The CBO on the Bush Tax Cuts

Today, Douglas Elmendorf, the head of the Congressional Budget Office, testified before the Senate Budget Committee on the subject of the Bush tax cuts. If

Jul 31, 20203.1K Shares620.5K Views

Today, Douglas Elmendorf, the head of the Congressional Budget Office, testifiedbefore the Senate Budget Committee on the subject of the Bush tax cuts. If Congress does nothing, the tax cuts expire as planned at the end of the year and taxes rise for all earners. The White House and most Democrats want to extend the tax cuts for the middle class and let them expire for the richest 2 percent of earners. And most Republicans want to make the income tax cuts permanent.

To be honest, the testimony isn’t the easiest to understand. It is pretty wonky, and the descriptions of the impact on government revenue, gross national income, employment and dozens of other factors become pretty arcane.

But the analysis ultimately argues that making the Bush tax cuts permanent would not benefit the economy in the long run:

“„Permanently or temporarily extending all or part of the expiring income tax cuts would boost income and employment in the next few years relative to what would occur under current law. However, even a temporary extension would add to federal debt and reduce future income if it was not accompanied by other changes in policy. A permanent extension of all of those tax cuts without future increases in taxes or reductions in federal spending would roughly double the projected budget deficit in 2020; a permanent extension of those cuts except for certain provisions that would apply only to high-income taxpayers would increase the budget deficit by roughly three-quarters to four-fifths as much. As a result, if policymakers then wanted to balance the budget in 2020, the required increases in taxes or reductions in spending would amount to a substantial share of the budget — and without significant changes of that sort, federal debt would be on an unsustainable path that would ultimately reduce national income.

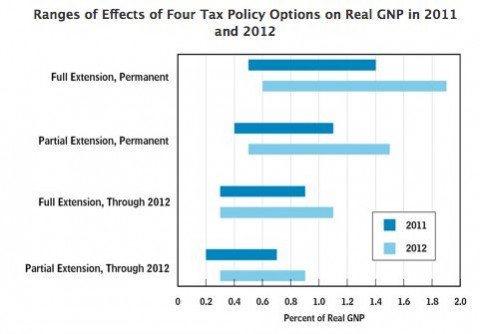

I think this analysis is a bit easier to understand in graphs, which the CBO provides. Over the next two years, extending some or all of the tax cuts helps the economy, boosting the gross national product anywhere from 0.2 percent to 1.9 percent. (In the chart, “partial” means Congress has said the cuts will expire in 2012, and “permanent” means Congress has said income taxes will not go up.)

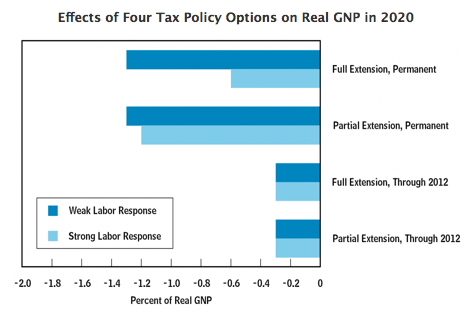

But by 2020, any extension of the cuts will prove bad for the economy, because of the burdens of the national debt.

But extending the tax cuts for just two years obviously has a much smaller impact than making the income tax cuts permanent, which would cut economic growth.

Hajra Shannon

Reviewer

Latest Articles

Popular Articles