European Rejection of Obama’s Call for Stimulus Threatens U.S. Economy

President Obama’s push for additional economic stimulus has hit a wall not only in Congress, but also at the G-20 summit among European leaders.

Jul 31, 202070.3K Shares1.2M Views

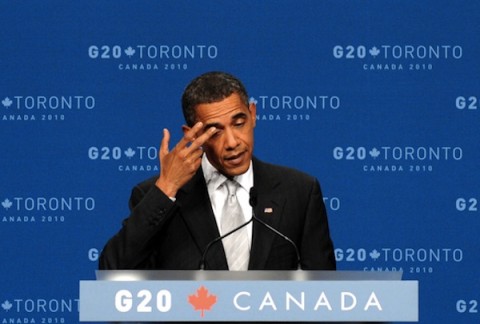

President Obama at the G-20 Summit in Toronto on June 27 (Xinhua/ZUMApress.com)

BERLIN — President Obama’s push for additional economic stimulus is not just hitting a wall in Congress. The president has also been rebuffed by the largest European countries — with potentially profound consequences for the U.S. economy and Obama’s national agenda.

[Economy1] In the run-up to the G-20 summit in late June, the Obama administration went on a PR offensive, urging other wealthy nations to keep pumping stimulus into their economies. But with the Greek budget crisis heightening anxieties over public debt, conservative governments in Berlin, Paris, Londonand Romeare all on an austerity track. Instead of a pledge to inject more capital into their economies, all Obama got at the Toronto conference was a communiquethat emphasizes savings over stimulus.

Some economists fret that Europe’s fiscal retreat threatens to tip the U.S. deeper into recession. Meanwhile, leading analysts in Germany, the continent’s largest economy, say the trans-Atlantic spending spat underscores Obama’s limited maneuvering room in his effort to steer the fragile recovery back home.

“America is having enormous difficulties,” said economist Gustav Horn of the Macroeconomic Policy Institute, part of a labor-affiliated foundation in Düsseldorf, Germany. “At the moment, [the U.S.] is dependent on the rest of the world offering it a friendly economic environment.”

For Obama, the environment is less friendly than he would like. In an open letterto other G-20 heads of state before the summit, the president wrote that leaders should “learn from the consequential mistakes of the past when stimulus was too quickly withdrawn.” Treasury Secretary Tim Geithner, meanwhile, told the BBC, “Growth in the future around the world can’t depend on the United States as much as it did in the past.”

Some economists warn that austerity in the largest European economies, combined with severe budget cuts in countries such as Greece and Spain, could push the continent into a double-dip recession. If so, the consequences for the U.S. could be severe. A European downturn, Horn said, would hurt American exports, both by lowering demand and by strengthening the dollar. Perhaps more importantly, he added, a stumbling Europe could weaken crucial U.S. trading partners in Asia. Likewise, Nobel Prize-winning economist Paul Krugman recently warnedthat the resistance to more stimulus in Europe and the U.S. raises the specter of a depression.

But the dominant view in Germany is that such fears are misguided. Supporters of budget consolidation note the country is on an upswing, with GDP growth expected to reach as high as 2 percent this year as exports accelerate. Moreover, they argue that fiscal retrenchment will spur private-sector spending. A recent reportby the Ifo Institute for Economic Research, a Munich-based think tank with government funding, says cuts would lead to an “expansive confidence effect on German consumers and investors.”

The fear that a European slowdown could hurt American trade underscores a more fundamental challenge that German economists say the U.S. must tackle: expanding exports as a source of economic growth.

“Before the crisis, we had a consumption boom in the U.S. that was not sustainable,” said Ifo economist Klaus Abberger. “And so we think there is a need for some redirection.”

That redirection, economists say, will be outward.

“The growth driver you’ve got left is ultimately net exports,” said economist Christian Dreger of the Berlin-based German Institute for Economic Research, another government-funded think tank.

The Obama administration has come to a similar conclusion. In his State of the Union speech in January, the president announced a new initiative to double American exports within five years, though many analystscalled the goal unrealistic.

“For too long, America served as the consumer engine for the entire world,” the president said in follow-up remarksin March. “But we’re rebalancing. … Countries with external deficits need to save and export more.”

But the future of U.S. exports is not entirely under American control. The country can only reduce its trade deficit if the rest of the world has sufficient buying power, Horn said. The G-20 has been touting a new initiativeto ease trade imbalances, which would require net exporters like Germany to buy more from net importers like the U.S. But it remains to be seen whether there will be any action to follow the talk.

Obama’s inability to induce Europe to boost its stimulus spending is rendered even more discouraging by the limited traction his spending proposals are getting in Congress. And it does not help that Obama is looking increasingly isolated among world leaders in pushing a more expansive fiscal policy.

“You don’t win something in Congress by saying, oh, Europe’s doing this,” said economist Dean Baker, co-director of the left-leaning Center for Economic and Policy Research in Washington. “[But] you don’t want the U.S. to look like an outlier.”

The president should not get his hopes up for a hand from Berlin, though. As the Berliner Zeitungnewspaper declared of Germany’s chancellor in a recent headline: “Merkel won’t listen to Obama.” The country has a culture of thriftinessto rival even the fiscal-conservative wing of the Republican Party. The traumatic hyperinflation that racked the Weimar Republic during the 1920s has made Germany hyper-sensitive to price stability. The country last year amended its constitution to include limits on government debt. Deep concern that the aging of the population will soon make Germany’s welfare state unaffordable have made people here anxious to get back to budget cutting. Meanwhile, unemployment is lowerthan in the U.S., so the economic pain is less acute.

Deficit hawks here also argue the turmoil in Greece is a warning to profligate governments across the continent.

“We saw with the Greek crisis how vulnerable highly indebted countries are to [speculative] attack,” said Norbert Barthle, a member of the German parliament from the ruling center-right Christian Democratic Union party (CDU) who specializes in budgeting.

The American economy has managed impressive growth so far this year, but it has largely been driven by the effects of government stimulus, Horn said. And the looming dry-up of stimulus funds around the world amounts to a serious problem for the American president.

“He has to do more if other countries do less,” Horn said. “And in that sense, his worries are absolutely understandable.”

David Dagan is a freelance journalist living in Berlin.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles