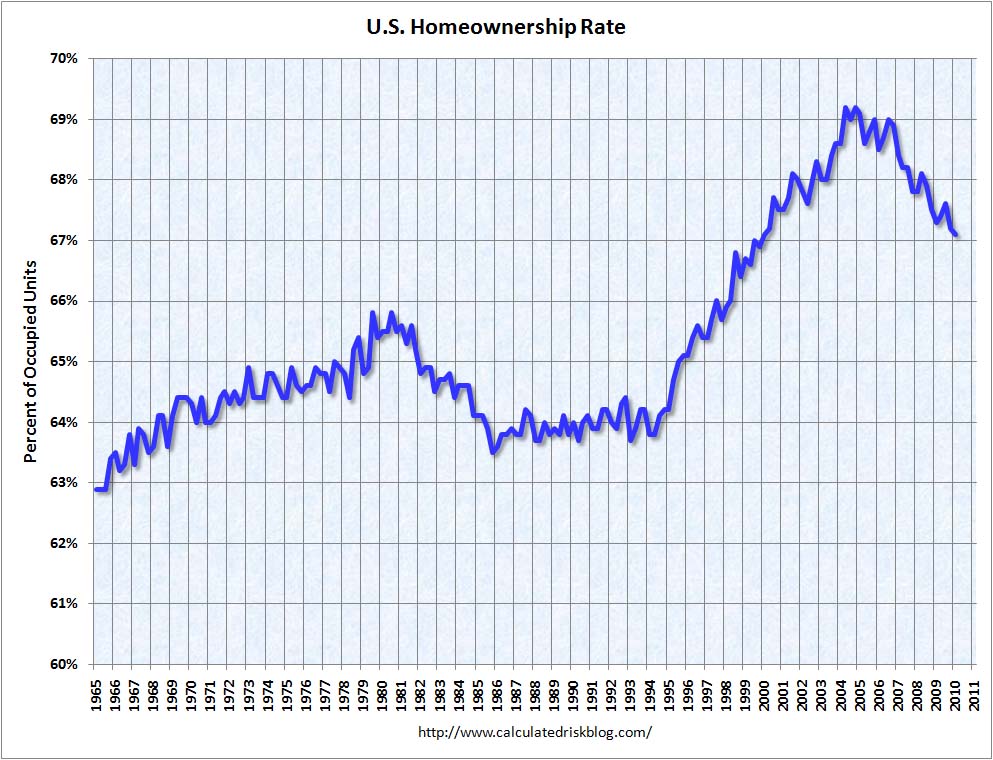

Homeownership Declines to 10-Year Low

Calculated Risk has a smart analysis -- with graphs! -- on the first-quarter housing and rental vacancy rates released by the Census Bureau this morning. The

Jul 31, 20206.5K Shares435.1K Views

Calculated Risk has a smart analysis— with graphs! — on the first-quarter housing and rental vacancy rates releasedby the Census Bureau this morning. The rate of homeownership fell to 67.1 percent, its lowest level in more than a decade.

The homeowner vacancy rate (the percentage of total housing units that are for sale but have not found a buyer) declined to 2.6 percent; it averaged 2.85 percent in 2009. Calculated Risk notes, “A normal rate for recent years appears to be about 1.7 percent. This leaves the homeowner vacancy rate about 0.9 percent above normal. This data is not perfect, but based on the approximately 75 million homeowner occupied homes, we can estimate that there are close to 675 thousand excess vacant homes.” And the rental vacancy rate declined slightly to 10.6 percent, after averaging 10.63 percent last year. “It’s hard to define a ‘normal’ rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8 percent,” the blog says.

The word “normal” is crucial there. It is difficult, if not impossible, to prescribe housing norms, because the housing bubble and its attending credit bubble distorted the economy so much, for so long. One might expect to see those statistics returning to their trend lines. But homeowners are defaulting at historically high and in some cases rising rates. Until the foreclosure crisis stops — and, again, there is no sign of that yet — there is no saying what “normal” is.

Hajra Shannon

Reviewer

Latest Articles

Popular Articles