Yes, It Was a Housing Bubble

Casey Mulligan, a University of Chicago economist, writes over at The New York Times’ Economix: Adjusted for inflation, residential property values were still

Jul 31, 2020780 Shares195K Views

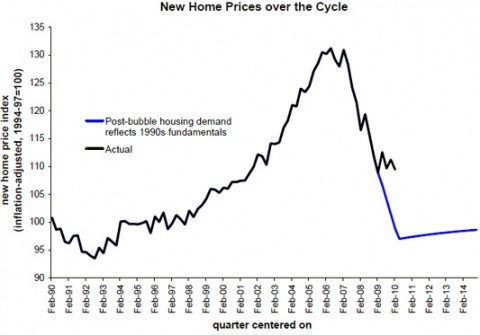

Casey Mulligan, a University of Chicago economist, writesover at The New York Times’ Economix: “Adjusted for inflation, residential property values were still higher at the end of 2009 than 10 years ago. This fact raises the possibility that at least part of the housing boom was an efficient response to market fundamentals.”

The economist backs this up by noting:

“„A reasonable estimate, based on bubble theory, is that housing inventory is about 3 or 4 percent above what it would have been without the bubble and without the temptation to overbuild. In order to make these excess homes worth buying, prices need to fall further; economists would generally estimate that an extra 1 percentage point of housing inventory requires a matching 1 percentage point decline in price to make those excess homes look like a good deal.

“„So if we believe we had 3 or 4 percent more homes than we really needed last year, based on market fundamentals, that means that housing prices would eventually be about 3 or 4 percent below what they were before the bubble, to make those extra houses worth purchasing.

Mulligan includes this chart to back the point up:

Mulligan adds that he plans to examine different aspects of this issue in further posts, so I cannot take on his whole argument yet. But I’d note that he discusses housing price fundamentals without mentioning Fannie Mae, Freddie Mac, mortgage rates, interest rates or the federal government’s extraordinary effort — literally, trillion-dollar effort — over the course of the past year to prevent foreclosures (therefore stemming supply) and to keep mortgage rates low (therefore stoking demand). The housing story is in no small part a credit and interest rate story — so I hope Mulligan turns to those topics soon.

Hajra Shannon

Reviewer

Latest Articles

Popular Articles