House Prices Stabilizing – Maybe

This morning, Standard & Poor’s released the latest update of the Case-Shiller home price index, considered the best measure of national housing prices. The

Jul 31, 2020244.3K Shares3.4M Views

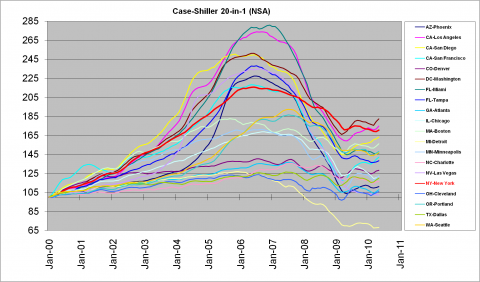

This morning, Standard & Poor’s releasedthe latest update of the Case-Shiller home price index, considered the best measure of national housing prices. The main index rose 0.47 percent month-on-month and 4.61 percent year-on-year in May, a bit better than expected. (The data is seasonally adjusted.) Las Vegas remained the worst market — the only one to decline month-on-month, and the biggest decliner year-on-year. All in all, housing prices seem to have bottomed-out and stabilized for the time being. Here is a chart from The Big Picture, showing housing about 42 months off its peak:

Still, housing experts and economist-types believe the data paints a rosier picture than merited, and that housing might tick down again. Ryan Avent explains:

“„“[I]ndex values are computed as a three-month moving average, and so May prices reflect the average of transactions in March, April, and May. These are also closed sales, with contracts concluded a month or two prior to May. Why is this relevant? Because the price data is based entirely on transactions originated before the government’s housing tax credit expired. Most other housing market variables were also rising before the end of the credit, only to tumble back after its expiration. So the index will likely turn down in the months ahead.”

Rhyley Carney

Reviewer

Latest Articles

Popular Articles