New Foreclosure Record Set as House Holds Mortgage Modification Hearings

Tomorrow, the House Financial Services Committee, headed by Rep. Barney Frank (D-Mass.), starts a series of hearings on mortgage modification and the housing

Jul 31, 202011.3K Shares454K Views

Tomorrow, the House Financial Services Committee, headed by Rep. Barney Frank (D-Mass.), starts a series of hearings on mortgage modification and the housing market. The schedule is as follows:

- On Tuesday morning, the committee holds a hearing with home loan executives from Bank of America, Citigroup, J.P. Morgan and Wells Fargo on “Second Liens and Other Barriers to Principal Reduction as an Effective Foreclosure Mitigation Program.”

- On Wednesday morning, the committee holds a hearing entitled “Housing Finance: What Should the New System Be Able to Do?” The witness list is not yet set.

- On Wednesday afternoon, the Subcommittee on Housing and Community Opportunity holds a hearing on “The Recently Announced Revisions to the Home Affordable Modification Program (HAMP).” The witness list is not yet set.

Some troubling data on the inadequacies of HAMP and the still-weak housing market form a backdrop to the hearings. Today, Bank of America reportsthat it has completed 33,000 mortgage-modifications, up 12,000 since March — it says it has now modified around a quarter of eligible mortgages. (Citigroup does better: It has modified more than half.)

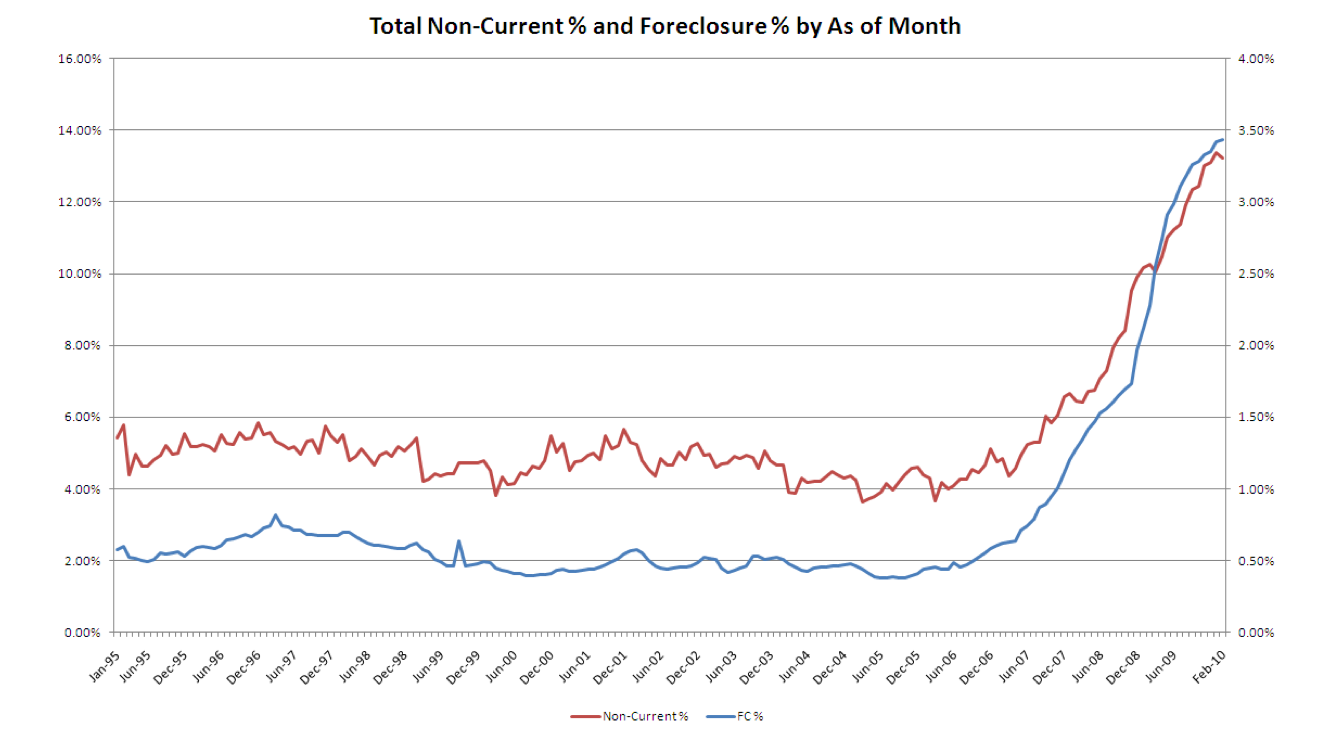

But those positive statistics are overshadowed by a reportfrom Lender Processing Services — a major mortgage processing company — showing that the inventory of foreclosed homes hit a “record high” in February. The number of delinquencies jumped 21 percent year-on-year. The report notes: “More than 1.1 million loans that were current at the beginning of January 2010 were already at least 30 days delinquent or in foreclosure by February 2010 month-end.” This graph shows the percentage of mortgages that are non-current or in foreclosure, month by month:

Hajra Shannon

Reviewer

Latest Articles

Popular Articles