Income Inequality and Recession

Today, the Democrats on the Joint Economic Committee are out with a politically charged, compellingly presented report on the relationship between income

Jul 31, 202056.7K Shares1.8M Views

Today, the Democrats on the Joint Economic Committee are out with a politically charged, compellingly presented reporton the relationship between income inequality and the recession.

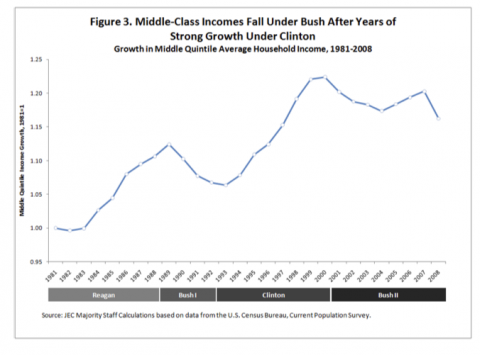

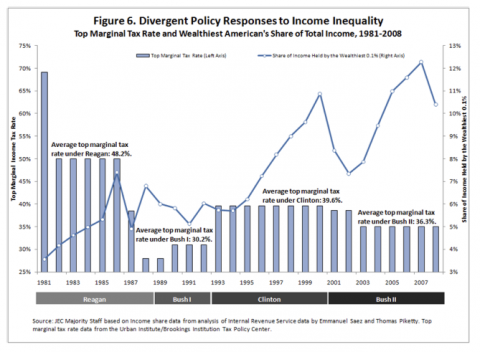

First, they put the blame for growing American income inequality on George W. Bush’s shoulders, arguing, “Middle?class incomes stagnated under President Bush. During the recovery of the 1990s under President Clinton, middle?class incomes grew at a healthy pace. However, during the jobless recovery of the 2000s under President Bush, that trend reversed course. Middle?class incomes continued to fall well into the recovery, and never regained their 2001 high.”

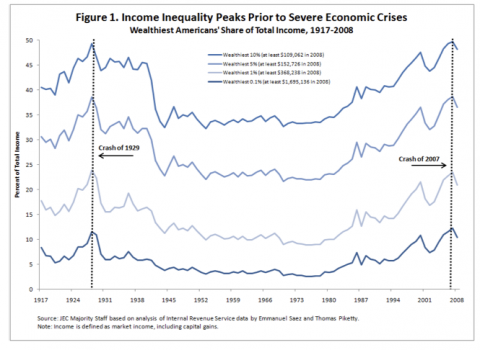

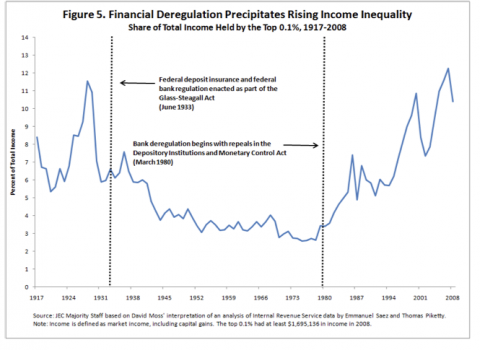

Then, they note that income inequality might have precipitated the recession. “Stagnant incomes for all but the wealthiest Americans meant an increased demand for credit, fueling the growth of an unsustainable credit bubble,” the JEC writes. “Bank deregulation allowed financial institutions to create new exotic products in which the ever?richer rich could invest. The result was a bubble?based economy that came crashing down in late 2007.”

They note that the income gap tends to yawn before major economic crises.

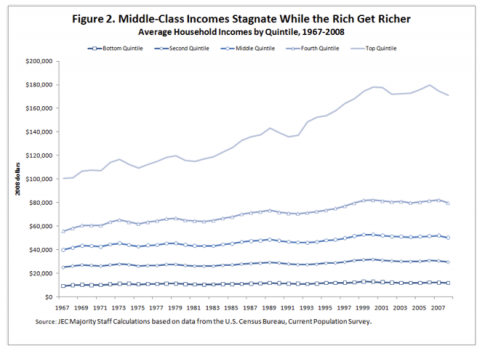

Though income inequality has in fact gotten worse and worse since the 1960s.

They note that middle-class incomes climbed during Clinton and actually fell during Bush — meaning that most families became poorer, not richer, over the course of a decade.

And argue for many causes — a primary one being financial deregulation. This both helped middle-class families become indebted, and high-income earners to find investment products to take even bigger shares of the gains, the JEC writes: “The everyday consequence of stagnant middle?class paychecks is the creation of demand for credit in order to make ends meet – and to keep up with the Joneses, as the rich get richer. Former Chief Economist of the International Monetary Fund Raghuram Rajan argues that, instead of attacking the root causes of rising income inequality in the U.S., policymakers made access to credit much easier for low?income households in order to support their spending.”

The JEC argues that more-progressive taxing might help. (The huge bump in inequality during the Clinton years is due to the tech and stock bubble.) “Policymakers today have the opportunity to continue the work begun by President Clinton,” the JEC writes, specifically referring to the current Congressional battle over taxes. “[They have the opportunity to] help steer America back onto a course of economic growth where rising tides lift all boats, rather than just the wealthiest American’s yachts. Retaining the Bush tax cuts for all households, instead of letting them expire for the top two income brackets, would make the income tax system less progressive and could further exacerbate income inequality and economic fragility.”

Paula M. Graham

Reviewer

Latest Articles

Popular Articles