Oversight Panel Slams Obama’s Small Business Lending Efforts

Today, the Congressional Oversight Panel -- the independent watchdog that oversees the Obama administration’s Troubled Asset Relief Program -- issued a report

Jul 31, 202084.1K Shares2M Views

Today, the Congressional Oversight Panel — the independent watchdog that oversees the Obama administration’s Troubled Asset Relief Program — issueda report slamming TARP’s progress in aiding small businesses. The report notes that despite the administration’s efforts to encourage banks to lend to small businesses, “it is not clear that [TARP has] had any significant impact on small business lending” at all.

The report notes, however, that any programs to encourage banks to lend to small businesses will fail unless those small businesses are benefiting from an improved economic climate in general — a loan will do little good to help a business if the business has no customers — and that Treasury and the government need more data on small-business lending:

“„A small business loan is, at its heart, a contract between two parties: a bank that is willing and able to lend, and a business that is creditworthy and in need of a loan. Due to the recession, relatively few small businesses now fit that description. **To the extent that contraction in small business lending reflects a shortfall of demand rather than of supply, any supply-side solution will fail to gain traction. Treasury should be mindful of this concern and should consider creative solutions that engage banks, state-based lending consortia, and other market participants. **

“„****The debate over whether small business lending is constrained by supply or demand is a reminder of the absence of high-quality data about current lending practices. Such poor data have made it far more difficult to pinpoint the causes of today’s problems and, as a result, to find effective solutions. Treasury should take active steps to gather more detailed and dependable data about small business lending, and put data-reporting requirements in place so that in the future policymakers will not be forced to make decisions with too little information about what is actually happening.

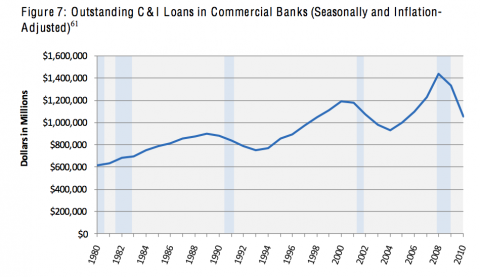

That said, it remains extraordinarily difficult for even worthy small businesses to access the credit markets — a phenomenon I previously examined. The report also includes a plethora of charts and tables showing reduced confidence in and reduced lending to small businesses. This chart demonstrates the continued tightening of credit to these “engines” of economic growth.

Paula M. Graham

Reviewer

Latest Articles

Popular Articles