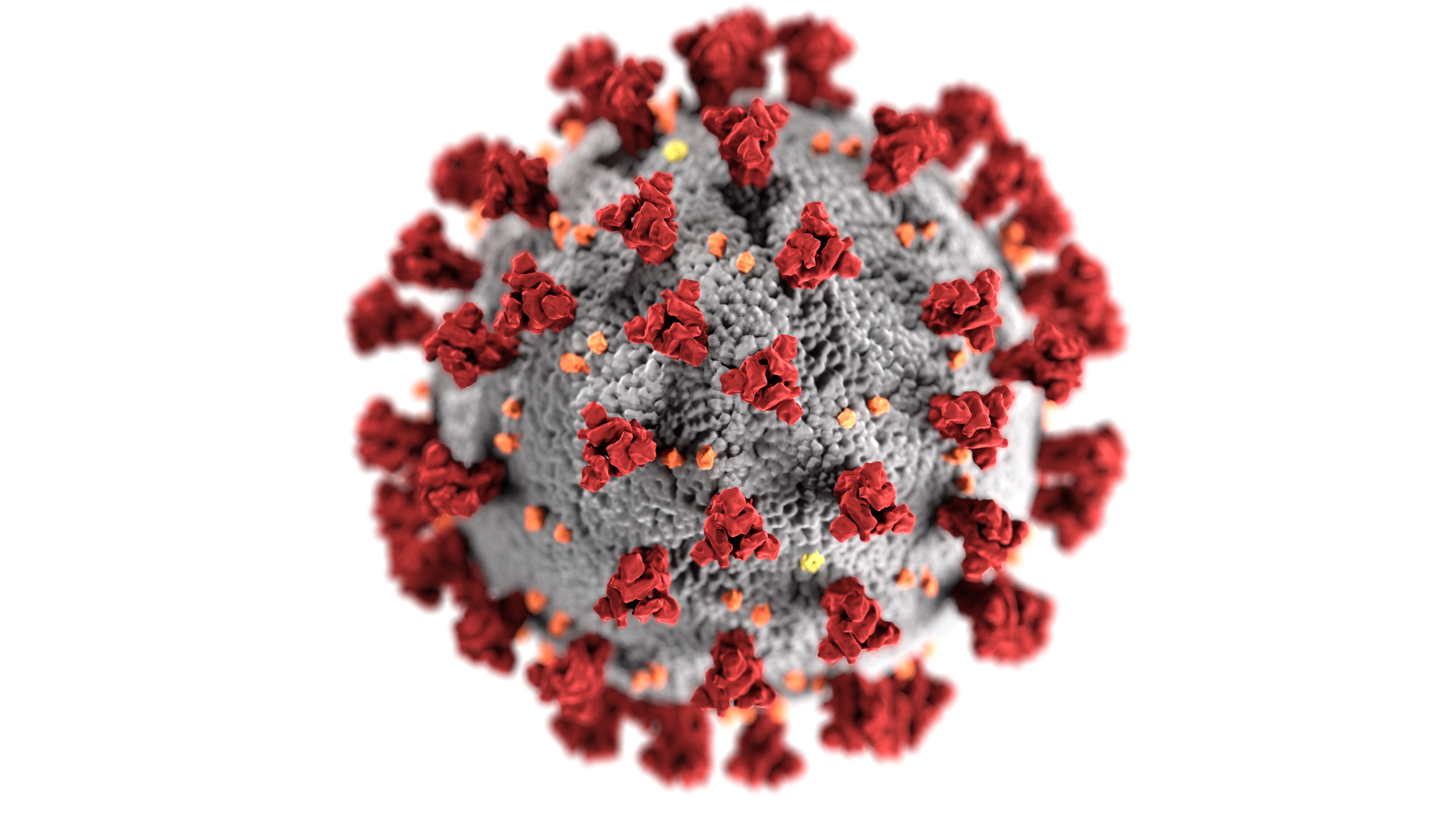

The pandemic has taken a toll on almost all industries. But people are still hoping that vaccines can save humanity. Setting this topic aside, companies who make the Covid vaccines are competing in the stock market right now.

Author:James PierceReviewer:Camilo WoodMay 25, 20217.8K Shares604.2K Views

The pandemic has taken a toll on almost all industries. But people are still hoping that vaccines can save humanity. Setting this topic aside, companies who make the Covid vaccines are competing in the stock market right now. Although there are major and well-known companies, still, those that haven’t been the talk of the town are shining, like CureVac.

When it comes to investing in healthcare, CureVac stock is one of the alternatives for many investors. There aren’t many reasons why, but the pandemic has helped the company show its potential to investors. Let’s take a look at some key points to include in your

About CureVac

CureVac N.V., a clinical-stage biopharmaceutical firm, is working on a number of innovative medicines based on messenger ribonucleic acid (mRNA).

It's working on prophylactic vaccines including an mRNA-based vaccine candidate for COVID-19; CV7202, a prophylactic mRNA-based vaccine for rabies virus glycoprotein that's in Phase 1 clinical trial; vaccines for Lassa yellow fever; vaccines for the respiratory syncytial virus; CV7301, a second-generation lipid nanoparticle flu vaccine; and vaccines for rota, malaria, and universal influenza.

CV8102 (BI 1361849), a self-adjuvant mRNA vaccine in Phase 1 clinical trial for non-small cell lung cancer, as well as tumor-related antigens and squamous cell cancer of the skin, head, and neck; and CV9202 (BI 1361849), a self-adjuvant mRNA vaccine in Phase 1 clinical trial for non-small cell lung cancer, as well as tumor-related antigens and squamous cell. In addition, therapeutic antibodies and protein-based therapies for Cas9 gene editing, ocular diseases, and lung respiratory illnesses are being developed.

The company was established in the year 2000 and is based in T14bingen, Germany.

CureVac Previous Performance

2020 was a year of radical corporate change for the company, propelling it ahead in its transformation from a research-focused biotech firm to a fully integrated commercial biopharma firm. The company believes that the progress they have made not only in building the organization but also in moving forward with its COVID-19 vaccine program, which is focused on its differentiated mRNA technology, has laid a strong foundation for continued growth in 2021.

To give you a summary of some of the main highlights in 2020, as well as the progress it made since the beginning of the year, it has successfully completed enrollment for our two central clinical trials, our Phase 2a trial with over 670 participants and its pivotal Phase 2b clinical trial with over 40,000 subjects, for its lead COVID-19 vaccine candidate, CVnCoV. The presence of a high number of COVID-19 cases in its Phase 2a trial prompted the company to propose a protocol update to include a secondary endpoint for vaccine efficacy.

Thus, CureVAc believes that additional data from the entire population, especially from those over 60, would be extremely useful in supplementing the data from the Phase 2b/3 interim study, which will be released in the second quarter of 2021.

What’s The Big Deal With CureVac?

There are a couple of catalysts for growth potential for the company. With the creation of its mRNA-based vaccine drug candidate, the company has entered the global fight against the outbreak of COVID-19.

CureVac N.V. will obtain funding from the European Union to continue developing the COVID-19 vaccine and increase production capacity. By the end of 2022, the company hopes to have delivered 900 million doses.

CureVac has signed several collaboration agreements with pharmaceutical companies such as Bayer (BAYRY), GlaxoSmithKline (GSK), and Novartis AG (NVS) to improve its vaccine and a next-generation vaccine candidate that will function against coronavirus variants.

These pharmaceutical behemoths will also help produce 150 million doses in 2021 and up to 360 million doses in 2022.

Furthermore, CV8102, the company's therapeutic candidate for four forms of solid tumors, is on track, with the most current clinical trial findings indicating an appropriate degree of tolerability.

Is CureVac Worth Considering?

More often than not, investors listen to the noise coming from insiders. Insiders also purchase shares of companies that work well over time. Unfortunately, there are several reports of stock values plummeting after insiders sell their shares. So, should you push your investment with an insider’s information? It depends.

In terms of long-term investing, insider transactions aren't the most important factor. On the other hand, we'd be reckless to neglect insider dealings entirely. Insiders are much more likely to participate in open market acquisitions of their own company's stock when the business is about to announce new deals with buyers and suppliers, according to a Columbia University report.

Of course, you shouldn’t let other people affect your judgment when it comes to assessing a stock’s value. You should do your own research and trade on your own. This is the safest test you can do to tell if one stock is worth considering.

For the interesting part, we have gathered some information you can rely on if you are planning to invest in CureVac.

At the end of the year, CureVac's vaccine product will most likely be in phase 3. Keep in mind that this possible vaccine is sustainable at storage temperatures (for ease of transportation) and can last up to 24 hours at room temperature. (Pfizer's must be kept exceptionally cold, which can be difficult.) At a cost of 10 euros per dose, the EU has already ordered 225 million doses of CVnCoV (plus a choice of 180 million more). For biotech with a market valuation of $18 billion, that's a lot of money. CureVac plans to increase its production capacity to 300 million doses in 2021 and 600 million doses in 2022.

The Bill and Melinda Gates Foundation, as well as the German government, have invested in the business. CureVac has secured more than 552 million euros in grants and contributions from the European Commission to develop a coronavirus vaccine. This is one coronavirus stock that biotech stakeholders should not overlook, with a high chance of approval on the table.

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles