The Joblessness Crisis as Long Joblessness Hangover

This morning, Kevin Drum flagged the UCLA Anderson Forecast, a quarterly release on national and California economic conditions. Ed Leamer, the head of the

Jul 31, 2020184.6K Shares3.2M Views

This morning, Kevin Drum flaggedthe UCLA Anderson Forecast, a quarterly releaseon national and California economic conditions. Ed Leamer, the head of the forecast and a UCLA economist, predicts that because there is little hope for a consumer-led recovery, unemployment will remain woefully high. He explains it as a Catch-22: If consumers spent more, employers would hire more workers, bringing down the unemployment rate. But consumers cannot spend more, because so many of them are unemployed.

“„Leamer notes that while expansive, free-spending consumers fueled past economic recoveries, today’s “frugal consumers” cannot be counted on to power a strong recovery in the foreseeable future.

“„“If the next year is going to bring exceptional growth,” Leamer writes, “consumers will need to express their optimism in the way that really counts — buying homes and cars. And that is not going to happen if businesses continue to express their pessimism in the way that really counts — by not hiring workers.”

“„The result is an economic Catch-22. Leamer explains that significant reductions in the unemployment rate require real gross domestic product (GDP) growth in the 5.0 percent to 6.0 percent range. Normal GDP growth is 3.0 percent, enough to sustain unemployment levels, but not strong enough to put Americans back to work. As a consequence, consumers concerned about their employment status are reluctant to spend, and businesses concerned about growth are reluctant to hire.

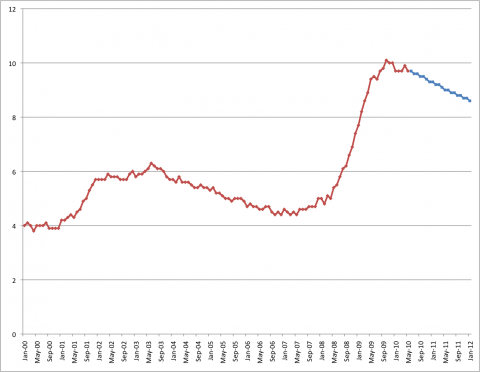

“„The forecast for GDP growth this year is 3.4 percent, followed by 2.4 percent in 2011 and 2.8 percent in 2012, well below the 5.0 percent growth of previous recoveries and even a bit below the 3.0 percent long-term normal growth. With this weak economic growth comes a weak labor market, and unemployment slowly declines to 8.6 percent by 2012.

“„Tepid growth leaves plenty of excess capacity, subdued pricing power and very little inflation. This will allow the Federal Reserve to postpone interest-rate increases that the Forecast expects to come late this year or early next, as the sustainability of a modest recovery becomes clear and as the need for preemptive action against future inflation begins to dominate monetary policy decisions.

The result is a bleak labor-market picture, made bleaker by the fact that deficit concerns on Capitol Hill mean the government will not step in to gin up aggregate demand with further stimulus. Here is what Leamer predicts the unemployment rate will look like, with forecast numbers in blue on the right. Our unemployment rate in January 2012 would be the same as the unemployment rate in fall 2009.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles