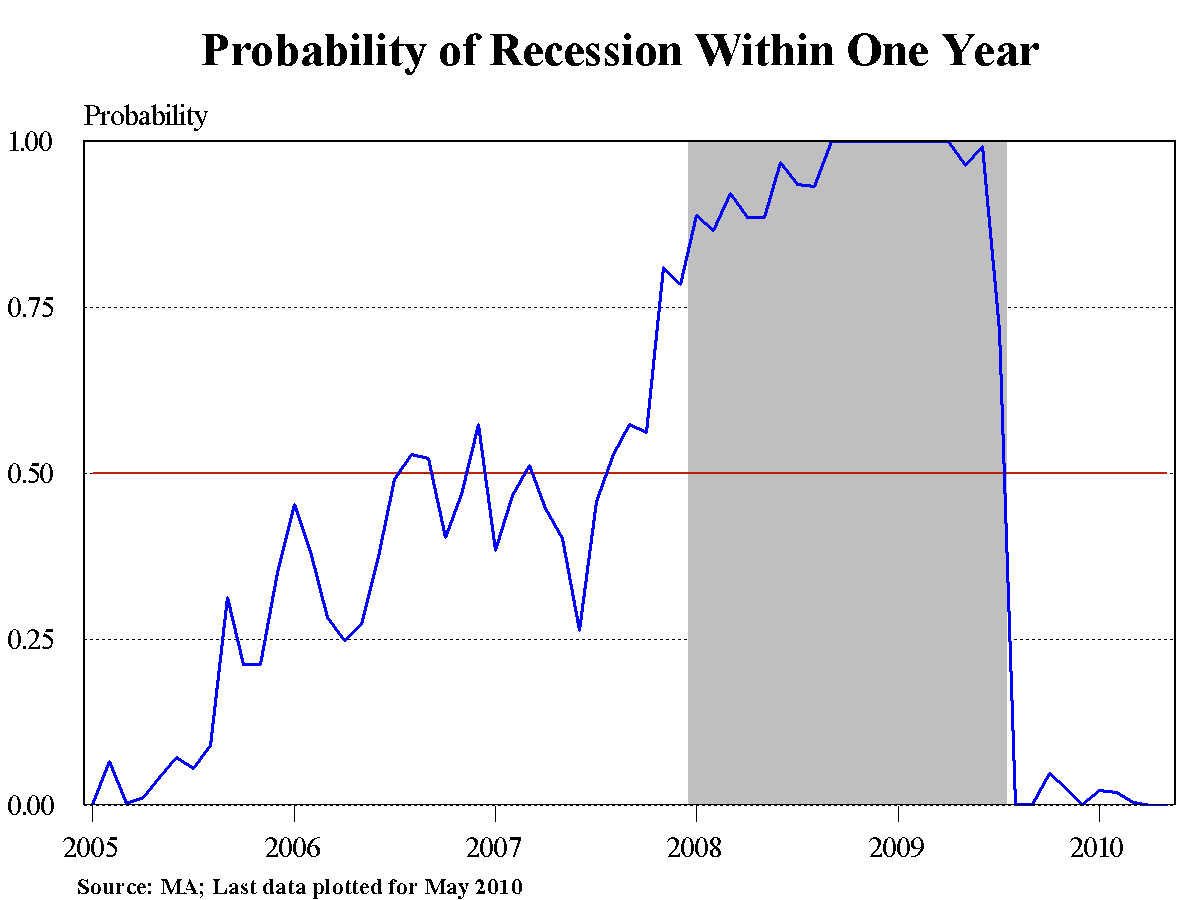

Chance of a Double-Dip ‘Essentially Nil’

At least Macroeconomic Advisers says so. Ben Herzon explains: Early in the recovery many forecasters, concerned that the nascent expansion was fueled

Jul 31, 2020113.2K Shares2M Views

Ben Herzon explains:

“„Early in the recovery many forecasters, concerned that the nascent expansion was fueled only by temporary inventory dynamics and short-lived fiscal stimulus, fretted over the possibility of a double-dip recession. Now, with the emergence of the sovereign debt crisis in Europe, that concern has re-surfaced. Certainly we recognize that the debt crisis imparts some downside risk to our baseline forecast for GDP growth. However, based on current, high-frequency data — most of which is financial in nature and so is not subject to revision — we believe the chance of a double-dip recession is small.

“„[The probability of having a month of recession in the next 12 is] a function of the term slope of interest rates, stock prices, payroll employment, personal income, and industrial production…term slope, stock prices, credit spreads, bank lending conditions, oil prices, and the unemployment rate. Currently this model, updated through May’s data, estimates that the probability of another recession month occurring within the coming year is zero.

On the one hand, this is good news: A double-dip, perhaps one fueled by continued declining home prices or another credit crunch caused by the Greek debt crisis, would be terrible.

On the other, if GDP does not expand or contract — meaning the economy is not technically in a recession, but things remain as bad as they are — or if GDP expands only slowly, that is still a terrible outcome, entailing stagnated incomes for families and high rates of unemployment.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles