White House Loan Modification Plan Falls Flat

While private lenders completed 120,000 permanent modifications monthly in early 2009, only about 10,000 were completed through October under the government initiative.

Jul 31, 20201.1K Shares598.7K Views

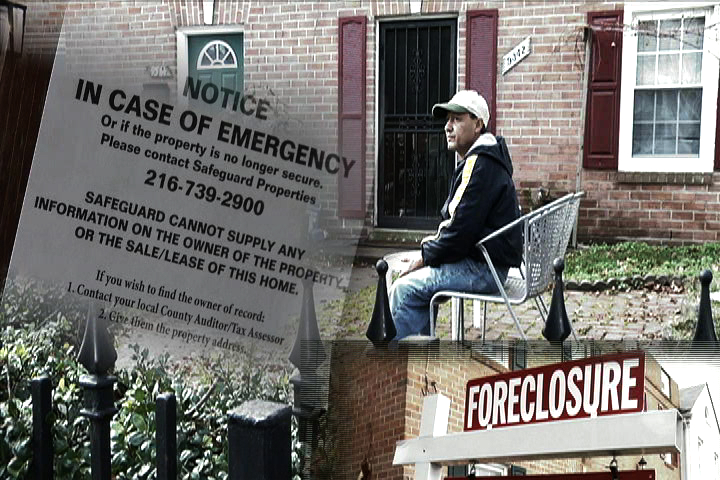

Julio Angulo was evicted from his Virginia home last December. (American News Project)

It was last December when Julio Angulo ignored the bitter cold and sat on a rusted patio chair in the front yard of his foreclosed home in suburban Manassas, Va. He sighed, resting his hand on his knee. He stared despondently at the sky. His lender had foreclosed on his house in July. He had just been evicted.

[Economy1]Angulo, then 55 years old, had nowhere to go. His wife and two children already had returned to El Salvador. He had refused during the summer to accept a cash-for-keys transaction, in which he could turn the house over to the lender in exchange for a cash payment. Instead, he remained, alone, in the three bedroom townhouse, in a modest working-class neighborhood called Georgetown South, until a Prince William County Sheriff’s Deputy knocked on the door on Dec. 1, 2008 for the foreclosure eviction.

A house painter, Angulo couldn’t afford the market rents of $1,500 a month for apartments elsewhere in the neighborhood. Most of Prince William County’s shelters also were full that day.

A year later, Angulo is gone. A legal resident of the United States, he joined his family in his native El Salvador, to let a knee injury heal, and to recover from his lost dream of owning a home. With nowhere to go immediately after the eviction, he luckily ran into a neighbor that night who offeredto rent him a room for two weeks. He went to a public health clinic, to see a doctor about the arthritis in his injured knee. Then he left for El Salvador.

The house he paid $280,000 for in July of 2005 sold for $69,900 on March 16, 2009, according to local real estate agent Keith Elliott Jr.Real estate investors bought it.

And a year later, the hopes of those who thought the government could come up with a plan to stop foreclosures and help keep people like Angulo in their houses seem in tatters as well. The Obama administration’s signature effort remains its $75 billion Making Home Affordable program, which was set up to aid as many as 4 million homeowners. But Making Home Affordable has in most ways been a crushing disappointment, housing advocates say.

At the beginning of this year lenders on their own were doing far more permanent loan modifications than the government has been able to accomplish since rolling out its program in April, noted Diane Thompson, an attorney with the National Consumer Law Center.Private lenders were completing 120,000 permanent loan modifications per month during the first quarter of this year. Under the Obama administration’s initiative, some 650,000 homeowners have entered into trial loan modifications, but only about 10,000 permanent loan modifications had been completed by the end of October, a Congressional oversight panel reportedon Wednesday. Treasury Department figures released Thursday showed that only 31,382 permanent loan modifications had been completedunder the government program as of Nov. 30.

Making Home Affordable’s loan modification effort is known as HAMP, or the Home Affordable Modification Program. The small number of permanent loan modifications so far is due in part to a new program getting established, and to the fact that borrowers in the government program have to complete three-month temporary trial loan modifications first, in order to qualify for permanent ones. Getting the permanent trial modification isn’t automatic — trial program borrowers must submit paperwork documenting their incomes to convert to permanent loan modifications, and they must make three months of payments under their trial agreements.

Treasury expectssome 375,000 trial modifications to be finished by the end of this year, but it’s not clear how many will become permanent. Updated numbers are expected this week. But none of this fully explains the glaring lack of progress so far, Thompson said.

“We’re more than nine months into the program, and trial modifications account for only about 11 percent of all the seriously delinquent loans, and permanent modifications aren’t even on the radar screen,” Thompson said. “The HAMP servicer participation agreements do not provide for any penalties, other than termination from the program, for the failure to make modifications. Until those agreements are revised, the administration has little recourse other than public shame to compel servicers to make loan modifications. Meanwhile, the number of homes seriously delinquent and in foreclosure continues to rise every quarter.”

This is hardly what Thompson expected, just a year ago.

“It’s been very distressing,” she said.

In testimony submitted to the House Financial Services Committee on Tuesday, officials from JP Morgan Chase reportedthat of every 100 homeowners who sought to have their loans reworked under the government’s program, just 15 have or will end up with, a permanent loan modification.

Thompson and others who follow loan modifications said they were aware from the beginning that the government program couldn’t prevent all foreclosures, especially as job losses mounted and even prime borrowers fell behind on their payments. Experts also knew there would be some slowdown under the administration’s new program, as servicers worked to convert temporary loan modifications into permanent ones.

Servicers and borrowers are pointing the finger at each other over the lack of more permanent loan modifications. Servicerscontendborrowers aren’t coming up with the necessary paperwork, such as documenting their incomes, that is required for permanent loan modifications. But housing counselors say just the opposite — that borrowers supply servicers with pay stubs and other paperwork, only to have their servicers lose them, or sit on them so long they aren’t current.

Thompson said there are even bigger problems with the program that leave her feeling very differently about the effort today, compared to her optimism when it was first announced.

“I don’t yet see any of the work on HAMP by the administration addressing the core problems in the program–a lack of accountability and transparency–so I am not optimistic, although I do believe that some of the incremental changes to the program are helpful and may help tens of thousands of people,” she said. “The problem is that we need to help millions, not tens of thousands.”

Alan White, a Valparaiso University law professor who studies loan modifications, was even more blunt:

“If we don’t see more permanent mods soon,” he said, “it will look like the HAMP program is a failure. We’ve seen a net reduction in permanent loan modifications. That’s not good.”

The failure to get more permanent loan modifications done “should be considered a breach of contract” by servicers and lenders that have accepted taxpayer bailout money and are eligible for financial incentives from the government for reworking loans, White said.

He and others never expected things to end up like this. In November 2008, mortgage giants Fannie Mae and Freddie Macannounceda foreclosure moratorium for the holidays, beginning in Thanksgiving, to allow the government to work out the details of streamlined loan modification efforts. Hopes were high that many borrowers would stay in their homes.

In Angulo’s case, the help was too late. He was evicted regardless, because the policy applied only to new foreclosures, not those already in the pipeline.

Fannie Mae announcedlast month a new policy to allow qualified owners facing foreclosure to rent back their homes for as long as a year. But Angulo most likely would not have qualified for that help, either, had it been available a year ago, since he couldn’t afford market rents in the area, a requirement of the program.

Angulo had covered his mortgage by renting out some of the bedrooms. In the spring of 2008, his renters left and the monthly payment on his adjustable rate mortgage also jumped from $1,400 to $2,600. As a house painter, he earned $500 a week.

Angulo said at the time that he tried to contact his lender, Aurora Loan Services, a subsidiary of Lehman Bros. that specialized in Alt-A and interest-only loans. But the servicer wouldn’t help him, he said.

Since his eviction, his old neighborhood isn’t the only location were housing values have fallen. In November, Zillow, an online real estate service, reported that year over year housing values nationwide had declined for the 11th consecutive quarter.

In Georgetown South, since last December, the highest priced home that has been sold went for $120,000, and it most likely resulted from an investor flip, Elliott said. In Prince William County overall, the first-time homebuyer tax credit helped boost sales of bank-owned foreclosed properties – but that doesn’t mean the local housing market has recovered, he said.

“Banks are probably planning on trickling out these additional foreclosures slowly while the market continues to improve,” he said. “How big is the shadow market? Honestly, I think it’s anybody’s guess. The banks could be sitting on a whole bunch just waiting to trickle them out a few at a time.”

As neighborhoods like Georgetown South continue to absorb the effects of a collapsed housing market, NCLC’s Thompson noted that growing foreclosures are spreading damage throughout the economy, hurting neighborhood property values, and cutting into state and local tax revenues.

That’s why Julio Angulo’s story is much more than just the eviction of another former homeowner on a cold December day, a year ago.

“This isn’t just about homeowners who need help,” Thompson said. “Unless officials take forceful action on foreclosures, things will only get worse. I never thought, at this point, that foreclosures still would not be effectively addressed by the administration. If we don’t get foreclosures under control, and soon, they’re going to drag down the whole economy.”

Angulo, for his part, promised to call if he ever could make his way back to Virginia, to try again to find work, and to buy another home.

He hasn’t been heard from since he left.

This article was to include new Treasury Department loan modification figures released Thursday.

*Read Mary Kane’s December 2008 article about Julio Angulo’s eviction here.

Hajra Shannon

Reviewer

Latest Articles

Popular Articles