Young Investors Avoiding Stocks

Back in the 1990s, companies like eTrade and the big banks democratized stock investing: Anyone, anywhere could purchase an index fund for a long-term

Jul 31, 2020143.9K Shares2.2M Views

Back in the 1990s, companies like eTrade and the big banks democratized stock investing: Anyone, anywhere could purchase an index fund for a long-term investment or try to make a buck day trading. Stocks became sexy, and young individuals floodedinto the market. Now, young people with cash in hand, spooked by the recession, are putting it in savings accounts, Nan Cook reportsin Newsweek:

“„Traditionally, we associate the early years with risky behavior — but one consequence of the recession appears to be a shift in the way 18- to 34-year-olds handle money. **Affluent millennials and 30-somethings say their tolerance for risky investments is much lower than it was a year ago, rivaled only by people over the age of 65, according to a new study by Merrill Lynch Global Wealth Management …

**

“„Avoiding risk may feel sensible to a generation whose financial coming-of-age has been bookended by the dotcom bubble and the subprime-mortgage meltdown. In 2010, only 41 percent of 18- to 29-year-olds reported working full time, compared with 50 percent in 2006, according to the Pew Research Center. Millennials were more likely to report losing their jobs than workers over the age of 30, and many recent college graduates have had a hard time finding a toehold in a tight labor market, even as the national unemployment rate rose Friday to 9.6 percent. If the 18- to 34-year-olds feel more cautious about investing, it’s partly because they have less money to spend and little economic security. …

“„But in the long term, is it wise for 18- to 34-year-olds to avoid stocks, load up on bonds, and keep more cash in their bank accounts? Perhaps not, if they want to live comfortably in retirement. “You need the growth potential of stocks,” says Christine Benz, director of personal finance for Morningstar.com. “Investors cannot expect the same returns from bonds and bond funds.”

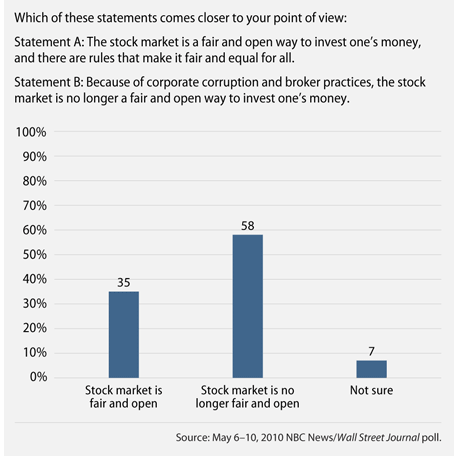

Of course, it isn’t just young, rich folks fleeing the stock market. Since the 2008 crash, investors have broadly taken their money elsewhere. And incidentslike the flash crash have not helped to boost individual investors’ confidence. Moreover, young people — all people, actually — are just lesstrusting of stocks as a way to develop wealth in the wake of the downturn.

The public perception is that stocks are a complex financial product, the market for them dominated by Wall Street insiders, rather than a transparent, democratic way to invest. That might give young folks pause.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles